As per Intent Market Research, the Enterprise Social Networks and Online Communities Market was valued at USD 8.3 billion in 2023 and will surpass USD 23.0 billion by 2030; growing at a CAGR of 15.7% during 2024 - 2030.

The Enterprise Social Networks (ESN) and Online Communities market is undergoing significant transformation, with organizations increasingly adopting digital collaboration tools to enhance communication, knowledge sharing, and engagement. Among the various deployment types, cloud-based solutions have become the most popular choice for businesses. The cloud-based deployment model offers unmatched scalability, flexibility, and cost-effectiveness, enabling businesses to expand or downsize their network infrastructure as per demand. Moreover, cloud solutions facilitate seamless access to data and collaboration tools from anywhere in the world, making them a preferred choice for organizations with remote or globally distributed teams.

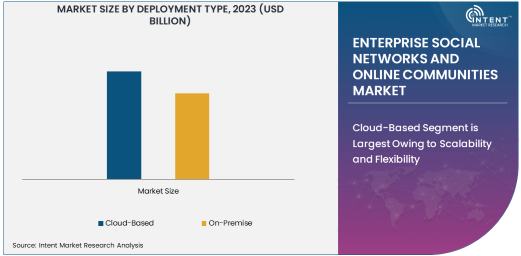

Cloud-Based Segment is Largest Owing to Scalability and Flexibility

The cloud-based ESN sub-segment is expected to maintain its dominant position due to the growing trend of remote working and the increasing demand for scalable, easy-to-deploy solutions. Cloud-based systems also offer enhanced security features, automatic updates, and disaster recovery options that make them a reliable choice for large enterprises and SMEs alike. The ability to integrate with other cloud applications further boosts its appeal, making it easier for businesses to adopt a unified system that works across various departments. This flexibility and ease of integration are key factors driving the growth of the cloud-based sub-segment in the enterprise social networks market.

Large Enterprises Lead the Market Owing to Greater Collaboration Needs

The market for Enterprise Social Networks and Online Communities is experiencing substantial growth as businesses look to enhance internal communication and collaboration. Among the two primary organization sizes Small & Medium Enterprises (SMEs) and Large Enterprise the latter segment has emerged as the largest due to the complex organizational structures and the need for robust, scalable collaboration tools. Large enterprises typically have more extensive workforces, both locally and globally, which increases the need for efficient communication tools that can streamline workflows, encourage employee engagement, and foster knowledge sharing.

Large enterprises often invest in ESN platforms to facilitate cross-departmental collaboration, improve employee engagement, and integrate with other enterprise applications for enhanced productivity. Furthermore, these organizations tend to have greater financial resources, allowing them to implement high-end ESN solutions that support their expansive networks and help manage large-scale internal communications. The complex requirements of large enterprises, including compliance with regulatory standards, integration with legacy systems, and a need for enhanced security, make them the largest adopters of enterprise social networks.

BFSI Segment is Largest Owing to Secure Communication Needs

The BFSI (Banking, Financial Services, and Insurance) industry is one of the largest end-users of Enterprise Social Networks and Online Communities. This industry relies heavily on secure, real-time communication channels to ensure smooth operations, manage customer relations, and meet regulatory compliance standards. ESNs in the BFSI sector are used for both internal communication and customer engagement, with platforms enabling employees to collaborate effectively on projects while ensuring that sensitive financial data remains secure.

The BFSI sector's adoption of ESN platforms is primarily driven by the increasing need for secure, compliant communication solutions. With the growing digitalization of financial services, banks and financial institutions require robust internal networks to support teamwork, streamline decision-making, and manage risks. Furthermore, customer engagement is becoming increasingly important in this sector, with ESNs enabling direct interaction with clients for feedback and personalized services. As financial institutions continue to embrace digital transformation, the BFSI segment will remain a leading adopter of enterprise social networking tools.

Employee Collaboration is Fastest Growing Owing to Remote Work Trends

The application segment of the Enterprise Social Networks and Online Communities market is diverse, with a range of use cases such as internal communication, employee collaboration, customer engagement, and knowledge sharing. Among these, employee collaboration is the fastest-growing application, largely driven by the rise of remote work and the increasing need for seamless communication and teamwork in virtual environments. The COVID-19 pandemic significantly accelerated the shift to remote and hybrid work models, leading to an increased demand for collaboration tools that allow teams to work together efficiently, regardless of their physical location.

Employee collaboration platforms are designed to facilitate file sharing, project management, and real-time communication, enabling teams to work on common goals and tasks. As organizations continue to embrace flexible work arrangements, the demand for tools that support collaboration between distributed teams will grow, making employee collaboration the fastest-growing application in the ESN market. This trend is expected to continue as more businesses implement hybrid working models and look for tools that enable efficient communication, coordination, and idea exchange among employees.

North America Dominates the Market Owing to Technological Advancements

The global Enterprise Social Networks and Online Communities market is also experiencing varying growth across regions, with North America leading the charge. North America is the largest region in the ESN market, primarily due to the region’s technological advancements, high adoption of digital collaboration tools, and the presence of several key market players. The United States, in particular, is home to many large enterprises that have been early adopters of enterprise social networking solutions, driven by their need for secure, scalable communication and collaboration tools to manage complex organizational structures and geographically dispersed teams.

Moreover, North America has a highly competitive and dynamic business environment, with companies across sectors such as technology, finance, and healthcare actively investing in ESN platforms to enhance productivity and employee engagement. The region's robust IT infrastructure, coupled with a high rate of digitalization and innovation, ensures that North America remains the dominant player in the ESN market. The increasing shift towards cloud-based solutions and remote work practices further bolsters the region’s position as the largest market for enterprise social networking tools.

Competitive Landscape: Key Players and Market Dynamics

The Enterprise Social Networks and Online Communities market is highly competitive, with several key players offering innovative solutions to meet the growing demand for digital collaboration. Leading companies like Microsoft, Slack Technologies, and Salesforce dominate the market, with each offering unique features and functionalities to cater to a wide range of organizational needs. Microsoft’s Yammer and Slack’s team collaboration features are widely recognized for their ease of use, integration capabilities, and scalability, making them the top choices for large enterprises and SMEs alike.

The competitive landscape is marked by frequent mergers and acquisitions, as companies seek to expand their portfolios and enhance their offerings. For instance, Salesforce's acquisition of Slack Technologies allowed the company to integrate advanced collaboration tools into its customer relationship management (CRM) suite, providing a seamless experience for users. Additionally, emerging players continue to innovate with specialized solutions tailored to specific industries, further intensifying competition. As the market grows, companies must focus on offering personalized and secure solutions to maintain a competitive edge in this rapidly evolving space.

Recent Developments:

- Microsoft announced its acquisition of Nuance Communications in 2021 to enhance its AI capabilities, including voice recognition and healthcare solutions integrated into enterprise social networks.

- Slack introduced updates to improve collaboration for remote teams, including better integration with Microsoft Teams, Google Workspace, and improved security measures.

- Meta Platforms introduced advanced collaboration tools within Workplace by Facebook, focusing on improving employee engagement and productivity.

- In 2021, Salesforce completed its acquisition of Slack Technologies to expand its enterprise social networking and collaboration offerings.

- SAP added new AI-driven features to its SAP SuccessFactors platform, enhancing employee collaboration, knowledge sharing, and engagement within organizations.

List of Leading Companies:

- Microsoft Corporation

- Slack Technologies

- Facebook (Meta Platforms, Inc.)

- IBM Corporation

- Salesforce.com, Inc.

- Cisco Systems, Inc.

- Google LLC

- Workplace by Facebook

- Yammer Inc.

- SAP SE

- Jive Software (a part of Aurea Software)

- Chatter by Salesforce

- Trello (Atlassian)

- Asana, Inc.

- Zoho Corporation

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 8.3 Billion |

|

Forecasted Value (2030) |

USD 23.0 Billion |

|

CAGR (2024 – 2030) |

15.7% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Enterprise Social Networks and Online Communities Market By Deployment Type (Cloud-Based, On-Premise), By Organization Size (Small & Medium Enterprises, Large Enterprises), By End-Use Industry (BFSI, IT & Telecommunications, Retail & E-commerce, Healthcare, Government, Education, Manufacturing), By Application (Internal Communication, Employee Collaboration, Customer Engagement, Knowledge Sharing, Brand Building) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Microsoft Corporation, Slack Technologies, Facebook (Meta Platforms, Inc.), IBM Corporation, Salesforce.com, Inc., Cisco Systems, Inc., Google LLC, Workplace by Facebook, Yammer Inc., SAP SE, Jive Software (a part of Aurea Software), Chatter by Salesforce, Trello (Atlassian), Asana, Inc., Zoho Corporation |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Enterprise Social Networks and Online Communities Market, by Deployment Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Cloud-Based |

|

4.2. On-Premise |

|

5. Enterprise Social Networks and Online Communities Market, by Organization Size (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Small & Medium Enterprises (SMEs) |

|

5.2. Large Enterprises |

|

6. Enterprise Social Networks and Online Communities Market, by End-Use Industry (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. BFSI |

|

6.2. IT & Telecommunications |

|

6.3. Retail & E-commerce |

|

6.4. Healthcare |

|

6.5. Government |

|

6.6. Education |

|

6.7. Manufacturing |

|

7. Enterprise Social Networks and Online Communities Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Internal Communication |

|

7.2. Employee Collaboration |

|

7.3. Customer Engagement |

|

7.4. Knowledge Sharing |

|

7.5. Brand Building |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Enterprise Social Networks and Online Communities Market, by Deployment Type |

|

8.2.7. North America Enterprise Social Networks and Online Communities Market, by Organization Size |

|

8.2.8. North America Enterprise Social Networks and Online Communities Market, by End-Use Industry |

|

8.2.9. North America Enterprise Social Networks and Online Communities Market, by Application |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Enterprise Social Networks and Online Communities Market, by Deployment Type |

|

8.2.10.1.2. US Enterprise Social Networks and Online Communities Market, by Organization Size |

|

8.2.10.1.3. US Enterprise Social Networks and Online Communities Market, by End-Use Industry |

|

8.2.10.1.4. US Enterprise Social Networks and Online Communities Market, by Application |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Microsoft Corporation |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Slack Technologies |

|

10.3. Facebook (Meta Platforms, Inc.) |

|

10.4. IBM Corporation |

|

10.5. Salesforce.com, Inc. |

|

10.6. Cisco Systems, Inc. |

|

10.7. Google LLC |

|

10.8. Workplace by Facebook |

|

10.9. Yammer Inc. |

|

10.10. SAP SE |

|

10.11. Jive Software (a part of Aurea Software) |

|

10.12. Chatter by Salesforce |

|

10.13. Trello (Atlassian) |

|

10.14. Asana, Inc. |

|

10.15. Zoho Corporation |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Enterprise Social Networks and Online Communities Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Enterprise Social Networks and Online Communities Market. The research methodoloagy encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Enterprise Social Networks and Online Communities Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA