As per Intent Market Research, the Fitness App Market was valued at USD 8.8 billion in 2023 and will surpass USD 28.6 billion by 2030; growing at a CAGR of 18.2% during 2024 - 2030.

The fitness app market has seen unprecedented growth in recent years, fueled by increasing health awareness and the rising adoption of smartphones and wearable devices. These apps provide users with personalized fitness programs, tracking tools, and wellness resources, catering to a variety of health and lifestyle needs. With technological advancements like AI-driven insights, real-time analytics, and integration with wearable devices, fitness apps are transforming how people approach health and fitness. The demand for fitness apps is expected to grow further as individuals and organizations increasingly emphasize maintaining physical and mental well-being in an increasingly digital world.

This market is segmented into various types of apps, platforms, and devices, each contributing to its dynamic growth. The following sections explore the largest and fastest-growing subsegments within these categories, providing insights into the factors driving their development.

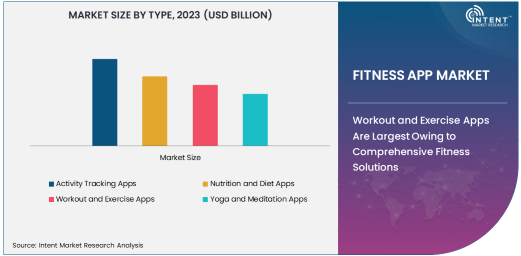

Workout and Exercise Apps Are Largest Owing to Comprehensive Fitness Solutions

Workout and exercise apps are the largest subsegment in the fitness app market, thanks to their comprehensive offerings, which include strength training, cardio routines, and personalized fitness plans. These apps are widely adopted by individual users and fitness enthusiasts for their ability to guide workouts, track progress, and provide video demonstrations, making fitness accessible even without a gym membership. Popular apps in this category often include live coaching features and integration with wearables for real-time feedback.

The growing trend of at-home fitness, spurred by the COVID-19 pandemic, has significantly boosted the adoption of workout and exercise apps. The convenience and cost-effectiveness of these apps, combined with the increasing interest in fitness among all age groups, ensure their continued dominance. With ongoing innovations like gamification and AI-driven personalization, workout and exercise apps are expected to maintain their leadership in the market.

iOS Platform Is Fastest Growing Owing to Premium User Base

The iOS platform is the fastest-growing segment in the fitness app market due to its premium user base and high app engagement rates. Fitness app developers prioritize the iOS platform for its robust ecosystem, which includes seamless integration with Apple Watch and HealthKit. iOS users often demonstrate a willingness to pay for premium features, including advanced analytics, personalized coaching, and exclusive content, driving revenue growth for app providers.

The platform’s focus on privacy and user experience also attracts health-conscious users who value data security. As Apple continues to expand its health and fitness offerings, such as the introduction of Fitness+, the ecosystem's appeal for fitness app developers and users alike will strengthen, further accelerating growth in this segment.

Wearable Devices Are Fastest Growing Owing to Real-Time Tracking

Wearable devices are the fastest-growing subsegment within the device type category, driven by their ability to provide real-time tracking of physical activity, heart rate, and other health metrics. Devices such as fitness bands, smartwatches, and health trackers are becoming increasingly integrated with fitness apps, offering users a seamless experience. This growth is supported by advancements in wearable technology, including improved sensor accuracy and extended battery life.

As wearables become more affordable and accessible, their adoption among health-conscious individuals continues to rise. The integration of wearable devices with fitness apps not only enhances user engagement but also allows for data-driven personalization, creating a synergistic growth cycle between the two technologies.

Individual Consumers Are Largest Owing to Personalized Wellness Needs

Individual consumers represent the largest end-use industry in the fitness app market, driven by growing awareness of personal health and wellness. Fitness apps provide tailored solutions for weight management, fitness goals, and mental well-being, making them an attractive option for individuals seeking convenience and affordability. The segment encompasses a diverse user base, including beginners, fitness enthusiasts, and those managing chronic health conditions.

The increasing prevalence of sedentary lifestyles and rising healthcare costs are encouraging more individuals to adopt fitness apps as preventive health measures. Additionally, the social and competitive features offered by many apps, such as leaderboards and community challenges, foster engagement and long-term usage, solidifying this segment's leadership.

North America Is Largest Region Owing to High Adoption and Advanced Infrastructure

North America is the largest region in the fitness app market, attributed to high smartphone penetration, widespread awareness of health and wellness, and advanced digital infrastructure. The region is home to leading fitness app developers and technology providers, ensuring a steady stream of innovative products and services. Additionally, the popularity of fitness trends such as at-home workouts, mindfulness practices, and wearable technology has further bolstered demand.

The region's growth is supported by a strong culture of health consciousness and a well-established fitness industry. As North American consumers increasingly prioritize holistic wellness, the adoption of fitness apps for both physical and mental health purposes will continue to drive market expansion.

Competitive Landscape and Leading Companies

The fitness app market is highly competitive, with key players such as MyFitnessPal, Fitbit, Strava, and Calm leading the space. These companies focus on expanding their features, leveraging AI and machine learning for personalized recommendations, and integrating seamlessly with wearable devices. Partnerships with corporate wellness programs and fitness equipment manufacturers are also common strategies employed by major players.

The competitive landscape is characterized by rapid innovation and a focus on user engagement. Smaller, niche app developers are also entering the market, targeting specific segments such as yoga, nutrition, or high-intensity interval training. As consumer demand for fitness solutions continues to evolve, companies that offer a combination of personalization, convenience, and advanced technology are poised to lead the market.

Recent Developments:

- Fitbit launched a premium fitness app upgrade, integrating advanced health monitoring features such as stress management and sleep tracking.

- Strava introduced a new AI-powered training recommendation feature aimed at enhancing user performance analytics.

- Nike Training Club announced a collaboration with wellness influencers to develop tailored workout programs for their app.

- Headspace expanded its fitness app to include guided meditation sessions specifically designed for post-workout recovery.

- Peloton rolled out an upgraded app experience with live and on-demand classes targeting outdoor fitness enthusiasts.

List of Leading Companies:

- 8fit GmbH

- Aaptiv, Inc.

- Adidas Runtastic GmbH

- Asana Rebel

- Fitbit, Inc. (Google LLC)

- FitOn Inc.

- Headspace, Inc.

- JEFIT, Inc.

- MapMyRun (Under Armour, Inc.)

- MyFitnessPal, Inc.

- Nike Training Club (Nike, Inc.)

- Peloton Interactive, Inc.

- Strava, Inc.

- Sweat by Kayla Itsines

- Under Armour, Inc.

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 8.8 Billion |

|

Forecasted Value (2030) |

USD 28.6 Billion |

|

CAGR (2024 – 2030) |

18.2% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Fitness App Market by Type (Activity Tracking Apps, Nutrition and Diet Apps, Workout and Exercise Apps, Yoga and Meditation Apps), by Platform (Android, iOS), by Device Type (Smartphones, Tablets, Wearable Devices), by End-Use Industry (Individual Consumers, Corporate Wellness Programs, Fitness Studios and Gyms) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

8fit GmbH, Aaptiv, Inc., Adidas Runtastic GmbH, Asana Rebel, Fitbit, Inc. (Google LLC), FitOn Inc., JEFIT, Inc., MapMyRun (Under Armour, Inc.), MyFitnessPal, Inc., Nike Training Club (Nike, Inc.), Peloton Interactive, Inc., Strava, Inc., Under Armour, Inc. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Fitness App Market, by Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Activity Tracking Apps |

|

4.2. Nutrition and Diet Apps |

|

4.3. Workout and Exercise Apps |

|

4.4. Yoga and Meditation Apps |

|

5. Fitness App Market, by Platform (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Android |

|

5.2. iOS |

|

5.3. Others |

|

6. Fitness App Market, by Device Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Smartphones |

|

6.2. Tablets |

|

6.3. Wearable Devices |

|

7. Fitness App Market, by End-Use Industry (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Individual Consumers |

|

7.2. Corporate Wellness Programs |

|

7.3. Fitness Studios and Gyms |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Fitness App Market, by Type |

|

8.2.7. North America Fitness App Market, by Platform |

|

8.2.8. North America Fitness App Market, by Device Type |

|

8.2.9. North America Fitness App Market, by End-Use Industry |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Fitness App Market, by Type |

|

8.2.10.1.2. US Fitness App Market, by Platform |

|

8.2.10.1.3. US Fitness App Market, by Device Type |

|

8.2.10.1.4. US Fitness App Market, by End-Use Industry |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. 8fit GmbH |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Aaptiv, Inc. |

|

10.3. Adidas Runtastic GmbH |

|

10.4. Asana Rebel |

|

10.5. Fitbit, Inc. (Google LLC) |

|

10.6. FitOn Inc. |

|

10.7. Headspace, Inc. |

|

10.8. JEFIT, Inc. |

|

10.9. MapMyRun (Under Armour, Inc.) |

|

10.10. MyFitnessPal, Inc. |

|

10.11. Nike Training Club (Nike, Inc.) |

|

10.12. Peloton Interactive, Inc. |

|

10.13. Strava, Inc. |

|

10.14. Sweat by Kayla Itsines |

|

10.15. Under Armour, Inc. |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Fitness App Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Fitness App Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Fitness App Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA