As per Intent Market Research, the Facial Rejuvenation Market was valued at USD 11.6 Billion in 2023 and will surpass USD 21.3 Billion by 2030; growing at a CAGR of 9.1% during 2024 - 2030.

The facial rejuvenation market has experienced substantial growth driven by increasing demand for aesthetic treatments that address signs of aging and enhance overall facial appearance. Consumers, particularly among the aging population and younger individuals seeking to maintain youthful features, are increasingly opting for both surgical and non-surgical procedures to rejuvenate their skin and restore facial harmony. Advancements in treatment technologies, along with the growing availability of minimally invasive procedures, have made facial rejuvenation more accessible and appealing. With more emphasis placed on self-care and personal well-being, the facial rejuvenation market is expected to continue its upward trajectory, offering a wide range of solutions to cater to diverse consumer needs.

In this section, we examine the largest and fastest-growing subsegments across procedure types, treatment types, target areas, and end-use industries, highlighting the factors contributing to their market position.

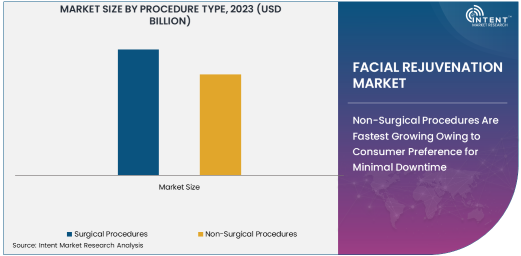

Non-Surgical Procedures Are Fastest Growing Owing to Consumer Preference for Minimal Downtime

Non-surgical procedures are experiencing rapid growth in the facial rejuvenation market. These treatments offer patients an effective solution with minimal downtime, making them increasingly popular among individuals looking for quick results without the commitment required for surgical options. Non-surgical procedures such as botox injections, dermal fillers, and laser treatments have seen widespread adoption due to their convenience, reduced recovery time, and relatively lower cost compared to traditional surgery.

Consumers are increasingly choosing non-invasive treatments for facial rejuvenation because of the quick turnaround and subtle results that enhance natural beauty. The availability of advanced technologies in non-surgical treatments, coupled with their ability to target multiple facial concerns such as wrinkles, fine lines, and volume loss, has led to a strong demand for these services. This segment is expected to maintain its rapid growth, especially in urban regions where aesthetics are a high priority.

Botox & Fillers Are Largest Due to High Demand and Immediate Results

Botox and dermal fillers represent the largest treatment type within the facial rejuvenation market, driven by the widespread acceptance and demand for these quick, non-invasive treatments. Botox, used primarily for the reduction of wrinkles and fine lines, remains one of the most popular non-surgical treatments globally. The ability to deliver immediate and noticeable results with minimal risk and recovery time has made Botox a go-to solution for individuals seeking facial rejuvenation.

Dermal fillers, often used in conjunction with Botox, are commonly employed to restore lost volume in areas such as the cheeks, lips, and under-eye regions. Together, Botox and fillers have revolutionized the facial rejuvenation industry, offering consumers highly effective treatments without the need for surgery. With ongoing innovations in formulations and injection techniques, this segment is expected to maintain its leadership in the market.

Wrinkles & Fine Lines Are Largest Target Area Owing to Aging Population and Beauty Trends

Wrinkles and fine lines are the largest target area within the facial rejuvenation market, driven by the natural aging process and the increasing focus on anti-aging solutions. As individuals age, the skin loses elasticity, leading to the formation of wrinkles and fine lines, particularly around the eyes, forehead, and mouth. As a result, a large proportion of facial rejuvenation treatments are focused on smoothing out these signs of aging.

The global trend toward maintaining youthful appearances, along with increased awareness of the effectiveness of rejuvenation treatments in addressing these concerns, has solidified wrinkles and fine lines as the primary target area for facial rejuvenation. This segment continues to dominate, particularly among individuals aged 35 and older, as they seek ways to combat visible signs of aging and enhance their facial aesthetics.

Dermatology Clinics Are Largest End-Use Industry Owing to Specialized Services

Dermatology clinics are the largest end-use industry for facial rejuvenation treatments, as these clinics offer a wide array of specialized services and advanced skincare solutions. Dermatologists are highly trained professionals who can effectively diagnose skin conditions and administer treatments tailored to individual needs, making dermatology clinics a trusted choice for facial rejuvenation procedures.

Patients often visit dermatology clinics for non-surgical treatments like Botox, fillers, and laser resurfacing, as these treatments are generally more accessible and affordable compared to surgical options. The expertise offered by dermatologists in managing both cosmetic and medical skin concerns ensures that dermatology clinics will continue to dominate as a key venue for facial rejuvenation treatments.

North America Is Largest Region Owing to High Disposable Income and Aesthetic Trends

North America is the largest region in the facial rejuvenation market, driven by high disposable incomes, a strong healthcare infrastructure, and a societal emphasis on aesthetic beauty. The U.S., in particular, leads the market due to its well-established cosmetic surgery industry, the presence of skilled practitioners, and a growing focus on aging populations seeking facial rejuvenation treatments. With a significant number of individuals opting for both non-surgical and surgical procedures, North America maintains a dominant share of the global market.

Additionally, trends such as social media influence, celebrity culture, and a rising awareness of available rejuvenation procedures contribute to the region’s growth. As consumers continue to prioritize self-care and beauty treatments, North America remains the largest and most lucrative market for facial rejuvenation procedures.

Competitive Landscape and Leading Companies

The facial rejuvenation market is highly competitive, with a large number of players offering a wide range of treatment solutions. Leading companies in this market include Allergan, Revance Therapeutics, Merz Pharmaceuticals, and Galderma, all of which offer well-known injectable products like Botox and Restylane, as well as advanced technology for skin rejuvenation. These companies continue to innovate in terms of product offerings and expand their global footprint to meet the increasing demand for aesthetic treatments.

The competitive landscape also includes a rising number of smaller specialized companies offering niche products and services, catering to regional markets and specific customer needs. With growing demand for personalized and non-invasive facial rejuvenation treatments, market players are focusing on innovation, expanding treatment portfolios, and improving customer experiences to maintain a competitive edge. Furthermore, the rise of online platforms and medical spas is reshaping the competitive dynamics, providing consumers with more options for accessing rejuvenation services.

Recent Developments:

- Allergan launched an innovative injectable filler designed to address deep wrinkles and volume loss in the face.

- Revance Therapeutics received FDA approval for a new non-surgical Botox alternative, enhancing facial aesthetics with longer-lasting results.

- Medytox expanded its portfolio with a new anti-aging injectable treatment for facial wrinkles.

- Galderma S.A. launched a new dermal filler line aimed at improving skin hydration and reducing signs of aging.

- Lumenis Ltd. unveiled a next-generation laser system for skin resurfacing, targeting fine lines, pigmentation, and overall skin tone improvement.

List of Leading Companies:

- Allergan

- Bausch Health Companies Inc.

- Cutera, Inc.

- Cynosure, Inc.

- Galderma S.A.

- Hugel, Inc.

- Ipsen

- Johnson & Johnson (Janssen)

- Lumenis Ltd.

- Medytox, Inc.

- Merz Pharmaceuticals

- Revance Therapeutics

- Syneron Candela

- Viora Ltd.

- Zimmer Biomet

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 11.6 Billion |

|

Forecasted Value (2030) |

USD 21.3 Billion |

|

CAGR (2024 – 2030) |

9.1% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Facial Rejuvenation Market by Procedure Type (Surgical Procedures, Non-Surgical Procedures), by Treatment Type (Botox & Fillers, Laser Resurfacing, Chemical Peels, Microneedling, Facelift Surgery), by Target Area (Wrinkles & Fine Lines, Skin Texture & Tone, Skin Tightening), by End-Use Industry (Dermatology Clinics, Cosmetic Surgery Centers, Hospitals, Medical Spas) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Allergan, Bausch Health Companies Inc., Cutera, Inc., Cynosure, Inc., Galderma S.A., Hugel, Inc., Johnson & Johnson (Janssen), Lumenis Ltd., Medytox, Inc., Merz Pharmaceuticals, Revance Therapeutics, Syneron Candela, Zimmer Biomet |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Facial Rejuvenation Market, by Procedure Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Surgical Procedures |

|

4.2. Non-Surgical Procedures |

|

5. Facial Rejuvenation Market, by Treatment Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Botox & Fillers |

|

5.2. Laser Resurfacing |

|

5.3. Chemical Peels |

|

5.4. Microneedling |

|

5.5. Facelift Surgery |

|

6. Facial Rejuvenation Market, by Target Area (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Wrinkles & Fine Lines |

|

6.2. Skin Texture & Tone |

|

6.3. Skin Tightening |

|

6.4. Others |

|

7. Facial Rejuvenation Market, by End-Use Industry (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Dermatology Clinics |

|

7.2. Cosmetic Surgery Centers |

|

7.3. Hospitals |

|

7.4. Medical Spas |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Facial Rejuvenation Market, by Procedure Type |

|

8.2.7. North America Facial Rejuvenation Market, by Treatment Type |

|

8.2.8. North America Facial Rejuvenation Market, by Target Area |

|

8.2.9. North America Facial Rejuvenation Market, by End-Use Industry |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Facial Rejuvenation Market, by Procedure Type |

|

8.2.10.1.2. US Facial Rejuvenation Market, by Treatment Type |

|

8.2.10.1.3. US Facial Rejuvenation Market, by Target Area |

|

8.2.10.1.4. US Facial Rejuvenation Market, by End-Use Industry |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Allergan |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Bausch Health Companies Inc. |

|

10.3. Cutera, Inc. |

|

10.4. Cynosure, Inc. |

|

10.5. Galderma S.A. |

|

10.6. Hugel, Inc. |

|

10.7. Ipsen |

|

10.8. Johnson & Johnson (Janssen) |

|

10.9. Lumenis Ltd. |

|

10.10. Medytox, Inc. |

|

10.11. Merz Pharmaceuticals |

|

10.12. Revance Therapeutics |

|

10.13. Syneron Candela |

|

10.14. Viora Ltd. |

|

10.15. Zimmer Biomet |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Facial Rejuvenation Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Facial Rejuvenation Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Facial Rejuvenation Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA