As per Intent Market Research, the Electrolysis Hydrogen Generation Market was valued at USD 1.5 billion in 2023 and will surpass USD 5.6 billion by 2030; growing at a CAGR of 20.9% during 2024 - 2030.

The electrolysis hydrogen generation market is experiencing significant growth as industries seek clean and sustainable energy sources. Electrolysis is a key technology in producing green hydrogen, where water is split into hydrogen and oxygen using electricity. The process offers an eco-friendly alternative to conventional hydrogen production methods, particularly when powered by renewable energy sources. This market is gaining traction due to global decarbonization goals, increasing investments in hydrogen infrastructure, and the growing demand for renewable energy. As a result, the electrolysis hydrogen generation market is poised to expand across multiple sectors, including energy, chemical, and industrial manufacturing.

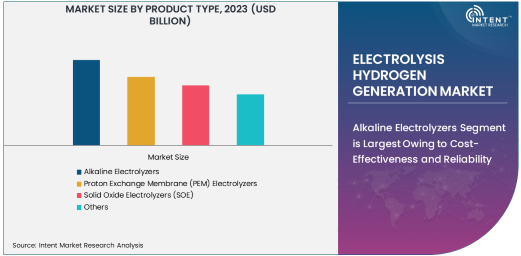

Alkaline Electrolyzers Segment is Largest Owing to Cost-Effectiveness and Reliability

Among the different types of electrolyzers, alkaline electrolyzers dominate the market due to their cost-effectiveness, reliability, and scalability. Alkaline electrolysis has been the standard for large-scale hydrogen production due to its established technology and relatively low initial investment costs. The robust nature of these electrolyzers and their ability to operate at high capacities make them an attractive choice for industries looking to produce hydrogen efficiently at a competitive cost. Alkaline electrolyzers have been widely adopted in chemical industries and energy sectors, contributing to their position as the largest subsegment in the electrolysis hydrogen generation market.

As the demand for clean hydrogen grows, alkaline electrolyzers continue to improve in efficiency and durability. Advancements in materials and system integration are making these electrolyzers even more efficient, driving their adoption. Furthermore, the ability to scale up production for industrial applications makes them a preferred choice for meeting the needs of sectors like chemical manufacturing, energy, and transportation.

Energy & Power Industry is Fastest Growing Owing to Increasing Demand for Green Hydrogen

The energy and power industry is the fastest growing end-user industry in the electrolysis hydrogen generation market. Green hydrogen is increasingly seen as a vital solution to decarbonize the energy sector, especially in applications such as power generation and energy storage. Hydrogen offers an efficient method to store excess energy produced from renewable sources, such as solar and wind, and can be used in fuel cells for electricity generation. As the world moves toward net-zero emissions goals, hydrogen is becoming an essential part of the energy transition, driving rapid growth in its production through electrolysis.

Several large-scale projects and government incentives aimed at promoting clean hydrogen production are accelerating the growth of the energy and power sector's adoption of electrolysis. With countries and regions committing to reducing their carbon footprints, green hydrogen is seen as a critical element in energy security, grid stabilization, and supporting renewable energy initiatives. The increasing shift towards hydrogen as an energy carrier in various regions is expected to propel the growth of electrolysis hydrogen generation technologies in this sector.

Industrial Hydrogen Production is Largest Application Owing to Widespread Adoption in Various Industries

Industrial hydrogen production is the largest application in the electrolysis hydrogen generation market, driven by its widespread use across various sectors. Hydrogen is a critical feedstock in industries such as chemicals, refining, and metals production. Electrolysis offers a clean and efficient method for producing hydrogen, particularly in applications that require high-purity hydrogen for industrial processes. The growing emphasis on sustainability and reducing carbon emissions has led many industries to adopt green hydrogen solutions for their hydrogen production needs.

As industrial hydrogen production continues to be a key driver for electrolysis technologies, the market is likely to see greater integration of renewable energy sources in industrial applications. Electrolysis enables businesses to meet their sustainability targets by reducing reliance on traditional hydrogen production methods like steam methane reforming, which are carbon-intensive. This transition to cleaner hydrogen production methods is fostering further growth in the industrial hydrogen production subsegment.

Proton Exchange Membrane Electrolysis Technology is Fastest Growing Owing to Efficiency and Flexibility

Proton Exchange Membrane (PEM) electrolysis technology is the fastest growing subsegment due to its higher efficiency and operational flexibility. PEM electrolyzers are more efficient than alkaline electrolyzers, offering higher purity hydrogen production and better responsiveness to fluctuations in electricity supply, making them ideal for intermittent renewable energy sources like solar and wind. The rapid advancements in PEM technology, along with decreasing costs, are fueling the adoption of PEM electrolyzers in a variety of applications, including fuel cells, industrial hydrogen production, and energy storage.

The growing interest in PEM electrolysis is particularly strong in the transportation sector, where fuel cell technology is gaining popularity for use in hydrogen-powered vehicles. The ability of PEM electrolyzers to produce high-purity hydrogen in a compact form makes them an ideal solution for both stationary and mobile applications. With significant ongoing research and development in this field, PEM electrolysis is set to play a key role in the future of green hydrogen generation.

North America is the Largest Region Owing to Government Support and Investment in Green Hydrogen Initiatives

North America is the largest region in the electrolysis hydrogen generation market, driven by significant government support and investments in clean hydrogen technologies. The United States, in particular, has been proactive in advancing hydrogen infrastructure through initiatives like the Hydrogen Fuel Cell Partnership and the U.S. Department of Energy's hydrogen programs. These efforts aim to accelerate the commercialization of hydrogen as a clean energy source, positioning the U.S. as a leader in the adoption of hydrogen technologies.

The region is also home to major energy companies investing in hydrogen production through electrolysis. With growing interest from both the public and private sectors, North America is poised to continue driving the global demand for electrolysis hydrogen generation technologies. As renewable energy sources gain traction and more hydrogen infrastructure projects are developed, North America's role in the green hydrogen revolution will remain pivotal in the coming years.

Competitive Landscape and Leading Companies

The electrolysis hydrogen generation market is competitive, with several companies leading the way in innovation and large-scale projects. Major players such as Siemens Energy, ITM Power, and Plug Power dominate the market, offering cutting-edge technologies in electrolyzers and hydrogen production systems. Companies are increasingly focused on enhancing the efficiency and scalability of their products, with a strong emphasis on reducing costs to make green hydrogen more commercially viable.

Research and development in electrolysis technology is a key area of competition, with companies investing in improving electrolyzer designs and integrating renewable energy sources for more efficient hydrogen production. Strategic partnerships and collaborations are also playing a significant role in advancing the market, as companies work together to build hydrogen infrastructure and scale up production capabilities. As the market continues to expand, the competitive landscape will evolve, with emerging players likely to bring new technologies to the forefront.

Recent Developments:

- Siemens Energy and ITM Power announced their collaboration on a new project to produce green hydrogen through electrolysis, targeting large-scale hydrogen production for industrial use.

- Nel ASA has significantly expanded its electrolyzer manufacturing capabilities to meet the rising global demand for green hydrogen, focusing on PEM electrolyzers.

- Plug Power has completed its acquisition of Applied Hydrogen Systems to enhance its capabilities in electrolyzer technology, helping to scale green hydrogen production.

- McPhy Energy has formed a strategic partnership with EDF Group to deploy large-scale green hydrogen production projects using alkaline electrolyzers for renewable energy applications.

- Air Products has entered into a collaboration with Saudi Aramco to develop clean hydrogen solutions using electrolysis technology, aiming to boost the hydrogen economy in the Middle East.

List of Leading Companies:

- Siemens Energy

- Nel ASA

- ITM Power

- Plug Power

- McPhy Energy

- Cummins Inc.

- Air Products and Chemicals

- Ballard Power Systems

- Johnson Matthey

- Hydrogenics (now part of Cummins)

- Enapter AG

- Toshiba Energy Systems & Solutions

- Linde Group

- Schneider Electric

- Green Hydrogen Systems

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 1.5 Billion |

|

Forecasted Value (2030) |

USD 5.6 Billion |

|

CAGR (2024 – 2030) |

20.9% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Electrolysis Hydrogen Generation Market By Product Type (Alkaline Electrolyzers, Proton Exchange Membrane (PEM) Electrolyzers, Solid Oxide Electrolyzers (SOE)), By End-User Industry (Energy & Power, Chemical Industry, Transportation, Industrial Manufacturing, Agriculture), By Application (Industrial Hydrogen Production, Fuel Cells, Power Generation, Energy Storage, Synthetic Fuels Production), and By Technology (Alkaline Electrolysis Technology, Proton Exchange Membrane Electrolysis Technology, Solid Oxide Electrolysis Technology, High-Temperature Electrolysis Technology) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Siemens Energy, Nel ASA, ITM Power, Plug Power, McPhy Energy, Cummins Inc., Air Products and Chemicals, Ballard Power Systems, Johnson Matthey, Hydrogenics (now part of Cummins), Enapter AG, Toshiba Energy Systems & Solutions, Linde Group, Schneider Electric, Green Hydrogen Systems |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Electrolysis Hydrogen Generation Market, by Product Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Alkaline Electrolyzers |

|

4.2. Proton Exchange Membrane (PEM) Electrolyzers |

|

4.3. Solid Oxide Electrolyzers (SOE) |

|

4.4. Others |

|

5. Electrolysis Hydrogen Generation Market, by End-User Industry (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Energy & Power |

|

5.2. Chemical Industry |

|

5.3. Transportation |

|

5.4. Industrial Manufacturing |

|

5.5. Agriculture |

|

5.6. Others |

|

6. Electrolysis Hydrogen Generation Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Industrial Hydrogen Production |

|

6.2. Fuel Cells |

|

6.3. Power Generation |

|

6.4. Energy Storage |

|

6.5. Synthetic Fuels Production |

|

6.6. Others |

|

7. Electrolysis Hydrogen Generation Market, by Technology (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Alkaline Electrolysis Technology |

|

7.2. Proton Exchange Membrane Electrolysis Technology |

|

7.3. Solid Oxide Electrolysis Technology |

|

7.4. High-Temperature Electrolysis Technology |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Electrolysis Hydrogen Generation Market, by Product Type |

|

8.2.7. North America Electrolysis Hydrogen Generation Market, by End-User Industry |

|

8.2.8. North America Electrolysis Hydrogen Generation Market, by Application |

|

8.2.9. North America Electrolysis Hydrogen Generation Market, by |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Electrolysis Hydrogen Generation Market, by Product Type |

|

8.2.10.1.2. US Electrolysis Hydrogen Generation Market, by End-User Industry |

|

8.2.10.1.3. US Electrolysis Hydrogen Generation Market, by Application |

|

8.2.10.1.4. US Electrolysis Hydrogen Generation Market, by |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Siemens Energy |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Nel ASA |

|

10.3. ITM Power |

|

10.4. Plug Power |

|

10.5. McPhy Energy |

|

10.6. Cummins Inc. |

|

10.7. Air Products and Chemicals |

|

10.8. Ballard Power Systems |

|

10.9. Johnson Matthey |

|

10.10. Hydrogenics (now part of Cummins) |

|

10.11. Enapter AG |

|

10.12. Toshiba Energy Systems & Solutions |

|

10.13. Linde Group |

|

10.14. Schneider Electric |

|

10.15. Green Hydrogen Systems |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Electrolysis Hydrogen Generation Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Electrolysis Hydrogen Generation Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Electrolysis Hydrogen Generation Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA