As per Intent Market Research, the Endobronchial Ultrasound Biopsy Market was valued at USD 1.1 billion in 2023 and will surpass USD 2.6 billion by 2030; growing at a CAGR of 12.6% during 2024 - 2030.

The endobronchial ultrasound biopsy market is an essential segment in the diagnostic imaging industry, focusing on minimally invasive procedures used to evaluate and diagnose lung diseases, particularly lung cancer. This procedure helps clinicians perform real-time imaging during a bronchoscopy, enabling them to access lymph nodes and tumors in the lungs, often providing a more precise diagnosis than traditional methods. As the demand for early diagnosis of respiratory diseases and lung cancer increases, the market for endobronchial ultrasound biopsies continues to expand, driven by advancements in technology and growing healthcare needs across the globe.

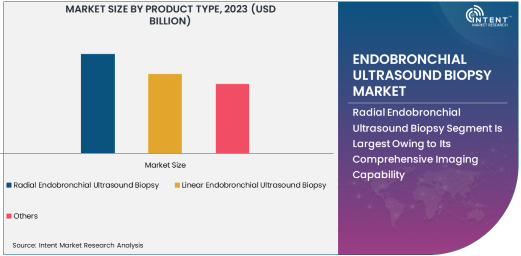

Radial Endobronchial Ultrasound Biopsy Segment Is Largest Owing to Its Comprehensive Imaging Capability

The radial endobronchial ultrasound biopsy segment holds the largest market share due to its ability to provide a 360-degree view of the lung structures, offering more detailed imaging compared to other types. This comprehensive imaging capability allows for better visualization of surrounding tissues and potential tumors, making it ideal for accurate biopsy targeting. Radial ultrasound is particularly beneficial for assessing mediastinal and hilar lymph nodes, which are crucial in staging lung cancer. Given the rising prevalence of lung cancer, radial endobronchial ultrasound systems have become the preferred choice for many clinicians performing biopsies.

Radial endobronchial ultrasound technology's ability to provide a broad view of the lung's anatomy is essential for precise tissue sampling, and its integration into routine clinical practice has expanded in recent years. It is often used in conjunction with other diagnostic tools to increase the accuracy of lung cancer diagnoses, significantly improving patient outcomes. As a result, this technology continues to be the most widely adopted in endobronchial ultrasound biopsy procedures, securing its position as the largest subsegment in the market.

Hospitals Segment Is Fastest Growing Due to Rising Demand for Early Diagnosis

The hospital segment is the fastest growing within the endobronchial ultrasound biopsy market, driven by increasing patient volumes, particularly in the diagnosis of respiratory diseases and cancer. Hospitals play a key role in providing comprehensive healthcare services, including diagnostic imaging, which makes them central to the demand for advanced diagnostic technologies like endobronchial ultrasound biopsies. As the focus on early detection and accurate diagnosis of lung cancer intensifies, hospitals are increasingly adopting these ultrasound technologies to enhance the precision of biopsies and improve patient care.

Hospitals are particularly focused on adopting advanced technologies to meet the growing demand for cancer detection, especially in regions with higher incidences of lung cancer. With hospitals being well-equipped to handle complex medical cases and provide multidisciplinary care, they are poised to drive the growth of endobronchial ultrasound biopsy procedures. Furthermore, the increasing availability of reimbursement policies for these diagnostic procedures is fueling growth in the hospital segment, allowing more healthcare providers to invest in advanced biopsy systems.

High-Resolution Endobronchial Ultrasound Technology Is Leading the Market

Among the different technologies used in endobronchial ultrasound biopsies, high-resolution ultrasound technology is leading the market. This technology offers superior imaging capabilities that are critical for identifying and assessing small tumors or lymph nodes that might not be visible with conventional ultrasound technology. High-resolution ultrasound ensures greater clarity and detail, which improves the accuracy of tissue sampling during biopsies. As precision is crucial in the diagnosis of lung cancer and other pulmonary diseases, high-resolution technology is becoming the preferred choice for many clinicians, contributing significantly to the growth of the market.

The ability to detect early-stage tumors and evaluate lymph nodes with more precision has made high-resolution ultrasound technology a game-changer in the field of respiratory disease diagnosis. Its growing adoption is driven by the need for better diagnostic tools that can provide real-time, accurate results, particularly in cancer staging and assessing the spread of the disease. As a result, this technology is expected to continue to dominate the market in the coming years, supported by ongoing advancements in imaging techniques.

Lung Cancer Diagnosis Application Is the Most Prominent Use of Endobronchial Ultrasound Biopsy

The lung cancer diagnosis application is the largest and most critical area for endobronchial ultrasound biopsy systems. Lung cancer remains one of the leading causes of cancer-related deaths globally, and early diagnosis is key to improving patient outcomes. Endobronchial ultrasound biopsy is highly effective in diagnosing lung cancer, as it allows clinicians to biopsy lymph nodes and tumors in the lungs that may not be easily accessible through other methods. With the rise in lung cancer awareness and the increasing focus on early detection, this application is driving the demand for endobronchial ultrasound biopsy devices.

The increasing adoption of minimally invasive techniques for cancer diagnosis has played a crucial role in the growth of this segment. By offering faster recovery times and more accurate results compared to traditional biopsy methods, endobronchial ultrasound is revolutionizing lung cancer diagnosis. As the global prevalence of lung cancer continues to rise, the demand for precise and early diagnostic tools will further boost the lung cancer diagnosis application segment.

Asia Pacific Region Is the Fastest Growing Due to Rising Healthcare Investments

The Asia Pacific region is the fastest growing in the endobronchial ultrasound biopsy market, driven by rapidly improving healthcare infrastructure, rising cancer incidences, and increasing investments in advanced diagnostic technologies. Countries like China, India, and Japan are witnessing significant growth in their healthcare sectors, with a particular focus on improving cancer diagnosis and treatment. The demand for non-invasive diagnostic methods, such as endobronchial ultrasound biopsies, is accelerating due to the increasing burden of lung cancer in these regions. Additionally, government initiatives aimed at improving healthcare accessibility and the growing number of specialized medical centers are further contributing to the market's expansion.

Asia Pacific's expanding population and the rising demand for advanced medical devices are key factors driving this growth. As healthcare spending increases and access to high-quality medical services improves, the region is expected to continue its rapid adoption of endobronchial ultrasound biopsy systems. This trend will likely continue in the coming years, positioning Asia Pacific as the fastest growing region in the market.

Competitive Landscape of the Endobronchial Ultrasound Biopsy Market

The global endobronchial ultrasound biopsy market is competitive, with several leading companies vying for market share through product innovation, strategic partnerships, and acquisitions. Key players such as Olympus Corporation, Medtronic, and Fujifilm Holdings Corporation dominate the market with their comprehensive range of diagnostic tools and ultrasound systems. These companies are investing heavily in research and development to enhance the resolution, accuracy, and ease of use of endobronchial ultrasound systems.

The competitive landscape is characterized by the presence of established medical device manufacturers, along with emerging players who are introducing innovative technologies and systems. Companies are also focusing on expanding their geographic footprint, particularly in emerging markets where healthcare investments are rapidly increasing. To stay competitive, firms are adopting strategies such as mergers and acquisitions, collaborations with hospitals and healthcare institutions, and expanding their product portfolios to cater to the growing demand for advanced diagnostic tools in lung cancer detection.

Recent Developments:

- Olympus Corporation announced the launch of their next-generation endobronchial ultrasound system, improving image resolution for better diagnostic accuracy in lung cancer detection.

- Medtronic entered into a partnership with a leading diagnostic center to advance their endobronchial ultrasound systems for broader clinical applications in cancer research.

- Fujifilm received FDA approval for a new digital endobronchial ultrasound system that enhances real-time imaging and reduces procedure time for bronchoscopists.

- Siemens Healthineers unveiled an upgraded high-resolution ultrasound system specifically designed for lung cancer screening, with improved visualization of lymphatic regions.

- Hitachi acquired a key competitor in the medical ultrasound space, expanding its portfolio of endobronchial ultrasound devices, aiming to enhance product offerings in the global market.

List of Leading Companies:

- Olympus Corporation

- Medtronic Plc

- Fujifilm Holdings Corporation

- Smith & Nephew

- Boston Scientific Corporation

- Hitachi Ltd.

- Hoya Corporation

- Philips Healthcare

- GE Healthcare

- Samsung Medison

- Carestream Health

- Siemens Healthineers

- Mindray Medical International Limited

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- Echosens

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 1.1 Billion |

|

Forecasted Value (2030) |

USD 2.6 Billion |

|

CAGR (2024 – 2030) |

12.6% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Endobronchial Ultrasound Biopsy Market By Product Type (Radial Endobronchial Ultrasound Biopsy, Linear Endobronchial Ultrasound Biopsy), By End-User Industry (Hospitals, Clinics, Diagnostic Centers, Research Institutes), By Technology (Conventional Endobronchial Ultrasound Technology, High-Resolution Endobronchial Ultrasound Technology, Digital Endobronchial Ultrasound Technology), By Application (Lung Cancer Diagnosis, Mediastinal Lymph Node Evaluation, Pulmonary Disease Assessment, Bronchial Biopsy) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Olympus Corporation, Medtronic Plc, Fujifilm Holdings Corporation, Smith & Nephew, Boston Scientific Corporation, Hitachi Ltd., Hoya Corporation, Philips Healthcare, GE Healthcare, Samsung Medison, Carestream Health, Siemens Healthineers, Mindray Medical International Limited, Shenzhen Mindray Bio-Medical Electronics Co., Ltd., Echosens |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Endobronchial Ultrasound Biopsy Market, by Product Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Radial Endobronchial Ultrasound Biopsy |

|

4.2. Linear Endobronchial Ultrasound Biopsy |

|

4.3. Others |

|

5. Endobronchial Ultrasound Biopsy Market, by End-User Industry (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Hospitals |

|

5.2. Clinics |

|

5.3. Diagnostic Centers |

|

5.4. Research Institutes |

|

5.5. Others |

|

6. Endobronchial Ultrasound Biopsy Market, by Technology (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Conventional Endobronchial Ultrasound Technology |

|

6.2. High-Resolution Endobronchial Ultrasound Technology |

|

6.3. Digital Endobronchial Ultrasound Technology |

|

6.4. Others |

|

7. Endobronchial Ultrasound Biopsy Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Lung Cancer Diagnosis |

|

7.2. Mediastinal Lymph Node Evaluation |

|

7.3. Pulmonary Disease Assessment |

|

7.4. Bronchial Biopsy |

|

7.5. Others |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Endobronchial Ultrasound Biopsy Market, by Product Type |

|

8.2.7. North America Endobronchial Ultrasound Biopsy Market, by End-User Industry |

|

8.2.8. North America Endobronchial Ultrasound Biopsy Market, by Technology |

|

8.2.9. North America Endobronchial Ultrasound Biopsy Market, by Application |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Endobronchial Ultrasound Biopsy Market, by Product Type |

|

8.2.10.1.2. US Endobronchial Ultrasound Biopsy Market, by End-User Industry |

|

8.2.10.1.3. US Endobronchial Ultrasound Biopsy Market, by Technology |

|

8.2.10.1.4. US Endobronchial Ultrasound Biopsy Market, by Application |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Olympus Corporation |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Medtronic Plc |

|

10.3. Fujifilm Holdings Corporation |

|

10.4. Smith & Nephew |

|

10.5. Boston Scientific Corporation |

|

10.6. Hitachi Ltd. |

|

10.7. Hoya Corporation |

|

10.8. Philips Healthcare |

|

10.9. GE Healthcare |

|

10.10. Samsung Medison |

|

10.11. Carestream Health |

|

10.12. Siemens Healthineers |

|

10.13. Mindray Medical International Limited |

|

10.14. Shenzhen Mindray Bio-Medical Electronics Co., Ltd. |

|

10.15. Echosens |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Endobronchial Ultrasound Biopsy Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Endobronchial Ultrasound Biopsy Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Endobronchial Ultrasound Biopsy Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA