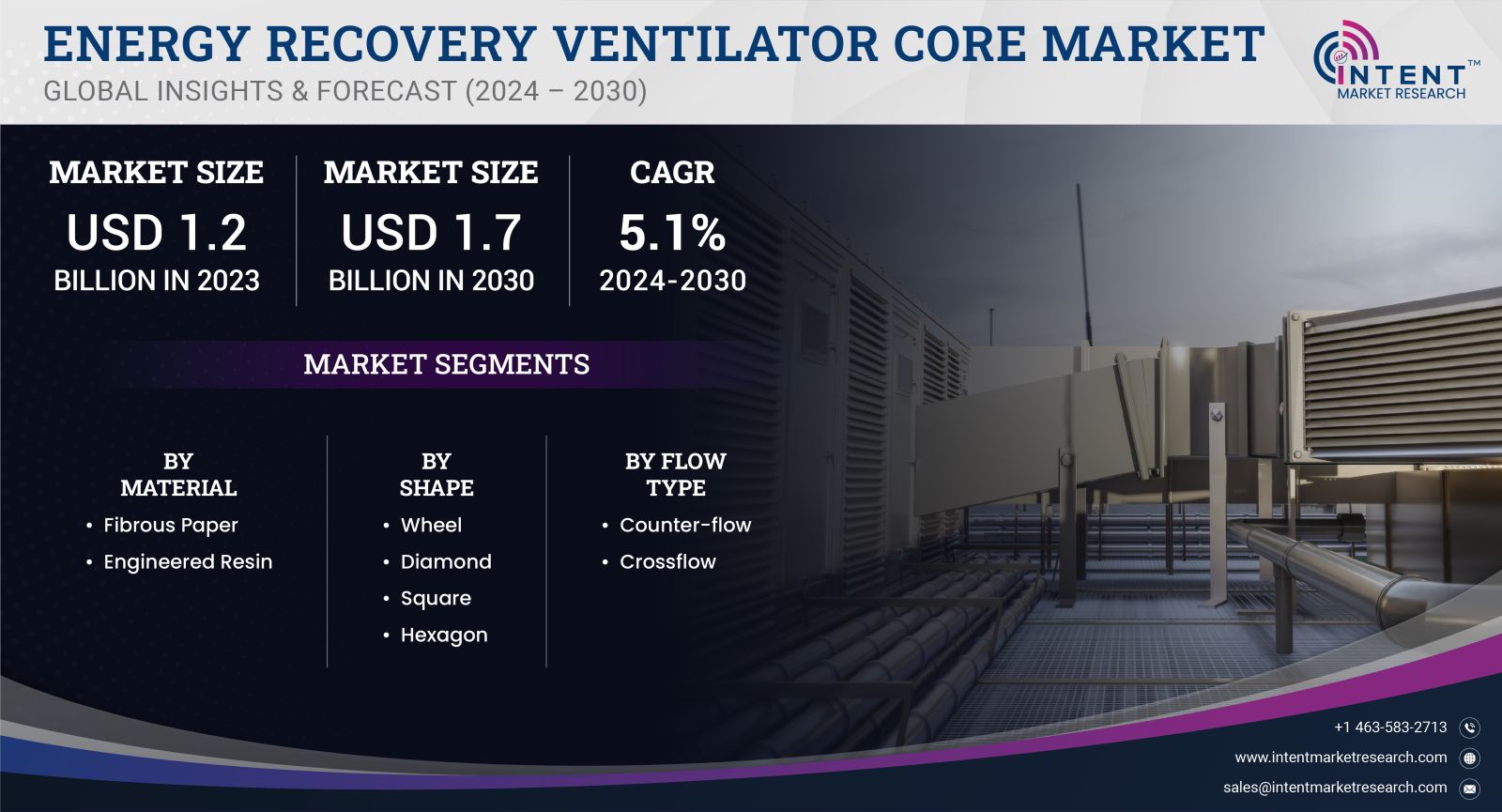

As per Intent Market Research, the Energy Recovery Ventilator Core Market was valued at USD 1.2 billion in 2023-e and will surpass USD 1.7 billion by 2030; growing at a CAGR of 5.1% during 2024 - 2030.

As urbanization continues to rise and building codes become more stringent, the demand for energy-efficient solutions has surged. Energy recovery ventilators have emerged as a vital technology for achieving energy efficiency in both new constructions and retrofits. By capturing and reusing energy, these systems not only lower operational costs but also contribute to reduced greenhouse gas emissions, aligning with global sustainability goals. As a result, the ERV core market is poised for significant expansion, driven by technological advancements and increasing consumer demand for efficient building systems.

Polymeric ERV Cores Segment is Largest Owing to Versatility and Cost-Effectiveness

The polymeric ERV cores segment is currently the largest in the energy recovery ventilator core market, primarily due to its versatility and cost-effectiveness. These cores are made from materials such as polypropylene and polystyrene, which are lightweight, durable, and resistant to moisture and temperature variations. Their inherent properties make them suitable for various applications, from residential units to large commercial systems. The cost-effectiveness of polymeric materials also appeals to manufacturers and end-users looking for affordable yet high-performing energy recovery solutions.

Additionally, polymeric ERV cores are relatively easy to manufacture and install, contributing to their widespread adoption. The ability to provide efficient heat and moisture transfer while maintaining a compact design has made polymeric cores the preferred choice for many HVAC systems. As energy efficiency becomes increasingly paramount in building design and operation, the polymeric ERV cores segment is expected to maintain its leadership in the market.

Metallic ERV Cores Segment is Fastest Growing Owing to Superior Performance

The metallic ERV cores segment is recognized as the fastest-growing segment within the energy recovery ventilator core market. Made from materials such as aluminum and stainless steel, these cores offer superior thermal conductivity and structural integrity, making them ideal for high-performance applications. The increased focus on energy recovery in commercial and industrial settings has driven the demand for metallic cores, which are capable of handling higher airflows and temperatures than their polymeric counterparts.

Moreover, metallic ERV cores can withstand more rigorous cleaning and maintenance routines, making them suitable for environments that require stringent hygiene standards, such as healthcare facilities and food processing plants. As industries seek solutions that can enhance energy efficiency while meeting specific operational requirements, the metallic ERV cores segment is projected to experience significant growth, appealing to a wide range of applications.

Residential ERV Cores Segment is Largest Owing to Increased Demand for Indoor Air Quality

The residential ERV cores segment is currently the largest within the energy recovery ventilator core market. The growing awareness of indoor air quality and its impact on health has led to increased adoption of ERVs in residential buildings. Homeowners are increasingly prioritizing air quality and energy efficiency, especially in regions with extreme weather conditions where HVAC systems are essential for comfort. Energy recovery ventilators play a crucial role in ensuring fresh air circulation while minimizing energy losses, making them a valuable addition to modern homes.

Furthermore, government incentives and programs aimed at promoting energy-efficient technologies have contributed to the growth of residential ERV installations. As more homeowners invest in energy-efficient upgrades and smart home technologies, the demand for residential ERV cores is expected to continue its upward trajectory, driving market growth in this segment.

North America Region is Largest Owing to Advanced Infrastructure and Regulations

North America holds the largest market share in the energy recovery ventilator core market, driven by advanced infrastructure, regulatory support, and a strong emphasis on energy efficiency. The United States and Canada have implemented various building codes and standards that mandate the use of energy recovery systems in new constructions, particularly in commercial and multi-family residential buildings. These regulations have spurred the demand for energy recovery ventilators, as they help meet the required energy performance benchmarks.

Additionally, the presence of established manufacturers and a well-developed distribution network in North America contributes to the region's leadership in the market. The increasing awareness of indoor air quality and energy conservation among consumers further fuels the demand for ERV systems. As sustainable building practices gain traction, North America is expected to maintain its position as the largest market for energy recovery ventilator cores.

Leading Companies in the Competitive Landscape

The competitive landscape of the energy recovery ventilator core market features several prominent players dedicated to innovation and market expansion. Key companies in this market include Carrier Corporation, Trane Technologies plc, Daikin Industries, Ltd., Honeywell International Inc., Johnson Controls International plc, Nortek Air Management, Mitsubishi Electric Corporation, Greenheck Fan Corporation, Ventacity Systems, and Fantech. These companies are recognized for their diverse product portfolios, strong brand presence, and commitment to research and development.

Competition in the ERV core market is characterized by strategic partnerships, mergers, and acquisitions as companies seek to enhance their product offerings and expand their market reach. Many leading manufacturers are investing in advanced technologies, such as smart sensors and IoT integration, to improve the performance and efficiency of their energy recovery systems. With a growing emphasis on sustainability and energy efficiency, these companies are well-positioned to capitalize on emerging opportunities in the evolving energy recovery ventilator core market.

Report Objectives:

The report will help you answer some of the most critical questions in the Energy Recovery Ventilator Core Market. A few of them are as follows:

- What are the key drivers, restraints, opportunities, and challenges influencing the market growth?

- What are the prevailing technology trends in the Energy Recovery Ventilator Core Market?

- What is the size of the energy recovery ventilator core market based on segments, sub-segments, and regions?

- What is the size of different market segments across key regions: North America, Europe, Asia Pacific, Latin America, Middle East & Africa?

- What are the market opportunities for stakeholders after analyzing key market trends?

- Who are the leading market players and what are their market share and core competencies?

- What is the degree of competition in the market and what are the key growth strategies adopted by leading players?

- What is the competitive landscape of the market, including market share analysis, revenue analysis, and a ranking of key players?

Report Scope:

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 1.2 billion |

|

Forecasted Value (2030) |

USD 1.7 billion |

|

CAGR (2024-2030) |

5.1% |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024-2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Energy Recovery Ventilator Core Market By Material (Fibrous Paper, Engineered Resin) By Shape (Hexagon, Diamond, Wheel, Square), By Flow Type (Crossflow, Counter-flow) |

|

Regional Analysis |

North America (US, Canada), Europe (Germany, France, UK, Spain, Italy & Rest of Europe), Asia Pacific (China, Japan, South Korea, India, and rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, & Rest of Latin America), Middle East & Africa (Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1.Introduction |

|

1.1.Market Definition |

|

1.2.Scope of the Study |

|

1.3.Research Assumptions |

|

1.4.Study Limitations |

|

2.Research Methodology |

|

2.1.Research Approach |

|

2.1.1.Top-Down Method |

|

2.1.2.Bottom-Up Method |

|

2.1.3.Factor Impact Analysis |

|

2.2.Insights & Data Collection Process |

|

2.2.1.Secondary Research |

|

2.2.2.Primary Research |

|

2.3.Data Mining Process |

|

2.3.1.Data Analysis |

|

2.3.2.Data Validation and Revalidation |

|

2.3.3.Data Triangulation |

|

3.Executive Summary |

|

3.1.Major Markets & Segments |

|

3.2.Highest Growing Regions and Respective Countries |

|

3.3.Impact of Growth Drivers & Inhibitors |

|

3.4.Regulatory Overview by Country |

|

4.Energy Recovery Ventilator Core Market, by Material (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

4.1.Fibrous Paper |

|

4.2.Engineered Resin |

|

5.Energy Recovery Ventilator Core Market, by Shape (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

5.1.Wheel |

|

5.2.Diamond |

|

5.3.Square |

|

5.4.Hexagon |

|

6.Energy Recovery Ventilator Core Market, by Flow Type (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

6.1.Counter-flow |

|

6.2.Crossflow |

|

7.Regional Analysis (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

7.1.Regional Overview |

|

7.2.North America |

|

7.2.1.Regional Trends & Growth Drivers |

|

7.2.2.Barriers & Challenges |

|

7.2.3.Opportunities |

|

7.2.4.Factor Impact Analysis |

|

7.2.5.Technology Trends |

|

7.2.6.North America Energy Recovery Ventilator Core Market, by Material |

|

7.2.7.North America Energy Recovery Ventilator Core Market, by Shape |

|

7.2.8.North America Energy Recovery Ventilator Core Market, by Flow Type |

|

*Similar segmentation will be provided at each regional level |

|

7.3.By Country |

|

7.3.1.US |

|

7.3.1.1.US Energy Recovery Ventilator Core Market, by Material |

|

7.3.1.2.US Energy Recovery Ventilator Core Market, by Shape |

|

7.3.1.4.US Energy Recovery Ventilator Core Market, by Flow Type |

|

7.3.2.Canada |

|

7.3.2.Mexico |

|

*Similar segmentation will be provided at each and country level |

|

7.4.Europe |

|

7.5.APAC |

|

7.6.Latin America |

|

7.7.Middle East & Africa |

|

8.Competitive Landscape |

|

8.1.Overview of the Key Players |

|

8.2.Competitive Ecosystem |

|

8.2.1.Platform Manufacturers |

|

8.2.2.Subsystem Manufacturers |

|

8.2.3.Service Providers |

|

8.2.4.Software Providers |

|

8.3.Company Share Analysis |

|

8.4.Company Benchmarking Matrix |

|

8.4.1.Strategic Overview |

|

8.4.2.Product Innovations |

|

8.5.Start-up Ecosystem |

|

8.6.Strategic Competitive Insights/ Customer Imperatives |

|

8.7.ESG Matrix/ Sustainability Matrix |

|

8.8.Manufacturing Network |

|

8.8.1.Locations |

|

8.8.2.Supply Chain and Logistics |

|

8.8.3.Product Flexibility/Customization |

|

8.8.4.Digital Transformation and Connectivity |

|

8.8.5.Environmental and Regulatory Compliance |

|

8.9.Technology Readiness Level Matrix |

|

8.10.Technology Maturity Curve |

|

8.11.Buying Criteria |

|

9.Company Profiles |

|

9.1.Hoval Group |

|

9.1.1.Company Overview |

|

9.1.2.Company Financials |

|

9.1.3.Product/Service Portfolio |

|

9.1.4.Recent Developments |

|

9.1.5.IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2.CORE Energy Recovery Solutions |

|

9.3.Greenheck Fan Corporation |

|

9.4.InEnergy Group |

|

9.5.Klingenberg Group |

|

9.6.ERI Corporation |

|

9.7.Renewaire |

|

9.8.Oji Holdings Corporation |

|

9.9.Gaontech Co. |

|

9.10.Holmak HeatX |

|

10.Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Energy Recovery Ventilator Core Market. In the process, the analysis was also done to estimate the parent market and relevant adjacencies to measure the impact of them on the energy recovery ventilator core market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the energy recovery ventilator core ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Estimation

A combination of top-down and bottom-up approaches was utilized to estimate the overall size of the energy recovery ventilator core market. These methods were also employed to estimate the size of various sub segments within the market. The market size estimation methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size estimates, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size estimates.

NA