As per Intent Market Research, the Flat Steel Market was valued at USD 547.7 billion in 2023 and will surpass USD 824.3 billion by 2030; growing at a CAGR of 6.0% during 2024 - 2030.

The flat steel market is a vital segment of the global steel industry, characterized by its use in manufacturing a wide range of products, from automotive components to packaging materials. Flat steel is produced by rolling steel into thin sheets, which can then be further processed or coated for various applications. With its ability to be formed into diverse shapes and its excellent strength-to-weight ratio, flat steel is widely used in numerous industries. As demand for products that require durable and high-quality materials continues to rise, the flat steel market remains an essential part of the manufacturing supply chain.

The market is influenced by economic growth, infrastructure development, and the expanding demand for automobiles and consumer goods. Technological advancements in steel production methods, including the development of advanced high-strength steels, are driving innovation and increasing the efficiency of flat steel manufacturing. As industries such as construction, automotive, and packaging experience continued growth, the flat steel market is poised for substantial expansion, with key players focusing on improving product quality and sustainability.

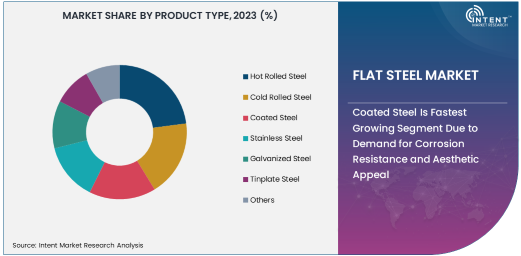

Coated Steel Is Fastest Growing Segment Due to Demand for Corrosion Resistance and Aesthetic Appeal

Coated steel is the fastest-growing segment within the flat steel market, driven by its ability to provide corrosion resistance, aesthetic appeal, and durability. Coated steel, including galvanized and tinplate steel, is used in industries such as automotive, construction, and packaging, where protection from the elements and attractive finishes are essential. In the automotive industry, galvanized steel is widely used for car body panels and structural components to prevent rust and extend the vehicle's lifespan.

The construction industry also uses coated steel for roofing, cladding, and wall systems, where the added protection against corrosion is crucial for ensuring long-term durability. As demand for environmentally friendly and low-maintenance materials increases, the use of coated steel is expanding. The growth in demand for coated steel products is expected to continue at a rapid pace, making it the fastest-growing segment in the flat steel market.

Automotive Application Is Largest Segment Due to Growing Demand for Durable and Lightweight Materials

The automotive application segment is the largest within the flat steel market, driven by the increasing demand for durable, lightweight materials that contribute to vehicle performance, safety, and fuel efficiency. Flat steel, particularly galvanized and stainless steel, is used extensively in the production of automotive body parts, chassis, and engine components. The automotive industry has increasingly turned to flat steel for its ability to deliver strength without compromising on weight, making vehicles more energy-efficient and environmentally friendly.

In addition to its use in structural parts, flat steel is also vital for the production of car interiors and external components, such as doors, hoods, and roofs. With the global automotive industry focusing on lightweighting to meet stricter emissions standards, the demand for advanced high-strength steel products, including coated and stainless steel, is growing rapidly. As a result, the automotive sector is expected to remain the largest application segment in the flat steel market for the foreseeable future.

OEMs Are Largest End-User Segment Due to High Demand for Flat Steel Components in Manufacturing

Original Equipment Manufacturers (OEMs) represent the largest end-user segment in the flat steel market. OEMs in industries such as automotive, construction, and industrial equipment rely heavily on flat steel for the production of various components. OEMs require high-quality steel that meets precise specifications for strength, durability, and performance, making flat steel a crucial material in the manufacturing process. Whether it's for building vehicles, industrial machinery, or construction materials, OEMs are the largest consumers of flat steel products, driving significant demand in the market.

OEMs often require large quantities of flat steel products, including hot rolled, cold rolled, and coated steels, to meet their manufacturing needs. The need for customization, particularly in industries like automotive and construction, further contributes to the growth of this segment. As manufacturing demand continues to rise across industries, OEMs will continue to be the primary consumers of flat steel products.

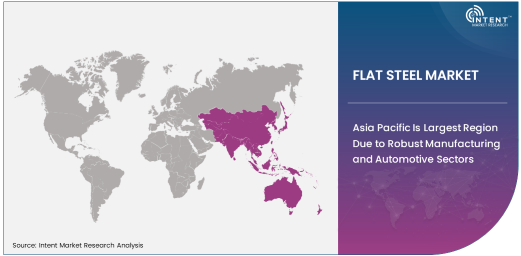

Asia Pacific Is Largest Region Due to Robust Manufacturing and Automotive Sectors

Asia Pacific is the largest region in the flat steel market, driven by its dominant manufacturing base and the rapid growth of the automotive and construction industries. Countries such as China, India, and Japan are major producers and consumers of flat steel products, owing to their large-scale industrial production and infrastructure development. China, in particular, is a significant player in the flat steel market, both as a producer and consumer, with its booming automotive and construction sectors driving the demand for steel.

The region also benefits from a well-established supply chain and strong government support for industrial growth. The increasing demand for consumer goods, industrial equipment, and automobiles across Asia Pacific has led to a surge in flat steel consumption. As manufacturing continues to expand in the region, Asia Pacific is expected to maintain its position as the largest market for flat steel in the coming years.

Competitive Landscape and Leading Companies

The flat steel market is highly competitive, with several key players leading the way in terms of production capacity, technological advancements, and market share. Leading companies such as ArcelorMittal, POSCO, and Tata Steel dominate the market, offering a wide range of flat steel products for various applications. These companies invest heavily in innovation, producing advanced steel types such as high-strength, lightweight, and corrosion-resistant steel to meet the growing demand from industries like automotive and construction.

The competitive landscape is also shaped by a large number of smaller regional players that cater to niche markets, offering specialized products for specific applications. Companies are increasingly focusing on sustainability and energy-efficient manufacturing processes to gain a competitive edge in the market. As the demand for flat steel continues to rise globally, the competitive dynamics in the market will likely remain intense, with both established players and new entrants striving to capture market share through innovation and efficiency.

Recent Developments:

- In December 2024, ArcelorMittal announced the launch of a new line of sustainable flat steel products aimed at reducing carbon emissions in manufacturing.

- In November 2024, Tata Steel signed a partnership agreement with an automotive manufacturer to provide high-performance flat steel for electric vehicle production.

- In October 2024, POSCO expanded its production capacity for galvanized flat steel to meet growing demand in the construction and automotive sectors.

- In September 2024, United States Steel Corporation introduced a new flat steel product line designed to enhance energy efficiency in industrial applications.

- In August 2024, Nippon Steel Corporation unveiled a breakthrough in producing lightweight, high-strength flat steel products for use in electric vehicles.

List of Leading Companies:

- ArcelorMittal

- China Baowu Steel Group

- Nippon Steel Corporation

- POSCO

- Tata Steel Limited

- JFE Steel Corporation

- Hyundai Steel Company

- United States Steel Corporation

- Steel Authority of India Limited (SAIL)

- Nucor Corporation

- Ansteel Group Corporation

- BaoSteel Group

- HBIS Group

- Voestalpine AG

- Shougang Group

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 547.7 billion |

|

Forecasted Value (2030) |

USD 824.3 billion |

|

CAGR (2024 – 2030) |

6.0% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Flat Steel Market By Product Type (Hot Rolled Steel, Cold Rolled Steel, Coated Steel, Stainless Steel, Galvanized Steel, Tinplate Steel), By Application (Automotive, Construction, Packaging, Industrial Equipment, Consumer Goods), By End-User (OEMs, Aftermarket) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

ArcelorMittal, China Baowu Steel Group, Nippon Steel Corporation, POSCO, Tata Steel Limited, JFE Steel Corporation, Hyundai Steel Company, United States Steel Corporation, Steel Authority of India Limited (SAIL), Nucor Corporation, Ansteel Group Corporation, BaoSteel Group, HBIS Group, Voestalpine AG, Shougang Group |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Flat Steel Market, by Product Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Hot Rolled Steel |

|

4.2. Cold Rolled Steel |

|

4.3. Coated Steel |

|

4.4. Stainless Steel |

|

4.5. Galvanized Steel |

|

4.6. Tinplate Steel |

|

4.7. Others |

|

5. Flat Steel Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Automotive |

|

5.2. Construction |

|

5.3. Packaging |

|

5.4. Industrial Equipment |

|

5.5. Consumer Goods |

|

5.6. Others |

|

6. Flat Steel Market, by End-User (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. OEMs |

|

6.2. Aftermarket |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Flat Steel Market, by Product Type |

|

7.2.7. North America Flat Steel Market, by Application |

|

7.2.8. North America Flat Steel Market, by End-User |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Flat Steel Market, by Product Type |

|

7.2.9.1.2. US Flat Steel Market, by Application |

|

7.2.9.1.3. US Flat Steel Market, by End-User |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. ArcelorMittal |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. China Baowu Steel Group |

|

9.3. Nippon Steel Corporation |

|

9.4. POSCO |

|

9.5. Tata Steel Limited |

|

9.6. JFE Steel Corporation |

|

9.7. Hyundai Steel Company |

|

9.8. United States Steel Corporation |

|

9.9. Steel Authority of India Limited (SAIL) |

|

9.10. Nucor Corporation |

|

9.11. Ansteel Group Corporation |

|

9.12. BaoSteel Group |

|

9.13. HBIS Group |

|

9.14. Voestalpine AG |

|

9.15. Shougang Group |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Flat Steel Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Flat Steel Market. The research methodoloagy encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

a

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Flat Steel Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA