As per Intent Market Research, the End User Computing Market was valued at USD 53.9 billion in 2023 and will surpass USD 104.4 billion by 2030; growing at a CAGR of 9.9% during 2024 - 2030.

The end-user computing market is a critical component of the modern IT landscape, facilitating a wide range of digital interactions across multiple sectors. As technology continues to advance, demand for end-user devices and technologies—such as laptops, desktops, and cloud-based solutions—has surged. The increasing reliance on remote working, e-commerce, and educational platforms is further propelling this market’s growth. Additionally, the integration of emerging technologies, such as artificial intelligence (AI) and 5G, is transforming how organizations and individuals interact with their computing devices. With diverse applications spanning various industries, the end-user computing market is expected to witness substantial growth in the coming years.

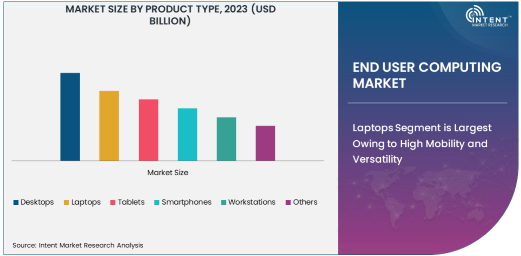

Laptops Segment is Largest Owing to High Mobility and Versatility

Among the various product types in the end-user computing market, laptops dominate due to their versatility, portability, and performance capabilities. With increasing adoption across enterprises, educational institutions, and healthcare sectors, laptops provide an efficient solution for mobile computing needs. Their compact design and portability make them the preferred choice for employees and students who require mobility and flexibility in their daily work or learning activities. The growing trend of remote work and learning, particularly post-pandemic, has further boosted the demand for laptops, as they offer powerful processing capabilities, long battery life, and connectivity features essential for a variety of applications.

The rise of hybrid work environments and the need for efficient mobile solutions in both personal and professional spaces continue to fuel the dominance of laptops in this market. As businesses and educational institutions focus on offering flexible and dynamic work solutions, laptops remain the go-to choice for end-users. Additionally, advancements in laptop hardware, including more powerful processors, better battery life, and lightweight designs, have contributed to the segment's growth. As a result, the laptop market is expected to continue expanding, with significant innovations in performance and design expected to drive further demand.

Enterprise Use Application is Fastest Growing Due to Digital Transformation

Among the various applications of end-user computing, enterprise use is the fastest-growing segment, driven by the increasing need for businesses to digitize and modernize their IT infrastructure. Companies across industries are rapidly adopting cloud services, AI, and data analytics, necessitating a robust computing environment for employees. The growing trend of digital transformation and automation within organizations is increasing demand for computing devices that can seamlessly integrate with cloud-based solutions, virtualization technologies, and other enterprise-grade software.

Enterprise use encompasses a variety of devices and applications, from office desktops to high-performance workstations used by professionals in sectors such as finance, design, and engineering. With businesses expanding their use of mobile devices and remote working solutions, demand for laptops, tablets, and other mobile devices for enterprise applications has also surged. The pandemic further accelerated this trend, as companies moved to remote work models that require flexible, secure, and efficient computing options for employees across various locations. As enterprises continue to focus on digital tools to enhance productivity, the enterprise use segment is expected to remain the fastest-growing application in the market.

IT & Telecommunications End-User Industry is Largest Due to High Demand for Computing Solutions

In terms of end-user industries, IT & telecommunications is the largest sector in the end-user computing market, driven by its high demand for powerful computing solutions to support critical business operations. The sector encompasses various enterprises and service providers that require robust computing infrastructure to manage networks, offer cloud services, and develop new digital technologies. As the backbone of modern technology ecosystems, the IT and telecommunications industry relies heavily on advanced computing solutions to support both enterprise and consumer needs, including everything from mobile communication to large-scale data storage and processing.

The industry's continuous evolution with the integration of 5G, cloud computing, and edge computing further drives the need for cutting-edge end-user computing devices. Furthermore, telecom companies are increasingly adopting AI, machine learning, and data analytics to enhance network management and customer experience. The constant innovation and adoption of new technologies in the IT & telecommunications sector make it the largest user of end-user computing solutions. The growing need for processing power and high-performance devices across the sector is expected to sustain its dominance in the market.

Cloud Computing Technology is Fastest Growing Owing to the Shift Toward Remote and Hybrid Work Models

Cloud computing technology has emerged as the fastest-growing technology within the end-user computing market, primarily driven by the shift toward remote and hybrid work models. Cloud platforms provide users with access to applications, data, and services through the internet, enabling employees to work seamlessly from virtually anywhere. With increasing adoption of cloud services across industries, the demand for computing devices that can efficiently interact with cloud-based infrastructure has surged.

Cloud computing allows businesses to scale their operations, reduce IT infrastructure costs, and enhance collaboration among remote teams. As organizations continue to adopt cloud-based solutions, end-user devices such as laptops, tablets, and mobile phones must be optimized to support cloud applications. This technological shift is not only benefiting businesses but also individuals, as cloud-based software becomes more accessible and affordable, allowing users to access services without the need for high-performance local hardware. Consequently, the cloud computing technology segment is expected to grow rapidly in the coming years, facilitating a more integrated and flexible computing environment.

North America is the Largest Region, Driven by Technological Advancements and High Demand

North America holds the largest market share in the end-user computing market, driven by its advanced technological infrastructure and high demand for computing devices across various industries. The region has long been a leader in technological innovation, with a strong presence of companies in the IT and telecommunications, healthcare, and education sectors that are significant consumers of end-user computing products. The rapid adoption of cloud services, AI, and 5G technologies has further fueled the demand for computing devices in North America.

In addition, the region's strong focus on digital transformation and modernization in both the public and private sectors continues to drive growth in end-user computing. With increasing investment in IT infrastructure, coupled with a high level of technology adoption, North America is expected to maintain its dominance in the global end-user computing market. The presence of major players in the technology space, such as Apple, Microsoft, and Dell, also contributes to the region’s strong position in the market.

Competitive Landscape and Leading Companies

The end-user computing market is highly competitive, with several leading companies operating across various segments. Major players such as Dell Technologies, HP Inc., Apple Inc., Microsoft Corporation, and Lenovo Group lead the market with their innovative products and strong market presence. These companies continuously invest in R&D to enhance the performance, design, and capabilities of their devices, meeting the growing demand for powerful and efficient end-user computing solutions.

The market is also characterized by strategic collaborations, product launches, and mergers and acquisitions, as companies aim to expand their product portfolios and enhance their technological capabilities. For instance, leading companies are incorporating advanced technologies like AI, 5G, and cloud computing to stay ahead of the competition. As the market continues to evolve, businesses must focus on providing flexible, secure, and high-performance computing devices that meet the ever-changing needs of end-users across different industries.

Recent Developments:

- Dell Technologies launched a new line of high-performance desktops and laptops, integrating AI-powered security and edge computing capabilities.

- Apple Inc. announced the launch of its latest MacBook Pro, featuring upgraded processors and enhanced machine learning capabilities.

- HP Inc. unveiled its latest suite of cloud-enabled desktops for enterprise use, aiming to streamline remote work environments.

- Lenovo Group acquired a leading cloud computing company to bolster its enterprise solutions portfolio and enhance its end-user computing offerings.

- Intel Corporation unveiled a new range of processors designed specifically for edge computing applications, aimed at improving device performance and security

List of Leading Companies:

- Dell Technologies

- HP Inc.

- Apple Inc.

- Microsoft Corporation

- Lenovo Group

- Samsung Electronics

- Acer Inc.

- ASUS Computer International

- Google LLC

- IBM Corporation

- Intel Corporation

- Oracle Corporation

- Fujitsu Ltd.

- Sony Corporation

- Toshiba Corporation

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 53.9 Billion |

|

Forecasted Value (2030) |

USD 104.4 Billion |

|

CAGR (2024 – 2030) |

9.9% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

End-User Computing Market By Product Type (Desktops, Laptops, Tablets, Smartphones, Workstations), By Application (Enterprise Use, Educational Institutions, Healthcare & Medical, Government & Public Sector, Retail & E-Commerce), By End-User Industry (IT & Telecommunications, Education, Healthcare, Government & Public Sector, Retail & E-Commerce, BFSI, Manufacturing), and By Technology (Virtualization Technology, Cloud Computing Technology, Edge Computing Technology, AI and Machine Learning Technologies, 5G Technology, IoT Integration) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Dell Technologies, HP Inc., Apple Inc., Microsoft Corporation, Lenovo Group, Samsung Electronics, Acer Inc., ASUS Computer International, Google LLC, IBM Corporation, Intel Corporation, Oracle Corporation, Fujitsu Ltd., Sony Corporation, Toshiba Corporation |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. End User Computing Market, by Product Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Desktops |

|

4.2. Laptops |

|

4.3. Tablets |

|

4.4. Smartphones |

|

4.5. Workstations |

|

4.6. Others |

|

5. End User Computing Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Enterprise Use |

|

5.2. Educational Institutions |

|

5.3. Healthcare & Medical |

|

5.4. Government & Public Sector |

|

5.5. Retail & E-Commerce |

|

5.6. Others |

|

6. End User Computing Market, by End-User Industry (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. IT & Telecommunications |

|

6.2. Education |

|

6.3. Healthcare |

|

6.4. Government & Public Sector |

|

6.5. Retail & E-Commerce |

|

6.6. BFSI (Banking, Financial Services, and Insurance) |

|

6.7. Manufacturing |

|

6.8. Others |

|

7. End User Computing Market, by Technology (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Virtualization Technology |

|

7.2. Cloud Computing Technology |

|

7.3. Edge Computing Technology |

|

7.4. AI and Machine Learning Technologies |

|

7.5. 5G Technology |

|

7.6. IoT (Internet of Things) Integration |

|

7.7. Other Technologies |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America End User Computing Market, by Product Type |

|

8.2.7. North America End User Computing Market, by Application |

|

8.2.8. North America End User Computing Market, by End-User Industry |

|

8.2.9. North America End User Computing Market, by Technology |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US End User Computing Market, by Product Type |

|

8.2.10.1.2. US End User Computing Market, by Application |

|

8.2.10.1.3. US End User Computing Market, by End-User Industry |

|

8.2.10.1.4. US End User Computing Market, by Technology |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Dell Technologies |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. HP Inc. |

|

10.3. Apple Inc. |

|

10.4. Microsoft Corporation |

|

10.5. Lenovo Group |

|

10.6. Samsung Electronics |

|

10.7. Acer Inc. |

|

10.8. ASUS Computer International |

|

10.9. Google LLC |

|

10.10. IBM Corporation |

|

10.11. Intel Corporation |

|

10.12. Oracle Corporation |

|

10.13. Fujitsu Ltd. |

|

10.14. Sony Corporation |

|

10.15. Toshiba Corporation |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the End-User Computing Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the End-User Computing Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the End-User Computing Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA