As per Intent Market Research, the Electro Absorption Modulator Market was valued at USD 1.9 billion in 2023 and will surpass USD 4.3 billion by 2030; growing at a CAGR of 11.8% during 2024 - 2030.

The Electro Absorption Modulator (EAM) market is integral to high-speed optical communication systems, primarily used to modulate light signals in telecommunications, data centers, and consumer electronics. As global demand for faster data transmission continues to surge, driven by innovations in 5G, cloud computing, and the Internet of Things (IoT), EAMs are poised to play a crucial role in modern communication infrastructure. These modulators enable high-efficiency signal modulation by leveraging the electro-absorption effect in semiconductors, providing both high-speed and energy-efficient solutions for optical systems. As telecommunications companies and data service providers focus on improving the performance and capacity of their networks, the adoption of EAMs is set to expand rapidly, particularly in the fiber-optic communication space.

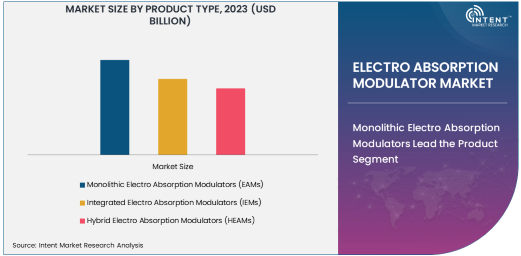

Monolithic Electro Absorption Modulators Lead the Product Segment

Among the different product types in the EAM market, Monolithic Electro Absorption Modulators (EAMs) hold the largest share due to their compact design, cost-effectiveness, and ease of integration into existing optical systems. These modulators are fabricated as a single piece, making them suitable for high-volume production and mass deployment, especially in telecommunications networks and optical communication systems. Monolithic EAMs offer high-speed performance, low power consumption, and robust reliability, essential for modern optical networks that demand fast and efficient signal transmission. Their compatibility with both short- and long-distance communication systems further enhances their appeal across various applications, including fiber-optic communications and 5G backhaul networks.

In addition to the technical benefits, the market for monolithic EAMs is also driven by their ability to support increasing bandwidth demands in data transmission. As the global data traffic continues to grow, the scalability of these modulators becomes crucial in meeting the needs of expanding telecommunications infrastructures. Their integration into both current and next-generation optical systems makes them indispensable for operators seeking to enhance network capacity and performance.

Telecommunications Application Grows Fastest in EAM Market

The Telecommunications segment is the fastest-growing application area for Electro Absorption Modulators. The expanding need for higher bandwidth and reduced latency in optical communication networks is the primary driver for this growth. Telecommunications companies, particularly in regions with high internet consumption and the rollout of 5G networks, are seeking advanced solutions to manage large data volumes efficiently. EAMs, with their ability to modulate optical signals at high speeds, are key enablers of faster, more reliable communication systems that can handle the increasing demand for high-speed data, streaming, and real-time communications.

In addition to supporting 5G and future wireless communication technologies, EAMs are essential for optical transport networks (OTNs), which require high-efficiency, low-latency solutions for large-scale data routing and transmission. As the world transitions to higher-bandwidth communication standards, the role of EAMs in the telecommunications sector becomes even more critical, propelling their rapid adoption in next-generation infrastructure projects.

Telecommunications End-User Industry Dominates the Market

The Telecommunications end-user industry is the largest and most influential in the Electro Absorption Modulator market. As the global telecommunications sector evolves to support higher-speed internet and data transmission, particularly with the rollout of 5G and advanced optical networks, the demand for modulators capable of supporting these advancements continues to rise. Telecom operators are investing heavily in network upgrades and expansions, pushing the need for high-performance optical communication solutions such as EAMs. These components play an essential role in ensuring seamless data transfer across vast distances and maintaining the efficiency of networks that span across continents.

Telecommunications companies are increasingly focusing on improving their optical fiber networks, both in metropolitan areas and rural regions, to ensure the delivery of high-speed internet to end users. EAMs are an ideal choice for these infrastructure upgrades due to their low power consumption, small form factor, and the ability to handle increasing traffic volumes while maintaining signal integrity. As global internet usage continues to climb, telecommunications companies are expected to remain the dominant end-users of EAM technology.

Hybrid Modulation Technologies Emerge as Key Trend

Hybrid Modulation Technologies are gaining traction in the Electro Absorption Modulator market as they combine the benefits of multiple modulation methods, offering improved performance and flexibility for modern communication systems. Hybrid modulation combines the high-speed capabilities of direct modulation with the precision and reliability of external modulation, enabling efficient data transmission across different transmission distances and network architectures. This hybrid approach ensures greater adaptability in diverse applications, including long-haul optical networks and high-frequency communications.

As data centers and telecommunications providers seek solutions to accommodate increasing data traffic, hybrid modulator technologies offer scalability and high efficiency in managing bandwidth. The hybrid approach allows for better signal fidelity and improved system performance, making it a sought-after technology for next-generation communication systems. The growing demand for faster, more reliable communication networks is expected to accelerate the adoption of hybrid modulation technologies, particularly in long-distance and high-capacity applications.

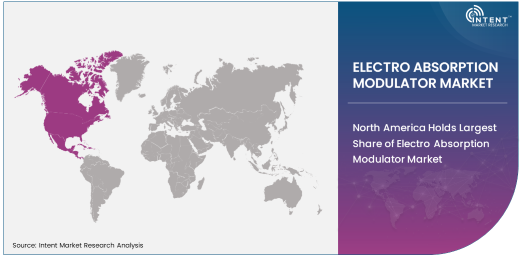

North America Holds Largest Share of Electro Absorption Modulator Market

North America is the largest region in the Electro Absorption Modulator market, driven by significant investments in telecommunications infrastructure and the increasing demand for high-speed data transmission in both commercial and residential sectors. The United States, in particular, has been at the forefront of 5G deployment, with telecom companies accelerating the rollout of next-generation wireless networks. This increase in network demands creates a steady need for advanced optical communication solutions like EAMs to support high-bandwidth applications. The presence of major telecom companies, data centers, and research facilities in North America further strengthens the region’s dominance in the market.

Moreover, North America’s mature infrastructure and ongoing technological advancements in data centers and optical communication networks ensure that the demand for Electro Absorption Modulators will continue to grow. As the region continues to lead in technology adoption and infrastructure development, the market for EAMs is poised to see sustained growth, with increased application in both existing and upcoming projects related to 5G, fiber-optic networks, and cloud-based solutions.

Competitive Landscape of the Electro Absorption Modulator Market

The competitive landscape of the Electro Absorption Modulator market is dominated by several key players, including Lumentum Holdings, NeoPhotonics Corporation, and II-VI Incorporated, among others. These companies lead in product innovation, offering a variety of modulator types and technologies to meet the growing demand for high-speed optical communication solutions. Their ability to develop advanced, high-performance modulators that are integral to the success of next-generation optical networks and 5G rollouts places them at the forefront of the market.

As the market evolves, companies are focusing on enhancing their product offerings through research and development, collaborations, and strategic acquisitions. With the increasing reliance on optical communication systems for both telecommunications and data centers, companies that can offer scalable, efficient, and low-cost modulator solutions are likely to capture a larger share of the market. The competitive dynamics of the market are characterized by technological advancements and the continuous need for higher bandwidth and faster data transmission capabilities.

Recent Developments:

- Lumentum Holdings announced the launch of new high-performance electro-absorption modulators designed for next-generation optical communication networks, enhancing transmission speeds and efficiency for telecom operators.

- II-VI Incorporated completed the acquisition of Finisar Corporation, further expanding its portfolio of optical communication components, including electro-absorption modulators, to serve high-speed communication applications.

- NeoPhotonics Corporation unveiled a series of advanced electro-absorption modulators aimed at improving performance for high-capacity optical networks, focusing on the growing demand for 5G network infrastructure.

- Mitsubishi Electric Corporation has made strategic investments in the development of hybrid electro-absorption modulators to support both short- and long-range data transmission systems for high-speed networks.

- Keysight Technologies has entered into a partnership with leading telecom companies to provide cutting-edge test solutions for electro-absorption modulators, helping optimize network performance for emerging technologies such as 5G and optical networks

List of Leading Companies:

- Intel Corporation

- Broadcom Inc.

- Mitsubishi Electric Corporation

- Fujitsu Ltd.

- Huawei Technologies Co., Ltd.

- Sumitomo Electric Industries Ltd.

- Lumentum Holdings Inc.

- Finisar Corporation (now part of II-VI Incorporated)

- Nokia Corporation

- II-VI Incorporated

- NeoPhotonics Corporation

- Oclaro, Inc. (now part of Lumentum Holdings)

- Toshiba Corporation

- Keysight Technologies

- Infinera Corporation

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 1.9 Billion |

|

Forecasted Value (2030) |

USD 4.3 Billion |

|

CAGR (2024 – 2030) |

11.8% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Electro Absorption Modulator Market By Product Type (Monolithic Electro Absorption Modulators, Integrated Electro Absorption Modulators, Hybrid Electro Absorption Modulators), By Application (Telecommunications, Data Communications, Optical Communication Networks, Consumer Electronics, Military & Aerospace), By End-User Industry (Telecommunications, Consumer Electronics, Data Centers, Aerospace & Defense, Research & Development), and By Technology (Direct Modulation, External Modulation, High-Speed Modulation, Hybrid Modulation Technologies) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Intel Corporation, Broadcom Inc., Mitsubishi Electric Corporation, Fujitsu Ltd., Huawei Technologies Co., Ltd., Sumitomo Electric Industries Ltd., Lumentum Holdings Inc., Finisar Corporation (now part of II-VI Incorporated), Nokia Corporation, II-VI Incorporated, NeoPhotonics Corporation, Oclaro, Inc. (now part of Lumentum Holdings), Toshiba Corporation, Keysight Technologies, Infinera Corporation |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Electro Absorption Modulator Market, by Product Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Monolithic Electro Absorption Modulators (EAMs) |

|

4.2. Integrated Electro Absorption Modulators (IEMs) |

|

4.3. Hybrid Electro Absorption Modulators (HEAMs) |

|

5. Electro Absorption Modulator Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Telecommunications |

|

5.2. Data Communications |

|

5.3. Optical Communication Networks |

|

5.4. Consumer Electronics |

|

5.5. Military & Aerospace |

|

6. Electro Absorption Modulator Market, by End-User Industry (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Telecommunications |

|

6.2. Consumer Electronics |

|

6.3. Data Centers |

|

6.4. Aerospace & Defense |

|

6.5. Research & Development |

|

7. Electro Absorption Modulator Market, by Technology (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Direct Modulation |

|

7.2. External Modulation |

|

7.3. High-Speed Modulation |

|

7.4. Hybrid Modulation Technologies |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Electro Absorption Modulator Market, by Product Type |

|

8.2.7. North America Electro Absorption Modulator Market, by Application |

|

8.2.8. North America Electro Absorption Modulator Market, by End-User Industry |

|

8.2.9. North America Electro Absorption Modulator Market, by Technology |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Electro Absorption Modulator Market, by Product Type |

|

8.2.10.1.2. US Electro Absorption Modulator Market, by Application |

|

8.2.10.1.3. US Electro Absorption Modulator Market, by End-User Industry |

|

8.2.10.1.4. US Electro Absorption Modulator Market, by Technology |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Intel Corporation |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Broadcom Inc. |

|

10.3. Mitsubishi Electric Corporation |

|

10.4. Fujitsu Ltd. |

|

10.5. Huawei Technologies Co., Ltd. |

|

10.6. Sumitomo Electric Industries Ltd. |

A comprehensive market research approach was employed to gather and analyze data on the Electro Absorption Modulator Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Electro Absorption Modulator Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Electro Absorption Modulator Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA