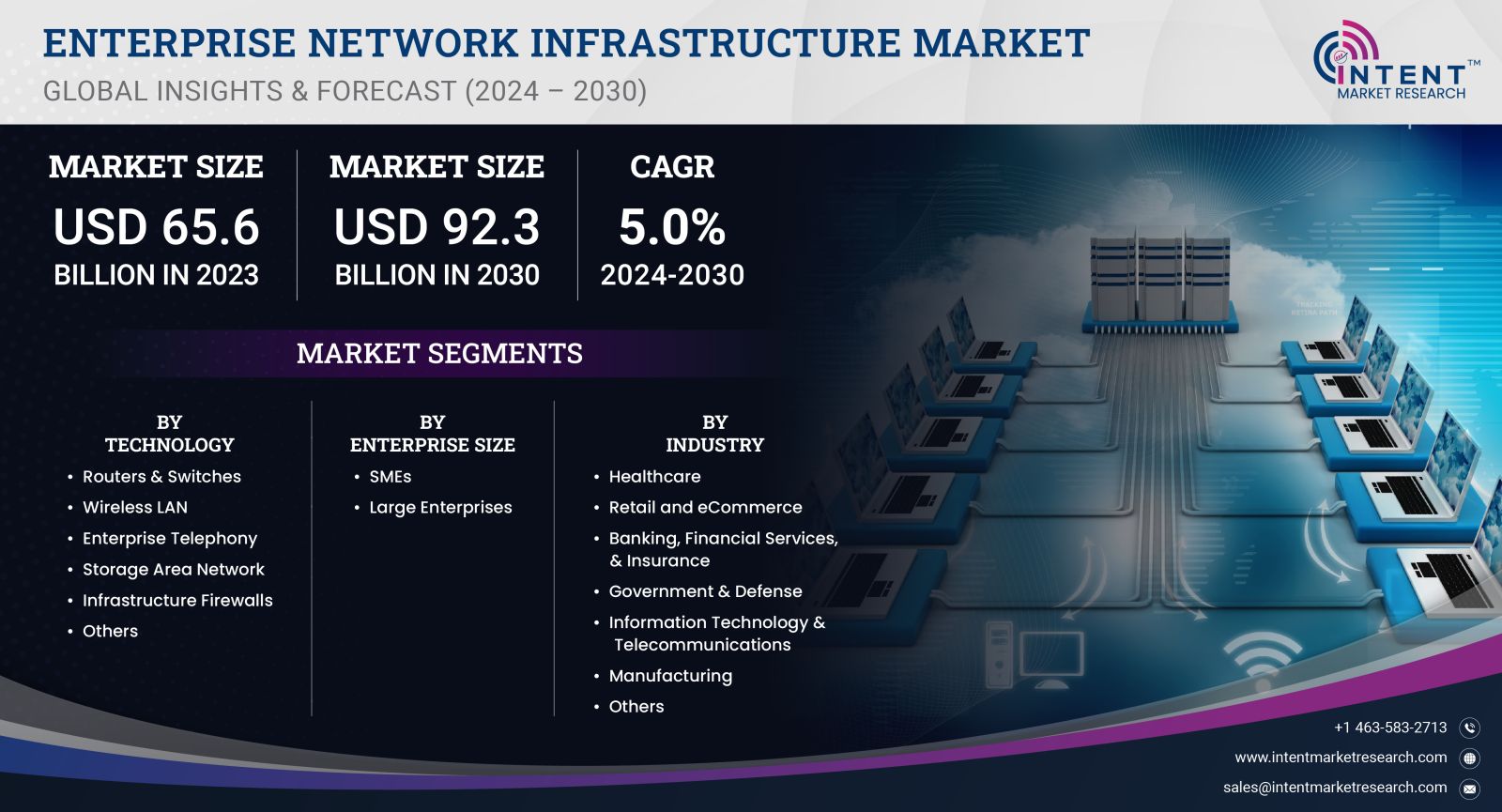

As per Intent Market Research, the Enterprise Network Infrastructure Market was valued at USD 65.6 billion in 2023 and will surpass USD 92.3 billion by 2030; growing at a CAGR of 5.0% during 2024 - 2030.

The Enterprise Network Infrastructure Market is poised for substantial growth as businesses increasingly recognize the importance of robust and scalable network solutions to support digital transformation. This market encompasses a wide array of products and services, including switches, routers, wireless access points, network security devices, and management software, essential for enabling reliable and efficient communication within organizations. With the rapid adoption of cloud computing, the Internet of Things (IoT), and 5G technology, the demand for advanced networking infrastructure is expected to surge.

Switches Segment is Largest Owing to Growing Data Traffic

Within the enterprise network infrastructure market, the switches segment stands out as the largest subsegment, driven by the ever-increasing volume of data traffic generated by digital applications and services. Switches are fundamental components that facilitate the seamless transfer of data between devices within a local area network (LAN). As enterprises expand their digital footprint and leverage cloud-based solutions, the need for high-performance switches capable of managing increased data loads becomes critical. The shift towards remote work and the proliferation of connected devices further exacerbate the demand for sophisticated switching solutions that ensure high availability, low latency, and scalability.

The growth of the switches segment is also propelled by advancements in technology, including the adoption of software-defined networking (SDN) and network functions virtualization (NFV). These innovations allow for greater flexibility and agility in network management, enabling enterprises to respond swiftly to changing business needs. Additionally, the integration of artificial intelligence (AI) and machine learning (ML) in network management solutions is enhancing the capabilities of switches, making them more intelligent and self-managing. As organizations increasingly prioritize digital transformation initiatives, investments in switching infrastructure are expected to remain robust, solidifying the switches segment's leadership in the enterprise network infrastructure market.

Routers Segment is Fastest Growing Owing to Cloud Adoption

The routers segment is recognized as the fastest-growing subsegment within the enterprise network infrastructure market, largely due to the accelerated adoption of cloud computing. Routers play a pivotal role in directing data traffic between different networks and are essential for enabling secure and efficient connections to cloud services. As more organizations migrate their operations to the cloud, the demand for advanced routers that can handle increased bandwidth and provide enhanced security features is surging. This trend is particularly pronounced in industries such as finance, healthcare, and e-commerce, where data privacy and regulatory compliance are paramount.

In addition to cloud adoption, the rise of remote work has led to an increased need for routers that support secure virtual private network (VPN) connections. Organizations are investing in routers equipped with advanced security protocols to protect sensitive data and maintain secure communications among remote employees. The introduction of next-generation routers, which offer capabilities such as integrated security features, support for IoT devices, and enhanced performance metrics, is further driving the growth of this segment. As enterprises continue to prioritize robust and secure connectivity solutions, the routers segment is expected to maintain its rapid growth trajectory through 2030.

Wireless Access Points Segment is Largest Owing to Mobility Trends

The wireless access points (WAPs) segment emerges as the largest subsegment in the enterprise network infrastructure market, attributed to the ongoing trends towards mobility and flexible work environments. Wireless access points enable seamless connectivity for mobile devices, allowing employees to work from various locations within the organization. With the increasing reliance on mobile devices and applications, enterprises are investing heavily in WAPs to ensure reliable and high-speed wireless connectivity throughout their facilities. This demand is particularly prominent in sectors such as education, healthcare, and retail, where a high density of mobile users is common.

Moreover, the proliferation of IoT devices in enterprise environments is further fueling the growth of the WAP segment. Organizations require robust wireless infrastructure to connect and manage numerous IoT devices, which often operate on low-power, high-traffic networks. The evolution of Wi-Fi technologies, including the introduction of Wi-Fi 6 and future advancements in Wi-Fi 7, enhances the capabilities of wireless access points, providing improved data transfer speeds, increased device capacity, and enhanced security features. As enterprises increasingly prioritize the establishment of mobile-first environments, the wireless access points segment is well-positioned for continued expansion.

Network Security Devices Segment is Fastest Growing Owing to Cybersecurity Threats

The network security devices segment is recognized as the fastest-growing subsegment within the enterprise network infrastructure market, driven by the escalating prevalence of cybersecurity threats. As organizations become more digital and interconnected, they face an increased risk of data breaches, malware attacks, and other cyber threats. Consequently, there is a heightened emphasis on investing in robust network security solutions to protect sensitive information and maintain business continuity. Network security devices, including firewalls, intrusion detection systems (IDS), and unified threat management (UTM) solutions, are critical for safeguarding enterprise networks against these threats.

The rapid adoption of remote work has further underscored the need for enhanced network security measures. Organizations are increasingly deploying advanced security devices that can provide real-time threat detection and response capabilities, ensuring that remote and on-site employees can operate securely. Furthermore, the integration of AI and machine learning technologies into network security devices is revolutionizing the way organizations detect and respond to threats, enabling proactive measures rather than reactive responses. As the landscape of cyber threats continues to evolve, the demand for network security devices is expected to grow significantly, making it a key focus area for enterprises through 2030.

Competitive Landscape: Leading Companies and Market Dynamics

The competitive landscape of the enterprise network infrastructure market is characterized by a diverse array of companies striving to differentiate themselves through innovative solutions and strategic partnerships. Leading players in this market include Cisco Systems, Inc., Juniper Networks, Arista Networks, and HPE Aruba, among others. These companies are continuously investing in research and development to enhance their product offerings, particularly in areas such as SDN, NFV, and network security. Additionally, strategic acquisitions and collaborations are common as firms seek to expand their market presence and capabilities.

The competitive dynamics of the enterprise network infrastructure market are further shaped by the increasing demand for integrated solutions that combine networking, security, and management functionalities. As businesses prioritize end-to-end solutions that streamline operations and reduce complexity, vendors are responding by developing comprehensive platforms that address these needs. This trend is expected to drive further consolidation in the market, with smaller players seeking partnerships with larger enterprises to leverage their resources and reach. Overall, the enterprise network infrastructure market is anticipated to remain highly competitive, with innovation and strategic positioning playing crucial roles in determining market success.

Regional Insights: North America is Largest Region Owing to Technology Adoption

In terms of regional dynamics, North America stands as the largest market for enterprise network infrastructure, owing to its early adoption of advanced technologies and robust digital transformation initiatives. The region's enterprises have been at the forefront of embracing cloud computing, IoT, and cybersecurity solutions, driving the demand for sophisticated network infrastructure. The presence of major technology companies and a highly skilled workforce further enhance North America's position in the market. Additionally, significant investments in research and development by key players in the region contribute to the continuous evolution of networking technologies.

However, the Asia-Pacific region is emerging as the fastest-growing market, fueled by rapid urbanization, digitalization, and increased investments in IT infrastructure. Countries such as China and India are witnessing a surge in demand for enterprise networking solutions as businesses seek to enhance operational efficiency and compete on a global scale. The region's burgeoning small and medium-sized enterprises (SMEs) are increasingly adopting cloud-based networking solutions, propelling the growth of the enterprise network infrastructure market. As organizations in Asia-Pacific continue to digitize their operations, the region is expected to experience significant market expansion through 2030.

Report Objectives:

The report will help you answer some of the most critical questions in the Enterprise Network Infrastructure Market. A few of them are as follows:

- What are the key drivers, restraints, opportunities, and challenges influencing the market growth?

- What are the prevailing technology trends in the Enterprise Network Infrastructure Market?

- What is the size of the Enterprise Network Infrastructure Market based on segments, sub-segments, and regions?

- What is the size of different market segments across key regions: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa?

- What are the market opportunities for stakeholders after analyzing key market trends?

- Who are the leading market players and what are their market share and core competencies?

- What is the degree of competition in the market and what are the key growth strategies adopted by leading players?

- What is the competitive landscape of the market, including market share analysis, revenue analysis, and a ranking of key players?

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 65.6 billion |

|

Forecasted Value (2030) |

USD 92.3 billion |

|

CAGR (2024 – 2030) |

5.0% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Enterprise Network Infrastructure Market By Technology (Routers & Switches, Wireless LAN, Enterprise Telephony, Storage Area Network, Infrastructure Firewalls), By Industry (Healthcare, Retail and eCommerce, Banking, Financial Services, & Insurance, Government & Defense, Information Technology & Telecommunications, Manufacturing), By Enterprise Size (SMEs, Large Enterprises) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3.Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Enterprise Network Infrastructure Market, by Technology (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Routers & Switches |

|

4.2. Wireless LAN |

|

4.3. Enterprise Telephony |

|

4.4. Storage Area Network |

|

4.5. Infrastructure Firewalls |

|

4.6. Others |

|

5. Enterprise Network Infrastructure Market, by Enterprise Size (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. SMEs |

|

5.2. Large Enterprises |

|

6. Enterprise Network Infrastructure Market, by Industry (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Healthcare |

|

6.2. Retail and eCommerce |

|

6.3. Banking, Financial Services, & Insurance |

|

6.4. Government & Defense |

|

6.5. Information Technology & Telecommunications |

|

6.6. Manufacturing |

|

6.7. Others |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Enterprise Network Infrastructure Market, by Technology |

|

7.2.7. North America Enterprise Network Infrastructure Market, by Enterprise Size |

|

7.2.8. North America Enterprise Network Infrastructure Market, by Industry |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Enterprise Network Infrastructure Market, by Technology |

|

7.2.9.1.2. US Enterprise Network Infrastructure Market, by Enterprise Size |

|

7.2.9.1.3. US Enterprise Network Infrastructure Market, by Industry |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. ALE International |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Arista Networks, Inc. |

|

9.3. Broadcom |

|

9.4. Cisco Systems, Inc. |

|

9.5. Cloudflare, Inc. |

|

9.6. Extreme Networks |

|

9.7. Fortinet, Inc. |

|

9.8. Hewlett Packard Enterprise Development LP |

|

9.9. Huawei Technologies Co., Ltd. |

|

9.10. Juniper Networks, Inc. |

|

9.11. Riverbed Technology |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Enterprise Network Infrastructure Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Enterprise Network Infrastructure Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the Enterprise Network Infrastructure ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Enterprise Network Infrastructure Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA