As per Intent Market Research, the Flue Gas Desulfurization System Market was valued at USD 20.9 billion in 2023 and will surpass USD 35.5 billion by 2030; growing at a CAGR of 7.9% during 2024 - 2030.

The Flue Gas Desulfurization (FGD) system market has become a critical component in industries that rely on combustion processes, particularly in power generation, industrial manufacturing, and chemical processing. These systems are designed to remove sulfur dioxide (SO?) from the exhaust gases of fossil fuel power plants, refineries, and other industrial facilities to meet stringent environmental regulations. With the global push toward reducing air pollution and meeting emissions standards, the FGD market is evolving to meet these challenges. The market growth is fueled by increasing environmental concerns, tightening emission regulations, and the growing demand for cleaner energy.

The key technologies in the FGD market—wet, dry, and semi-dry systems—offer varied advantages depending on the specific needs of the installation, such as efficiency, cost-effectiveness, and environmental impact. The continued demand for sustainable industrial practices and the introduction of innovative solutions to meet emission targets is driving the market forward. As countries across the globe implement more stringent environmental standards, especially in regions like North America, Europe, and Asia-Pacific, the FGD system market is expected to experience substantial growth in the coming years.

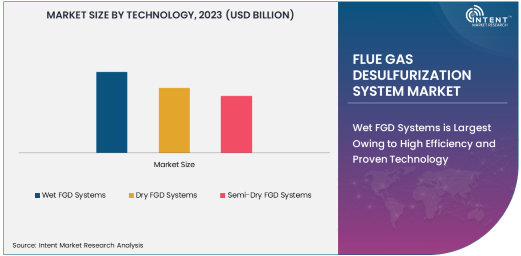

Wet FGD Systems is Largest Owing to High Efficiency and Proven Technology

Wet FGD systems are the largest segment in the flue gas desulfurization system market, primarily due to their high efficiency and long-standing use in power plants and industrial applications. These systems use a water-based solution, typically a limestone slurry, to absorb sulfur dioxide (SO?) from exhaust gases. The wet scrubbing process is highly effective, capable of removing up to 98% of sulfur dioxide from the gas stream, making it the preferred choice in industries requiring stringent air quality standards.

The popularity of wet FGD systems is driven by their proven reliability and ability to meet environmental regulations in various industries, particularly power plants, which are among the largest sources of SO? emissions. Wet systems are capable of handling large volumes of exhaust gases and are widely used in both new installations and retrofit applications. Their ability to efficiently reduce sulfur emissions, combined with advancements in system design and operation, has solidified wet FGD systems as the dominant technology in the market. With increasing environmental regulations and growing demand for cleaner emissions, the wet FGD system segment will continue to lead the market.

Power Plants Application is Largest Owing to Regulatory Compliance and Emission Reduction Needs

The power plants application segment is the largest in the FGD system market, driven by the regulatory pressure to reduce sulfur dioxide emissions. Power plants that rely on coal and other fossil fuels produce significant amounts of SO?, a major contributor to air pollution and acid rain. In response to stringent emission standards set by governments globally, power plants are increasingly adopting FGD systems to mitigate their environmental impact and comply with regulatory requirements.

As the global energy sector shifts towards more sustainable practices, the demand for cleaner energy production has surged, boosting the adoption of FGD systems in power plants. The combination of regulatory pressures, government incentives, and the need for power producers to meet compliance deadlines ensures that power plants will continue to drive the demand for flue gas desulfurization systems. In addition, the ability of FGD systems to not only meet environmental standards but also support the overall efficiency and performance of power plants makes them a long-term investment in cleaner energy production.

Energy Generation End-User Industry is Largest Owing to Stringent Emission Regulations

The energy generation end-user industry holds the largest share in the FGD system market, primarily due to the significant contribution of power plants to sulfur dioxide emissions. Governments and regulatory bodies worldwide have introduced stricter air quality standards and emission reduction targets to limit the environmental impact of fossil fuel-based power generation. In order to comply with these regulations, energy generation companies are increasingly investing in FGD systems to ensure their operations meet the required emission standards.

The energy generation sector’s large share is further driven by the high cost of non-compliance with environmental regulations, which can lead to hefty fines, legal actions, and reputational damage. FGD systems are therefore seen as essential investments for power producers to avoid these risks and ensure continued operation in a regulated environment. With the growing demand for clean energy and increased government focus on reducing carbon footprints, the energy generation industry will remain the dominant driver for the flue gas desulfurization market.

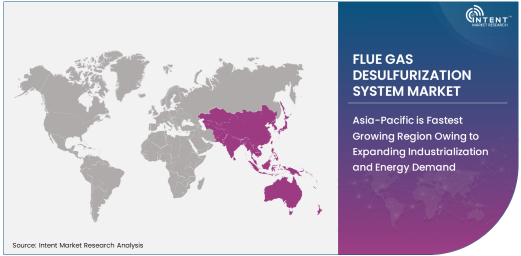

Asia-Pacific is Fastest Growing Region Owing to Expanding Industrialization and Energy Demand

The Asia-Pacific region is the fastest growing in the flue gas desulfurization system market, driven by rapid industrialization, urbanization, and an increasing demand for energy. Countries like China and India are major contributors to the growing demand for FGD systems due to their large coal-based power generation sectors. The region’s industrial boom, coupled with the need to comply with tightening emission regulations, is accelerating the adoption of flue gas desulfurization systems in industries such as power generation, chemical processing, and metal manufacturing.

The demand for cleaner air and improved environmental quality in Asia-Pacific is becoming increasingly urgent as these countries continue to industrialize. Governments in the region are implementing stricter air quality standards, prompting industries to invest in FGD technology. Additionally, the rising focus on environmental sustainability and international trade agreements regarding emissions has spurred the demand for advanced desulfurization technologies. The region's rapid adoption of these systems will make Asia-Pacific a key player in the global FGD system market in the coming years.

Competitive Landscape and Leading Companies

The Flue Gas Desulfurization (FGD) system market is competitive, with several global and regional players offering a range of solutions to meet the growing demand for sulfur dioxide reduction technologies. Leading companies in the market include GE Power, Andritz AG, Mitsubishi Heavy Industries, Doosan Heavy Industries & Construction, and FLSmidth, among others. These companies are focusing on innovations in FGD system efficiency, cost reduction, and environmental performance to stay ahead of the competition. They are also expanding their geographical footprint and entering new markets through strategic partnerships, acquisitions, and joint ventures.

The market is also witnessing an increasing shift toward eco-friendly and energy-efficient FGD systems, with a growing emphasis on reducing operating costs and improving overall plant efficiency. Companies are investing in R&D to develop advanced technologies, such as semi-dry FGD systems, which offer cost-effective alternatives to wet systems. The competitive landscape is becoming more dynamic as regulatory pressures and the shift toward cleaner energy sources continue to influence market strategies and product innovations. As the demand for FGD systems grows globally, these companies are poised to lead the market in offering sustainable solutions to meet environmental compliance standards.

Recent Developments:

- Siemens AG announced the successful implementation of its advanced wet FGD systems at a large coal-fired power plant in Europe, improving sulfur emissions reduction.

- GE Power signed a major contract with a leading industrial plant in Asia to supply a new dry FGD system, aimed at reducing SO2 emissions and meeting new environmental regulations.

- Thermax Limited launched an upgraded version of its FGD technology, offering higher efficiency and reduced operational costs, designed for coal-fired power plants.

- Mitsubishi Heavy Industries completed an FGD system upgrade for a major refinery in the Middle East, significantly reducing sulfur emissions in compliance with stricter environmental laws.

- Babcock & Wilcox Enterprises, Inc. received an order for a new FGD system from a large power plant in North America, part of the plant’s effort to meet upcoming environmental standards for

List of Leading Companies:

- Alstom SA

- Siemens AG

- Mitsubishi Heavy Industries

- GE Power

- Thermax Limited

- Andritz AG

- Doosan Lentjes

- FLSmidth & Co. A/S

- Babcock & Wilcox Enterprises, Inc.

- Kawasaki Heavy Industries, Ltd.

- Valmet Corporation

- Daewoo Engineering & Construction

- Hamon Group

- Dongfang Electric Corporation

- Lurgi GmbH (Air Liquide)

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 20.9 Billion |

|

Forecasted Value (2030) |

USD 35.5 Billion |

|

CAGR (2024 – 2030) |

7.9% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Flue Gas Desulfurization System Market by Technology (Wet FGD Systems, Dry FGD Systems, Semi-Dry FGD Systems), by Application (Power Plants, Industrial Plants, Oil Refineries), by End-User Industry (Energy Generation, Chemical Processing, Metal Processing) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Alstom SA, Siemens AG, Mitsubishi Heavy Industries, GE Power, Thermax Limited, Andritz AG, FLSmidth & Co. A/S, Babcock & Wilcox Enterprises, Inc., Kawasaki Heavy Industries, Ltd., Valmet Corporation, Daewoo Engineering & Construction, Hamon Group, Lurgi GmbH (Air Liquide) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Flue Gas Desulfurization System Market, by Technology (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Wet FGD Systems |

|

4.2. Dry FGD Systems |

|

4.3. Semi-Dry FGD Systems |

|

5. Flue Gas Desulfurization System Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Power Plants |

|

5.2. Industrial Plants |

|

5.3. Oil Refineries |

|

5.4. Others |

|

6. Flue Gas Desulfurization System Market, by End-User (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Energy Generation |

|

6.2. Chemical Processing |

|

6.3. Metal Processing |

|

6.4. Others |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Flue Gas Desulfurization System Market, by Technology |

|

7.2.7. North America Flue Gas Desulfurization System Market, by Application |

|

7.2.8. North America Flue Gas Desulfurization System Market, by End-User |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Flue Gas Desulfurization System Market, by Technology |

|

7.2.9.1.2. US Flue Gas Desulfurization System Market, by Application |

|

7.2.9.1.3. US Flue Gas Desulfurization System Market, by End-User |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Alstom SA |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Siemens AG |

|

9.3. Mitsubishi Heavy Industries |

|

9.4. GE Power |

|

9.5. Thermax Limited |

|

9.6. Andritz AG |

|

9.7. Doosan Lentjes |

|

9.8. FLSmidth & Co. A/S |

|

9.9. Babcock & Wilcox Enterprises, Inc. |

|

9.10. Kawasaki Heavy Industries, Ltd. |

|

9.11. Valmet Corporation |

|

9.12. Daewoo Engineering & Construction |

|

9.13. Hamon Group |

|

9.14. Dongfang Electric Corporation |

|

9.15. Lurgi GmbH (Air Liquide) |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Flue Gas Desulfurization System Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Flue Gas Desulfurization System Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Flue Gas Desulfurization System Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA