As per Intent Market Research, the Fitness Tracker Market was valued at USD 49.9 Billion in 2024-e and will surpass USD 172.8 Billion by 2030; growing at a CAGR of 19.4% during 2025-2030.

The fitness tracker market has witnessed significant growth in recent years, driven by increasing health-consciousness, the rise in personal wellness, and advancements in wearable technology. As consumers become more aware of the importance of physical fitness and health monitoring, fitness trackers have emerged as essential tools to help users manage and track their physical activity and overall well-being. These devices monitor various metrics such as steps, heart rate, calories burned, sleep patterns, and more, providing users with valuable insights into their health. Fitness trackers are available in different forms and technologies, offering a wide range of options for consumers. The market is set to continue its upward trajectory as technology evolves, offering more sophisticated features and improving user experiences.

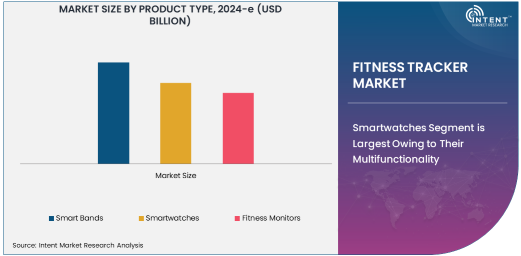

Smartwatches Segment is Largest Owing to Their Multifunctionality

Among the various product types, smartwatches have emerged as the largest segment in the fitness tracker market. This is primarily due to their multifunctionality, combining fitness tracking with other features such as communication capabilities, notifications, and more. Smartwatches cater to a broader audience by providing not only fitness monitoring but also serving as an extension of users’ smartphones. With integration of GPS, heart rate sensors, ECG monitors, and other advanced features, smartwatches are highly appealing to tech-savvy individuals and fitness enthusiasts who desire an all-in-one device. This multifunctionality is contributing to the segment's dominance in the market, as smartwatches are seen as a versatile and convenient solution for a range of health, fitness, and lifestyle needs.

Smartwatches have also experienced steady adoption in the professional sports industry, where athletes rely on their tracking capabilities for accurate performance data and health monitoring. The increased investment in research and development by major players like Apple, Samsung, and Garmin to enhance smartwatch features further solidifies their position as the dominant product in the fitness tracker market.

Bluetooth Technology is Fastest Growing Owing to its Wide Adoption

Bluetooth technology is the fastest-growing segment in the fitness tracker market, owing to its widespread adoption in fitness devices. Bluetooth offers efficient data transmission, minimal power consumption, and seamless compatibility with smartphones, making it an ideal choice for fitness trackers. As fitness trackers are primarily designed to sync with mobile devices for tracking and analysis, Bluetooth's low energy consumption and ease of integration have fueled its rapid growth. The technology allows for continuous connectivity, enabling users to track and monitor their health metrics in real-time via smartphone apps.

In addition, Bluetooth has become the industry standard in wireless communication for fitness devices, driving its adoption across various fitness tracker models, from smart bands to high-end smartwatches. The expanding number of mobile applications focused on health and fitness further supports Bluetooth’s rapid growth, ensuring an excellent user experience when syncing fitness data with personal devices.

Health-Conscious Individuals Segment is Largest End-User Group

The health-conscious individuals segment is the largest end-user group in the fitness tracker market. As people become increasingly aware of the need to stay healthy and active, fitness trackers have become integral tools to monitor and achieve fitness goals. Health-conscious individuals are motivated by the desire to track their daily physical activity, including steps, calories burned, heart rate, and sleep patterns. Fitness trackers provide them with real-time data, allowing them to make informed decisions and improve their health and fitness levels. This segment includes people across various age groups who want to improve or maintain their well-being.

The widespread appeal of fitness trackers among health-conscious individuals has been driven by the growing demand for personalized health and fitness data. The ability to set goals and receive feedback motivates individuals to adopt healthier lifestyles, contributing to the segment’s dominance in the market. Fitness trackers that offer tailored insights and user-friendly features further attract health-conscious consumers, driving their preference for these devices.

Mid-Range Price Range is Most Popular Among Consumers

The mid-range price segment is the most popular among consumers in the fitness tracker market. This segment strikes the right balance between affordability and advanced features, offering a wide range of options for customers who want robust functionality without the high price tag of premium models. Mid-range fitness trackers often include essential features like heart rate monitoring, step counting, sleep tracking, and basic GPS, which are sufficient for most users who seek to monitor their fitness levels effectively.

With the increasing number of budget-friendly, yet feature-rich, devices available in the market, consumers are more inclined toward purchasing mid-range fitness trackers. This segment benefits from the growing demand for high-quality wearables that offer essential health-tracking functionalities at a reasonable price. Brands like Garmin, Xiaomi, and Fitbit offer attractive mid-range options, which further fuels the popularity of this price category among health-conscious consumers.

Online Retail is Dominant Distribution Channel

Online retail is the dominant distribution channel in the fitness tracker market, driven by the growing trend of e-commerce and consumer preference for the convenience of shopping online. With a vast variety of models, prices, and features available, online retail platforms provide consumers with easy access to a wide range of fitness trackers. This channel also benefits from the ability to compare different products, read customer reviews, and receive the product at home, all of which contribute to an enhanced shopping experience. The ease of online shopping, along with discounts, deals, and fast delivery, makes online retail the go-to distribution channel for many fitness tracker buyers.

Furthermore, the COVID-19 pandemic accelerated the shift to online shopping, making it even more prevalent as people preferred to shop from home. As e-commerce continues to expand, online retail is expected to maintain its leadership in the distribution of fitness trackers, offering both global reach and convenience to consumers worldwide.

Asia-Pacific is the Fastest Growing Region

The Asia-Pacific region is the fastest-growing market for fitness trackers, driven by the increasing adoption of wearable technology in countries like China, India, Japan, and South Korea. The region's rapidly growing middle class, along with heightened awareness of health and wellness, has led to an increasing demand for fitness trackers. Additionally, the proliferation of smartphones and the growing availability of affordable fitness tracker options have further fueled the market's growth in this region.

Asia-Pacific is also home to several key manufacturers of fitness trackers, including companies like Xiaomi and Huawei, which are well-positioned to cater to the region’s burgeoning demand. With advancements in technology, as well as rising disposable incomes, the fitness tracker market in Asia-Pacific is expected to continue its strong growth trajectory, outpacing other regions in the coming years.

Competitive Landscape and Leading Companies

The fitness tracker market is highly competitive, with several global and regional players leading the charge. Major companies such as Apple, Garmin, Fitbit, Xiaomi, and Huawei dominate the market, offering a diverse range of fitness trackers with various features and price points. These companies focus heavily on product innovation, frequently releasing new models with advanced features such as ECG monitors, GPS tracking, sleep analysis, and integration with other health platforms.

The competitive landscape is also influenced by new entrants, particularly in the mid-range and budget segments, which continue to offer innovative solutions to meet the growing demand for affordable fitness trackers. As the market expands, companies are increasingly focusing on partnerships, mergers, and acquisitions to enhance their technology offerings, broaden their market reach, and maintain their competitive advantage. With the ongoing focus on fitness and health, the fitness tracker market is expected to remain dynamic and highly competitive, with established players and new entrants vying for market share.

Recent Developments:

- Fitbit recently launched the Charge 5, a fitness tracker with advanced health monitoring features, including EKG and stress management tracking.

- Apple announced its acquisition of a health tech startup focused on advanced fitness and wellness tracking, enhancing its Apple Watch capabilities.

- Xiaomi introduced the Mi Band 6, expanding its fitness tracker portfolio with new features like blood oxygen level monitoring and a larger display.

- Garmin updated its Forerunner and Fenix series with improved GPS accuracy, adding new running and cycling metrics for serious athletes.

- Huawei's collaboration with major healthcare providers focuses on integrating fitness trackers with medical-grade health monitoring systems.

List of Leading Companies:

- Fitbit Inc.

- Garmin Ltd.

- Xiaomi Corporation

- Apple Inc.

- Huawei Technologies Co. Ltd.

- Samsung Electronics Co., Ltd.

- Polar Electro Oy

- Amazfit (Huami Corporation)

- Whoop

- Xiaomi

- Withings

- Oura Health

- Suunto

- Coros Wearables Inc.

- Misfit Wearables

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 49.9 Billion |

|

Forecasted Value (2030) |

USD 172.8 Billion |

|

CAGR (2025 – 2030) |

19.4% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Fitness Tracker Market By Product Type (Smart Bands, Smartwatches, Fitness Monitors), By Technology (Bluetooth, Wi-Fi, NFC, GPS), By End-User (Fitness Enthusiasts, Health-conscious Individuals, Professional Athletes, Corporate Wellness Programs, Medical Patients), By Price Range (Low-Cost, Mid-Range, Premium), By Distribution Channel (Online Retail, Offline Retail, Direct Sales, Third-Party Distribution, Specialty Stores); |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Fitbit Inc., Garmin Ltd., Xiaomi Corporation, Apple Inc., Huawei Technologies Co. Ltd., Samsung Electronics Co., Ltd., Polar Electro Oy, Amazfit (Huami Corporation), Whoop, Xiaomi, Withings, Oura Health, Suunto, Coros Wearables Inc., Misfit Wearables |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Fitness Tracker Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Smart Bands |

|

4.2. Smartwatches |

|

4.3. Fitness Monitors |

|

5. Fitness Tracker Market, by Technology (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Bluetooth |

|

5.2. Wi-Fi |

|

5.3. NFC |

|

5.4. GPS |

|

6. Fitness Tracker Market, by End-User (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Fitness Enthusiasts |

|

6.2. Health-conscious Individuals |

|

6.3. Professional Athletes |

|

6.4. Corporate Wellness Programs |

|

6.5. Medical Patients |

|

7. Fitness Tracker Market, by Price Range (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Low-Cost |

|

7.2. Mid-Range |

|

7.3. Premium |

|

8. Fitness Tracker Market, by Distribution Channel (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Online Retail |

|

8.2. Offline Retail |

|

8.3. Direct Sales |

|

8.4. Third-Party Distribution |

|

8.5. Specialty Stores |

|

9. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

9.1. Regional Overview |

|

9.2. North America |

|

9.2.1. Regional Trends & Growth Drivers |

|

9.2.2. Barriers & Challenges |

|

9.2.3. Opportunities |

|

9.2.4. Factor Impact Analysis |

|

9.2.5. Technology Trends |

|

9.2.6. North America Fitness Tracker Market, by Product Type |

|

9.2.7. North America Fitness Tracker Market, by Technology |

|

9.2.8. North America Fitness Tracker Market, by End-User |

|

9.2.9. North America Fitness Tracker Market, by Distribution Channel |

|

9.2.10. By Country |

|

9.2.10.1. US |

|

9.2.10.1.1. US Fitness Tracker Market, by Product Type |

|

9.2.10.1.2. US Fitness Tracker Market, by Technology |

|

9.2.10.1.3. US Fitness Tracker Market, by End-User |

|

9.2.10.1.4. US Fitness Tracker Market, by Distribution Channel |

|

9.2.10.2. Canada |

|

9.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

9.3. Europe |

|

9.4. Asia-Pacific |

|

9.5. Latin America |

|

9.6. Middle East & Africa |

|

10. Competitive Landscape |

|

10.1. Overview of the Key Players |

|

10.2. Competitive Ecosystem |

|

10.2.1. Level of Fragmentation |

|

10.2.2. Market Consolidation |

|

10.2.3. Product Innovation |

|

10.3. Company Share Analysis |

|

10.4. Company Benchmarking Matrix |

|

10.4.1. Strategic Overview |

|

10.4.2. Product Innovations |

|

10.5. Start-up Ecosystem |

|

10.6. Strategic Competitive Insights/ Customer Imperatives |

|

10.7. ESG Matrix/ Sustainability Matrix |

|

10.8. Manufacturing Network |

|

10.8.1. Locations |

|

10.8.2. Supply Chain and Logistics |

|

10.8.3. Product Flexibility/Customization |

|

10.8.4. Digital Transformation and Connectivity |

|

10.8.5. Environmental and Regulatory Compliance |

|

10.9. Technology Readiness Level Matrix |

|

10.10. Technology Maturity Curve |

|

10.11. Buying Criteria |

|

11. Company Profiles |

|

11.1. Fitbit Inc. |

|

11.1.1. Company Overview |

|

11.1.2. Company Financials |

|

11.1.3. Product/Service Portfolio |

|

11.1.4. Recent Developments |

|

11.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

11.2. Garmin Ltd. |

|

11.3. Xiaomi Corporation |

|

11.4. Apple Inc. |

|

11.5. Huawei Technologies Co. Ltd. |

|

11.6. Samsung Electronics Co., Ltd. |

|

11.7. Polar Electro Oy |

|

11.8. Amazfit (Huami Corporation) |

|

11.9. Whoop |

|

11.10. Xiaomi |

|

11.11. Withings |

|

11.12. Oura Health |

|

11.13. Suunto |

|

11.14. Coros Wearables Inc. |

|

11.15. Misfit Wearables |

|

12. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Fitness Tracker Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Fitness Tracker Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Fitness Tracker Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA