As per Intent Market Research, the Enterprise Data Management Market was valued at USD 93.2 billion in 2023 and will surpass USD 168.2 billion by 2030; growing at a CAGR of 8.8% during 2024 - 2030.

The Enterprise Data Management (EDM) Market has emerged as a critical component for organizations aiming to leverage their data assets effectively. With the exponential growth of data in today's digital landscape, enterprises are increasingly adopting robust data management solutions to ensure the integrity, security, and accessibility of their information. The market encompasses a wide range of solutions, including data integration, data quality management, data governance, and master data management. As businesses recognize the value of accurate and timely data in driving decision-making and operational efficiency, the EDM market is projected to grow significantly in the coming years.

This growth is primarily driven by the rising need for data governance, regulatory compliance, and the increasing adoption of cloud-based solutions. Organizations across various sectors, including healthcare, finance, and retail, are prioritizing EDM solutions to enhance data visibility, improve data-driven strategies, and foster collaboration across departments.

.jpg)

Data Integration Segment is Largest Owing to Increasing Demand for Unified Data Systems

Within the Enterprise Data Management market, the Data Integration segment stands out as the largest due to the critical need for businesses to consolidate data from disparate sources. As organizations accumulate vast amounts of data from various channels—including customer interactions, sales processes, and operational workflows—there is a pressing demand for integrated systems that provide a comprehensive view of the data landscape. Data integration solutions enable enterprises to connect applications, databases, and data warehouses, thereby facilitating seamless data flow and real-time insights.

The significance of data integration is further amplified by the trend of digital transformation, as organizations seek to enhance their operational efficiency and improve customer experiences. As more companies adopt cloud technologies, the need for effective data integration strategies becomes paramount. This segment is anticipated to witness continuous growth, driven by advancements in data integration tools, such as ETL (Extract, Transform, Load) and API (Application Programming Interface) technologies, which simplify the process of merging data from various sources and formats.

Data Quality Management Segment is Fastest Growing Owing to the Need for Accurate Insights

The Data Quality Management segment is experiencing the fastest growth within the Enterprise Data Management market, fueled by organizations’ increasing emphasis on data accuracy and reliability. With data serving as the foundation for critical business decisions, ensuring high-quality data has become essential. Poor data quality can lead to erroneous insights, negatively impacting strategic initiatives and operational efficiency. As businesses recognize this risk, they are investing in robust data quality management solutions to cleanse, validate, and enrich their data assets.

The surge in data-driven decision-making across industries is a key driver of this growth. Companies are focusing on implementing comprehensive data governance frameworks that encompass data quality measures, leading to improved trust in data insights. Furthermore, regulatory requirements surrounding data accuracy and compliance are prompting organizations to adopt data quality management practices. As a result, this segment is expected to maintain a rapid growth trajectory, reflecting the increasing recognition of data quality as a vital business asset.

Data Governance Segment is Largest Owing to Compliance Requirements

The Data Governance segment holds the largest share within the Enterprise Data Management market, primarily due to the escalating need for regulatory compliance and risk management. Organizations are faced with stringent regulations regarding data privacy and security, such as the General Data Protection Regulation (GDPR) and the Health Insurance Portability and Accountability Act (HIPAA). Consequently, businesses are compelled to implement comprehensive data governance frameworks that establish policies, procedures, and standards for managing data assets effectively.

By ensuring data governance, organizations can mitigate risks associated with data breaches and non-compliance. This proactive approach not only helps in maintaining data integrity but also enhances accountability and transparency within the organization. As the focus on data governance intensifies, companies are increasingly allocating resources towards establishing governance committees, appointing data stewards, and implementing governance tools. This trend is projected to contribute to the sustained growth of the data governance segment in the EDM market.

Master Data Management Segment is Fastest Growing Owing to Streamlined Operations

The Master Data Management (MDM) segment is witnessing the fastest growth within the Enterprise Data Management market, driven by the need for organizations to create a single, authoritative source of truth for their data. MDM solutions enable businesses to consolidate and manage critical data entities, such as customers, products, and suppliers, across various systems and departments. This centralized approach enhances data accuracy, consistency, and accessibility, which are essential for informed decision-making and operational efficiency.

As organizations expand their digital footprints and adopt multi-channel strategies, the complexity of managing master data increases. MDM solutions help streamline operations by eliminating data silos and ensuring that all stakeholders have access to reliable data. Furthermore, the integration of MDM with advanced technologies, such as artificial intelligence and machine learning, is enhancing its capabilities and driving innovation in this space. As businesses continue to recognize the value of MDM in optimizing data management processes, this segment is set to experience significant growth in the coming years.

Cloud-Based Solutions Segment is Largest Owing to Scalability and Flexibility

The Cloud-Based Solutions segment represents the largest share within the Enterprise Data Management market, as organizations increasingly migrate their data management practices to the cloud. Cloud solutions offer numerous advantages, including scalability, flexibility, and cost-effectiveness, allowing businesses to adapt to changing data requirements without significant upfront investments. This shift towards cloud-based EDM solutions is further accelerated by the growing adoption of remote work practices and the need for real-time access to data from anywhere.

By leveraging cloud-based EDM solutions, organizations can streamline their data management processes, enhance collaboration among teams, and improve data security through robust cloud infrastructure. Furthermore, cloud solutions facilitate automatic updates and maintenance, ensuring that organizations remain compliant with the latest data management regulations and best practices. As a result, the cloud-based solutions segment is poised for continued growth as businesses seek to harness the power of the cloud in managing their data assets effectively.

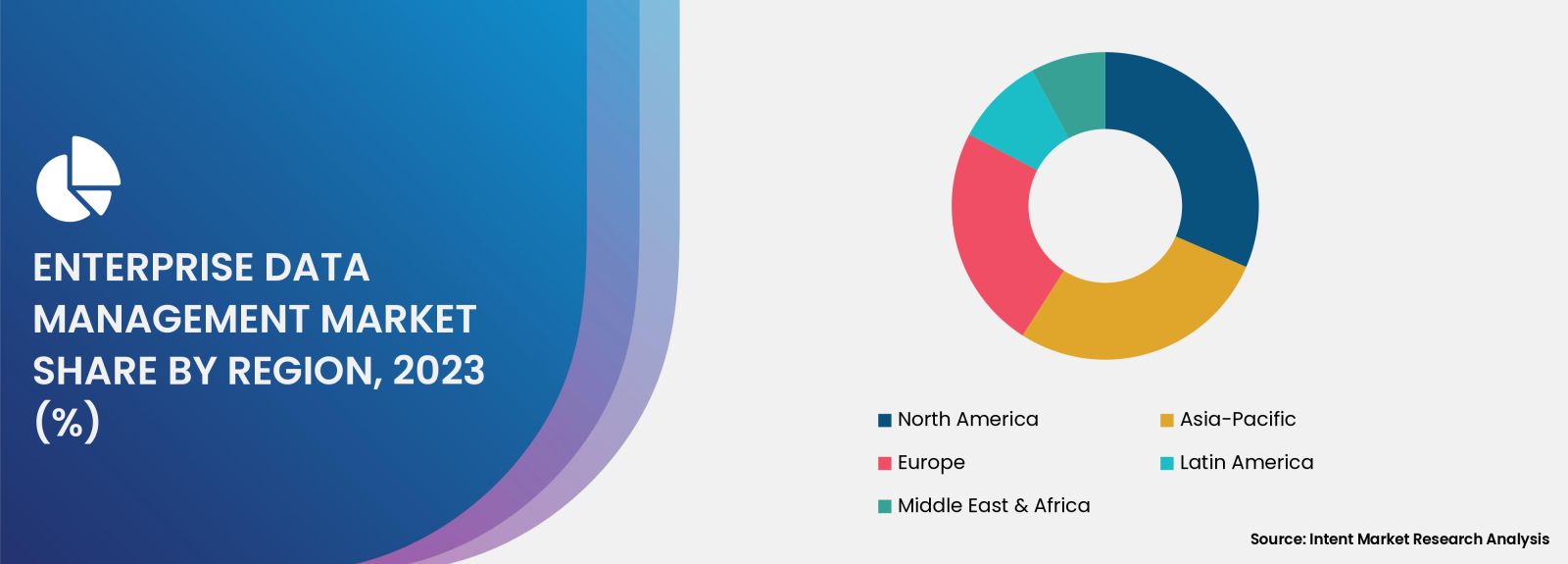

North America Region is Largest Owing to Advanced Infrastructure and Investment

In the North America region, the Enterprise Data Management market holds the largest share, attributed to its advanced technological infrastructure and significant investments in data management solutions. Organizations in this region are at the forefront of digital transformation, with a strong focus on leveraging data for competitive advantage. The presence of key players, coupled with a robust ecosystem of technology providers, further enhances the growth prospects for the EDM market in North America.

Moreover, stringent regulations governing data privacy and security are driving businesses to invest in comprehensive data management frameworks. Industries such as finance, healthcare, and retail are particularly proactive in adopting EDM solutions to ensure compliance and mitigate risks. As North America continues to lead in technological advancements and data management initiatives, it is expected to maintain its dominant position in the global EDM market through 2030.

Competitive Landscape and Leading Companies

The Enterprise Data Management market is characterized by a dynamic competitive landscape, with several key players striving to establish their presence and enhance their offerings. Leading companies in this market include IBM Corporation, SAP SE, Oracle Corporation, Microsoft Corporation, and Informatica LLC. These organizations are investing heavily in research and development to innovate and expand their product portfolios, ensuring they meet the evolving needs of businesses in an increasingly data-driven world.

The competitive environment is also marked by strategic partnerships, mergers, and acquisitions as companies seek to enhance their capabilities and broaden their market reach. Additionally, the rise of new entrants and startups is contributing to market dynamism, driving innovation and competition. As organizations continue to prioritize data management, the competitive landscape in the Enterprise Data Management market is expected to evolve, with companies focusing on delivering integrated, scalable, and user-friendly solutions to meet the diverse needs of their clients.

Report Objectives:

The report will help you answer some of the most critical questions in the Enterprise Data Management Market. A few of them are as follows:

- What are the key drivers, restraints, opportunities, and challenges influencing the market growth?

- What are the prevailing technology trends in the Enterprise Data Management Market?

- What is the size of the Enterprise Data Management Market based on segments, sub-segments, and regions?

- What is the size of different market segments across key regions: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa?

- What are the market opportunities for stakeholders after analyzing key market trends?

- Who are the leading market players and what are their market share and core competencies?

- What is the degree of competition in the market and what are the key growth strategies adopted by leading players?

- What is the competitive landscape of the market, including market share analysis, revenue analysis, and a ranking of key players?

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 93.2 billion |

|

Forecasted Value (2030) |

USD 168.2 billion |

|

CAGR (2024 – 2030) |

8.8% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Enterprise Data Management Market By Components (Software, Services), By Deployment Mode (Cloud, On-Premises), By Organization Size (Small & Medium-Sized Enterprises, Large Enterprises), By Industry Vertical (Healthcare & Life Science, Banking, Financial Services & Insurance, Telecom & Information Technology, Retail & Consumer Goods, Media & Entertainment, Manufacturing, Energy & Utilities, Transportation & Logistics, Government & Defense) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3.Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Enterprise Data Management Market, by Components (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Software |

|

4.1.1. Data Security |

|

4.1.2. Master Data Management |

|

4.1.3. Data Integration |

|

4.1.4. Data Migration |

|

4.1.5. Others |

|

4.2. Services |

|

4.2.1. Managed Services |

|

4.2.2. Professional Services |

|

5. Enterprise Data Management Market, by Deployment Mode (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Cloud |

|

5.2. On-Premises |

|

6. Enterprise Data Management Market, by Organization Size (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Small & Medium-Sized Enterprises |

|

6.2. Large enterprises |

|

7. Enterprise Data Management Market, by Industry Vertical (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Healthcare & Life Science |

|

7.2. Banking, Financial Services & Insurance |

|

7.3. Telecom & Information Technology |

|

7.4. Retail & Consumer Goods |

|

7.5. Media & Entertainment |

|

7.6. Manufacturing |

|

7.7. Energy & Utilities |

|

7.8. Transportation & Logistics |

|

7.9. Government & Defense |

|

7.10. Others |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Enterprise Data Management Market, by Components |

|

8.2.7. North America Enterprise Data Management Market, by Deployment Mode |

|

8.2.8. North America Enterprise Data Management Market, by Organization Size |

|

8.2.9. North America Enterprise Data Management Market, by Industry Vertical |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Enterprise Data Management Market, by Components |

|

8.2.10.1.2. US Enterprise Data Management Market, by Deployment Mode |

|

8.2.10.1.3. US Enterprise Data Management Market, by Organization Size |

|

8.2.10.1.4. US Enterprise Data Management Market, by Industry Vertical |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. IBM Corporation |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. SAS Institute Inc. |

|

10.3. Teradata Corporation |

|

10.4. Oracle |

|

10.5. SAP SE |

|

10.6. Talend, Inc. |

|

10.7. Broadcom |

|

10.8. Cloudera, Inc. |

|

10.9. Ataccama |

|

10.10. Informatica Inc. |

|

10.11. Verizon |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Enterprise Data Management Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Enterprise Data Management Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the Enterprise Data Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Enterprise Data Management Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA