As per Intent Market Research, the Flavored Alcohol Market was valued at USD 29.9 billion in 2023 and will surpass USD 45.4 billion by 2030; growing at a CAGR of 6.2% during 2024 - 2030.

The flavored alcohol market has experienced significant growth in recent years, driven by changing consumer preferences and the growing trend for more personalized and unique alcoholic beverages. As more consumers seek out new experiences and flavor profiles in their drinks, flavored alcohol offers an exciting alternative to traditional beverages. This demand for innovation has encouraged alcohol producers to expand their product offerings, catering to a wide range of taste preferences and demographics. The global flavored alcohol market includes a diverse range of products, including flavored beer, wine, spirits, vodka, and whiskey, each infused with various flavor profiles, from fruit and sweet to more exotic herbs and spices.

Additionally, the rise in cocktail culture, particularly among younger generations, has further boosted the flavored alcohol market. Consumers are increasingly drawn to the convenience of ready-to-drink beverages and the appeal of unique flavor combinations. As flavor experimentation continues to evolve, the market is expected to see continued growth, driven by innovation in flavor profiles and distribution strategies. The popularity of flavored alcohol is also being fueled by increased social acceptance, making it a mainstream option for consumers seeking variety in their drinking experience.

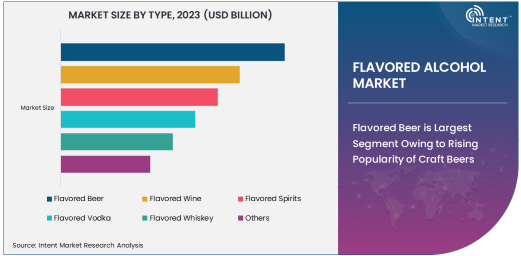

Flavored Beer is Largest Segment Owing to Rising Popularity of Craft Beers

Flavored beer is the largest segment in the flavored alcohol market, owing to the growing popularity of craft beer and the increasing interest in innovative and unique beer flavors. The craft beer movement, which has gained significant momentum globally, has encouraged brewers to experiment with various flavors to differentiate their offerings. This has led to an influx of fruit-infused beers, herb and spice flavored brews, and other creative concoctions, making flavored beer a go-to choice for consumers seeking variety. The ability to combine traditional beer styles with adventurous and refreshing flavors has expanded the consumer base, especially among younger, trend-conscious drinkers.

The growth of flavored beer is also attributed to its versatility. It appeals to a broad range of taste preferences, from light fruit flavors to more complex combinations with spices and herbs. As consumer demand for novel flavor profiles continues to rise, brewers are likely to keep exploring new combinations and ingredients, ensuring the segment’s sustained popularity. Additionally, the increased availability of flavored beers in both local and international markets has played a key role in its growth, with supermarkets, convenience stores, and online retailers offering these products more widely.

Fruit Flavors Profile is Fastest Growing Due to Consumer Preference for Refreshing Tastes

The fruit flavor profile is the fastest growing in the flavored alcohol market, driven by the widespread consumer preference for refreshing and natural-tasting drinks. Fruit-flavored alcohol appeals to a broad demographic, including those who prefer lighter, sweeter, and more refreshing beverages. Popular fruit flavors such as citrus, berries, and tropical fruits are increasingly being incorporated into beers, wines, and spirits, creating a vibrant, fruity experience that stands out in the competitive alcoholic beverage landscape. These flavors are particularly appealing to younger consumers and those who may not traditionally drink alcohol, offering a more approachable and enjoyable way to indulge in alcoholic beverages.

The demand for fruit-flavored alcoholic drinks has surged in response to the growing interest in low-alcohol and healthier options. Fruit-based flavors are perceived as lighter and more refreshing, making them suitable for casual drinking occasions and social settings. As consumers continue to experiment with flavors and seek out new taste experiences, the popularity of fruit-infused alcoholic beverages is expected to expand even further. The development of innovative fruit flavor combinations, such as tropical blends or citrus and berry mixes, will likely fuel this trend, keeping the segment on an upward trajectory.

Supermarkets/Hypermarkets Distribution Channel is Largest Due to Convenience and Accessibility

Supermarkets and hypermarkets are the largest distribution channels in the flavored alcohol market, primarily due to their widespread reach and convenience for consumers. These retail outlets offer a wide variety of flavored alcoholic beverages, often in dedicated sections for beer, wine, and spirits, making it easy for consumers to explore different flavor profiles. The ability to access flavored alcohol in these mass-market retail environments has significantly contributed to its popularity, as supermarkets and hypermarkets are able to provide both variety and competitive pricing. The extensive presence of these stores across urban and suburban areas ensures that flavored alcohol is easily accessible to a wide consumer base.

Furthermore, supermarkets and hypermarkets often capitalize on in-store promotions, product bundling, and attractive displays to entice customers to try new flavored alcoholic beverages. The convenience of being able to pick up flavored alcohol alongside other groceries has made it an attractive choice for consumers. As the demand for flavored alcohol continues to grow, retailers are likely to increase their offerings in these locations, further solidifying supermarkets and hypermarkets as the dominant distribution channels.

Citrus Flavors Profile is Fastest Growing Due to Appeal of Zesty, Refreshing Tastes

The citrus flavor profile is the fastest growing in the flavored alcohol market, driven by its zesty and refreshing taste that resonates with a wide range of consumers. Citrus flavors, such as lemon, lime, and orange, are increasingly being used in various alcoholic beverages, including beer, wine, and spirits, due to their bright, tangy notes that enhance the overall drinking experience. Citrus-infused drinks are particularly popular in cocktails and mixed drinks, where the acidity and freshness of citrus complement a variety of spirits. As consumers continue to seek new, invigorating flavors, citrus profiles are becoming a go-to choice for both casual and seasoned drinkers.

The growing popularity of citrus-flavored alcoholic beverages can be attributed to the rising demand for lighter, more refreshing options that can be enjoyed during social gatherings and casual drinking occasions. The versatility of citrus flavors also makes them an ideal base for experimenting with other fruit and spice infusions, further driving innovation in the sector. As this trend continues, the citrus flavor profile is expected to maintain its upward momentum, contributing to the overall growth of the flavored alcohol market.

Asia Pacific is Fastest Growing Region Due to Emerging Consumer Trends

The Asia Pacific region is the fastest growing in the flavored alcohol market, driven by emerging consumer trends, increasing disposable income, and a growing interest in western-style beverages. As the region’s younger population becomes more exposed to global drinking habits and international brands, the demand for flavored alcohol has surged. Countries such as China, India, Japan, and South Korea are witnessing a rapid shift toward flavored alcoholic beverages, particularly among millennials and Gen Z consumers, who are seeking innovative and diverse flavor experiences. Additionally, the rise of e-commerce and modern retail outlets in Asia Pacific has made flavored alcohol more accessible, fueling market expansion.

The growing trend of premiumization in the Asia Pacific alcoholic beverage sector is also driving the popularity of flavored alcohol, with consumers increasingly willing to explore unique flavors and high-quality products. As flavored alcohol becomes more ingrained in the social and drinking culture of the region, the demand for a wide range of products, from fruit-flavored beers to citrus-infused spirits, is expected to continue to rise. The strong growth potential in Asia Pacific makes it a key region for future market expansion.

Competitive Landscape and Leading Companies

The flavored alcohol market is highly competitive, with several key players actively innovating to meet the growing demand for unique and diverse flavors. Leading companies include global alcohol giants such as Anheuser-Busch InBev, Diageo, and Pernod Ricard, which have significantly expanded their portfolios to include flavored beer, wine, and spirits. These companies are focusing on flavor innovation, packaging, and marketing strategies to capture the attention of younger, trend-driven consumers.

Additionally, smaller, craft alcohol producers are also making a mark in the flavored alcohol space, offering highly customizable and niche flavors to appeal to specific consumer segments. The competitive landscape is marked by continuous innovation in flavor profiles and distribution strategies, with companies leveraging both traditional retail channels and online platforms to maximize their reach. As consumer tastes evolve, brands are likely to continue experimenting with new ingredients and flavor combinations, ensuring that the flavored alcohol market remains dynamic and competitive.

Recent Developments:

- In November 2024, Diageo introduced a new line of citrus-flavored vodka to meet growing consumer demand for fresh and fruity spirits.

- In October 2024, Bacardi Limited expanded its flavored rum range with new tropical fruit-infused variants.

- In September 2024, Pernod Ricard launched a new herbal-infused whiskey, aimed at attracting millennials looking for unique flavors.

- In August 2024, Constellation Brands announced the acquisition of a popular craft flavored beer brand to enhance its portfolio of flavored alcoholic beverages.

- In July 2024, Anheuser-Busch InBev debuted a new collection of fruit-flavored beers targeted at the younger generation for summer consumption.

List of Leading Companies:

- Diageo

- Pernod Ricard

- Bacardi Limited

- Brown-Forman Corporation

- Molson Coors Beverage Company

- Anheuser-Busch InBev

- Constellation Brands

- The Absolut Company (Pernod Ricard)

- Beam Suntory

- Campari Group

- The Boston Beer Company

- Davide Campari-Milano N.V.

- Sazerac Company

- Rémy Cointreau

- Edrington Group

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 29.9 billion |

|

Forecasted Value (2030) |

USD 45.4 billion |

|

CAGR (2024 – 2030) |

6.2% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Flavored Alcohol Market By Type (Flavored Beer, Flavored Wine, Flavored Spirits, Flavored Vodka, Flavored Whiskey), By Flavor Profile (Fruit Flavors, Herb and Spice Flavors, Sweet Flavors, Citrus Flavors, Exotic Flavors), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retail, Liquor Stores) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Diageo, Pernod Ricard, Bacardi Limited, Brown-Forman Corporation, Molson Coors Beverage Company, Anheuser-Busch InBev, Constellation Brands, The Absolut Company (Pernod Ricard), Beam Suntory, Campari Group, The Boston Beer Company, Davide Campari-Milano N.V., Sazerac Company, Rémy Cointreau, Edrington Group |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Flavored Alcohol Market, by Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Flavored Beer |

|

4.2. Flavored Wine |

|

4.3. Flavored Spirits |

|

4.4. Flavored Vodka |

|

4.5. Flavored Whiskey |

|

4.6. Others |

|

5. Flavored Alcohol Market, by Flavor Profile (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Fruit Flavors |

|

5.2. Herb and Spice Flavors |

|

5.3. Sweet Flavors |

|

5.4. Citrus Flavors |

|

5.5. Exotic Flavors |

|

5.6. Others |

|

6. Flavored Alcohol Market, by Distribution Channel (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Supermarkets/Hypermarkets |

|

6.2. Convenience Stores |

|

6.3. Online Retail |

|

6.4. Liquor Stores |

|

6.5. Others |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Flavored Alcohol Market, by Type |

|

7.2.7. North America Flavored Alcohol Market, by Flavor Profile |

|

7.2.8. North America Flavored Alcohol Market, by Distribution Channel |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Flavored Alcohol Market, by Type |

|

7.2.9.1.2. US Flavored Alcohol Market, by Flavor Profile |

|

7.2.9.1.3. US Flavored Alcohol Market, by Distribution Channel |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Diageo |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Pernod Ricard |

|

9.3. Bacardi Limited |

|

9.4. Brown-Forman Corporation |

|

9.5. Molson Coors Beverage Company |

|

9.6. Anheuser-Busch InBev |

|

9.7. Constellation Brands |

|

9.8. The Absolut Company (Pernod Ricard) |

|

9.9. Beam Suntory |

|

9.10. Campari Group |

|

9.11. The Boston Beer Company |

|

9.12. Davide Campari-Milano N.V. |

|

9.13. Sazerac Company |

|

9.14. Rémy Cointreau |

|

9.15. Edrington Group |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Flavored Alcohol Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Flavored Alcohol Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Flavored Alcohol Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA