As per Intent Market Research, the End-Stage Renal Disease Treatment Market was valued at USD 15.4 Billion in 2024-e and will surpass USD 26.8 Billion by 2030; growing at a CAGR of 8.2% during 2025-2030.

The global end-stage renal disease (ESRD) treatment market has seen significant growth in recent years, driven by the increasing prevalence of chronic kidney disease (CKD), particularly among the aging population. ESRD occurs when the kidneys can no longer filter waste products from the blood, necessitating treatments such as dialysis, kidney transplantation, or conservative management. With advancements in medical technology and rising healthcare access, the market is expanding rapidly, offering improved quality of life for patients and a wide range of treatment options. This market encompasses a variety of segments, including product types, end-user industries, treatment modalities, and distribution channels.

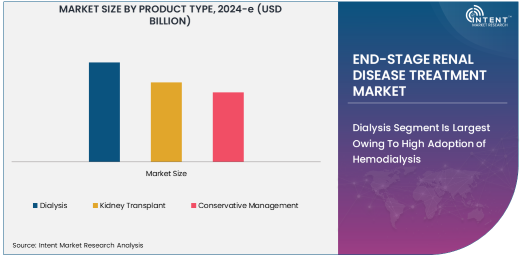

Dialysis Segment Is Largest Owing To High Adoption of Hemodialysis

Dialysis has become the cornerstone treatment for ESRD patients, with hemodialysis accounting for the majority of dialysis procedures globally. Hemodialysis offers effective filtration of blood using an external machine and is widely used due to its proven efficacy in maintaining patients' health when kidney function is critically impaired. The increasing global prevalence of ESRD and the widespread availability of dialysis centers have contributed to the growth of this segment. In particular, hemodialysis is more commonly performed in clinical settings, such as hospitals and specialized dialysis centers, as it requires specialized equipment and trained medical staff. Furthermore, home hemodialysis is gaining traction due to the increasing preference for home-based treatments, providing more convenience and comfort to patients.

The market for dialysis products is expanding as manufacturers focus on improving the efficiency of dialysis machines, enhancing the patient experience, and reducing the risks associated with dialysis treatments. Technological advancements, such as portable dialysis machines and systems offering more comfortable and efficient treatment options, are anticipated to further accelerate the growth of this segment. In addition, the increased emphasis on dialysis in home care settings is expected to drive market growth, as more patients seek to manage their condition outside of hospitals and clinics.

Hospitals Segment Is Largest End-User Industry Due To High Patient Demand

Hospitals remain the largest end-user industry for ESRD treatments due to the high demand for both dialysis and kidney transplant procedures. Hospitals are equipped with the necessary infrastructure, healthcare professionals, and resources to manage complex renal treatments, making them a crucial provider of care for patients with end-stage renal disease. Hemodialysis, in particular, is predominantly conducted in hospital-based dialysis units, where patients receive treatment on a regular basis under the supervision of specialized nephrologists and nurses. Hospitals also play an essential role in conducting kidney transplant surgeries, which are highly complex and require intensive post-operative care.

The growth of hospital-based treatments is expected to continue as the burden of kidney diseases increases globally. Moreover, hospitals are well-positioned to provide multidisciplinary care, addressing the wide-ranging medical needs of ESRD patients. The establishment of more specialized kidney care centers within hospitals is also anticipated to contribute to the market's expansion, offering patients access to specialized treatments in a centralized setting.

Hemodialysis Is Fastest Growing Treatment Modality Due To Technological Advancements

Hemodialysis remains the most widely used treatment modality for ESRD patients, but it is also the fastest-growing segment within the ESRD treatment market. The increased adoption of home hemodialysis, which enables patients to perform dialysis in the comfort of their homes, has contributed significantly to the growth of this modality. Advancements in home hemodialysis technology, such as compact, portable dialysis machines and improved patient monitoring systems, have led to greater patient convenience, comfort, and independence, all of which are driving adoption. Moreover, hemodialysis centers are incorporating more advanced and efficient dialysis systems, enhancing the quality of care provided to patients.

As healthcare systems worldwide seek to offer more personalized and cost-effective treatment options, home hemodialysis is emerging as an important alternative to traditional hospital-based treatments. This trend is expected to gain momentum as technological innovations reduce the complexity and cost of home dialysis, providing a more viable option for a growing number of ESRD patients.

Direct Sales Is Fastest Growing Distribution Channel Due To Increased Demand for Home Care Solutions

The direct sales channel is the fastest-growing distribution channel in the ESRD treatment market. As patients increasingly seek home-based treatment options, such as home hemodialysis and home dialysis machines, direct sales have gained importance in providing these specialized products directly to healthcare providers and patients. Companies that offer home dialysis equipment, dialysis solutions, and other ESRD-related products are increasingly adopting direct-to-consumer models, which allow them to bypass traditional distribution networks and provide personalized services to patients. Direct sales offer customers the convenience of purchasing products tailored to their specific needs, and it enables companies to offer technical support, training, and customer service directly to patients.

This shift toward direct sales is being fueled by the growing patient preference for home-based treatments and the rise of telemedicine, which enables remote monitoring of patients' health and treatment progress. As the demand for home dialysis solutions continues to grow, companies are investing in direct sales strategies to meet this rising need and ensure that patients have access to the products they require.

North America Is Largest Region in the ESRD Treatment Market Due to Advanced Healthcare Infrastructure

North America is the largest region in the ESRD treatment market, driven by the highly developed healthcare infrastructure, advanced treatment modalities, and high prevalence of chronic kidney disease (CKD). The U.S. has the highest number of ESRD patients globally, with a large proportion of the population requiring dialysis or kidney transplantation. The region is also home to some of the largest dialysis service providers, such as DaVita Inc. and Fresenius Medical Care, which operate thousands of dialysis centers across the country. The availability of cutting-edge technologies, including portable hemodialysis machines and home dialysis systems, has further boosted the market in this region.

The strong focus on research and development, government initiatives to improve healthcare access, and the presence of well-established healthcare providers have contributed to North America's dominance in the global ESRD treatment market. Additionally, the high healthcare spending and strong reimbursement policies have supported the widespread adoption of advanced ESRD treatments, ensuring continued growth in the region.

Leading Companies and Competitive Landscape

The end-stage renal disease treatment market is highly competitive, with several key players leading the charge in technological innovations and product offerings. Some of the major companies operating in this market include Fresenius Medical Care, DaVita Inc., Baxter International, Medtronic, and Nipro Corporation. These companies have established a strong presence in the dialysis segment, offering a wide range of dialysis machines, solutions, and services.

In recent years, there has been a growing emphasis on improving the quality of life for ESRD patients, which has led companies to invest in home dialysis solutions, portable dialysis machines, and patient monitoring technologies. Additionally, partnerships and acquisitions are common in this market, as companies seek to expand their product portfolios and strengthen their market positions. The competitive landscape is expected to remain dynamic, with companies continuously innovating to meet the evolving needs of ESRD patients and improve treatment outcomes.

Recent Developments:

- Fresenius Medical Care announced the launch of an innovative portable hemodialysis machine, designed to improve patient mobility and comfort while receiving dialysis treatments.

- DaVita Inc. signed a strategic partnership with a leading biotech firm to develop a novel kidney disease treatment that could potentially reverse some of the damage caused by ESRD.

- Baxter International Inc. acquired a global dialysis product manufacturer to expand its peritoneal dialysis solutions portfolio, strengthening its leadership in ESRD care.

- Medtronic received FDA approval for a new home-based dialysis machine, enabling patients to conduct dialysis from the comfort of their own homes with greater ease.

- Nipro Corporation entered into a partnership with a healthcare technology startup to enhance the functionality and effectiveness of dialysis-related devices, aiming to improve patient outcomes.

List of Leading Companies:

- DaVita Inc.

- Fresenius Medical Care AG & Co. KGaA

- Baxter International Inc.

- Medtronic PLC

- Nipro Corporation

- B. Braun Melsungen AG

- Johnson & Johnson

- Asahi Kasei Medical Co., Ltd.

- Terumo Corporation

- SWS Hemodialysis Care Inc.

- Dialysis Clinic, Inc.

- NephroPlus

- Rockwell Medical Inc.

- HemoSonics LLC

- Dialysist International LLC

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 15.4 Billion |

|

Forecasted Value (2030) |

USD 26.8 Billion |

|

CAGR (2025 – 2030) |

8.2% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

End-Stage Renal Disease Treatment Market By Product Type (Dialysis, Kidney Transplant, Conservative Management), By End-User Industry (Hospitals, Dialysis Centers, Home Care Settings, Ambulatory Surgical Centers), By Treatment Modality (Hemodialysis, Peritoneal Dialysis, Kidney Transplantation, Conservative Management), and By Distribution Channel (Direct Sales, Online Sales, Third-Party Sales); Global Insights & Forecast (2023 – 2030) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

DaVita Inc., Fresenius Medical Care AG & Co. KGaA, Baxter International Inc., Medtronic PLC, Nipro Corporation, B. Braun Melsungen AG, Johnson & Johnson, Asahi Kasei Medical Co., Ltd., Terumo Corporation, SWS Hemodialysis Care Inc., Dialysis Clinic, Inc., NephroPlus, Rockwell Medical Inc., HemoSonics LLC, Dialysist International LLC |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. End-Stage Renal Disease Treatment Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Dialysis |

|

4.2. Kidney Transplant |

|

4.3. Conservative Management |

|

5. End-Stage Renal Disease Treatment Market, by End-User Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Hospitals |

|

5.2. Dialysis Centers |

|

5.3. Home Care Settings |

|

5.4. Ambulatory Surgical Centers |

|

6. End-Stage Renal Disease Treatment Market, by Treatment Modality (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Hemodialysis |

|

6.2. Peritoneal Dialysis |

|

6.3. Kidney Transplantation |

|

6.4. Conservative Management |

|

7. End-Stage Renal Disease Treatment Market, by Distribution Channel (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Direct Sales |

|

7.2. Online Sales |

|

7.3. Third-Party Sales |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America End-Stage Renal Disease Treatment Market, by Product Type |

|

8.2.7. North America End-Stage Renal Disease Treatment Market, by End-User Industry |

|

8.2.8. North America End-Stage Renal Disease Treatment Market, by Treatment Modality |

|

8.2.9. North America End-Stage Renal Disease Treatment Market, by Distribution Channel |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US End-Stage Renal Disease Treatment Market, by Product Type |

|

8.2.10.1.2. US End-Stage Renal Disease Treatment Market, by End-User Industry |

|

8.2.10.1.3. US End-Stage Renal Disease Treatment Market, by Treatment Modality |

|

8.2.10.1.4. US End-Stage Renal Disease Treatment Market, by Distribution Channel |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. DaVita Inc. |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Fresenius Medical Care AG & Co. KGaA |

|

10.3. Baxter International Inc. |

|

10.4. Medtronic PLC |

|

10.5. Nipro Corporation |

|

10.6. B. Braun Melsungen AG |

|

10.7. Johnson & Johnson |

|

10.8. Asahi Kasei Medical Co., Ltd. |

|

10.9. Terumo Corporation |

|

10.10. SWS Hemodialysis Care Inc. |

|

10.11. Dialysis Clinic, Inc. |

|

10.12. NephroPlus |

|

10.13. Rockwell Medical Inc. |

|

10.14. HemoSonics LLC |

|

10.15. Dialysist International LLC |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the End-Stage Renal Disease Treatment Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the End-Stage Renal Disease Treatment Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the End-Stage Renal Disease Treatment Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA