As per Intent Market Research, the Flavored And Functional Water Market was valued at USD 15.9 Billion in 2023 and will surpass USD 29.5 Billion by 2030; growing at a CAGR of 9.2% during 2024 - 2030.

The flavored and functional water market is witnessing robust growth, driven by increasing consumer demand for healthier beverage alternatives. These products combine hydration with added benefits, catering to diverse preferences for flavor and nutrition. Flavored water appeals to consumers seeking a refreshing, low-calorie option, while functional water offers enhanced health benefits with ingredients such as vitamins, minerals, and antioxidants. This dual demand is fueling market expansion across various regions and consumer demographics.

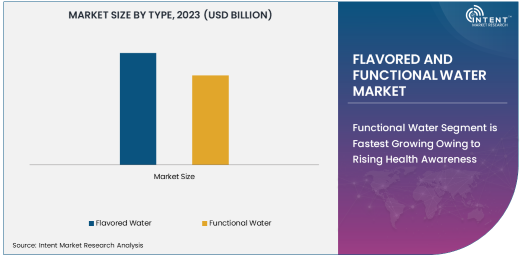

Functional Water Segment is Fastest Growing Owing to Rising Health Awareness

The functional water segment is the fastest-growing type in the market, driven by increasing consumer awareness of health and wellness. Functional water is infused with beneficial ingredients like vitamins, minerals, and antioxidants, appealing to health-conscious consumers who seek hydration with added nutritional value. This segment is particularly popular among athletes, fitness enthusiasts, and busy professionals looking for convenient, on-the-go health solutions.

The growth of the functional water segment is further supported by innovations in ingredient formulation and marketing strategies emphasizing wellness. Manufacturers are introducing products that target specific health concerns, such as energy boosts, immune support, and skin health, expanding the segment's appeal. As consumer demand for functional beverages continues to rise, this category is expected to maintain its upward trajectory.

Vitamins Ingredient Segment is Largest Owing to Broad Consumer Appeal

Among ingredient types, the vitamins segment holds the largest market share, owing to its broad consumer appeal and versatility. Vitamin-enriched flavored and functional waters are marketed as convenient ways to supplement daily nutritional needs, attracting a wide range of consumers, from children to health-conscious adults. These products often highlight essential vitamins such as B-complex, C, and D, which are associated with energy, immunity, and overall well-being.

The popularity of vitamin-enriched water is bolstered by increasing public awareness of the importance of micronutrients and the desire for healthier, fortified beverages. The segment's versatility allows manufacturers to cater to specific consumer needs, such as immunity-boosting drinks during flu seasons or energy-enhancing options for active lifestyles, ensuring its continued dominance in the market.

Bottles Packaging Segment is Largest Due to Convenience and Durability

The bottles segment dominates the packaging market for flavored and functional water, attributed to its convenience, durability, and widespread availability. Bottles are the preferred packaging format for both manufacturers and consumers, offering portability and ease of use for on-the-go hydration. Additionally, bottles allow for clear branding and labeling, which helps manufacturers attract and inform consumers at the point of purchase.

As sustainability becomes a key consideration, many companies are transitioning to eco-friendly materials, such as recyclable or biodegradable bottles, to address environmental concerns. This shift aligns with consumer demand for environmentally responsible products, further solidifying the position of bottles as the largest packaging segment in the market.

Online Retail is Fastest Growing Distribution Channel Owing to E-Commerce Boom

The online retail segment is the fastest-growing distribution channel for flavored and functional water, driven by the global boom in e-commerce and changing consumer shopping behaviors. Online platforms provide consumers with the convenience of home delivery, a wide variety of choices, and access to detailed product information and reviews, making it an attractive option for purchasing beverages.

Manufacturers are leveraging online channels to reach broader audiences through targeted digital marketing and partnerships with e-commerce giants like Amazon and regional platforms. The pandemic-induced shift towards online shopping has further accelerated this trend, and as digital adoption continues to grow, online retail is expected to maintain its rapid expansion.

Health-Conscious Consumers Segment is Largest Owing to Growing Wellness Trends

Health-conscious consumers form the largest end-user segment in the flavored and functional water market, reflecting a global trend toward healthier lifestyles. These consumers prioritize products that align with their wellness goals, such as hydration, nutrition, and calorie control. Flavored and functional waters meet these criteria, offering refreshing alternatives to sugary drinks while providing added health benefits.

This segment is further fueled by awareness campaigns and social media influence, which have highlighted the advantages of staying hydrated and choosing functional beverages. As wellness trends continue to shape consumer behavior, health-conscious consumers are expected to remain the primary drivers of market demand.

Asia-Pacific is Fastest Growing Region Owing to Expanding Middle-Class and Urbanization

Asia-Pacific (APAC) is the fastest-growing region in the flavored and functional water market, driven by rapid urbanization, rising disposable incomes, and an expanding middle class. Countries such as China, India, and Japan are experiencing increased demand for healthier beverage options, fueled by growing health awareness and a shift away from carbonated and sugary drinks.

The region's youthful population and increasing adoption of fitness-oriented lifestyles further contribute to the demand for flavored and functional water. Additionally, the entry of international brands and the rise of local players offering innovative products tailored to regional tastes are propelling market growth in APAC.

Competitive Landscape and Leading Companies

The flavored and functional water market is highly competitive, with key players such as PepsiCo, Coca-Cola, Nestlé, Danone, and Hint Water dominating the global landscape. These companies focus on product innovation, branding, and strategic partnerships to maintain their competitive edge. Emerging players are also making significant inroads with unique formulations and niche marketing strategies.

The competitive landscape is characterized by a growing emphasis on sustainability, with companies adopting eco-friendly packaging and sourcing practices to appeal to environmentally conscious consumers. As the market evolves, innovation in flavor profiles, ingredient combinations, and marketing approaches will continue to shape the competitive dynamics of the industry.

Recent Developments:

- Nestlé Waters launched a new vitamin-infused water line targeting health-conscious millennials, emphasizing sustainability with eco-friendly packaging.

- PepsiCo expanded its Propel Fitness Water brand by introducing plant-based antioxidant blends for hydration and recovery.

- The Coca-Cola Company acquired a minority stake in a wellness beverage startup, signaling a strategic move into premium functional hydration.

- Danone S.A. introduced a sugar-free functional water range enriched with electrolytes and probiotics to tap into the fitness market.

- Hint Water secured a partnership with leading grocery chains to expand its distribution network, boosting its market presence in North America.

List of Leading Companies:

- AQUAhydrate, Inc.

- Danone S.A.

- FIJI Water Company LLC

- Glacéau Vitaminwater (Coca-Cola)

- Grupo Vichy Catalan

- Hint Water, Inc.

- Keurig Dr Pepper Inc.

- National Beverage Corp.

- Nestlé Waters

- PepsiCo, Inc.

- Suntory Beverage & Food Limited

- Talking Rain Beverage Company

- The Coca-Cola Company

- Unilever PLC

- Voss Water

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 15.9 Billion |

|

Forecasted Value (2030) |

USD 29.5 Billion |

|

CAGR (2024 – 2030) |

9.2% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Flavored and Functional Water Market by Type (Flavored Water, Functional Water), by Ingredient Type (Vitamins, Minerals, Botanicals, Proteins, Antioxidants), by Packaging (Bottles, Cans, Pouches), by Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retail, Specialty Stores), by End-User (Adults, Children, Athletes, Health-Conscious Consumers) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

AQUAhydrate, Inc., Danone S.A., FIJI Water Company LLC, Glacéau Vitaminwater (Coca-Cola), Grupo Vichy Catalan, Hint Water, Inc., National Beverage Corp., Nestlé Waters, PepsiCo, Inc., Suntory Beverage & Food Limited, Talking Rain Beverage Company, The Coca-Cola Company, Voss Water |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Flavored And Functional Water Market, by Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Flavored Water |

|

4.2. Functional Water |

|

5. Flavored And Functional Water Market, by Ingredient Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Vitamins |

|

5.2. Minerals |

|

5.3. Botanicals |

|

5.4. Proteins |

|

5.5. Antioxidants |

|

6. Flavored And Functional Water Market, by Packaging (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Bottles |

|

6.2. Cans |

|

6.3. Pouches |

|

7. Flavored And Functional Water Market, by Distribution Channel (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Supermarkets/Hypermarkets |

|

7.2. Convenience Stores |

|

7.3. Online Retail |

|

7.4. Specialty Stores |

|

8. Flavored And Functional Water Market, by End-User (Market Size & Forecast: USD Million, 2022 – 2030) |

|

8.1. Adults |

|

8.2. Children |

|

8.3. Athletes |

|

8.4. Health-Conscious Consumers |

|

9. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

9.1. Regional Overview |

|

9.2. North America |

|

9.2.1. Regional Trends & Growth Drivers |

|

9.2.2. Barriers & Challenges |

|

9.2.3. Opportunities |

|

9.2.4. Factor Impact Analysis |

|

9.2.5. Technology Trends |

|

9.2.6. North America Flavored And Functional Water Market, by Type |

|

9.2.7. North America Flavored And Functional Water Market, by Ingredient Type |

|

9.2.8. North America Flavored And Functional Water Market, by Packaging |

|

9.2.9. North America Flavored And Functional Water Market, by Distribution Channel |

|

9.2.10. North America Flavored And Functional Water Market, by End-User |

|

9.2.11. By Country |

|

9.2.11.1. US |

|

9.2.11.1.1. US Flavored And Functional Water Market, by Type |

|

9.2.11.1.2. US Flavored And Functional Water Market, by Ingredient Type |

|

9.2.11.1.3. US Flavored And Functional Water Market, by Packaging |

|

9.2.11.1.4. US Flavored And Functional Water Market, by Distribution Channel |

|

9.2.11.1.5. US Flavored And Functional Water Market, by End-User |

|

9.2.11.2. Canada |

|

9.2.11.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

9.3. Europe |

|

9.4. Asia-Pacific |

|

9.5. Latin America |

|

9.6. Middle East & Africa |

|

10. Competitive Landscape |

|

10.1. Overview of the Key Players |

|

10.2. Competitive Ecosystem |

|

10.2.1. Level of Fragmentation |

|

10.2.2. Market Consolidation |

|

10.2.3. Product Innovation |

|

10.3. Company Share Analysis |

|

10.4. Company Benchmarking Matrix |

|

10.4.1. Strategic Overview |

|

10.4.2. Product Innovations |

|

10.5. Start-up Ecosystem |

|

10.6. Strategic Competitive Insights/ Customer Imperatives |

|

10.7. ESG Matrix/ Sustainability Matrix |

|

10.8. Manufacturing Network |

|

10.8.1. Locations |

|

10.8.2. Supply Chain and Logistics |

|

10.8.3. Product Flexibility/Customization |

|

10.8.4. Digital Transformation and Connectivity |

|

10.8.5. Environmental and Regulatory Compliance |

|

10.9. Technology Readiness Level Matrix |

|

10.10. Technology Maturity Curve |

|

10.11. Buying Criteria |

|

11. Company Profiles |

|

11.1. AQUAhydrate, Inc. |

|

11.1.1. Company Overview |

|

11.1.2. Company Financials |

|

11.1.3. Product/Service Portfolio |

|

11.1.4. Recent Developments |

|

11.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

11.2. Danone S.A. |

|

11.3. FIJI Water Company LLC |

|

11.4. Glacéau Vitaminwater (Coca-Cola) |

|

11.5. Grupo Vichy Catalan |

|

11.6. Hint Water, Inc. |

|

11.7. Keurig Dr Pepper Inc. |

|

11.8. National Beverage Corp. |

|

11.9. Nestlé Waters |

|

11.10. PepsiCo, Inc. |

|

11.11. Suntory Beverage & Food Limited |

|

11.12. Talking Rain Beverage Company |

|

11.13. The Coca-Cola Company |

|

11.14. Unilever PLC |

|

11.15. Voss Water |

|

12. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Flavored and Functional Water Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Flavored and Functional Water Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Flavored and Functional Water Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA