As per Intent Market Research, the Foldable Smartphone Market was valued at USD 12.5 billion in 2023 and will surpass USD 60.1 billion by 2030; growing at a CAGR of 25.2% during 2024 - 2030.

The foldable smartphone market is witnessing rapid advancements in design and technology, driven by the growing demand for innovative, space-efficient devices with large screens. As consumer preferences evolve towards devices that offer greater versatility, foldable smartphones provide an attractive solution by combining portability with an enhanced display experience. With improved durability, performance, and flexibility in recent years, foldable smartphones are expected to see widespread adoption, particularly in high-end consumer segments. As the technology matures, both device manufacturers and component suppliers are investing heavily in foldable display technologies, ensuring that these products meet the increasing consumer demand for cutting-edge designs.

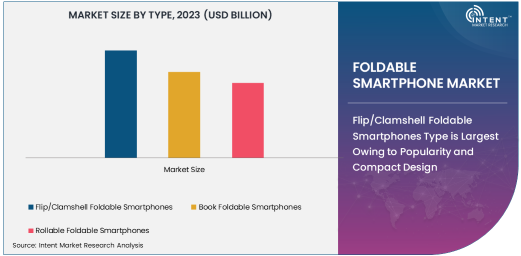

Flip/Clamshell Foldable Smartphones Type is Largest Owing to Popularity and Compact Design

Among the various types of foldable smartphones, the flip/clamshell foldable smartphones segment is the largest, driven by the compact design and convenience they offer to consumers. These devices typically feature a horizontal fold, allowing the phone to be pocket-sized when closed and offering a larger screen when opened. Popularized by high-profile releases such as Samsung's Galaxy Z Flip series, flip foldables are well-suited for users who prefer a smaller form factor but still want the functionality of a larger smartphone display.

The appeal of flip foldable smartphones lies in their ease of use, portability, and the ability to provide a larger screen in a small, stylish design. The segment continues to grow as more brands introduce similar designs, targeting both premium and mid-range price segments, thus attracting a wider consumer base.

OLED Display Technology is Largest Owing to Superior Quality and Efficiency

OLED (Organic Light Emitting Diode) display technology is the largest segment within the foldable smartphone market, known for its superior display quality, energy efficiency, and flexible characteristics. OLED displays offer vibrant colors, deep blacks, and thinner profiles compared to traditional LCD screens, making them ideal for foldable designs. They also contribute to the device's overall flexibility, allowing manufacturers to create foldable screens that can bend without compromising the visual experience.

The widespread adoption of OLED technology in flagship foldable smartphones, such as those from Samsung and Huawei, has significantly boosted its prominence in the market. As OLED technology continues to advance, it is expected to remain the go-to choice for foldable smartphones, offering high-definition displays with low power consumption and superior brightness.

Android Operating System is Largest Owing to Market Penetration and Customization Options

The Android operating system is the largest segment in the foldable smartphone market, primarily because of its widespread adoption and versatility in supporting innovative foldable designs. Android offers a flexible and customizable platform that allows manufacturers to design foldable smartphones with unique user interfaces and features. Additionally, Android’s compatibility with a wide range of hardware configurations makes it an ideal choice for foldable smartphones across various price points.

As Android remains the dominant operating system in the smartphone market, its presence in the foldable segment is growing. Major brands like Samsung, Motorola, and others use Android in their foldable devices, ensuring a seamless experience for users. The platform's continuous updates, support for multi-window functionality, and app optimization for foldable screens further enhance its appeal to manufacturers and consumers.

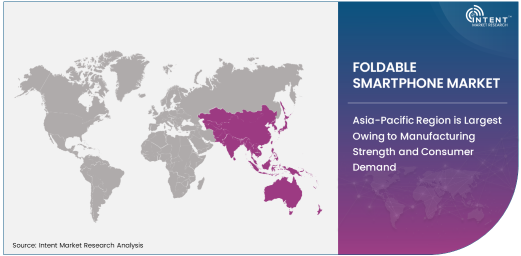

Asia-Pacific Region is Largest Owing to Manufacturing Strength and Consumer Demand

The Asia-Pacific region is the largest market for foldable smartphones, driven by the strong manufacturing base in countries like China, South Korea, and Japan, where key foldable smartphone manufacturers, including Samsung, Huawei, and Xiaomi, are headquartered. Additionally, the region's large consumer base and increasing disposable income, particularly in countries such as China and India, contribute to the growing demand for premium smartphones, including foldable models.

In Asia-Pacific, foldable smartphones are seen as a status symbol and are gaining popularity among tech-savvy consumers who value innovative designs and large-screen experiences. As the region continues to lead in smartphone production, it is expected to maintain its dominance in the foldable smartphone market, with manufacturers further expanding their offerings in this segment.

Competitive Landscape and Leading Companies

The foldable smartphone market is highly competitive, with several major players striving to innovate and capture a significant share of the market. Leading companies in the foldable smartphone space include Samsung, Huawei, Motorola, Xiaomi, and Royole, each offering unique foldable devices with cutting-edge features. Samsung is a market leader, with its Galaxy Z Fold and Z Flip series setting industry standards for foldable designs. Huawei and Motorola are also significant players, offering competitive foldable smartphones that cater to both premium and mid-range markets.

As the market continues to mature, competition is intensifying, with companies focusing on improving the durability, battery life, and display technology of foldable smartphones. Additionally, new entrants and smaller players are increasingly investing in foldable technologies, hoping to carve out a niche in the rapidly growing market. The ongoing evolution of foldable displays, along with advancements in materials science, is expected to drive innovation and further shape the competitive landscape in the coming years.

Recent Developments:

- Samsung Electronics launched its latest Galaxy Z Fold 5 and Z Flip 5 models, featuring improved hinges and enhanced displays for a better foldable experience.

- Huawei Technologies introduced the Huawei Mate X3, a new foldable device with a thinner design, upgraded camera features, and 5G support.

- Motorola unveiled the Motorola Razr 2024 with improved durability and enhanced software features for a seamless user experience in foldable devices.

- Royole Corporation announced its latest flexible display technology, aiming to expand its presence in the foldable smartphone market with more cost-effective solutions.

- Xiaomi revealed the Mi Mix Fold 2, featuring a more compact foldable form factor and competitive pricing, targeting the mid-range foldable smartphone segment.

List of Leading Companies:

- Samsung Electronics

- Huawei Technologies Co., Ltd.

- Motorola Solutions

- LG Electronics

- ZTE Corporation

- Royole Corporation

- Xiaomi Corporation

- Apple Inc.

- Oppo Electronics Corporation

- Vivo Communication Technology Co. Ltd.

- Google LLC

- Sony Corporation

- Realme

- TCL Corporation

- Lenovo Group Ltd.

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 12.5 Billion |

|

Forecasted Value (2030) |

USD 60.1 Billion |

|

CAGR (2024 – 2030) |

25.2% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Foldable Smartphone Market by Type (Flip/Clamshell Foldable Smartphones, Book Foldable Smartphones, Rollable Foldable Smartphones), by Display Technology (OLED, AMOLED, MicroLED), by Operating System (Android, iOS) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Samsung Electronics, Huawei Technologies Co., Ltd., Motorola Solutions, LG Electronics, ZTE Corporation, Royole Corporation, Apple Inc., Oppo Electronics Corporation, Vivo Communication Technology Co. Ltd., Google LLC, Sony Corporation, Realme and Lenovo Group Ltd. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Foldable Smartphone Market, by Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Flip/Clamshell Foldable Smartphones |

|

4.2. Book Foldable Smartphones |

|

4.3. Rollable Foldable Smartphones |

|

5. Foldable Smartphone Market, by Display Technology (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. AMOLED |

|

5.2. OLED |

|

5.3. MicroLED |

|

6. Foldable Smartphone Market, by Operating System (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Android |

|

6.2. iOS |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Foldable Smartphone Market, by Type |

|

7.2.7. North America Foldable Smartphone Market, by Display Technology |

|

7.2.8. North America Foldable Smartphone Market, by Operating System |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Foldable Smartphone Market, by Type |

|

7.2.9.1.2. US Foldable Smartphone Market, by Display Technology |

|

7.2.9.1.3. US Foldable Smartphone Market, by Operating System |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Samsung Electronics |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Huawei Technologies Co., Ltd. |

|

9.3. Motorola Solutions |

|

9.4. LG Electronics |

|

9.5. ZTE Corporation |

|

9.6. Royole Corporation |

|

9.7. Xiaomi Corporation |

|

9.8. Apple Inc. |

|

9.9. Oppo Electronics Corporation |

|

9.10. Vivo Communication Technology Co. Ltd. |

|

9.11. Google LLC |

|

9.12. Sony Corporation |

|

9.13. Realme |

|

9.14. TCL Corporation |

|

9.15. Lenovo Group Ltd. |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Foldable Smartphone Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Foldable Smartphone Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Foldable Smartphone Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA