As per Intent Market Research, the Electro-Chemical Energy Storage Systems Market was valued at USD 10.0 billion in 2023 and will surpass USD 20.7 billion by 2030; growing at a CAGR of 11.0% during 2024 - 2030.

The Electro-Chemical Energy Storage Systems market is experiencing significant growth driven by the increasing demand for efficient energy storage solutions across various sectors, including renewable energy, electric vehicles (EVs), and industrial applications. Electrochemical storage technologies, including lithium-ion, flow, and solid-state batteries, are at the forefront of this transformation, offering solutions for grid stabilization, energy backup, and mobile applications. As the world focuses on sustainable energy solutions, the role of advanced electrochemical energy storage systems becomes critical to balancing energy supply and demand, supporting energy transition efforts, and improving the reliability of power grids.

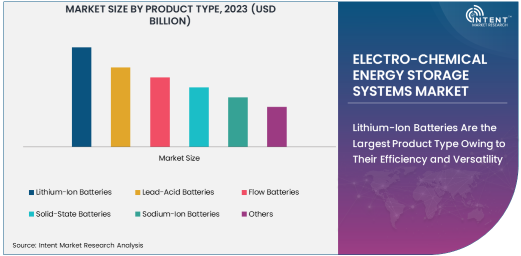

Lithium-Ion Batteries Are the Largest Product Type Owing to Their Efficiency and Versatility

Among the various product types in the electrochemical energy storage systems market, lithium-ion batteries continue to dominate. Their widespread adoption across sectors such as energy storage, electric vehicles (EVs), and portable electronics is driving their significant market share. Lithium-ion batteries offer high energy density, long cycle life, and relatively low self-discharge rates, making them ideal for a variety of applications. The electric vehicle market, in particular, has been a key driver, as automakers increasingly choose lithium-ion technology to power their vehicles.

The growing demand for energy-efficient and sustainable solutions in the automotive and power industries further propels the dominance of lithium-ion batteries. As a result, companies are investing heavily in improving the performance of these batteries, with advancements in technology such as solid-state lithium-ion batteries and next-generation chemistries aiming to enhance energy density and safety. The shift toward electric mobility and renewable energy storage is expected to continue boosting the demand for lithium-ion batteries in the coming years.

Energy Storage Applications Are the Fastest Growing Due to Increased Renewable Integration

The energy storage application segment is the fastest-growing, driven by the increasing integration of renewable energy sources such as solar and wind power. Energy storage systems play a crucial role in balancing supply and demand by storing excess energy produced during peak generation times and releasing it when demand exceeds production. This capability is essential in regions with high renewable energy penetration, where energy production is intermittent.

As governments worldwide focus on reducing carbon emissions and promoting renewable energy, energy storage systems are becoming indispensable to ensure grid stability and enhance the reliability of power supplies. The adoption of large-scale energy storage systems is accelerating, with batteries like lithium-ion and flow batteries being used for grid-scale energy storage applications. This trend is expected to expand as utilities and energy companies invest more in energy storage technologies to meet regulatory requirements and sustainability goals.

Automotive Industry Is the Largest End-User Owing to EV Adoption Surge

The automotive industry is the largest end-user for electrochemical energy storage systems, driven primarily by the rapid rise in electric vehicle (EV) adoption. With stricter emission regulations and growing consumer preference for green technologies, automakers are increasingly turning to electric powertrains, which rely heavily on advanced battery technologies such as lithium-ion and solid-state batteries. The shift to electric mobility is expected to continue to expand as governments implement policies to reduce vehicle emissions and promote sustainable transportation.

As electric vehicles become more mainstream, the demand for high-performance batteries with greater energy density and longer cycle lives is rising. Companies in the automotive sector are investing in partnerships with battery manufacturers to develop next-generation batteries that will support longer driving ranges, shorter charging times, and better safety standards. This is expected to further cement the automotive sector's role as the largest consumer of electrochemical energy storage systems in the years ahead.

Lithium-Ion Battery Technology Leads Owing to Its Proven Performance and Cost-Effectiveness

In terms of technology, lithium-ion battery technology remains the leader, owing to its proven performance, scalability, and cost-effectiveness. Lithium-ion batteries are widely used in a variety of applications, from portable electronics to grid energy storage and electric vehicles. The continued advancements in lithium-ion battery technology, including improvements in energy density, charging speeds, and safety features, have solidified their place as the most widely adopted technology.

The ongoing reduction in the cost of lithium-ion batteries, driven by economies of scale and innovations in manufacturing processes, has made them more accessible for a wide range of applications. As companies invest in improving battery efficiency, lithium-ion technology is expected to remain dominant, although new technologies such as solid-state and sodium-ion batteries are emerging as potential alternatives in the long term.

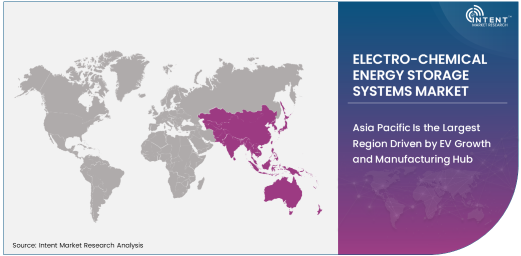

Asia Pacific Is the Largest Region Driven by EV Growth and Manufacturing Hub

The Asia Pacific (APAC) region is the largest market for electrochemical energy storage systems, largely due to its dominance in the manufacturing of lithium-ion batteries and the rapid growth of electric vehicle adoption. Countries like China, Japan, and South Korea are at the forefront of battery production and EV adoption, with China being the world's largest producer and consumer of lithium-ion batteries. The region’s governments have implemented aggressive policies to promote electric mobility and renewable energy, which are boosting the demand for energy storage systems.

China, in particular, is leading the global transition toward electric vehicles, with several domestic and international automakers ramping up their EV production in the region. Additionally, APAC is home to some of the largest battery manufacturers, such as CATL, BYD, and LG Energy Solution, which are increasing their capacity to meet the growing demand for batteries in both the automotive and energy storage markets.

Leading Companies and Competitive Landscape

The electrochemical energy storage systems market is highly competitive, with several leading companies dominating the landscape. Key players such as Tesla Inc., Panasonic Corporation, LG Energy Solution, and BYD Co. Ltd. are at the forefront of battery manufacturing and technology development. These companies continue to innovate, focusing on improving battery efficiency, reducing costs, and enhancing safety features to meet the growing demand for energy storage solutions in various industries.

The competitive landscape is also influenced by partnerships and mergers, as companies look to strengthen their technological capabilities and expand their market presence. For example, collaborations between automotive manufacturers and battery suppliers, such as the partnerships between General Motors and LG Chem, are helping to accelerate the development of advanced batteries for electric vehicles. Furthermore, as new technologies such as solid-state and sodium-ion batteries gain traction, the competitive dynamics of the market are expected to evolve, creating opportunities for new entrants to capture market share.

Recent Developments:

- Tesla Inc. has expanded its energy storage division with the launch of its Megapack system designed for large-scale energy storage applications, aimed at improving grid resilience and renewable energy integration.

- LG Energy Solution announced a new partnership with General Motors to manufacture advanced battery technology for electric vehicles and energy storage, signaling further growth in the sector.

- Panasonic recently received approval from the U.S. Department of Energy for a new battery plant in Kansas that will focus on producing high-efficiency lithium-ion batteries for both energy storage and electric vehicles.

- CATL signed a joint venture with Volkswagen Group to enhance the development of next-generation lithium-ion batteries, strengthening their position in both electric vehicle and energy storage markets.

- Fluence Energy raised $2 billion in an initial public offering (IPO) to expand its global footprint in energy storage solutions and is targeting new projects in the Middle East and Asia Pacific regions.

List of Leading Companies:

- Tesla Inc.

- Panasonic Corporation

- LG Energy Solution

- Samsung SDI Co., Ltd.

- BYD Co. Ltd.

- CATL (Contemporary Amperex Technology Co. Limited)

- ABB Ltd.

- Siemens AG

- AES Energy Storage

- Fluence Energy

- Envision AESC

- ViZn Energy Systems, Inc.

- Primus Power

- Sumitomo Electric Industries

- Hitachi Chemical Co. Ltd.

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 10.0 Million |

|

Forecasted Value (2030) |

USD 20.7 Million |

|

CAGR (2024 – 2030) |

11.0% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Electrochemical Energy Storage Systems Market By Product Type (Lithium-Ion Batteries, Lead-Acid Batteries, Flow Batteries, Solid-State Batteries, Sodium-Ion Batteries), By Application (Energy Storage, Electric Vehicles, Power Backup Systems, Grid Stabilization, Portable Electronics, Industrial Applications), By End-User Industry (Automotive, Energy & Power, Consumer Electronics, Industrial & Manufacturing, Military & Defense, Healthcare, Transport & Logistics), By Technology (Conventional Electrochemical Energy Storage Systems, Advanced Electrochemical Energy Storage Systems, Solid-State Electrochemical Energy Storage Systems, Flow Battery Technology, Lithium-Ion Battery Technology, Sodium-Ion Battery Technology) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Tesla Inc., Panasonic Corporation, LG Energy Solution, Samsung SDI Co., Ltd., BYD Co. Ltd., CATL (Contemporary Amperex Technology Co. Limited), ABB Ltd., Siemens AG, AES Energy Storage, Fluence Energy, Envision AESC, ViZn Energy Systems, Inc., Primus Power, Sumitomo Electric Industries, Hitachi Chemical Co. Ltd. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Electro-Chemical Energy Storage Systems Market, by Product Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Lithium-Ion Batteries |

|

4.2. Lead-Acid Batteries |

|

4.3. Flow Batteries |

|

4.4. Solid-State Batteries |

|

4.5. Sodium-Ion Batteries |

|

4.6. Others |

|

5. Electro-Chemical Energy Storage Systems Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Energy Storage |

|

5.2. Electric Vehicles |

|

5.3. Power Backup Systems |

|

5.4. Grid Stabilization |

|

5.5. Portable Electronics |

|

5.6. Industrial Applications |

|

6. Electro-Chemical Energy Storage Systems Market, by End-User Industry (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Automotive |

|

6.2. Energy & Power |

|

6.3. Consumer Electronics |

|

6.4. Industrial & Manufacturing |

|

6.5. Military & Defense |

|

6.6. Healthcare |

|

6.7. Transport & Logistics |

|

7. Electro-Chemical Energy Storage Systems Market, by Technology (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Conventional Electrochemical Energy Storage Systems |

|

7.2. Advanced Electrochemical Energy Storage Systems |

|

7.3. Solid-State Electrochemical Energy Storage Systems |

|

7.4. Flow Battery Technology |

|

7.5. Lithium-Ion Battery Technology |

|

7.6. Sodium-Ion Battery Technology |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Electro-Chemical Energy Storage Systems Market, by Product Type |

|

8.2.7. North America Electro-Chemical Energy Storage Systems Market, by Application |

|

8.2.8. North America Electro-Chemical Energy Storage Systems Market, by End-User Industry |

|

8.2.9. By Country |

|

8.2.9.1. US |

|

8.2.9.1.1. US Electro-Chemical Energy Storage Systems Market, by Product Type |

|

8.2.9.1.2. US Electro-Chemical Energy Storage Systems Market, by Application |

|

8.2.9.1.3. US Electro-Chemical Energy Storage Systems Market, by End-User Industry |

|

8.2.9.2. Canada |

|

8.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Tesla Inc. |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Panasonic Corporation |

|

10.3. LG Energy Solution |

|

10.4. Samsung SDI Co., Ltd. |

|

10.5. BYD Co. Ltd. |

|

10.6. CATL (Contemporary Amperex Technology Co. Limited) |

|

10.7. ABB Ltd. |

|

10.8. Siemens AG |

|

10.9. AES Energy Storage |

|

10.10. Fluence Energy |

|

10.11. Envision AESC |

|

10.12. ViZn Energy Systems, Inc. |

|

10.13. Primus Power |

|

10.14. Sumitomo Electric Industries |

|

10.15. Hitachi Chemical Co. Ltd. |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Electrochemical Energy Storage Systems Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Electrochemical Energy Storage Systems Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Electrochemical Energy Storage Systems Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA