As per Intent Market Research, the Foodservice Disposables Market was valued at USD 65.2 billion in 2023 and will surpass USD 100.7 billion by 2030; growing at a CAGR of 6.4% during 2024 - 2030.

The foodservice disposables market comprises various single-use products designed to support foodservice operations, from packaging to meal delivery. With growing demand for convenience, hygiene, and sustainability, foodservice disposables have become integral to daily operations across the restaurant, catering, and institutional foodservice industries. The increasing trend of takeaway and delivery services, combined with the rise of quick-service restaurants, has amplified the need for disposable products. With an expected compound annual growth rate (CAGR) of 6.1% from 2024 to 2030, this market continues to evolve as consumers and businesses prioritize convenience and eco-friendliness.

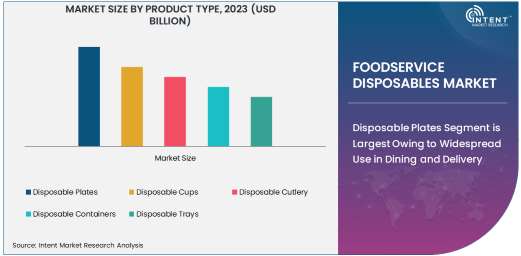

Disposable Plates Segment is Largest Owing to Widespread Use in Dining and Delivery

Among the various product types in the foodservice disposables market, disposable plates hold the largest share due to their extensive use in dining settings. These plates are essential for serving meals in a variety of foodservice environments, from quick-service restaurants to full-service dining establishments. Disposable plates are favored for their convenience, enabling quick clean-up and allowing restaurants to focus on meal preparation and customer service.

As takeout and delivery services expand, the demand for disposable plates has grown significantly. Food delivery services often require disposable plates for customers to enjoy meals at home, while restaurants use them for dine-in customers to maintain hygiene and ease of service. With consumer preferences shifting toward convenience, disposable plates are expected to remain a staple in foodservice operations across the globe.

Paper Material is Fastest Growing Owing to Sustainability Trends

The paper material segment is the fastest growing in the foodservice disposables market, driven by an increasing focus on sustainability. Paper-based disposables, such as plates, cups, and napkins, are gaining traction as consumers and businesses alike turn to more eco-friendly alternatives to plastic. Regulatory pressures and heightened environmental awareness are prompting foodservice providers to adopt paper products that offer biodegradability and recyclability, making them a preferred choice in many regions.

The move towards paper disposables is further bolstered by advancements in manufacturing techniques, which have improved the durability and functionality of paper products. These innovations, combined with growing consumer demand for sustainable options, have contributed to the paper material segment's rapid growth. With governments and organizations working toward reducing plastic waste, the market for paper-based foodservice disposables is expected to continue expanding.

Quick Service Restaurants (QSRs) Segment is Largest End-User Owing to High Disposable Demand

Quick-service restaurants (QSRs) dominate the foodservice disposables market, primarily due to their fast-paced nature and high volume of food served daily. QSRs, such as fast food chains and quick casual dining outlets, rely heavily on disposable items to ensure efficient service and quick turnaround times. Disposable products such as plates, cups, and containers allow QSRs to cater to a large number of customers while minimizing the time spent on cleaning and sanitization.

The demand for foodservice disposables in QSRs is further driven by the rapid growth of food delivery and takeout services. As more consumers opt for quick meals delivered to their homes, QSRs are increasingly turning to disposable packaging solutions to meet these needs. This trend has reinforced the QSR segment's dominance in the foodservice disposables market, making it the largest end-user segment.

Food Packaging Application is Largest Owing to Consumer Preference for Convenience

The food packaging application holds the largest share in the foodservice disposables market, driven by the need for efficient and hygienic packaging solutions. As the foodservice industry has evolved, packaging has become increasingly important for both food safety and consumer convenience. Disposable packaging is essential in takeaway and delivery services, where it helps preserve food quality and ensure easy transportation.

With the rise of delivery services, particularly during the COVID-19 pandemic, food packaging has become a central part of the foodservice disposables market. The shift toward online food delivery has caused a surge in demand for disposable food packaging products, including containers, bags, and wraps. This trend is expected to continue, making food packaging the largest application segment in the market.

North America is Largest Region Owing to Established Foodservice Infrastructure

North America remains the largest region in the foodservice disposables market, largely due to its well-established foodservice infrastructure and high consumption rates. The U.S., in particular, has a vast network of restaurants, fast food outlets, and catering services that heavily rely on disposable products. Additionally, the widespread adoption of food delivery services in North America has further accelerated the demand for foodservice disposables.

The region's foodservice disposables market is also shaped by stringent hygiene standards and consumer preferences for convenience. Regulations in North America often require foodservice providers to use disposable products to meet health and safety requirements, adding to the demand for these products. The North American market is expected to maintain its dominance as the region continues to lead in foodservice innovations and consumer trends.

Competitive Landscape and Leading Companies

The foodservice disposables market is highly competitive, with several global and regional players leading the way. Key companies include Dart Container Corporation, Huhtamaki Group, Berry Global Inc., and Genpak LLC. These companies are focused on product innovation, particularly in sustainable and biodegradable materials, to meet growing consumer demand for eco-friendly solutions. Additionally, many players are expanding their production capabilities and enhancing their distribution networks to cater to the increasing demand from foodservice providers worldwide.

The competitive landscape is also marked by strategic mergers and acquisitions, as companies aim to diversify their product portfolios and strengthen their market presence. Companies are increasingly investing in research and development to create products that meet environmental standards while maintaining the functionality and cost-effectiveness of traditional disposables. As sustainability becomes a key driver in the foodservice disposables market, these leading companies are expected to continue innovating and adapting to market trends.

Recent Developments:

- Dart Container Corporation announced the launch of new sustainable disposable containers made from 100% recycled plastic, catering to the growing demand for eco-friendly options.

- Huhtamaki Group acquired a major plant-based packaging company to enhance its portfolio of sustainable foodservice disposables and reduce environmental impact.

- Sealed Air Corporation launched a new line of biodegradable and compostable foodservice products, aiming to meet the demand for green alternatives.

- Berry Global Inc. expanded its foodservice packaging operations in Asia-Pacific, investing in new technology to improve product quality and reduce waste.

- Bunzl Plc entered into a strategic partnership with a key fast food chain to supply eco-friendly foodservice disposables, supporting the brand's sustainability goals.

List of Leading Companies:

- Anchor Packaging LLC

- Berry Global Inc.

- Bunzl Plc

- Cups & Cones LLC

- Dart Container Corporation

- Eco-Products, Inc.

- Georgia-Pacific LLC

- Huhtamaki Group

- Lollicup USA Inc.

- McDonald’s Corporation (supplies foodservice disposables)

- Placon Corporation

- Pro-Pak Industries

- Sealed Air Corporation

- Solenis LLC

- Vita Foods

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 65.2 Billion |

|

Forecasted Value (2030) |

USD 100.7 Billion |

|

CAGR (2024 – 2030) |

6.4% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Foodservice Disposables Market by Product Type (Tableware, Packaging, Cutlery, Cups & Lids, Trays), by Material (Plastic, Paper, Biodegradable, Foam, Aluminum), by End-Use (Restaurants, Fast Food Outlets, Catering, Institutional Foodservice) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Anchor Packaging LLC, Berry Global Inc., Bunzl Plc, Cups & Cones LLC, Dart Container Corporation, Eco-Products, Inc., Huhtamaki Group, Lollicup USA Inc., McDonald’s Corporation (supplies foodservice disposables), Placon Corporation, Pro-Pak Industries, Sealed Air Corporation and Vita Foods |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Foodservice Disposables Market, by Product Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Disposable Plates |

|

4.2. Disposable Cups |

|

4.3. Disposable Cutlery |

|

4.4. Disposable Containers |

|

4.5. Disposable Trays |

|

5. Foodservice Disposables Market, by Material Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Plastic |

|

5.2. Paper |

|

5.3. Foam |

|

5.4. Plant-Based Materials |

|

6. Foodservice Disposables Market, by End-Use Industry (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Quick Service Restaurants |

|

6.2. Full-Service Restaurants |

|

6.3. Catering Services |

|

6.4. Institutional Foodservice |

|

7. Foodservice Disposables Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Food Packaging |

|

7.2. Takeaway & Delivery Services |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Foodservice Disposables Market, by Product Type |

|

8.2.7. North America Foodservice Disposables Market, by Material Type |

|

8.2.8. North America Foodservice Disposables Market, by End-Use Industry |

|

8.2.9. North America Foodservice Disposables Market, by Application |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Foodservice Disposables Market, by Product Type |

|

8.2.10.1.2. US Foodservice Disposables Market, by Material Type |

|

8.2.10.1.3. US Foodservice Disposables Market, by End-Use Industry |

|

8.2.10.1.4. US Foodservice Disposables Market, by Application |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Anchor Packaging LLC |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Berry Global Inc. |

|

10.3. Bunzl Plc |

|

10.4. Cups & Cones LLC |

|

10.5. Dart Container Corporation |

|

10.6. Eco-Products, Inc. |

|

10.7. Georgia-Pacific LLC |

|

10.8. Huhtamaki Group |

|

10.9. Lollicup USA Inc. |

|

10.10. McDonald’s Corporation |

|

10.11. Placon Corporation |

|

10.12. Pro-Pak Industries |

|

10.13. Sealed Air Corporation |

|

10.14. Solenis LLC |

|

10.15. Vita Foods |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Foodservice Disposables Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Foodservice Disposables Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Foodservice Disposables Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA