As per Intent Market Research, the Epoxy Putty and Construction Chemicals Market was valued at USD 45.6 billion in 2023 and will surpass USD 59.2 billion by 2030; growing at a CAGR of 3.8% during 2024 - 2030.

The global epoxy putty and construction chemicals market is experiencing steady growth due to increasing infrastructure development, modernization of existing structures, and the demand for durable, high-performance building materials. These products are essential in addressing critical construction challenges, including repair, maintenance, and sustainability, across residential, commercial, and industrial sectors. The market is driven by rapid urbanization, stringent regulations for building quality, and the adoption of advanced construction technologies.

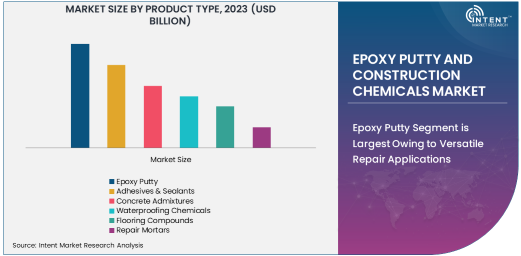

Epoxy Putty Segment is Largest Owing to Versatile Repair Applications

Epoxy putty dominates the product type segment, attributed to its versatility and effectiveness in diverse repair applications. Widely used for filling cracks, patching materials, and sealing leaks, epoxy putty offers a robust, durable solution for both residential and industrial applications. Its high adhesive strength and resistance to chemicals and water make it indispensable in structural maintenance.

Demand for epoxy putty is further driven by the growing need for quick, reliable repairs in aging infrastructure and residential buildings. Innovations in product formulations, such as enhanced curing properties and eco-friendly variants, are expanding its application scope, ensuring it remains a cornerstone in construction maintenance.

Waterproofing Chemicals Segment is Fastest Growing Owing to Demand for Durable Solutions

The waterproofing chemicals segment is experiencing the fastest growth, fueled by the rising focus on enhancing building durability and preventing structural damage caused by water infiltration. These chemicals are vital in ensuring the longevity of infrastructure, particularly in regions prone to high rainfall or flooding.

With increasing investments in large-scale infrastructure projects, including bridges, tunnels, and commercial spaces, the demand for advanced waterproofing solutions is surging. Technological advancements, such as crystalline waterproofing and liquid-applied membranes, are further propelling market growth by offering superior performance and ease of application.

Structural Repairs Segment is Largest Owing to Infrastructure Rehabilitation

Structural repairs account for the largest share within the application segment, driven by the need for rehabilitation of aging infrastructure. Governments and private sectors worldwide are allocating significant budgets to restore bridges, roads, and other critical structures to maintain safety standards and operational efficiency.

The adoption of high-strength construction chemicals, such as repair mortars and epoxy-based solutions, plays a vital role in structural reinforcement. These materials not only restore the original integrity of structures but also enhance their load-bearing capacity and resistance to environmental degradation.

Flooring & Coatings Segment is Fastest Growing Owing to Aesthetic and Functional Needs

The flooring & coatings segment is the fastest-growing application, as businesses and homeowners increasingly prioritize aesthetics and functionality. Flooring compounds and protective coatings are essential in ensuring durability, resistance to wear, and chemical protection in industrial and commercial spaces.

Advanced formulations, such as self-leveling compounds and decorative epoxy coatings, are gaining traction due to their seamless finish and ease of maintenance. The shift towards sustainable construction practices has also boosted demand for low-VOC, eco-friendly products in this category.

Commercial Construction Segment is Largest Owing to Urbanization Trends

Commercial construction leads the end-use industry segment, supported by rapid urbanization and the expansion of commercial real estate. Shopping malls, office complexes, and healthcare facilities require high-quality construction chemicals to meet stringent durability and aesthetic requirements.

The segment benefits from investments in smart cities and green buildings, where advanced materials play a crucial role in energy efficiency and sustainability. The growing need for cost-effective, long-lasting solutions in large-scale projects further solidifies this segment's dominance.

Residential Construction Segment is Fastest Growing Owing to Housing Demand

Residential construction is the fastest-growing end-use industry, driven by rising global housing demand and government initiatives promoting affordable housing. The segment heavily utilizes epoxy putty, adhesives, sealants, and waterproofing chemicals to ensure the longevity and quality of housing structures.

Emerging economies, particularly in Asia-Pacific and Latin America, are witnessing an upsurge in residential projects, further boosting demand. Additionally, the emphasis on energy-efficient housing and sustainable materials adds momentum to this segment's growth.

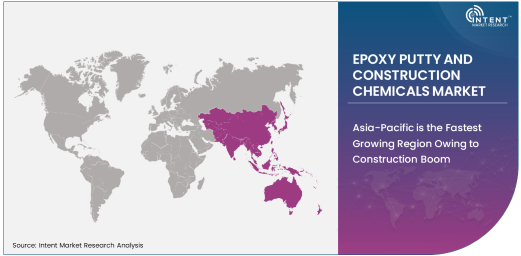

Asia-Pacific is the Fastest Growing Region Owing to Construction Boom

Asia-Pacific emerges as the fastest-growing region, propelled by rapid urbanization, infrastructural development, and rising investments in commercial and residential construction. Countries such as China, India, and Southeast Asian nations are at the forefront of this growth, driven by government initiatives and foreign direct investments in infrastructure.

The region’s increasing focus on smart cities and sustainable construction practices is creating significant demand for advanced construction chemicals. Moreover, the availability of cost-effective materials and labor enhances the region's appeal as a lucrative market for global manufacturers.

Leading Companies and Competitive Landscape

The epoxy putty and construction chemicals market is highly competitive, with leading players such as Sika AG, BASF SE, and Henkel AG driving innovation and market expansion. Companies are focusing on strategic acquisitions, partnerships, and product development to strengthen their foothold. The introduction of sustainable, high-performance solutions reflects the industry's commitment to addressing evolving customer needs and environmental concerns.

The competitive landscape is marked by regional players catering to local demands and global companies leveraging their technological expertise to penetrate emerging markets. As construction activities continue to grow worldwide, the market is poised for robust expansion, fueled by innovation and collaboration among industry leaders.

Recent Developments:

- Sika AG introduced an advanced waterproofing system in 2024 to enhance durability in large-scale infrastructure projects.

- In 2024, BASF completed the acquisition of a specialty chemicals company to strengthen its construction chemicals portfolio.

- Henkel launched eco-friendly, low-VOC construction adhesives to meet sustainability targets in early 2024.

- Mapei announced the expansion of its manufacturing unit in Vietnam to cater to rising demand in the APAC region.

- Pidilite entered into a strategic partnership with a global distributor to extend its market reach in the Middle East and Africa.

List of Leading Companies:

- Sika AG

- BASF SE

- Henkel AG & Co. KGaA

- Mapei S.p.A.

- Fosroc International Ltd

- Pidilite Industries Limited

- W.R. Grace & Co.

- Dow Inc.

- Akzo Nobel N.V.

- Saint-Gobain Weber

- Ardex Group

- Ashland Global Holdings Inc.

- Huntsman Corporation

- RPM International Inc.

- H.B. Fuller Company

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 45.6 Billion |

|

Forecasted Value (2030) |

USD 59.2 Billion |

|

CAGR (2024 – 2030) |

3.8% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Epoxy Putty and Construction Chemicals Market By Product Type (Epoxy Putty, Adhesives & Sealants, Concrete Admixtures, Waterproofing Chemicals, Flooring Compounds, Repair Mortars), By Application (Building Maintenance, Structural Repairs, Crack Filling, Flooring & Coatings, Waterproofing), By End-Use Industry (Residential Construction, Commercial Construction, Infrastructure Development, Industrial Construction) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Sika AG, BASF SE, Henkel AG & Co. KGaA, Mapei S.p.A., Fosroc International Ltd, Pidilite Industries Limited, W.R. Grace & Co., Dow Inc., Akzo Nobel N.V., Saint-Gobain Weber, Ardex Group, Ashland Global Holdings Inc., Huntsman Corporation, RPM International Inc., H.B. Fuller Company |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Epoxy Putty and Construction Chemicals Market, by Product Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Epoxy Putty |

|

4.2. Adhesives & Sealants |

|

4.3. Concrete Admixtures |

|

4.4. Waterproofing Chemicals |

|

4.5. Flooring Compounds |

|

4.6. Repair Mortars |

|

5. Epoxy Putty and Construction Chemicals Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Building Maintenance |

|

5.2. Structural Repairs |

|

5.3. Crack Filling |

|

5.4. Flooring & Coatings |

|

5.5. Waterproofing |

|

5.6. Others |

|

6. Epoxy Putty and Construction Chemicals Market, by End-Use Industry (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Residential Construction |

|

6.2. Commercial Construction |

|

6.3. Infrastructure Development |

|

6.4. Industrial Construction |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Epoxy Putty and Construction Chemicals Market, by Product Type |

|

7.2.7. North America Epoxy Putty and Construction Chemicals Market, by Application |

|

7.2.8. North America Epoxy Putty and Construction Chemicals Market, by End-Use Industry |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Epoxy Putty and Construction Chemicals Market, by Product Type |

|

7.2.9.1.2. US Epoxy Putty and Construction Chemicals Market, by Application |

|

7.2.9.1.3. US Epoxy Putty and Construction Chemicals Market, by End-Use Industry |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Sika AG |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. BASF SE |

|

9.3. Henkel AG & Co. KGaA |

|

9.4. Mapei S.p.A. |

|

9.5. Fosroc International Ltd |

|

9.6. Pidilite Industries Limited |

|

9.7. W.R. Grace & Co. |

|

9.8. Dow Inc. |

|

9.9. Akzo Nobel N.V. |

|

9.10. Saint-Gobain Weber |

|

9.11. Ardex Group |

|

9.12. Ashland Global Holdings Inc. |

|

9.13. Huntsman Corporation |

|

9.14. RPM International Inc. |

|

9.15. H.B. Fuller Company |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Epoxy Putty and Construction Chemicals Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Epoxy Putty and Construction Chemicals Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Epoxy Putty and Construction Chemicals Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA