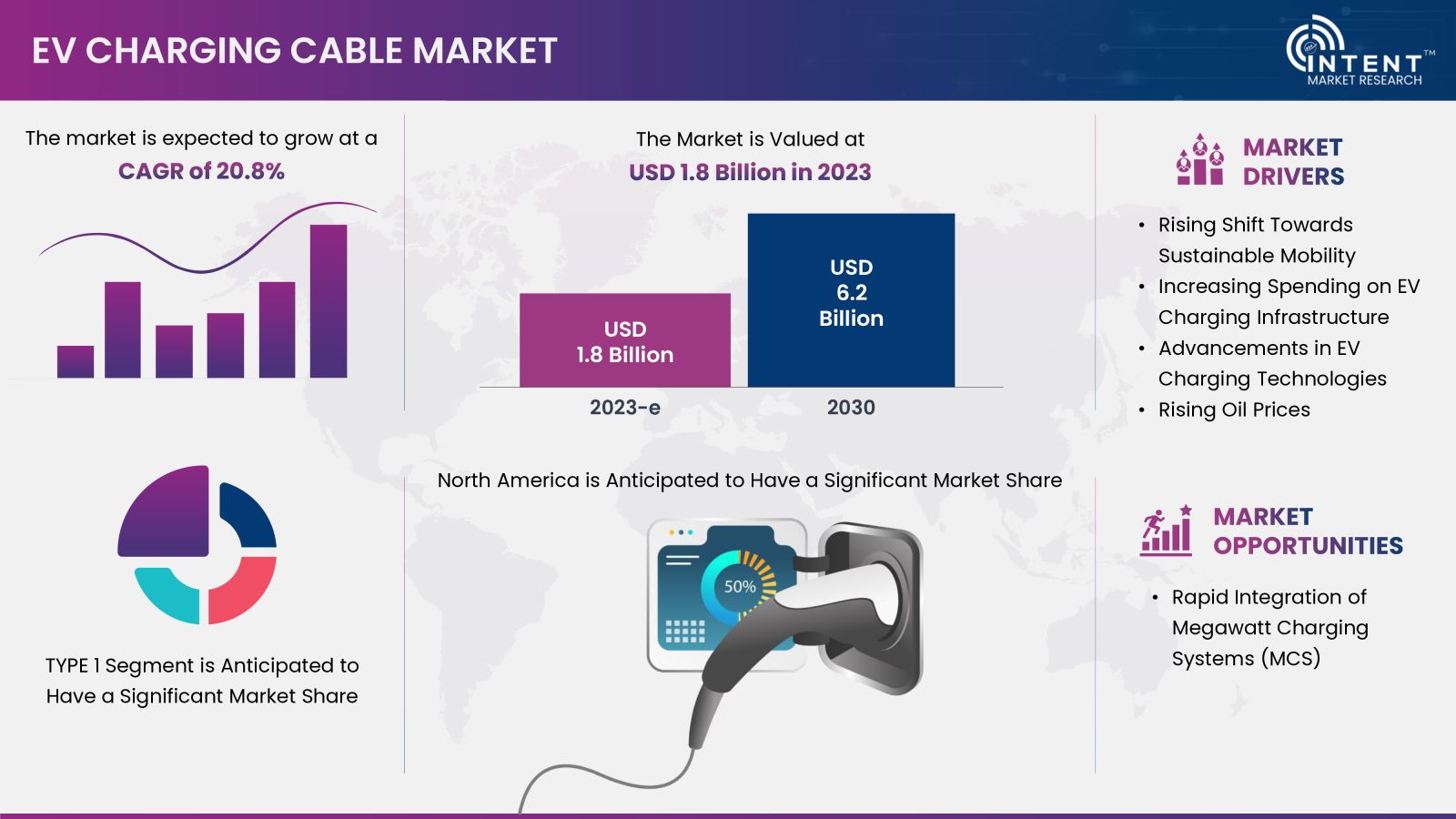

The EV Charging Cable Market is expected to grow from USD 1.8 billion in 2023-e to USD 6.2 billion by 2030, at a CAGR of 20.8% during the forecast period. The EV charging cable market is a competitive market, the prominent players in the global market include Aptiv, Besen International, Brugg Group, Dyden, Huber+Suhner, Leoni, Phoenix Contact, Sinbon Electronics, Systems Wire and Cable, and TE Connectivity. Advancements in EV charging technologies and rising oil prices are also augmenting the market growth. Rapid integration of megawatt charging systems (MCS) is anticipated to provide significant growth opportunities for the EV charging cable market.

Click here to: Get FREE Sample Pages of this Report

EV Charging Cable Market Overview

EV charging cables are utilized for charging EVs in private and public settings. The major components of the EV charging cables include the conductor, the insulation, and the jacket. It can comprise a range of commonly used materials including copper, cross-linked polyethylene (XLPE), TPE, TPU, PVC, silicone, and more. Growing sales of EVs and increasing infrastructure spending are driving the demand for EV charging cables globally.

Rising Shift Towards Sustainable Mobility is Driving the EV Charging Cable Market

EVs have become increasingly popular due to their low running costs, environmental friendliness, and impressive fuel efficiency. According to the International Energy Agency (IEA), the number of electric cars on the road in 2022 was over 26 million, which is a growth of about 60% compared to 2021. In 2022, electric car sales accounted for 14% of all new cars sold, compared to 9% in 2021 and 5% in 2020. This robust shift in the adoption of electric cars has resulted in a growth in demand for EV charging cables.

Segment Analysis

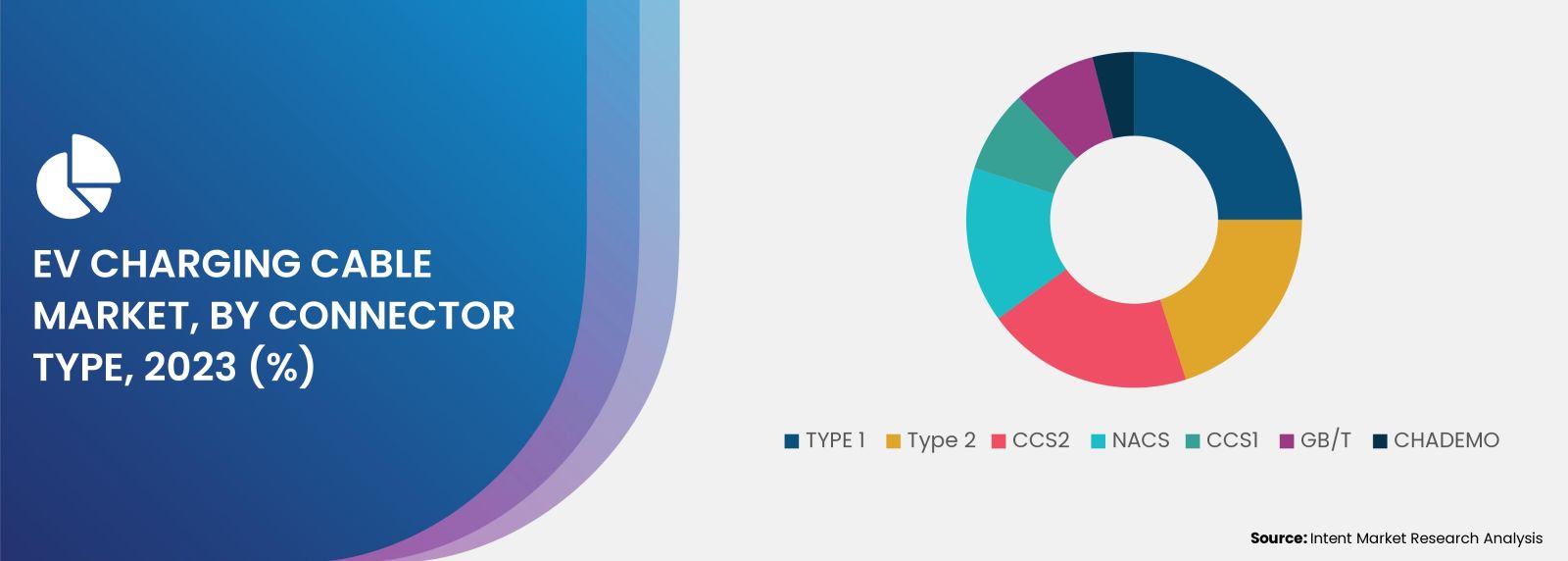

Standardization of NACS in North America is Driving the Market

North American Charging System (NACS) also known as the Tesla charging standard, is an EV charging connector system developed by Tesla. In November 2022, Tesla open-sourced its proprietary connector design, rebranding it as NACS. It is currently being standardized as SAE J3400. The increasing number of companies including Ford, Honda, Hyundai, Jaguar, Kia, Lexus, Toyota, Volkswagen, and others have announced that they will adopt NACS in their cars in 2024-2025 for the US and Canadian markets. Thus, the increasing number of companies adopting NACS is driving the segment’s growth.

Increasing Adoption of MODE 3 Charging is Driving the Market Growth

Mode 3 charging is one of the most widely used modes to charge EVs across the globe. Mode 3 charging involves charging the EV through a power supply system permanently connected to the mains. The control box is integrated directly into the dedicated charging structure and are used in workplaces, residential locations, and commercial and public parking lots. In Mode 3, the connecting cable is provided with the wall box or charging stations. It offers faster charging speeds and a higher level of safety compared to Mode 1 and Mode 2. In several countries, it is the only permitted way to charge a car in public places with alternating current.

Advantages of High-Rate AC Charging Through Level 2 Drives the EV Charging Cable Market Growth

Charging through level 2 charging cables are one of the most widely used cables for EV charging. Level 2 equipment offers high-rate AC charging through 240V (in residential applications) or 208V (in commercial applications). They are commonly used in a variety of locations, including parking lots, homes, and commercial properties. The amount of current supported by Level 2 extends from 12 to 80 amps. According to the US Department of Transportation, Level 2 chargers can charge a battery electric vehicle (BEV) to 80% from empty in 4-10 hours and a Plug-In Hybrid Electric Vehicle (PHEV) in 1-2 hours.

Advances in Liquid-Cooled High-Power Charging Cable is Driving the Demand

The liquid-cooled high-power charging cable products are used for DC charging cables and it provide thermal management systems. They generally provide higher protection than traditional air-cooled charging. Systems with liquid cooling can readily attain IP65 certification to withstand a variety of challenging conditions. These also have low noise, offer good heat dissipation, are easy to maintain, and offer faster charging. Thus, liquid-cooled charging is more efficient and there’s an increasing number of players launching liquid-cooled charging equipment.

Growing Number of Publicly Available Charging Ports is Augmenting the Market Growth

Public charging is one of the critical infrastructures for the adoption of EVs. In recent years, governments globally have been pushing for infrastructure development. According to the White House, as of December 2023, the US has more than 165,000 public charging ports. Moreover, since the start of the Biden Administration, the number of publicly available charging ports has grown by more than 70%. Thus, growing infrastructure spending for public charging stations is driving the segment’s growth.

High Preference of Light Weight Cables Drives the Demand for 2-4 Meter Cables

2-4 meter cables are generally provided as a standard cable with the new EVs. A longer cable gives more flexibility but is also heavier and more expensive. In contrast, 2-4 meter cables are lighter and easy to handle owing to which shorter cables are often preferred. Moreover, the availability of EV extension cords in the aftermarket also benefits consumers in preference for shorter cables. Thus, 2-4 meter cables are anticipated to hold a significant market share.

Coiled Cables are Shorter, Less Bulky, and Easier to Store in the Car

Coiled electric car chargers are designed to keep tripping hazards off the ground and prevent cables from getting run over. They can help to keep charging stations more efficient and safer for everyone who uses them. Compared to straight cables, coiled cables are shorter, less bulky, and easier to store in the car. They take up less space and are more convenient to use. Thus, coiled cables are anticipated to hold a significant market share.

Regional Analysis

North America has Witnessed High Spending on the EV Charging Infrastructure

There has been significant growth in the EV charging cable market in the North America owing to the growing adoption of electric vehicles, robust government initiatives, and high spending on the EV charging infrastructure. According to the National Automobile Dealer Association, the US crossed a major milestone for the EV industry with 1 million units sold in 2023. The data shows EV demand continues to grow month-over-month, increasing steadily from 6.4% of new vehicle sales in January to 7.2% in October 2023.

The presence of key EV manufacturers in the region such as Tesla, VW Group, General Motors, Hyundai Motor, and BMW, among others, also drives the market growth. Moreover, the government is increasingly taking initiatives for infrastructure development for the EV charging infrastructure. As a result, North America stands as the largest region in the EV charging cable market.

EV Charging Cable Market is Highly Competitive

In the EV charging cable market, key players include cable and wires manufacturers. These companies provide a wider portfolio of EV chargers and cables. The companies are actively launching innovative cables to capture market share. The market is highly competitive with the presence of dominant global players. Notable companies include Aptiv, Besen International, Brugg Group, Dyden, Huber+Suhner, Leoni, Phoenix Contact, Sinbon Electronics, Systems Wire and Cable, and TE Connectivity.

Following are the key developments in the EV charging cable market:

- In November 2023, Leoni launched new AC charging cables using LEONI EcoSense Nxt and LEONI EcoSense technologies.

- In September 2023, Aptiv (Ireland) acquired 85% of Intercable Automotive Solutions, a subsidiary of Intercable (Italy).

- In October 2022, ev.energy (UK), a charging software company partnered with Smartenit (US), an IoT solutions manufacturer, to launch a low-cost, smart EV charging cable.

Click here to: Get your custom research report today

EV Charging Cable Market Coverage

The report provides key insights into the EV charging cable market, and it focuses on technological developments, trends, and initiatives taken by the government in this sector. The report delves into market drivers, restraints, and opportunities, and analyzes key players as well as the competitive landscape within the market.

Report Scope

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 1.8 billion |

|

Forecast Revenue (2030) |

USD 6.2 billion |

|

CAGR (2024-2030) |

20.8% |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

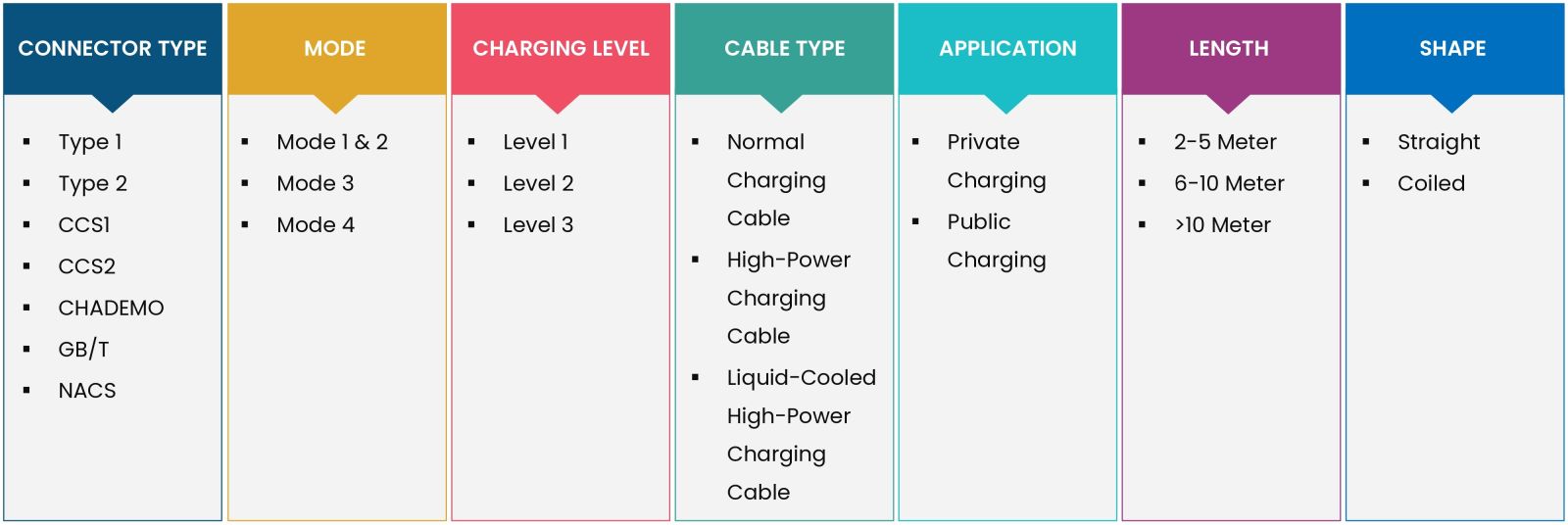

Segments Covered |

By Connector Type (Type 1, Type 2, CCS1, CCS2, CHAdeMO, GB/T, NACS), By Mode (Mode 1, Mode 2, Mode 3, Mode 4), By Charging Level (Level 1, Level 2, Level 3), By Cable Type (Normal Charging Cable, High-Power Charging Cable, Liquid-Cooled High-Power Charging Cable), By Application (Private Charging, Public Charging), By Length (2-4 Meters, 5-10 Meters, >10 Meters), and By Shape (Coiled, Straight) |

|

Regional Analysis |

North America (US, Canada), Europe (Germany, France, UK, Spain, Italy), Asia-Pacific (China, India, Japan, South Korea, Australia), Latin America (Brazil, Mexico, Argentina), Middle East and Africa (Saudi Arabia, UAE, South Africa) |

|

Competitive Landscape |

Aptiv, Besen International, Brugg Group, Dyden, Huber+Suhner, Leoni, Phoenix Contact, Sinbon Electronics, Systems Wire and Cable, and TE Connectivity |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

|

Purchase Options |

We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) |

|

1.Introduction |

|

1.1.Study Assumptions and Market Definition |

|

1.2.Scope of the Study |

|

2.Research Methodology |

|

3.Executive Summary |

|

4.Market Dynamics |

|

4.1.Market Growth Drivers |

|

4.1.1.Rising Shift Towards Sustainable Mobility |

|

4.1.2.Increasing Spending on EV Charging Infrastructure |

|

4.1.3.Advancements in EV Charging Technologies |

|

4.1.4.Rising Oil Prices |

|

4.2.Market Growth Restraints |

|

4.2.1.Safety Issues Related to Charging Cables |

|

4.2.2.Emergence of Wireless EV Charging |

|

4.3.Market Growth Opportunities |

|

4.3.1.Rapid Integration of Megawatt Charging Systems (MCS) |

|

4.4.Porter’s Five Forces |

|

4.5.PESTLE Analysis |

|

5.Market Outlook |

|

5.1.Supply Chain Analysis |

|

5.2.Regulatory Framework |

|

5.3.Technology Analysis |

|

5.4.Patent Analysis |

|

5.5.Consumer Behavior Analysis |

|

6.Market Segment Outlook (Market Size: USD Billion, 2023 – 2030) |

|

6.1.Segment Synopsis |

|

6.2.By Connector Type |

|

6.2.1.Type 1 |

|

6.2.2.Type 2 |

|

6.2.3.CCS1 |

|

6.2.4.CCS2 |

|

6.2.5.GB/T |

|

6.2.6.CHADEMO |

|

6.2.7.NACS |

|

6.3.By Mode |

|

6.3.1.Mode 1 |

|

6.3.2.Mode 2 6.3.3.Mode 3 |

|

6.3.4.Mode 4 |

|

6.4.By Charging Level |

|

6.4.1.Level 1 |

|

6.4.2.Level 2 |

|

6.4.3.Level 3 |

|

6.5.By Cable Type |

|

6.5.1.Normal Charging Cable |

|

6.5.2.High-Power Charging Cable |

|

6.5.3.Liquid-Cooled High-Power Charging Cable |

|

6.6.By Application |

|

6.6.1.Private Charging |

|

6.6.2.Public Charging |

|

6.7.By Length |

|

6.7.1.2-4 Meter |

|

6.7.2.5-10 Meter |

|

6.7.3.>10 Meter |

|

6.8.By Shape |

|

6.8.1.Coiled |

|

6.8.2.Straight |

|

7.Regional Outlook (Market Size: USD Billion, 2023 – 2030) |

|

7.1.Global Market Synopsis |

|

7.2.North America |

|

7.2.1.North America EV Charging Cable Market Outlook |

|

7.2.2.US |

|

7.2.2.1.US EV Charging Cable Market, By Connector Type |

|

7.2.2.2.US EV Charging Cable Market, By Mode |

|

7.2.2.3.US EV Charging Cable Market, By Charging Level |

|

7.2.2.4.US EV Charging Cable Market, By Cable Type |

|

7.2.2.5.US EV Charging Cable Market, By Application |

|

7.2.2.6.US EV Charging Cable Market, By Length |

|

7.2.2.7.US EV Charging Cable Market, By Shape |

|

*Note: Cross-segmentation by segments for each country will be covered as shown above. |

|

7.2.3.Canada |

|

7.3.Europe |

|

7.3.1.Europe EV Charging Cable Market Outlook |

|

7.3.2.Germany |

|

7.3.3.UK |

|

7.3.4.France |

|

7.3.5.Italy |

|

7.3.6.Spain |

|

7.4.Asia-Pacific |

|

7.4.1.Asia-Pacific EV Charging Cable Market Outlook |

|

7.4.2.China |

|

7.4.3.India |

|

7.4.4.Japan |

|

7.4.5.South Korea |

|

7.4.6.Australia |

|

7.5.Latin America |

|

7.5.1.Latin America EV Charging Cable Market Outlook |

|

7.5.2.Brazil |

|

7.5.3.Mexico |

|

7.6.Middle East & Africa |

|

7.6.1.Middle East & Africa EV Charging Cable Market Outlook |

|

7.6.2.Saudi Arabia |

|

7.6.3.UAE |

|

7.6.4.South Africa |

|

8.Competitive Landscape |

|

8.1.Market Share Analysis |

|

8.2.Company Strategy Analysis |

|

8.3.Competitive Matrix |

|

9.Company Profiles |

|

9.1.Aptiv |

|

9.1.1.Company Synopsis |

|

9.1.2.Company Financials |

|

9.1.3.Product/Service Portfolio |

|

9.1.4.Recent Developments |

|

*Note: All the companies in section 9.1 will cover the same sub-chapters as above. |

|

9.2.Besen International |

|

9.3.Brugg Group |

|

9.4.Dyden |

|

9.5.Huber+Suhner |

|

9.6.Leoni |

|

9.7.Phoenix Contact |

|

9.8.Sinbon Electronics |

|

9.9.Systems Wire and Cable |

|

9.10.TE Connectivity |

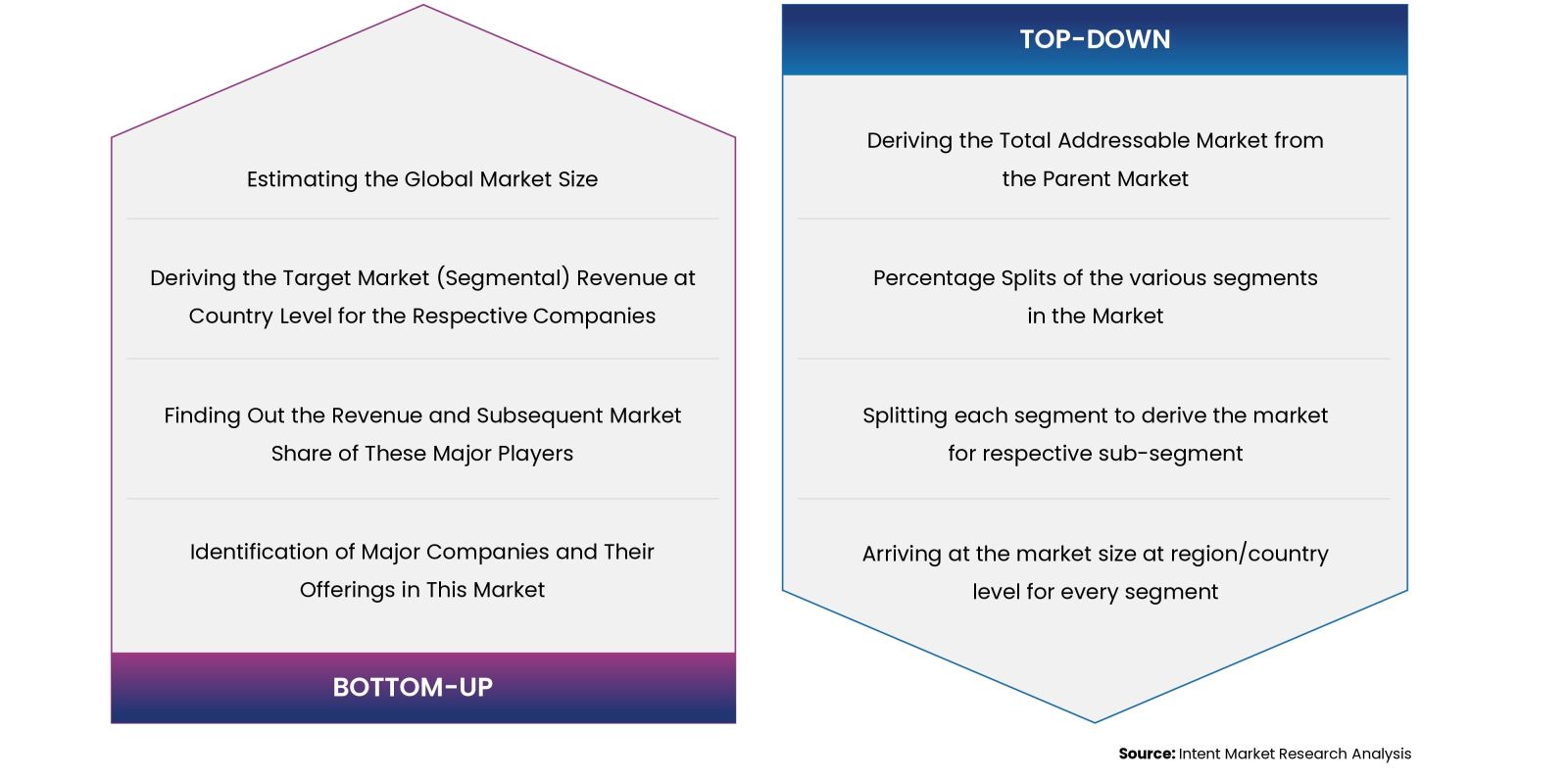

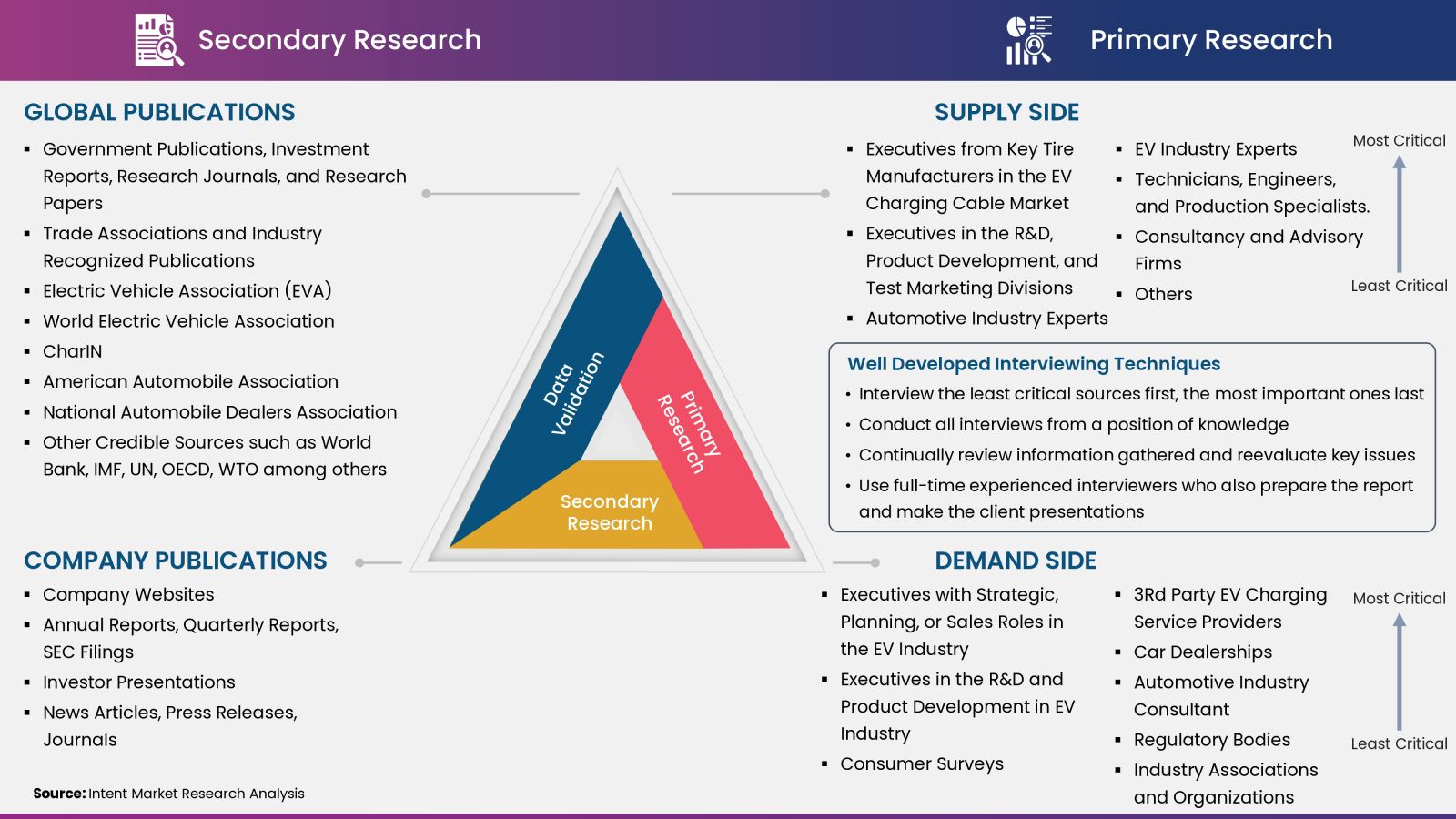

Intent Market Research employs a rigorous methodology to minimize residual errors by carefully defining the scope, validating findings through primary research, and consistently updating our in-house database. This dynamic approach allows us to capture ongoing market fluctuations and adapt to evolving market uncertainties.

The research factors used in our methodology vary depending on the specific market being analyzed. To begin with, we incorporate both demand and supply side information into our model to identify and address market gaps. Additionally, we also employ approaches such as Macro-Indicator Analysis, Factor Analysis, Value Chain-Based Sizing, and forecasting to further increase the accuracy of the numbers and validate the findings.

Research Approach

Secondary Research Approach: During the initial phase of the research process, we acquire and accumulate extensive data continuously. This data is carefully filtered and validated through a variety of secondary sources.

- Primary Research Approach: Following the consolidation of data gathered through secondary research, we initiate a validation and verification process to verify all the market numbers and assumptions by engaging with the subject matter experts.

Data Collection, Analysis and Interpretation:

Research Methodology

Our market research methodology utilizes both top-down and bottom-up approaches to segment and estimate quantitative aspects of the market. We also employ multi-perspective analysis, examining the market from distinct viewpoints.