Fatty Acids Market By Type (Saturated Fatty Acids, Unsaturated Fatty Acids, Omega-3 Fatty Acids), By Source (Plant-based, Animal-based, Marine-based), By Application (Food & Beverages, Personal Care & Cosmetics, Pharmaceuticals, Industrial Chemicals, Biofuels), By End-User Industry (Food & Beverage, Health & Wellness, Agriculture, Automotive), and By Distribution Channel (Direct Sales, Third-Party Distributors, Online Retail); Global Insights & Forecast (2024 - 2030)

As per Intent Market Research, the Fatty Acids Market was valued at USD 27.9 billion and will surpass USD 48.7 billion by 2030; growing at a CAGR of 8.3% during 2024 - 2030.

The fatty acids market is a vital component of various industries such as food & beverages, pharmaceuticals, personal care & cosmetics, and biofuels. As essential components of lipids, fatty acids are crucial for human health and play a significant role in various biological functions. With a growing global population and increasing awareness of health and wellness, there is a steady rise in demand for fatty acids in both consumer products and industrial applications. These versatile compounds can be derived from a variety of sources, including plant-based, animal-based, and marine-based materials. As a result, the market offers a broad spectrum of products, from omega-3 fatty acids, which have become a staple in health supplements, to saturated fatty acids used in various industrial processes.

In recent years, the fatty acids market has been witnessing significant growth, propelled by increasing consumer interest in health-conscious dietary choices, the rise of plant-based diets, and the growing focus on sustainability and renewable energy. Omega-3 fatty acids, in particular, are gaining popularity for their heart-healthy benefits, while biofuels are becoming a more prominent application for fatty acids as the world shifts toward renewable energy sources. In the food industry, the demand for healthier oils and fats is also boosting the growth of unsaturated fatty acids. As the global appetite for functional foods, sustainable energy, and eco-friendly personal care products expands, the fatty acids market is expected to experience continued growth in the coming years.

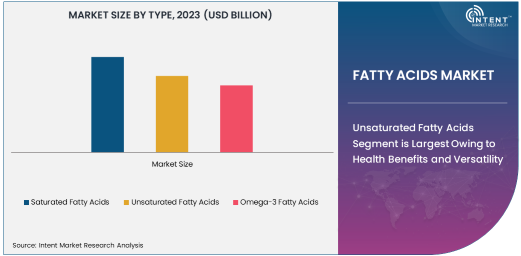

Unsaturated Fatty Acids Segment is Largest Owing to Health Benefits and Versatility

Unsaturated fatty acids represent the largest subsegment in the fatty acids market, driven by their numerous health benefits and broad versatility across industries. Unsaturated fats, which can be classified into monounsaturated and polyunsaturated fats, are naturally found in various plant-based oils like olive oil, sunflower oil, and canola oil, and are also prevalent in nuts, seeds, and avocados. These fats are considered healthy because they can help lower bad cholesterol (LDL) levels, reduce the risk of cardiovascular diseases, and improve overall heart health. In response to growing concerns about the adverse effects of trans fats and saturated fats, unsaturated fatty acids have gained significant traction as healthier alternatives in cooking and food preparation.

Beyond the food industry, unsaturated fatty acids are increasingly being incorporated into personal care products. Their moisturizing and anti-inflammatory properties make them desirable in skin creams, lotions, and hair care products. The versatility of unsaturated fatty acids is one of the main factors contributing to their dominance in the market, as they can be utilized across various sectors. The ongoing shift toward healthier food choices and more sustainable personal care products is fueling the growth of unsaturated fatty acids. Additionally, the rising awareness of the detrimental effects of saturated fats on health has led to a greater preference for unsaturated fats, positioning them as the largest segment in the fatty acids market.

Omega-3 Fatty Acids Segment is the Fastest Growing Due to Increasing Health Awareness

Omega-3 fatty acids are the fastest-growing subsegment in the fatty acids market, primarily due to the increasing consumer awareness of their health benefits. Omega-3s are a type of polyunsaturated fat that play a crucial role in supporting heart health, brain function, and reducing inflammation in the body. Studies have shown that omega-3 fatty acids can lower the risk of heart disease, improve cognitive function, and provide anti-inflammatory benefits, which is why they are gaining popularity in dietary supplements and functional foods. As consumers become more health-conscious, particularly with an increasing focus on preventive healthcare, the demand for omega-3 supplements and fortified food products is surging.

Omega-3 fatty acids are derived from a variety of sources, including fish oil, flaxseed, chia seeds, and algae. The plant-based sources of omega-3s, particularly algae, are experiencing strong demand due to the growing number of plant-based diets and vegan lifestyles. Omega-3 fatty acids are being integrated into a wide array of products, from fortified beverages, snacks, and baby food, to dietary supplements. This growing incorporation of omega-3s in food products is contributing to the rapid growth of this subsegment. As more consumers recognize the importance of omega-3s in maintaining overall wellness, the market for omega-3 fatty acids is expected to continue its upward trajectory, making it the fastest-growing segment within the fatty acids market.

Biofuels is the Key Application Driving Fatty Acids Demand

Biofuels, particularly biodiesel, represent one of the most important applications for fatty acids in the current market. The growing demand for renewable energy sources has led to an increased need for biofuels, and fatty acids are a crucial component in the production of biodiesel. Biodiesel, which is made from vegetable oils, animal fats, and algae, is a cleaner and more sustainable alternative to traditional fossil fuels. Fatty acids, in the form of methyl esters, are used in the process of transesterification to create biodiesel, contributing to the reduction of greenhouse gas emissions and air pollution.

As the world continues to focus on sustainability and reducing carbon footprints, the demand for biofuels is expected to rise, driving the need for fatty acids in biodiesel production. The growing popularity of biofuels is not only seen in developed markets but also in emerging economies, where there is increasing interest in sustainable energy solutions. The growing adoption of biodiesel, combined with government mandates and incentives supporting renewable energy sources, is likely to spur continued growth in the fatty acids market. This trend is particularly prominent in regions like Europe, North America, and parts of Asia, where biofuels are seen as a viable solution to reduce reliance on fossil fuels and achieve energy independence.

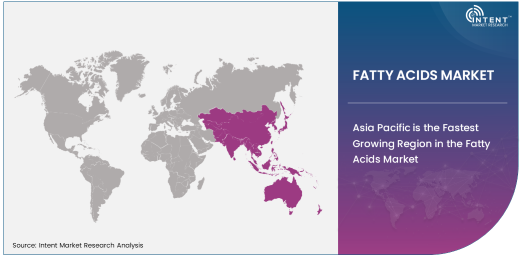

Asia Pacific is the Fastest Growing Region in the Fatty Acids Market

Asia Pacific is the fastest-growing region in the fatty acids market, driven by rapid industrialization, increased urbanization, and a growing middle class. As countries such as China, India, and Japan continue to expand economically, consumer demand for health-conscious products, including omega-3 supplements and unsaturated fats, is rising. The rising awareness about heart health, diabetes, and other chronic diseases is leading to an increased preference for omega-3 fatty acids and healthier fat alternatives in both food and dietary supplements. Additionally, the increasing shift toward plant-based diets in countries like India is fueling demand for plant-based fatty acids, particularly omega-3s derived from algae.

Asia Pacific is also witnessing a significant increase in the biofuels industry, particularly in countries like China and India, where government policies are driving the adoption of renewable energy sources, including biodiesel. The region’s growing agricultural sector, which is a key producer of vegetable oils used in biodiesel production, further contributes to the demand for fatty acids. As the region continues to evolve and adopt healthier, more sustainable lifestyles, the fatty acids market in Asia Pacific is expected to see rapid growth, making it the fastest-growing region globally.

Competitive Landscape and Leading Companies

The fatty acids market is competitive, with several key players actively engaging in product development, acquisitions, and market expansion to maintain their market positions. Leading companies in the market include Cargill, BASF, DowDuPont, Wilmar International, and Evonik Industries. These companies have established themselves as leaders in the production and distribution of fatty acids across various industries, including food & beverages, personal care, and biofuels. Many of these players focus on expanding their product portfolios and improving sustainability practices, catering to the increasing consumer demand for plant-based, non-GMO, and eco-friendly fatty acids.

In response to the growing demand for omega-3 fatty acids, several companies have shifted their focus toward plant-based sources, particularly algae, as a more sustainable and vegan-friendly option. Additionally, market leaders are investing in research and development to enhance the nutritional profiles of fatty acids and create innovative products that meet the changing needs of health-conscious consumers. Strategic partnerships, mergers, and acquisitions are common in this market, as companies seek to expand their reach and strengthen their position in key regions. The competitive landscape is expected to remain dynamic as companies continue to innovate and adapt to evolving market demands.

Recent Developments:

- Cargill announced the expansion of its production facilities for omega-3 fatty acids to meet growing demand in the health and wellness sector.

- BASF launched a new line of sustainably sourced fatty acids for use in food products and cosmetics, aimed at reducing environmental impact.

- Wilmar International introduced a new range of plant-based fatty acids for use in biofuel production, enhancing the sustainability of the energy sector.

- Evonik Industries developed a new type of fatty acid ester for use in personal care products, offering improved skin benefits and sustainability.

- AAK AB acquired a leading company in the marine-based fatty acids segment to expand its product offering for the pharmaceutical and nutraceutical markets.

List of Leading Companies:

- Cargill, Incorporated

- BASF SE

- Dow Chemical Company

- Wilmar International Ltd.

- Oleon NV

- Evonik Industries

- AAK AB

- Adani Wilmar Ltd.

- Archer Daniels Midland Company (ADM)

- Godrej Industries Ltd.

- The International Group, Inc. (IGI)

- Mitsubishi Corporation RtM Japan Ltd.

- Fuji Oil Holdings Inc.

- Bunge Limited

- Croda International Plc

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 27.9 billion |

|

Forecasted Value (2030) |

USD 48.7 billion |

|

CAGR (2024 – 2030) |

8.3% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Fatty Acids Market By Type (Saturated Fatty Acids, Unsaturated Fatty Acids, Omega-3 Fatty Acids), By Source (Plant-based, Animal-based, Marine-based), By Application (Food & Beverages, Personal Care & Cosmetics, Pharmaceuticals, Industrial Chemicals, Biofuels), By End-User Industry (Food & Beverage, Health & Wellness, Agriculture, Automotive), and By Distribution Channel (Direct Sales, Third-Party Distributors, Online Retail) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Cargill, Incorporated, BASF SE, Dow Chemical Company, Wilmar International Ltd., Oleon NV, Evonik Industries, AAK AB, Adani Wilmar Ltd., Archer Daniels Midland Company (ADM), Godrej Industries Ltd., The International Group, Inc. (IGI), Mitsubishi Corporation RtM Japan Ltd., Fuji Oil Holdings Inc., Bunge Limited, Croda International Plc |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Fatty Acids Market, by Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Saturated Fatty Acids |

|

4.2. Unsaturated Fatty Acids |

|

4.3. Omega-3 Fatty Acids |

|

5. Fatty Acids Market, by Source (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Plant-based |

|

5.2. Animal-based |

|

5.3. Marine-based |

|

6. Fatty Acids Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Food & Beverages |

|

6.2. Personal Care & Cosmetics |

|

6.3. Pharmaceuticals |

|

6.4. Industrial Chemicals |

|

6.5. Biofuels |

|

7. Fatty Acids Market, by End-User Industry (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Food & Beverage |

|

7.2. Health & Wellness |

|

7.3. Agriculture |

|

7.4. Automotive |

|

8. Fatty Acids Market, by Distribution Channel (Market Size & Forecast: USD Million, 2022 – 2030) |

|

8.1. Direct Sales |

|

8.2. Third-Party Distributors |

|

8.3. Online Retail |

|

9. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

9.1. Regional Overview |

|

9.2. North America |

|

9.2.1. Regional Trends & Growth Drivers |

|

9.2.2. Barriers & Challenges |

|

9.2.3. Opportunities |

|

9.2.4. Factor Impact Analysis |

|

9.2.5. Technology Trends |

|

9.2.6. North America Fatty Acids Market, by Type |

|

9.2.7. North America Fatty Acids Market, by Source |

|

9.2.8. North America Fatty Acids Market, by Application |

|

9.2.9. North America Fatty Acids Market, by End-User Industry |

|

9.2.10. North America Fatty Acids Market, by Distribution Channel |

|

9.2.11. By Country |

|

9.2.11.1. US |

|

9.2.11.1.1. US Fatty Acids Market, by Type |

|

9.2.11.1.2. US Fatty Acids Market, by Source |

|

9.2.11.1.3. US Fatty Acids Market, by Application |

|

9.2.11.1.4. US Fatty Acids Market, by End-User Industry |

|

9.2.11.1.5. US Fatty Acids Market, by Distribution Channel |

|

9.2.11.2. Canada |

|

9.2.11.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

9.3. Europe |

|

9.4. Asia-Pacific |

|

9.5. Latin America |

|

9.6. Middle East & Africa |

|

10. Competitive Landscape |

|

10.1. Overview of the Key Players |

|

10.2. Competitive Ecosystem |

|

10.2.1. Level of Fragmentation |

|

10.2.2. Market Consolidation |

|

10.2.3. Product Innovation |

|

10.3. Company Share Analysis |

|

10.4. Company Benchmarking Matrix |

|

10.4.1. Strategic Overview |

|

10.4.2. Product Innovations |

|

10.5. Start-up Ecosystem |

|

10.6. Strategic Competitive Insights/ Customer Imperatives |

|

10.7. ESG Matrix/ Sustainability Matrix |

|

10.8. Manufacturing Network |

|

10.8.1. Locations |

|

10.8.2. Supply Chain and Logistics |

|

10.8.3. Product Flexibility/Customization |

|

10.8.4. Digital Transformation and Connectivity |

|

10.8.5. Environmental and Regulatory Compliance |

|

10.9. Technology Readiness Level Matrix |

|

10.10. Technology Maturity Curve |

|

10.11. Buying Criteria |

|

11. Company Profiles |

|

11.1. Cargill, Incorporated |

|

11.1.1. Company Overview |

|

11.1.2. Company Financials |

|

11.1.3. Product/Service Portfolio |

|

11.1.4. Recent Developments |

|

11.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

11.2. BASF SE |

|

11.3. Dow Chemical Company |

|

11.4. Wilmar International Ltd. |

|

11.5. Oleon NV |

|

11.6. Evonik Industries |

|

11.7. AAK AB |

|

11.8. Adani Wilmar Ltd. |

|

11.9. Archer Daniels Midland Company (ADM) |

|

11.10. Godrej Industries Ltd. |

|

11.11. The International Group, Inc. (IGI) |

|

11.12. Mitsubishi Corporation RtM Japan Ltd. |

|

11.13. Fuji Oil Holdings Inc. |

|

11.14. Bunge Limited |

|

11.15. Croda International Plc |

|

12. Appendix |

Let us connect with you TOC

A comprehensive market research approach was employed to gather and analyze data on the Fatty Acids Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Fatty Acids Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Fatty Acids Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

Available Formats