As per Intent Market Research, the Enterprise Asset Leasing Market was valued at USD 84.2 billion in 2023 and will surpass USD 143.6 billion by 2030; growing at a CAGR of 7.9% during 2024 - 2030.

The enterprise asset leasing market has seen significant growth in recent years, driven by businesses’ increasing demand for flexible financing options and cost-effective solutions for acquiring assets without substantial capital expenditure. Leasing offers companies the ability to access high-value assets, such as vehicles, machinery, and real estate, without the need for upfront investment, which is particularly advantageous in industries facing tight capital budgets or rapidly changing technology. The market is characterized by various leasing types, product categories, and lease durations, making it an attractive option for both large enterprises and small & medium enterprises (SMEs). As leasing continues to evolve with technological advancements, businesses can benefit from more efficient, streamlined processes, offering them greater agility and financial flexibility.

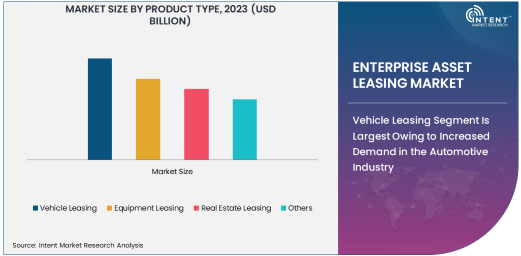

Vehicle Leasing Segment Is Largest Owing to Increased Demand in the Automotive Industry

Among the various types of assets leased, vehicle leasing is the largest segment within the enterprise asset leasing market. Vehicle leasing has become a popular solution for companies needing access to fleets without the upfront cost of purchasing, offering businesses the flexibility to expand and contract their fleet size based on demand. The growing demand for vehicles, particularly in sectors like logistics, transportation, and sales, where regular vehicle usage is essential, continues to propel the growth of vehicle leasing. Companies are increasingly opting for vehicle leasing to reduce maintenance costs and avoid the risks of depreciation associated with ownership.

The automotive industry has been a major driver of the vehicle leasing segment, with businesses looking to lease fleets to maintain cost efficiency and minimize long-term asset management concerns. The flexibility in lease terms and the option to upgrade vehicles regularly have further fueled this trend. Additionally, the shift toward electric vehicles (EVs) has created new opportunities within the vehicle leasing sector, as companies look to align their fleets with sustainability goals and government regulations. As EV adoption grows, the vehicle leasing market is expected to see significant growth, particularly in regions with high EV penetration, such as Europe and North America.

Equipment Leasing Segment Is Fastest Growing Due to Increased Demand from Industrial Sectors

The equipment leasing segment is the fastest-growing segment in the enterprise asset leasing market, primarily driven by the increasing demand from industries like construction, manufacturing, and energy. Equipment leasing provides businesses with access to high-value machinery and tools without incurring the full purchase cost, which is especially valuable in capital-intensive industries. Equipment leasing helps companies reduce overhead costs related to asset maintenance and management, offering them the flexibility to adapt quickly to changing market conditions and technological advancements.

Construction and industrial manufacturing, two of the largest consumers of leased equipment, are showing significant growth in demand for specialized equipment such as cranes, excavators, and advanced machinery. These sectors often rely on leasing for short-term projects and seasonal needs, making it a cost-effective solution. The increasing focus on infrastructure development and industrial automation, especially in emerging markets, will likely fuel further growth in the equipment leasing segment, as businesses seek to access state-of-the-art machinery without committing to large capital outlays.

Financial Lease Type Is Largest Due to Long-Term Investment and Flexibility

In the lease type segment, financial lease is the largest subsegment. Financial leases are long-term agreements where the lessee assumes most of the risks and rewards associated with ownership, making it a popular choice for businesses seeking to retain the asset for extended periods while benefiting from favorable tax treatments. This type of lease is particularly favored by companies looking to invest in high-cost, long-term assets like machinery, vehicles, and real estate.

The financial lease model offers enterprises greater flexibility as it often includes an option to purchase the asset at the end of the lease term. This feature appeals to businesses that want the ability to own the asset once the lease expires, without having to deal with depreciation or managing the asset for its full lifecycle. Financial leases are also preferred by businesses looking to leverage tax benefits, as interest payments and depreciation can be deducted from taxable income. This has made financial leases the go-to option for industries like manufacturing, automotive, and energy.

Large Enterprises Lead in Asset Leasing Demand Due to Scale and Financial Capacity

In terms of organization size, large enterprises dominate the enterprise asset leasing market. Large organizations often require access to a wide range of assets, including fleets, heavy machinery, and real estate, to operate on a global scale. Leasing provides these companies with the ability to scale their asset base in line with business growth, without committing significant capital upfront. Large enterprises are also more likely to have the financial stability required to negotiate favorable lease terms, making leasing an ideal solution to manage their extensive asset portfolios.

In addition, large enterprises have the internal resources to manage the complexity of long-term lease agreements, including compliance with tax and accounting regulations. They are increasingly opting for customized lease agreements that offer flexibility in terms of asset upgrades and maintenance. The ability to quickly adapt to changing market conditions by adjusting the size and type of leased assets is a key benefit that makes leasing attractive to large businesses in sectors such as automotive, energy, and manufacturing.

Asia-Pacific Region Is Fastest Growing Due to Emerging Markets and Infrastructure Development

The Asia-Pacific region is experiencing the fastest growth in the enterprise asset leasing market. This region’s rapid urbanization, infrastructure development, and industrialization have driven an increased demand for leased assets, particularly in countries like China, India, and Japan. These markets have seen significant investments in construction, automotive fleets, and manufacturing equipment, all of which are supported by leasing options.

Governments in Asia-Pacific are also increasingly supportive of asset leasing as a means to boost economic growth while reducing the burden on businesses’ capital expenditures. The rise of small and medium enterprises (SMEs) in these developing markets is another factor driving the growth of leasing, as these businesses often prefer leasing over purchasing due to limited capital. The ongoing trend toward modernizing infrastructure and increasing industrial automation in the region will further propel the demand for leased equipment, vehicles, and machinery.

Competitive Landscape and Leading Companies

The enterprise asset leasing market is competitive, with numerous global players offering a wide range of leasing solutions. Leading companies in the market include General Electric Capital Corporation, Caterpillar Financial Services, LeasePlan Corporation N.V., and Siemens Financial Services, among others. These companies dominate by offering diverse asset leasing solutions across various industries, including automotive, healthcare, manufacturing, and construction.

The competitive landscape is characterized by a mix of traditional leasing giants and new entrants leveraging technology to streamline the leasing process. Digital platforms and fintech innovations are becoming increasingly popular, offering businesses faster, more efficient ways to lease assets. Companies that integrate digital solutions, such as blockchain for secure transactions and AI for predictive maintenance, are expected to gain a competitive edge in the market. As the market continues to evolve, companies that can offer flexible, cost-effective, and tech-enabled leasing solutions will be well-positioned to lead the industry.

Recent Developments:

- LeasePlan Corporation entered into a strategic partnership with Ally Financial to offer customized leasing and fleet management services, expanding its offerings for corporate clients.

- General Electric Capital Corporation announced the launch of a new digital asset leasing platform, aiming to simplify the leasing process for small and medium-sized businesses (SMEs).

- Toyota Financial Services has been expanding its electric vehicle (EV) leasing options, offering more flexible and cost-effective leasing plans for businesses transitioning to sustainable fleets.

- Caterpillar Financial Services completed the acquisition of a construction equipment leasing firm, strengthening its position in the global construction industry.

- Hitachi Capital Corporation recently secured a regulatory approval to enter the renewable energy equipment leasing market, with a focus on solar power systems for commercial clients

List of Leading Companies:

- General Electric Capital Corporation

- Caterpillar Financial Services Corporation

- LeasePlan Corporation N.V.

- Siemens Financial Services

- DLL Group

- Deutsche Bank AG

- JPMorgan Chase & Co.

- Toyota Financial Services Corporation

- Mitsubishi UFJ Lease & Finance Company Limited

- Hitachi Capital Corporation

- Ally Financial Inc.

- UBS Group AG

- BNP Paribas Leasing Solutions

- Honda Financial Services

- Macquarie Group Limited

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 84.2 Billion |

|

Forecasted Value (2030) |

USD 143.6 Billion |

|

CAGR (2024 – 2030) |

7.9% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Enterprise Asset Leasing Market by Product Type (Vehicle Leasing, Equipment Leasing, Real Estate Leasing), by End-User Industry (Automotive, Healthcare, Industrial Manufacturing, Construction, Energy & Utilities, IT & Telecommunications, Retail), by Lease Type (Operating Lease, Financial Lease, Sale and Leaseback, Leveraged Lease), by Organization Size (Small & Medium Enterprises, Large Enterprises) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

General Electric Capital Corporation, Caterpillar Financial Services Corporation, LeasePlan Corporation N.V., Siemens Financial Services, DLL Group, Deutsche Bank AG, JPMorgan Chase & Co., Toyota Financial Services Corporation, Mitsubishi UFJ Lease & Finance Company Limited, Hitachi Capital Corporation, Ally Financial Inc., UBS Group AG, BNP Paribas Leasing Solutions, Honda Financial Services, Macquarie Group Limited |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Enterprise Asset Leasing Market, by Product Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Vehicle Leasing |

|

4.2. Equipment Leasing |

|

4.3. Real Estate Leasing |

|

4.4. Others |

|

5. Enterprise Asset Leasing Market, by End-User Industry (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Automotive |

|

5.2. Healthcare |

|

5.3. Industrial Manufacturing |

|

5.4. Construction |

|

5.5. Energy & Utilities |

|

5.6. IT & Telecommunications |

|

5.7. Retail |

|

5.8. Others |

|

6. Enterprise Asset Leasing Market, by Lease Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Operating Lease |

|

6.2. Financial Lease |

|

6.3. Sale and Leaseback |

|

6.4. Leveraged Lease |

|

6.5. Others |

|

7. Enterprise Asset Leasing Market, by Organization Size (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Small & Medium Enterprises (SMEs) |

|

7.2. Large Enterprises |

|

7.3. Others |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Enterprise Asset Leasing Market, by Product Type |

|

8.2.7. North America Enterprise Asset Leasing Market, by End-User Industry |

|

8.2.8. North America Enterprise Asset Leasing Market, by Lease Type |

|

8.2.9. North America Enterprise Asset Leasing Market, by |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Enterprise Asset Leasing Market, by Product Type |

|

8.2.10.1.2. US Enterprise Asset Leasing Market, by End-User Industry |

|

8.2.10.1.3. US Enterprise Asset Leasing Market, by Lease Type |

|

8.2.10.1.4. US Enterprise Asset Leasing Market, by |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. General Electric Capital Corporation |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Caterpillar Financial Services Corporation |

|

10.3. LeasePlan Corporation N.V. |

|

10.4. Siemens Financial Services |

|

10.5. DLL Group |

|

10.6. Deutsche Bank AG |

|

10.7. JPMorgan Chase & Co. |

|

10.8. Toyota Financial Services Corporation |

|

10.9. Mitsubishi UFJ Lease & Finance Company Limited |

|

10.10. Hitachi Capital Corporation |

|

10.11. Ally Financial Inc. |

|

10.12. UBS Group AG |

|

10.13. BNP Paribas Leasing Solutions |

|

10.14. Honda Financial Services |

|

10.15. Macquarie Group Limited |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Enterprise Asset Leasing Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Enterprise Asset Leasing Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Enterprise Asset Leasing Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA