As per Intent Market Research, the Functional Cosmetics and Skin Care Ingredients Market was valued at USD 50.6 Billion in 2024-e and will surpass USD 64.4 Billion by 2030; growing at a CAGR of 4.1% during 2025-2030.

The global functional cosmetics and skin care ingredients market is experiencing significant growth, driven by increasing consumer demand for effective personal care products that deliver visible results. As the beauty industry evolves, consumers are seeking products that not only enhance appearance but also offer specific skin benefits such as anti-aging, brightening, and hydration. Active ingredients play a vital role in this trend, as they are designed to deliver targeted effects on the skin. This market is also influenced by the rising popularity of natural and organic ingredients, alongside innovations in cosmetic formulations. The demand for functional ingredients is further bolstered by the growing awareness of the harmful effects of synthetic chemicals in beauty products.

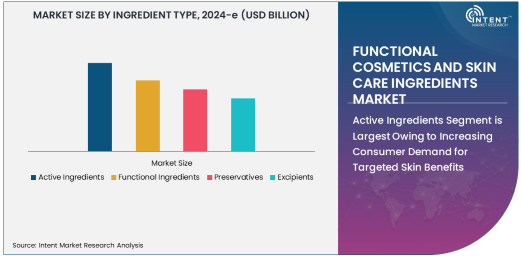

Active Ingredients Segment is Largest Owing to Increasing Consumer Demand for Targeted Skin Benefits

The active ingredients segment holds the largest share in the functional cosmetics and skin care ingredients market due to their pivotal role in providing specific skin benefits. These ingredients, which include antioxidants, peptides, and hyaluronic acid, are formulated to address skin issues like aging, pigmentation, and dryness. Active ingredients are often used in products aimed at rejuvenating and improving skin texture, which has resulted in increased demand for skincare solutions that target individual concerns. With the growing preference for personalized skincare, active ingredients are becoming an essential component of both mass-market and luxury cosmetic products.

As consumers continue to prioritize skin health, the demand for active ingredients is expected to grow at a steady pace. Skin care brands are increasingly incorporating these ingredients into their formulations to enhance product efficacy and differentiate themselves in a competitive market. This trend is also aided by increasing advancements in cosmetic science, enabling manufacturers to develop more potent and effective active ingredients for a variety of skin concerns.

Skin Care Application is Largest Owing to Growing Focus on Skin Health

The skin care application segment is the largest within the functional cosmetics and skin care ingredients market, reflecting the growing importance of maintaining healthy and youthful skin. Skin care products, such as moisturizers, serums, and sunscreens, are increasingly formulated with active and functional ingredients to provide hydration, anti-aging, and skin protection. With consumers becoming more educated about the importance of skincare routines, there has been a surge in demand for products that deliver both cosmetic benefits and therapeutic effects.

The skin care segment's dominance is also fueled by the rise of high-performance beauty products, including those focused on anti-aging, which is one of the fastest-growing categories in the market. As individuals become more conscious of the long-term health of their skin, they are seeking solutions that prevent skin damage and enhance skin vitality. This shift has driven a significant increase in the use of functional ingredients like peptides, retinoids, and antioxidants in skin care products.

Manufacturers of Skin Care Products Segment is Largest Owing to Strong Market Demand

The manufacturers of skin care products segment is the largest among end-users in the functional cosmetics and skin care ingredients market. This is due to the growing demand for skin care products across various demographics, driven by concerns over skin aging, pigmentation, and overall skin health. Skin care manufacturers are increasingly turning to high-quality functional ingredients to meet the specific needs of consumers, ranging from anti-aging solutions to hydration and skin brightening.

These manufacturers are investing heavily in research and development to create innovative formulations that align with consumer preferences for natural, organic, and clean beauty products. The rise of e-commerce and direct-to-consumer models has also boosted the demand for skin care products, enabling these manufacturers to reach a broader audience and increase their market share.

Online Retailers Segment is Fastest Growing Owing to Shift Towards E-Commerce

The online retailers segment is the fastest growing in the functional cosmetics and skin care ingredients market. With the rise of digital platforms and the growing trend of online shopping, consumers are increasingly purchasing skincare products through e-commerce channels. Online retailers provide a convenient and accessible way for consumers to explore a wide range of products and ingredients, compare prices, and make informed purchasing decisions.

This shift towards online retailing is also supported by the COVID-19 pandemic, which accelerated the adoption of e-commerce in the beauty industry. Consumers are now more inclined to shop online, where they can access a global range of products and read reviews before purchasing. The expansion of online platforms has become a key factor driving the growth of the functional cosmetics and skin care ingredients market.

North America Region is Largest Owing to High Consumer Spending on Personal Care

North America is the largest region in the functional cosmetics and skin care ingredients market, driven by high consumer spending on personal care and beauty products. The region is home to some of the largest cosmetic and skincare brands, which actively incorporate advanced ingredients into their formulations. Additionally, the increasing awareness about skin health and the growing demand for anti-aging products in countries like the United States and Canada are contributing to the market's expansion.

North America also leads in terms of innovation and regulatory standards, ensuring that products meet the highest safety and efficacy criteria. As a result, consumers in this region are more inclined to invest in high-quality skin care products that contain functional ingredients. The growing trend of clean beauty and natural ingredients has further fueled the demand for premium skin care solutions in the region.

Competitive Landscape and Leading Companies

The functional cosmetics and skin care ingredients market is highly competitive, with several global and regional players vying for market share. Leading companies such as BASF, Dow Chemical Company, Evonik Industries, and Croda International dominate the market, owing to their extensive product portfolios and strong R&D capabilities. These companies are continually innovating to develop new functional ingredients that cater to the evolving needs of consumers, such as natural, organic, and sustainable ingredients.

Moreover, the market is characterized by strategic collaborations, acquisitions, and mergers, as companies seek to strengthen their product offerings and expand their presence in key markets. For instance, recent acquisitions and partnerships have enabled companies to diversify their ingredient portfolios and enhance their competitive positioning. As the demand for advanced skincare solutions continues to rise, leading companies are focusing on expanding their product ranges, improving ingredient efficacy, and meeting consumer preferences for clean and sustainable beauty products.

Recent Developments:

- BASF announced the launch of a new line of skin care ingredients focused on boosting skin hydration and elasticity in 2024, responding to the growing demand for anti-aging products.

- Dow Chemical entered into a strategic partnership with a leading cosmetic brand in 2023 to supply innovative functional ingredients for hair care products aimed at improving hair health and shine.

- Evonik Industries unveiled a new natural preservative for skin care formulations in 2023, aligning with the increasing consumer demand for clean and sustainable ingredients.

- Croda International expanded its portfolio in 2023 with the acquisition of a leading cosmetic ingredient supplier, strengthening its position in the functional cosmetics market.

- Solvay launched a groundbreaking anti-aging ingredient in 2024, aimed at reducing fine lines and wrinkles, making it a top choice for skin care brands targeting mature consumers.

List of Leading Companies:

- BASF SE

- Dow Chemical Company

- Evonik Industries AG

- Croda International Plc

- Ashland Global Holdings Inc.

- Clariant AG

- Solvay S.A.

- Lonza Group Ltd.

- Givaudan SA

- Symrise AG

- Nouryon

- Huntsman Corporation

- Lubrizol Corporation

- Innospec Inc.

- Kraton Polymers

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 50.6 Billion |

|

Forecasted Value (2030) |

USD 64.4 Billion |

|

CAGR (2025 – 2030) |

4.1% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Functional Cosmetics and Skin Care Ingredients Market By Ingredient Type (Active Ingredients, Functional Ingredients, Preservatives, Excipients), By Application (Skin Care, Hair Care, Color Cosmetics, Fragrances, Anti-Aging Products), By End-User (Manufacturers of Skin Care Products, Manufacturers of Cosmetics Products, Contract Manufacturing Organizations, Retailers and Online Marketplaces), By Distribution Channel (Online Retailers, Offline Retailers, Direct Sales) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

BASF SE, Dow Chemical Company, Evonik Industries AG, Croda International Plc, Ashland Global Holdings Inc., Clariant AG, Solvay S.A., Lonza Group Ltd., Givaudan SA, Symrise AG, Nouryon, Huntsman Corporation, Lubrizol Corporation, Innospec Inc., Kraton Polymers |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Functional Cosmetics and Skin Care Ingredients Market, by Ingredient Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Active Ingredients |

|

4.2. Functional Ingredients |

|

4.3. Preservatives |

|

4.4. Excipients |

|

5. Functional Cosmetics and Skin Care Ingredients Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Skin Care |

|

5.2. Hair Care |

|

5.3. Color Cosmetics |

|

5.4. Fragrances |

|

5.5. Anti-Aging Products |

|

6. Functional Cosmetics and Skin Care Ingredients Market, by End-User (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Manufacturers of Skin Care Products |

|

6.2. Manufacturers of Cosmetics Products |

|

6.3. Contract Manufacturing Organizations (CMOs) |

|

6.4. Retailers and Online Marketplaces |

|

7. Functional Cosmetics and Skin Care Ingredients Market, by Distribution Channel (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Online Retailers |

|

7.2. Offline Retailers |

|

7.3. Direct Sales |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Functional Cosmetics and Skin Care Ingredients Market, by Ingredient Type |

|

8.2.7. North America Functional Cosmetics and Skin Care Ingredients Market, by Application |

|

8.2.8. North America Functional Cosmetics and Skin Care Ingredients Market, by End-User |

|

8.2.9. North America Functional Cosmetics and Skin Care Ingredients Market, by Distribution Channel |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Functional Cosmetics and Skin Care Ingredients Market, by Ingredient Type |

|

8.2.10.1.2. US Functional Cosmetics and Skin Care Ingredients Market, by Application |

|

8.2.10.1.3. US Functional Cosmetics and Skin Care Ingredients Market, by End-User |

|

8.2.10.1.4. US Functional Cosmetics and Skin Care Ingredients Market, by Distribution Channel |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. BASF SE |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Dow Chemical Company |

|

10.3. Evonik Industries AG |

|

10.4. Croda International Plc |

|

10.5. Ashland Global Holdings Inc. |

|

10.6. Clariant AG |

|

10.7. Solvay S.A. |

|

10.8. Lonza Group Ltd. |

|

10.9. Givaudan SA |

|

10.10. Symrise AG |

|

10.11. Nouryon |

|

10.12. Huntsman Corporation |

|

10.13. Lubrizol Corporation |

|

10.14. Innospec Inc. |

|

10.15. Kraton Polymers |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Functional Cosmetics and Skin Care Ingredients Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Functional Cosmetics and Skin Care Ingredients Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Functional Cosmetics and Skin Care Ingredients Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA