As per Intent Market Research, the Fishing Reels Market was valued at USD 3.2 Billion in 2024-e and will surpass USD 4.8 Billion by 2030; growing at a CAGR of 7.0% during 2025 - 2030.

The fishing reels market has witnessed steady growth, driven by the increasing popularity of recreational fishing and the growing demand for high-quality, durable, and efficient reels. As consumers seek better performance, lighter materials, and advanced features, manufacturers are focusing on creating innovative fishing reels tailored for both casual anglers and professional fishermen. These reels are designed to enhance fishing experiences across various environments, including freshwater and saltwater fishing. With advancements in materials and technology, the market is evolving to meet the specific needs of different fishing styles and applications.

As the recreational fishing industry expands and the demand for specialized equipment rises, fishing reels are increasingly seen as a combination of function and innovation. Different reel types and materials are being developed to offer greater efficiency, strength, and comfort to users, which is fueling market growth across various regions.

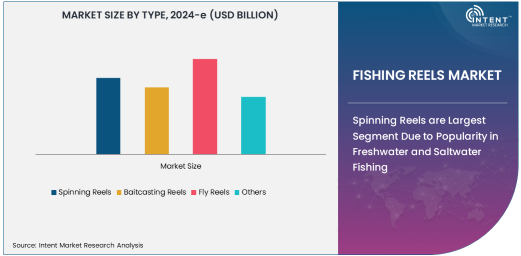

Spinning Reels are Largest Segment Due to Popularity in Freshwater and Saltwater Fishing

Spinning reels dominate the fishing reels market, largely due to their widespread popularity among recreational and commercial fishermen alike. Spinning reels are easy to use, versatile, and suitable for both freshwater and saltwater fishing, making them the preferred choice for beginners and seasoned anglers. Their ability to cast lighter lures and handle a wide variety of fishing styles, such as casting and trolling, makes them ideal for multiple fishing applications. Moreover, spinning reels offer reliable drag systems and smooth line retrieval, which are critical for an optimal fishing experience.

The versatility of spinning reels in both freshwater and saltwater environments, combined with their affordability and user-friendly design, ensures they remain the largest subsegment within the fishing reels market. As the market expands, manufacturers are continuously improving spinning reels with enhanced materials and features, such as corrosion-resistant components for saltwater use, lightweight frames, and advanced drag systems, further boosting their appeal.

Carbon Fiber Material is Fastest Growing Segment Owing to Lightweight and Durability

The carbon fiber material segment is the fastest growing in the fishing reels market. Carbon fiber reels are gaining popularity due to their exceptional strength-to-weight ratio, which provides anglers with a lightweight yet durable option for long fishing trips. Carbon fiber reels are highly resistant to corrosion, making them particularly well-suited for saltwater fishing, where reels are exposed to harsh environmental conditions. This material also reduces reel fatigue during extended use, enhancing the comfort of anglers who spend hours on the water.

The demand for carbon fiber reels is rapidly increasing as both recreational and commercial fishermen seek lighter, stronger, and more corrosion-resistant options. As advancements in carbon fiber manufacturing continue, reels made from this material are expected to become even more durable, further cementing their position as the fastest-growing material segment in the market.

Recreational Fishing is Largest End-Use Industry Driven by Increased Interest in Outdoor Activities

The recreational fishing industry is the largest end-use segment in the fishing reels market, driven by the growing interest in outdoor and leisure activities. As more individuals engage in recreational fishing for relaxation and sport, the demand for high-quality, reliable fishing equipment, including reels, has risen significantly. Fishing has become a popular pastime, with a focus on both solo and group activities, attracting anglers of all skill levels. Manufacturers are catering to this market by producing reels that offer a variety of features, from ease of use to lightweight materials and advanced technology.

The recreational fishing industry continues to expand, with increased interest in sustainable fishing practices, eco-friendly materials, and user-friendly equipment. The availability of fishing reels tailored to different experience levels, including beginner-friendly spinning reels and advanced baitcasting reels, further drives the growth of the recreational fishing segment. As outdoor recreation becomes increasingly popular, this segment is expected to maintain its position as the largest end-use industry in the fishing reels market.

North America is Largest Region Due to Strong Demand from Recreational and Commercial Sectors

North America is the largest region in the fishing reels market, driven by strong demand from both the recreational and commercial fishing sectors. The region’s extensive coastline, large freshwater bodies, and a culture of outdoor activities make fishing a popular pastime, fueling the demand for high-quality reels. Additionally, North America is home to a significant number of professional anglers and commercial fishing businesses, which contributes to the market's expansion. The increasing popularity of sport fishing and the growth of fishing tournaments in the region further boost the demand for advanced fishing reels.

In North America, fishing reels are widely available through both physical retail outlets and online platforms, making it easy for consumers to access the latest products. As the market for recreational fishing equipment continues to grow, manufacturers are focusing on innovation to meet the specific demands of anglers, ensuring that North America remains the largest market for fishing reels.

Competitive Landscape and Key Players

The fishing reels market is highly competitive, with several leading companies driving innovation and market growth. Key players in the market include Shimano Inc., Daiwa Corporation, Abu Garcia, Okuma Fishing Tackle Corp., and Penn Fishing Tackle Manufacturing Company. These companies have established themselves as major contributors to the development of advanced fishing reels, offering a wide range of products to cater to both recreational and commercial fishing needs.

To maintain their competitive edge, these companies are continuously innovating by incorporating new materials, such as carbon fiber and aluminum, into their reels and introducing advanced features like anti-corrosion coatings, smoother drag systems, and lightweight designs. Additionally, they are expanding their product portfolios to include reels suitable for various fishing applications, such as saltwater, freshwater, and fly fishing. The market is also witnessing increased collaborations with fishing gear retailers, online platforms, and sports organizations, ensuring that these companies remain leaders in the fishing reels market.

Recent Developments:

- Shimano Inc. launched an upgraded version of its high-performance spinning reel series, featuring advanced corrosion-resistant technology for saltwater fishing.

- Daiwa Corporation introduced a new fly reel line designed for both freshwater and saltwater fishing, incorporating enhanced drag systems for smoother performance.

- Abu Garcia unveiled a new series of baitcasting reels designed for sports fishing, featuring lightweight construction and enhanced casting accuracy.

- Okuma Fishing Tackle Co., Ltd. expanded its product range with the release of a heavy-duty trolling reel series, optimized for commercial fishing.

- KastKing announced the release of its latest carbon fiber baitcasting reel, targeting both recreational anglers and professional tournament fishermen.

List of Leading Companies:

- Shimano Inc.

- Daiwa Corporation

- Penn Fishing Tackle Manufacturing Company

- Abu Garcia (Pure Fishing, Inc.)

- Okuma Fishing Tackle Co., Ltd.

- Zebco Brands

- Fishpond, Inc.

- Mitchell Fishing (Pure Fishing)

- KastKing (Eposeidon)

- St. Croix Rods

- Fenwick Fishing

- Tica Fishing Tackle Co., Ltd.

- Van Staal

- Daiwa Sports (Europe) Ltd.

- Cabela’s (Bass Pro Shops)

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 3.2 Billion |

|

Forecasted Value (2030) |

USD 4.8 Billion |

|

CAGR (2025 – 2030) |

7.0% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Fishing Reels Market by Type (Spinning Reels, Baitcasting Reels, Fly Reels), by Material (Aluminum, Carbon Fiber, Stainless Steel), by Application (Freshwater Fishing, Saltwater Fishing), by End-Use Industry (Recreational, Commercial Fishing) and By Region |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Shimano Inc., Daiwa Corporation, Penn Fishing Tackle Manufacturing Company, Abu Garcia (Pure Fishing, Inc.), Okuma Fishing Tackle Co., Ltd., Zebco Brands, Mitchell Fishing (Pure Fishing), KastKing (Eposeidon), St. Croix Rods, Fenwick Fishing, Tica Fishing Tackle Co., Ltd., Van Staal, Cabela’s (Bass Pro Shops) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Fishing Reels Market, by Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Spinning Reels |

|

4.2. Baitcasting Reels |

|

4.3. Fly Reels |

|

4.4. Others |

|

5. Fishing Reels Market, by Material (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Aluminum |

|

5.2. Carbon Fiber |

|

5.3. Stainless Steel |

|

6. Fishing Reels Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Freshwater Fishing |

|

6.2. Saltwater Fishing |

|

6.3. Others |

|

7. Fishing Reels Market, by End-Use Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Recreational |

|

7.2. Commercial Fishing |

|

7.3. Others |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Fishing Reels Market, by Type |

|

8.2.7. North America Fishing Reels Market, by Material |

|

8.2.8. North America Fishing Reels Market, by Application |

|

8.2.9. North America Fishing Reels Market, by End-Use Industry |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Fishing Reels Market, by Type |

|

8.2.10.1.2. US Fishing Reels Market, by Material |

|

8.2.10.1.3. US Fishing Reels Market, by Application |

|

8.2.10.1.4. US Fishing Reels Market, by End-Use Industry |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Shimano Inc. |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Daiwa Corporation |

|

10.3. Penn Fishing Tackle Manufacturing Company |

|

10.4. Abu Garcia (Pure Fishing, Inc.) |

|

10.5. Okuma Fishing Tackle Co., Ltd. |

|

10.6. Zebco Brands |

|

10.7. Fishpond, Inc. |

|

10.8. Mitchell Fishing (Pure Fishing) |

|

10.9. KastKing (Eposeidon) |

|

10.10. St. Croix Rods |

|

10.11. Fenwick Fishing |

|

10.12. Tica Fishing Tackle Co., Ltd. |

|

10.13. Van Staal |

|

10.14. Daiwa Sports (Europe) Ltd. |

|

10.15. Cabela’s (Bass Pro Shops) |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Fishing Reels Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Fishing Reels Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Fishing Reels Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA