As per Intent Market Research, the Biomaterial Coating Market was valued at USD 1.9 billion in 2023 and will surpass USD 3.2 billion by 2030; growing at a CAGR of 8.2% during 2024 - 2030.

The biomaterial coating market is witnessing significant growth due to increasing demand for advanced, functional coatings in industries such as medical, automotive, aerospace, and electronics. These coatings are applied to biomaterials such as metals, polymers, and ceramics to enhance their properties, including biocompatibility, durability, and resistance to corrosion and wear. Biomaterial coatings play a crucial role in improving the performance and longevity of medical implants, drug delivery systems, and other bio-engineered devices, contributing to the advancement of healthcare and technology.

The shift toward using biomaterials coated with specialized coatings to improve their functionality is a result of technological advancements and a growing emphasis on enhancing product performance. As industries seek to develop more efficient, durable, and biocompatible products, the biomaterial coating market is set for strong expansion, particularly in sectors such as medical devices, automotive parts, and aerospace components, where high performance and reliability are essential.

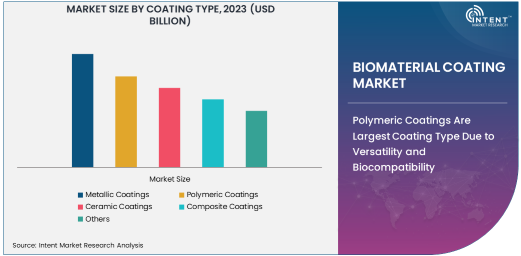

Polymeric Coatings Are Largest Coating Type Due to Versatility and Biocompatibility

Polymeric coatings are the largest segment in the biomaterial coating market, largely due to their versatility, biocompatibility, and ability to be customized for a wide range of applications. Polymeric coatings are commonly used in medical applications, particularly in implants and drug delivery systems, as they can enhance the surface properties of the biomaterials and improve their integration with the human body. These coatings also offer significant benefits in terms of flexibility, ease of processing, and cost-effectiveness, making them ideal for a variety of industries.

The ability of polymeric coatings to be engineered for specific functions, such as controlled release of drugs, antimicrobial properties, or enhanced tissue integration, drives their dominance in the medical sector. Moreover, polymeric coatings are lightweight, durable, and resistant to chemical degradation, which makes them suitable for use in a broad range of industries beyond healthcare, including automotive, electronics, and aerospace. As the demand for advanced biomaterials increases, polymeric coatings will continue to hold a significant share of the biomaterial coating market.

Titanium Material Is Largest Due to Superior Biocompatibility and Strength

Titanium is the largest material segment in the biomaterial coating market, owing to its superior biocompatibility, strength, and corrosion resistance, making it an ideal choice for use in medical implants and prosthetics. Titanium is widely used for coatings in the medical industry, particularly for orthopedic implants, dental implants, and joint replacements, as it integrates well with human tissues and promotes faster healing. Its ability to withstand harsh environments, such as high-pressure or corrosive conditions, also makes titanium-coated biomaterials valuable in industries like aerospace and automotive.

The widespread use of titanium in the medical sector is driven by its non-toxic nature, which is crucial for medical applications where direct contact with human tissue is common. In addition to its biocompatibility, titanium's high strength-to-weight ratio and durability make it suitable for a range of industrial applications that require materials to perform under extreme conditions. As the need for durable, biocompatible, and high-performance materials grows, titanium is expected to remain the dominant material in the biomaterial coating market.

Medical End-Use Industry Is Largest Due to Growing Healthcare Demand

The medical end-use industry holds the largest share in the biomaterial coating market, driven by the increasing demand for advanced medical devices and implants. Biomaterial coatings are essential in the development of implants, such as orthopedic and dental implants, that require enhanced durability, biocompatibility, and resistance to corrosion. These coatings also play a vital role in improving the functionality of drug delivery systems and wound dressings by providing controlled release properties and reducing the risk of infections.

With the aging population and rising prevalence of chronic diseases, the demand for medical implants and healthcare products is rapidly growing. Furthermore, advancements in medical technology are driving the development of new coatings that can improve the performance and longevity of medical devices, such as those used in cardiovascular or orthopedic applications. The growing emphasis on improving patient outcomes and the focus on minimally invasive surgeries will continue to propel the demand for high-quality biomaterial coatings in the medical sector.

Implants Application Is Largest Due to High Demand for Orthopedic and Dental Procedures

The implants application is the largest segment in the biomaterial coating market, as implants are among the most commonly used medical devices requiring specialized coatings. Biomaterial coatings are critical in enhancing the performance of implants, such as joint replacements, dental implants, and orthopedic devices, by improving their integration with bone tissue and reducing the risk of complications, such as infections or rejection. Coatings also help enhance the longevity of implants by providing resistance to wear and corrosion, ensuring that the device remains functional over a long period.

As the global population ages and the prevalence of conditions requiring implants, such as osteoarthritis and dental issues, increases, the demand for implants with advanced biomaterial coatings will continue to rise. Additionally, the growing trend of minimally invasive surgeries, which require highly durable and biocompatible implants, further supports the dominance of the implants application in the biomaterial coating market.

North America Leads the Biomaterial Coating Market Due to Advanced Healthcare Infrastructure

North America is the largest and leading region in the biomaterial coating market, driven by its advanced healthcare infrastructure, high investment in medical research, and strong demand for innovative healthcare solutions. The region’s robust healthcare system and its emphasis on improving medical device performance contribute significantly to the market growth. The United States, in particular, is a major player, where increasing investments in the development of advanced biomaterial coatings for medical implants, surgical instruments, and other devices are fueling market expansion.

The growing adoption of biomaterial coatings in various medical applications, including implants and drug delivery systems, is further boosting the demand in North America. With a high prevalence of chronic diseases and an aging population, the need for advanced medical solutions that enhance the longevity and functionality of devices is increasing. Additionally, favorable regulatory frameworks, strong healthcare expenditure, and rising consumer demand for innovative medical technologies are expected to drive the continued growth of the biomaterial coating market in North America.

Competitive Landscape and Leading Companies

The biomaterial coating market is highly competitive, with several key players focusing on innovation and the development of advanced coating solutions to meet the diverse needs of industries such as medical, aerospace, automotive, and electronics. Leading companies in the market include Covalon Technologies Ltd., DSM Biomedical, Biocoat, Inc., and Surmodics, Inc., among others. These companies are investing in research and development to enhance the functionality of their coatings and expand their product offerings to cater to a wide range of applications.

As competition intensifies, companies are also exploring strategic partnerships and acquisitions to strengthen their market position and expand their product portfolios. Additionally, there is a growing emphasis on sustainable and eco-friendly biomaterial coatings, as industries seek to reduce their environmental impact. As the demand for high-performance, biocompatible coatings continues to rise across various sectors, the competitive landscape in the biomaterial coating market is expected to evolve, with innovation and product differentiation playing a critical role in shaping market dynamics.

Recent Developments:

- In December 2024, Medtronic announced the launch of a new line of polymeric-coated implants that improve the integration of devices with human tissues while reducing the risk of infection.

- In November 2024, Stryker Corporation introduced a titanium-based coating for orthopedic implants that enhances wear resistance and biocompatibility.

- In October 2024, Zimmer Biomet partnered with a leading coating technology company to develop advanced coatings for knee and hip implants, improving longevity and patient satisfaction.

- In September 2024, Smith & Nephew launched a novel biodegradable coating for wound dressings, aimed at enhancing healing and reducing infection risk.

- In August 2024, Heraeus Medical announced a new drug delivery coating technology that allows for the controlled release of antibiotics in implantable devices.

List of Leading Companies:

- Medtronic

- Johnson & Johnson

- Boston Scientific Corporation

- Stryker Corporation

- Zimmer Biomet

- Smith & Nephew

- Wright Medical Group N.V.

- Becton, Dickinson and Company

- Biotronik

- Heraeus Medical

- Covestro AG

- Invibio Ltd.

- Nipro Corporation

- Arkema S.A.

- Surmodics, Inc.

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 1.9 billion |

|

Forecasted Value (2030) |

USD 3.2 billion |

|

CAGR (2024 – 2030) |

8.2% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Biomaterial Coating Market By Coating Type (Metallic Coatings, Polymeric Coatings, Ceramic Coatings, Composite Coatings), By Material (Titanium, Stainless Steel, Polyethylene, Polyurethane), By End-Use Industry (Medical, Automotive, Aerospace, Electronics), By Application (Implants, Drug Delivery Systems, Wound Dressings, Surface Protection) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Medtronic, Johnson & Johnson, Boston Scientific Corporation, Stryker Corporation, Zimmer Biomet, Smith & Nephew, Wright Medical Group N.V., Becton, Dickinson and Company, Biotronik, Heraeus Medical, Covestro AG, Invibio Ltd., Nipro Corporation, Arkema S.A., Surmodics, Inc. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Biomaterial Coating Market, by Coating Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Metallic Coatings |

|

4.2. Polymeric Coatings |

|

4.3. Ceramic Coatings |

|

4.4. Composite Coatings |

|

4.5. Others |

|

5. Biomaterial Coating Market, by Material (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Titanium |

|

5.2. Stainless Steel |

|

5.3. Polyethylene |

|

5.4. Polyurethane |

|

5.5. Others |

|

6. Biomaterial Coating Market, by End-Use Industry (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Medical |

|

6.2. Automotive |

|

6.3. Aerospace |

|

6.4. Electronics |

|

6.5. Others |

|

7. Biomaterial Coating Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Implants |

|

7.2. Drug Delivery Systems |

|

7.3. Wound Dressings |

|

7.4. Surface Protection |

|

7.5. Others |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Biomaterial Coating Market, by Coating Type |

|

8.2.7. North America Biomaterial Coating Market, by Material |

|

8.2.8. North America Biomaterial Coating Market, by End-Use Industry |

|

8.2.9. North America Biomaterial Coating Market, by Application |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Biomaterial Coating Market, by Coating Type |

|

8.2.10.1.2. US Biomaterial Coating Market, by Material |

|

8.2.10.1.3. US Biomaterial Coating Market, by End-Use Industry |

|

8.2.10.1.4. US Biomaterial Coating Market, by Application |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Medtronic |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Johnson & Johnson |

|

10.3. Boston Scientific Corporation |

|

10.4. Stryker Corporation |

|

10.5. Zimmer Biomet |

|

10.6. Smith & Nephew |

|

10.7. Wright Medical Group N.V. |

|

10.8. Becton, Dickinson and Company |

|

10.9. Biotronik |

|

10.10. Heraeus Medical |

|

10.11. Covestro AG |

|

10.12. Invibio Ltd. |

|

10.13. Nipro Corporation |

|

10.14. Arkema S.A. |

|

10.15. Surmodics, Inc. |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Biomaterial Coating Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Biomaterial Coating Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Biomaterial Coating Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA