Expanded Polystyrene (EPS) Market By Product Type (White EPS, Grey EPS, Black EPS), By Application (Packaging, Insulation, Automotive, Construction, Consumer Goods), By End-User Industry (Building & Construction, Automotive, Food & Beverage, Electronics, Consumer Goods), and By Distribution Channel (Direct Sales, Third-Party Distribution Partners, Online Retail); Global Insights & Forecast (2024 - 2030)

As per Intent Market Research, the Expanded Polystyrene (EPS) Market was valued at USD 17.2 billion and will surpass USD 29.8 billion by 2030; growing at a CAGR of 8.1% during 2024 - 2030.

The Expanded Polystyrene (EPS) market has witnessed significant growth over the past few years, driven by its broad range of applications across various industries such as packaging, construction, automotive, consumer goods, and insulation. EPS is a versatile material that is lightweight, durable, and cost-effective, making it an ideal choice for many industries. Its properties, such as excellent thermal insulation, impact resistance, and ease of molding, have made it a popular choice in construction, packaging, and consumer goods. The market is also being propelled by rising demand for eco-friendly and sustainable materials, as EPS is recyclable and can be reused in various applications.

The key drivers for the EPS market include increasing demand for packaging materials due to the growing e-commerce sector, as well as the rising emphasis on energy-efficient buildings that require advanced insulation materials. Additionally, the automotive industry is witnessing growing demand for EPS due to its lightweight nature, which contributes to vehicle fuel efficiency. As more industries recognize the benefits of EPS in terms of cost savings, product protection, and energy conservation, the demand for this material continues to expand. The market's future prospects are promising, driven by technological advancements, recycling initiatives, and innovations in EPS applications.

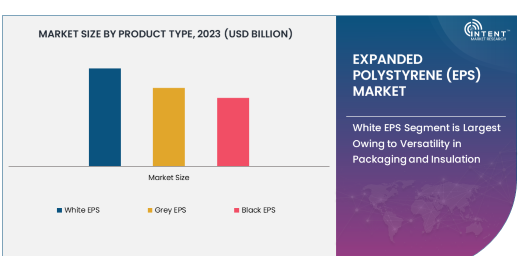

White EPS Segment is Largest Owing to Versatility in Packaging and Insulation

Among the various types of expanded polystyrene, white EPS holds the largest share in the market. This is largely due to its versatility and widespread use in packaging, insulation, and consumer goods. White EPS is primarily composed of 98% air, making it incredibly lightweight while maintaining durability and providing excellent thermal insulation properties. Its primary use in packaging is to protect delicate products during transit, especially in industries like food & beverage, electronics, and consumer goods. White EPS is also widely used in insulation for residential and commercial buildings, where it helps to improve energy efficiency by reducing heat loss or gain.

The growth of the white EPS segment is further driven by the increasing demand for sustainable packaging solutions and energy-efficient construction materials. With a growing preference for lightweight, cost-effective, and reliable materials, white EPS has become the material of choice for industries looking to reduce their carbon footprint while maintaining product integrity. Additionally, its recyclability and ability to be molded into different shapes and sizes contribute to its popularity. The white EPS segment is expected to maintain its dominant position as it continues to cater to key sectors such as packaging, construction, and consumer goods, which are expected to grow in tandem with global economic development.

Grey EPS Segment Grows Rapidly Due to Increased Demand in Insulation Applications

The grey EPS segment is growing rapidly due to its superior thermal insulation properties compared to white EPS. Grey EPS contains graphite particles that enhance the material's thermal conductivity, making it more effective at insulating buildings and reducing energy consumption. This makes grey EPS particularly attractive in construction applications, where it is used for wall and roof insulation, helping to improve the energy efficiency of buildings. The growing trend towards energy-efficient buildings, coupled with stricter environmental regulations, has fueled the demand for grey EPS, especially in markets where energy conservation is a priority.

Additionally, the demand for grey EPS is increasing in regions with colder climates, where superior insulation is necessary to maintain comfortable indoor temperatures while reducing heating costs. The construction industry, particularly in Europe and North America, is a major consumer of grey EPS as it is an ideal solution for meeting building codes related to thermal performance. The segment is also benefiting from the global emphasis on sustainability, as grey EPS is seen as a more energy-efficient alternative to other insulation materials. As the focus on energy conservation grows, particularly in residential and commercial building projects, the demand for grey EPS is expected to rise.

Packaging Application is the Largest Driver of EPS Demand

The packaging application is the largest driver of EPS demand, particularly in industries like food & beverage, electronics, and consumer goods. EPS is widely used for protective packaging because of its ability to absorb shock and protect fragile products during transportation. It is a preferred choice for packaging because of its lightweight nature, cost-effectiveness, and excellent protection properties. In the food industry, EPS is commonly used for food containers, trays, and take-out containers, where it helps maintain product freshness by providing insulation.

The growing e-commerce sector is a significant factor contributing to the demand for EPS in packaging, as the need for safe and efficient product delivery continues to increase. With a rise in online shopping, particularly for fragile and perishable goods, there is a growing need for protective packaging solutions. EPS packaging helps minimize product damage during transit, making it a valuable solution for both manufacturers and consumers. As online retail continues to expand globally, the demand for EPS packaging is expected to grow in tandem, particularly in emerging markets where e-commerce adoption is on the rise.

Asia Pacific Region Leads the Market Driven by Construction and Packaging Sectors

The Asia Pacific region is the largest and fastest-growing market for EPS, driven by the booming construction and packaging sectors in key countries such as China, India, Japan, and South Korea. The region is experiencing rapid urbanization, increased industrialization, and growing infrastructure development, which are all fueling the demand for EPS in construction applications. The rise of energy-efficient buildings and the implementation of green building standards are also contributing to the growth of EPS insulation in this region.

In addition to the construction sector, the packaging industry in Asia Pacific is expanding, driven by the growth of e-commerce and the increasing demand for consumer goods. As more people in the region adopt online shopping, the need for safe and efficient packaging solutions continues to rise. The increasing emphasis on sustainability and eco-friendly packaging in markets like China and India is further driving the adoption of EPS in packaging. The Asia Pacific region is expected to maintain its dominance in the EPS market due to its large-scale manufacturing capabilities, growing consumer demand, and government initiatives promoting energy efficiency and sustainability.

Competitive Landscape and Leading Companies

The competitive landscape of the EPS market is fragmented, with several large and medium-sized companies competing for market share. Leading players in the market include BASF SE, Total Petrochemicals, SABIC, Synbra Technology, and Alba Foams. These companies dominate the market through their extensive product portfolios, strong distribution networks, and focus on research and development to create advanced EPS products. Additionally, many of these companies are expanding their production capabilities in emerging markets to capitalize on the growing demand for EPS in construction, packaging, and other applications.

In response to increasing consumer demand for sustainable materials, several companies are investing in the development of eco-friendly EPS alternatives, such as EPS made from renewable resources or with enhanced recyclability. These innovations are helping companies stay competitive and align with the global shift towards environmental sustainability. Strategic partnerships, mergers, and acquisitions are also common in the EPS market as companies seek to expand their geographic reach and enhance their product offerings. The competitive landscape is expected to remain dynamic as companies continue to innovate and cater to the evolving demands of industries such as construction, packaging, and consumer goods.

Recent Developments:

- BASF SE launched a new line of grey EPS foam for enhanced insulation properties in the construction and building industry, focusing on energy efficiency.

- INEOS Styrolution expanded its EPS production capacity in Asia to meet the rising demand for insulation materials in the construction and automotive sectors.

- Total Petrochemicals introduced an upgraded version of EPS for packaging, offering improved durability and recyclability for consumer electronics.

- LG Chem developed a new EPS-based solution for automotive applications, offering superior impact resistance and weight reduction in vehicle production.

- SABIC partnered with a major construction firm to incorporate advanced EPS insulation materials into green building projects, aiming to reduce energy consumption.

List of Leading Companies:

- BASF SE

- Dow Chemical Company

- INEOS Styrolution

- Total Petrochemicals

- SABIC

- Kaneka Corporation

- LG Chem

- The Vita Group

- Sundolitt

- Alpek S.A.B. de C.V.

- ArcelorMittal

- Kingspan Group

- Synbra Technology

- Nova Chemicals

- Versalis (Eni)

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 17.2 billion |

|

Forecasted Value (2030) |

USD 29.8 billion |

|

CAGR (2024 – 2030) |

8.1% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Expanded Polystyrene (EPS) Market By Product Type (White EPS, Grey EPS, Black EPS), By Application (Packaging, Insulation, Automotive, Construction, Consumer Goods), By End-User Industry (Building & Construction, Automotive, Food & Beverage, Electronics, Consumer Goods), and By Distribution Channel (Direct Sales, Third-Party Distribution Partners, Online Retail) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

BASF SE, Dow Chemical Company, INEOS Styrolution, Total Petrochemicals, SABIC, Kaneka Corporation, LG Chem, The Vita Group, Sundolitt, Alpek S.A.B. de C.V., ArcelorMittal, Kingspan Group, Synbra Technology, Nova Chemicals, Versalis (Eni) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Expanded Polystyrene (EPS) Market, by Product Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. White EPS |

|

4.2. Grey EPS |

|

4.3. Black EPS |

|

5. Expanded Polystyrene (EPS) Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Packaging |

|

5.2. Insulation |

|

5.3. Automotive |

|

5.4. Construction |

|

5.5. Consumer Goods |

|

6. Expanded Polystyrene (EPS) Market, by End-User Industry (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Building & Construction |

|

6.2. Automotive |

|

6.3. Food & Beverage |

|

6.4. Electronics |

|

6.5. Consumer Goods |

|

7. Expanded Polystyrene (EPS) Market, by Distribution Channel (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Direct Sales |

|

7.2. Third-Party Distribution Partners |

|

7.3. Online Retail |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Expanded Polystyrene (EPS) Market, by Product Type |

|

8.2.7. North America Expanded Polystyrene (EPS) Market, by Application |

|

8.2.8. North America Expanded Polystyrene (EPS) Market, by End-User Industry |

|

8.2.9. North America Expanded Polystyrene (EPS) Market, by Distribution Channel |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Expanded Polystyrene (EPS) Market, by Product Type |

|

8.2.10.1.2. US Expanded Polystyrene (EPS) Market, by Application |

|

8.2.10.1.3. US Expanded Polystyrene (EPS) Market, by End-User Industry |

|

8.2.10.1.4. US Expanded Polystyrene (EPS) Market, by Distribution Channel |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. BASF SE |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Dow Chemical Company |

|

10.3. INEOS Styrolution |

|

10.4. Total Petrochemicals |

|

10.5. SABIC |

|

10.6. Kaneka Corporation |

|

10.7. LG Chem |

|

10.8. The Vita Group |

|

10.9. Sundolitt |

|

10.10. Alpek S.A.B. de C.V. |

|

10.11. ArcelorMittal |

|

10.12. Kingspan Group |

|

10.13. Synbra Technology |

|

10.14. Nova Chemicals |

|

10.15. Versalis (Eni) |

|

11. Appendix |

Let us connect with you TOC

A comprehensive market research approach was employed to gather and analyze data on the Expanded Polystyrene (EPS) Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Expanded Polystyrene (EPS) Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Expanded Polystyrene (EPS) Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

Available Formats