As per Intent Market Research, the Electro Optical Targeting System Market was valued at USD 5.0 billion in 2023 and will surpass USD 9.3 billion by 2030; growing at a CAGR of 9.2% during 2024 - 2030.

The Electro Optical Targeting System (EOTS) market has experienced significant growth driven by advancements in sensor technologies, increasing demand for precise and efficient targeting solutions in defense, security, and aerospace applications. These systems are integral to military and law enforcement operations, enabling the accurate detection, tracking, and engagement of targets. With innovations in infrared sensors, laser rangefinders, and multi-sensor fusion technologies, the EOTS market is poised for expansion across various segments, from tactical military operations to border surveillance. The increasing complexity of defense systems and the adoption of AI-driven targeting are some of the key factors that are expected to fuel the market's growth in the coming years.

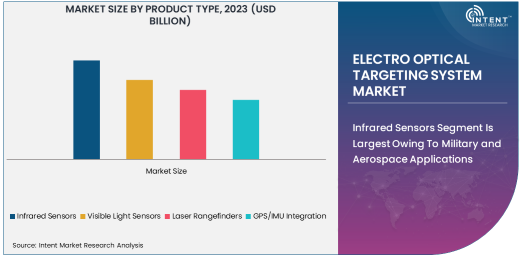

Infrared Sensors Segment Is Largest Owing To Military and Aerospace Applications

The Infrared Sensors segment holds the largest market share in the Electro Optical Targeting System industry. This is primarily due to their critical role in defense and military applications, where precise target identification and tracking in low-visibility conditions are essential. Infrared sensors are capable of detecting heat signatures from both moving and stationary targets, making them indispensable in a wide range of tactical situations. The demand for infrared sensors is particularly high in airborne and ground-based defense systems, such as fighter jets, drones, and missile guidance systems.

Infrared sensors also play a pivotal role in border surveillance and homeland security. Their ability to operate effectively in challenging environmental conditions, including nighttime and low-light environments, provides security forces with a significant advantage in protecting national borders and critical infrastructure. As the need for enhanced security measures grows globally, the demand for infrared sensors in military and defense applications is expected to remain robust, contributing to the segment’s dominance in the market.

Military & Defense Segment Is Fastest Growing Owing To Rising Security Threats

The Military & Defense application segment is the fastest-growing within the Electro Optical Targeting System market. The escalating geopolitical tensions and evolving security threats have led to an increased emphasis on advanced targeting solutions for modern military forces. Electro optical targeting systems, which integrate various sensors and technologies like infrared, visible light, and laser rangefinders, are pivotal in providing real-time intelligence and enhancing the effectiveness of military operations.

The growth in defense budgets, particularly in emerging economies, is also contributing to the accelerated adoption of electro-optical systems. Military forces are increasingly investing in high-precision targeting capabilities for aircraft, armored vehicles, and naval vessels to improve mission success rates and reduce collateral damage. The continuous technological advancements in artificial intelligence (AI) and machine learning are further enhancing the capabilities of these systems, driving the growth of this segment.

Government & Military Segment Is Largest End-User Industry Owing To Defense Budget Expansion

The Government & Military end-user industry is the largest within the Electro Optical Targeting System market, as defense and military applications are the primary consumers of these advanced systems. The segment's dominance is attributed to the substantial investment in defense technologies made by governments worldwide. With the growing need for enhanced surveillance, reconnaissance, and precision targeting, the demand for electro-optical targeting systems remains high in both developed and emerging economies.

Governments are also increasingly adopting these systems for border control, defense infrastructure protection, and counterterrorism efforts. As the complexity and sophistication of military operations grow, electro-optical targeting systems have become essential tools for maintaining national security. Additionally, the increasing demand for advanced systems that integrate AI and multi-sensor fusion technologies to enhance operational efficiency is expected to further fuel the growth of this segment.

Multi-Sensor Fusion Systems Technology Is Fastest Growing Owing To Advancements in Targeting Capabilities

The Multi-Sensor Fusion Systems technology segment is the fastest growing in the Electro Optical Targeting System market. This technology integrates data from multiple sensors, such as infrared, visible light, and laser rangefinders, to provide a comprehensive and accurate assessment of targets. Multi-sensor fusion systems enhance the reliability and precision of targeting solutions, making them highly effective in complex and dynamic environments where relying on a single sensor could lead to inaccuracies.

The increasing demand for high-precision targeting in military operations, coupled with advancements in AI and machine learning, is driving the growth of multi-sensor fusion systems. By combining different sensor technologies, these systems offer improved target recognition, reduced false alarms, and better decision-making capabilities, making them indispensable in modern defense operations. This technological evolution is expected to drive significant growth in the market over the next several years.

North America Is Largest Region Owing To Strong Defense Investments

North America holds the largest market share in the Electro Optical Targeting System market. The region, particularly the United States, is a major player in defense spending, with substantial investments in advanced military technologies. North America's defense budget supports the development and procurement of cutting-edge targeting systems, including electro-optical sensors, AI-driven targeting solutions, and multi-sensor fusion technologies. The U.S. military is at the forefront of adopting these advanced systems, integrating them into a variety of applications ranging from airborne operations to ground-based defense systems.

In addition to defense applications, the region's growing emphasis on homeland security and border surveillance is contributing to the region's dominance in the market. The presence of leading companies such as Lockheed Martin, Northrop Grumman, and Raytheon Technologies further bolsters the market growth in North America, as these companies are continually innovating and providing state-of-the-art electro-optical targeting solutions.

Leading Companies and Competitive Landscape

The Electro Optical Targeting System market is highly competitive, with several key players dominating the global landscape. Companies such as Lockheed Martin, Raytheon Technologies, Northrop Grumman, Thales Group, and Leonardo are the leading manufacturers of advanced targeting systems. These companies are leveraging technological advancements in infrared sensors, multi-sensor fusion, and AI-enhanced systems to offer high-precision solutions to military, defense, and law enforcement agencies worldwide.

The competitive landscape is characterized by ongoing research and development (R&D) efforts, strategic partnerships, and acquisitions aimed at expanding product portfolios and enhancing technological capabilities. As the demand for more sophisticated and accurate targeting systems increases, companies are focusing on developing integrated systems that combine multiple sensor technologies for improved operational performance. Additionally, with the growing importance of cybersecurity in defense applications, ensuring the security and integrity of these systems is a key priority for market players.

Recent Developments:

- Lockheed Martin recently announced the successful integration of its next-generation infrared targeting system with several military platforms, enhancing precision targeting capabilities for the U.S. military.

- Raytheon Technologies secured a major contract to deliver advanced Electro Optical Targeting Systems for a global defense program. This contract will further expand Raytheon's presence in the military targeting solutions market.

- Northrop Grumman launched a new high-precision targeting system that integrates multi-sensor fusion technology, improving the accuracy of airborne and ground-based defense systems in complex operational environments.

- Thales Group completed the acquisition of a leading provider of infrared sensor technologies, aiming to enhance its Electro Optical Targeting System offerings and expand its product portfolio in the defense sector.

- In a recent regulatory development, the U.S. Department of Defense issued new guidelines for the integration of AI and machine learning in targeting systems. This regulatory shift is expected to drive innovation and improve the capabilities of Electro Optical Targeting Systems.

List of Leading Companies:

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Leonardo S.p.A

- Thales Group

- Elbit Systems Ltd.

- Raytheon Technologies Corporation

- Saab AB

- BAE Systems PLC

- Rheinmetall AG

- L3 Technologies, Inc.

- Hensoldt AG

- Israel Aerospace Industries (IAI)

- FLIR Systems, Inc. (Teledyne FLIR)

- General Dynamics Corporation

- Babcock International Group

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 5.0 Billion |

|

Forecasted Value (2030) |

USD 9.3 Billion |

|

CAGR (2024 – 2030) |

9.2% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Electro Optical Targeting System Market By Product Type (Infrared Sensors, Visible Light Sensors, Laser Rangefinders, GPS/IMU Integration), By Application (Military & Defense, Aerospace, Border Surveillance, Homeland Security, Law Enforcement), By End-User Industry (Defense & Security, Aerospace & Aviation, Law Enforcement & Public Safety, Government & Military, Industrial Applications), and By Technology (Day/Night Targeting Systems, High-Precision Targeting Systems, Multi-Sensor Fusion Systems, AI-Enhanced Targeting Systems) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Lockheed Martin Corporation, Northrop Grumman Corporation, Leonardo S.p.A, Thales Group, Elbit Systems Ltd., Raytheon Technologies Corporation, Saab AB, BAE Systems PLC, Rheinmetall AG, L3 Technologies, Inc., Hensoldt AG, Israel Aerospace Industries (IAI), FLIR Systems, Inc. (Teledyne FLIR), General Dynamics Corporation, Babcock International Group |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Electro Optical Targeting System Market, by Product Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Infrared Sensors |

|

4.2. Visible Light Sensors |

|

4.3. Laser Rangefinders |

|

4.4. GPS/IMU Integration |

|

5. Electro Optical Targeting System Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Military & Defense |

|

5.2. Aerospace |

|

5.3. Border Surveillance |

|

5.4. Homeland Security |

|

5.5. Law Enforcement |

|

6. Electro Optical Targeting System Market, by End-User Industry (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Defense & Security |

|

6.2. Aerospace & Aviation |

|

6.3. Law Enforcement & Public Safety |

|

6.4. Government & Military |

|

6.5. Industrial Applications |

|

7. Electro Optical Targeting System Market, by Technology (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Day/Night Targeting Systems |

|

7.2. High-Precision Targeting Systems |

|

7.3. Multi-Sensor Fusion Systems |

|

7.4. AI-Enhanced Targeting Systems |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Electro Optical Targeting System Market, by Product Type |

|

8.2.7. North America Electro Optical Targeting System Market, by Application |

|

8.2.8. North America Electro Optical Targeting System Market, by End-User Industry |

|

8.2.9. North America Electro Optical Targeting System Market, by |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Electro Optical Targeting System Market, by Product Type |

|

8.2.10.1.2. US Electro Optical Targeting System Market, by Application |

|

8.2.10.1.3. US Electro Optical Targeting System Market, by End-User Industry |

|

8.2.10.1.4. US Electro Optical Targeting System Market, by |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Lockheed Martin Corporation |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Northrop Grumman Corporation |

|

10.3. Leonardo S.p.A |

|

10.4. Thales Group |

|

10.5. Elbit Systems Ltd. |

|

10.6. Raytheon Technologies Corporation |

|

10.7. Saab AB |

|

10.8. BAE Systems PLC |

|

10.9. Rheinmetall AG |

|

10.10. L3 Technologies, Inc. |

|

10.11. Hensoldt AG |

|

10.12. Israel Aerospace Industries (IAI) |

|

10.13. FLIR Systems, Inc. (Teledyne FLIR) |

|

10.14. General Dynamics Corporation |

|

10.15. Babcock International Group |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Electro Optical Targeting System Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Electro Optical Targeting System Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Electro Optical Targeting System Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA