As per Intent Market Research, the Ethylene Carbonate Market was valued at USD 0.6 billion in 2023 and will surpass USD 1.6 billion by 2030; growing at a CAGR of 14.1% during 2024 - 2030.

The ethylene carbonate market is witnessing significant growth, driven by its extensive use in various industrial applications such as lithium-ion batteries, solvents, and plasticizers. Ethylene carbonate is a highly versatile organic compound that serves as a key ingredient in battery technology, particularly for energy storage systems. Its demand is being fueled by the increasing adoption of electric vehicles (EVs), the expansion of renewable energy storage solutions, and advancements in various chemical applications. The market is expected to grow steadily through 2030, driven by both industrial and technological innovations.

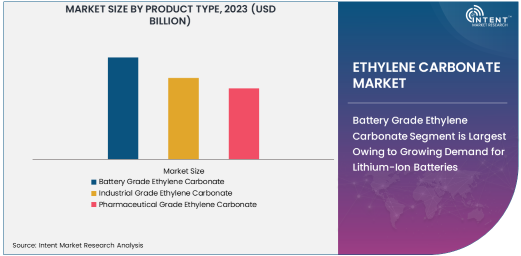

Battery Grade Ethylene Carbonate Segment is Largest Owing to Growing Demand for Lithium-Ion Batteries

The Battery Grade Ethylene Carbonate segment is the largest in the ethylene carbonate market, primarily due to its crucial role in the production of lithium-ion batteries (LIBs). Ethylene carbonate is a vital component in the electrolyte solution used in LIBs, which are essential for energy storage in applications such as electric vehicles and renewable energy systems. As the demand for electric vehicles continues to surge, so does the need for efficient, durable, and high-performing batteries, thus driving the demand for battery-grade ethylene carbonate. Its ability to enhance battery life and performance makes it indispensable for manufacturers in the energy and automotive sectors.

Battery-grade ethylene carbonate’s increasing adoption in energy storage applications, such as grid stabilization and portable electronics, further highlights its critical role in the growing demand for lithium-ion batteries. As sustainability goals drive the transition to electric mobility and renewable energy, the battery-grade segment is expected to continue its dominance in the ethylene carbonate market, expanding at a substantial rate.

Lithium-Ion Batteries Application is Fastest Growing Owing to Surge in Electric Vehicle Demand

The Lithium-Ion Batteries application segment is the fastest-growing segment in the ethylene carbonate market. Lithium-ion batteries are widely used in applications ranging from consumer electronics to electric vehicles (EVs) and energy storage systems. The exponential growth in the electric vehicle market, coupled with the increasing need for efficient energy storage solutions, is directly contributing to the rise in demand for ethylene carbonate, a crucial component in the production of LIBs. As the global automotive industry shifts toward electric mobility, the need for high-performance batteries is creating new opportunities for ethylene carbonate suppliers.

This growth is further supported by the global push for green energy and the ongoing advancements in battery technologies, which demand high-quality and stable electrolyte solutions. The battery-grade ethylene carbonate used in lithium-ion batteries provides improved charge and discharge rates, longer life cycles, and better thermal stability, making it a preferred choice for manufacturers. Given the expansion of the electric vehicle market and the increasing demand for large-scale energy storage, this application is expected to maintain its rapid growth trajectory.

Electronics Industry is Largest End-User for Ethylene Carbonate

Among the end-use industries, the Electronics sector is the largest consumer of ethylene carbonate. Ethylene carbonate is widely utilized in the manufacturing of various electronic components and devices, particularly as a solvent and electrolyte in batteries used in portable electronics such as smartphones, laptops, and tablets. As the electronics industry continues to expand with advancements in technology and consumer demand for more efficient and portable devices, ethylene carbonate will remain a critical raw material for these applications.

In addition to its role in consumer electronics, ethylene carbonate is also used in the semiconductor industry as a solvent in etching processes and as an additive in the production of high-performance coatings for electronic components. As the need for compact, high-capacity batteries grows, the electronics sector will continue to be a dominant force in the ethylene carbonate market, particularly in regions with high technological innovation.

Asia-Pacific Region is Fastest Growing Owing to Industrial Expansion and EV Adoption

The Asia-Pacific region is expected to be the fastest-growing market for ethylene carbonate, driven by rapid industrialization, increased energy storage needs, and the growing adoption of electric vehicles. Countries like China, Japan, and South Korea are at the forefront of electric vehicle production, which is fueling the demand for lithium-ion batteries and, in turn, ethylene carbonate. Additionally, the region is home to some of the largest electronics and chemical manufacturing industries, contributing further to the regional growth.

China, in particular, plays a pivotal role in the ethylene carbonate market, being one of the largest consumers of lithium-ion batteries for both domestic and international markets. As the country continues to strengthen its position in clean energy and electric mobility, the demand for ethylene carbonate in energy storage applications is anticipated to increase significantly. The Asia-Pacific region's rapid adoption of renewable energy and electric vehicles is expected to continue driving the demand for ethylene carbonate well into the next decade.

Leading Companies and Competitive Landscape

The competitive landscape of the ethylene carbonate market is characterized by a mix of major chemical players, battery material suppliers, and electronics manufacturers. Leading companies such as BASF SE, Solvay S.A., Eastman Chemical Company, Mitsubishi Chemical Corporation, and LG Chem Ltd. dominate the market. These companies are investing heavily in research and development to improve production processes and develop sustainable, high-performance ethylene carbonate solutions. In addition, several companies are focusing on strategic collaborations and acquisitions to expand their market presence and gain a competitive edge.

As the demand for ethylene carbonate continues to increase, especially in the lithium-ion battery sector, companies are also focusing on expanding their production capacities and enhancing their product portfolios to cater to the growing needs of the electronics, automotive, and energy storage industries. Competitive strategies such as vertical integration, mergers, acquisitions, and partnerships with battery manufacturers are key drivers for companies aiming to secure a significant share of the growing ethylene carbonate market.

Recent Developments:

- BASF SE recently launched new advanced electrolyte solutions, including ethylene carbonate, aiming to improve the performance and safety of lithium-ion batteries in electric vehicles (EVs).

- LG Chem announced the expansion of its lithium-ion battery materials production, increasing its capacity for ethylene carbonate to meet the growing demand from the EV market.

- Solvay introduced a more sustainable production process for ethylene carbonate, reducing the environmental impact and carbon footprint of its manufacturing operations.

- Eastman Chemical Company acquired a leading advanced battery materials firm to enhance its position in the growing lithium-ion battery sector, including ethylene carbonate production.

- SABIC collaborated with automotive giants to develop high-performance EV battery technologies, incorporating ethylene carbonate as a key component in their electrolyte solutions.

List of Leading Companies:

- BASF SE

- Shenzhen Capchem Technology Co., Ltd.

- LG Chem Ltd.

- Solvay S.A.

- Eastman Chemical Company

- LyondellBasell Industries N.V.

- Mitsubishi Chemical Corporation

- SABIC

- Zhejiang Jiahua Energy Chemical Industry Co., Ltd.

- Changzhou Tiansheng New Materials Co., Ltd.

- Zhejiang Xinfu Pharmaceutical Co., Ltd.

- Yunnan Tin Company Limited

- BASF Catalysts LLC

- Ube Industries Ltd.

- Jiangsu Tianyi Ecological Environment Co., Ltd.

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 0.6 Billion |

|

Forecasted Value (2030) |

USD 1.6 Billion |

|

CAGR (2024 – 2030) |

14.1% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Ethylene Carbonate Market By Product Type (Battery Grade Ethylene Carbonate, Industrial Grade Ethylene Carbonate, Pharmaceutical Grade Ethylene Carbonate), By Application (Lithium-Ion Batteries, Solvents, Plasticizers, Electrolytes, Coatings), By End-Use Industry (Electronics, Automotive, Pharmaceuticals, Energy Storage, Chemical Manufacturing) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

BASF SE, Shenzhen Capchem Technology Co., Ltd., LG Chem Ltd., Solvay S.A., Eastman Chemical Company, LyondellBasell Industries N.V., Mitsubishi Chemical Corporation, SABIC, Zhejiang Jiahua Energy Chemical Industry Co., Ltd., Changzhou Tiansheng New Materials Co., Ltd., Zhejiang Xinfu Pharmaceutical Co., Ltd., Yunnan Tin Company Limited, BASF Catalysts LLC, Ube Industries Ltd., Jiangsu Tianyi Ecological Environment Co., Ltd. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Ethylene Carbonate Market, by Product Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Battery Grade Ethylene Carbonate |

|

4.2. Industrial Grade Ethylene Carbonate |

|

4.3. Pharmaceutical Grade Ethylene Carbonate |

|

5. Ethylene Carbonate Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Lithium-Ion Batteries |

|

5.2. Solvents |

|

5.3. Plasticizers |

|

5.4. Electrolytes |

|

5.5. Coatings |

|

6. Ethylene Carbonate Market, by End-Use Industry (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Electronics |

|

6.2. Automotive |

|

6.3. Pharmaceuticals |

|

6.4. Energy Storage |

|

6.5. Chemical Manufacturing |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Ethylene Carbonate Market, by Product Type |

|

7.2.7. North America Ethylene Carbonate Market, by Application |

|

7.2.8. North America Ethylene Carbonate Market, by End-Use Industry |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Ethylene Carbonate Market, by Product Type |

|

7.2.9.1.2. US Ethylene Carbonate Market, by Application |

|

7.2.9.1.3. US Ethylene Carbonate Market, by End-Use Industry |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. BASF SE |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Shenzhen Capchem Technology Co., Ltd. |

|

9.3. LG Chem Ltd. |

|

9.4. Solvay S.A. |

|

9.5. Eastman Chemical Company |

|

9.6. LyondellBasell Industries N.V. |

|

9.7. Mitsubishi Chemical Corporation |

|

9.8. SABIC |

|

9.9. Zhejiang Jiahua Energy Chemical Industry Co., Ltd. |

|

9.10. Changzhou Tiansheng New Materials Co., Ltd. |

|

9.11. Zhejiang Xinfu Pharmaceutical Co., Ltd. |

|

9.12. Yunnan Tin Company Limited |

|

9.13. BASF Catalysts LLC |

|

9.14. Ube Industries Ltd. |

|

9.15. Jiangsu Tianyi Ecological Environment Co., Ltd. |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Ethylene Carbonate Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Ethylene Carbonate Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Ethylene Carbonate Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA