As per Intent Market Research, the Electrically Conductive Adhesives Market was valued at USD 4.4 billion in 2023 and will surpass USD 8.0 billion by 2030; growing at a CAGR of 8.8% during 2024 - 2030.

The electrically conductive adhesives (ECAs) market has gained significant traction in recent years, driven by the increasing demand for high-performance materials in electronic components, automotive systems, aerospace, and renewable energy applications. These adhesives are essential for creating reliable electrical connections in devices without the need for traditional soldering. As industries evolve toward miniaturized and high-functioning components, the demand for conductive adhesives offering low environmental impact, high reliability, and efficiency is increasing. Additionally, technological advancements in electronics, particularly in the fields of electric vehicles, renewable energy, and consumer electronics, are spurring the growth of the market.

With a broad array of product types, applications, and technologies available, the electrically conductive adhesives market is poised for substantial growth. The expansion is fueled by industries demanding more sophisticated and durable solutions for component assembly, particularly in areas where precision and performance are paramount. The following sections will delve into the largest or fastest-growing subsegments across different categories, illustrating the factors that drive the market’s rapid development.

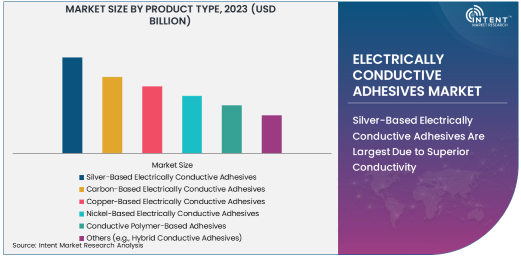

Silver-Based Electrically Conductive Adhesives Are Largest Due to Superior Conductivity

Among the various types of electrically conductive adhesives, silver-based conductive adhesives dominate the market. This is primarily because silver has the highest conductivity among all metals, making it an ideal material for applications that require high performance and reliability. Silver-based adhesives are commonly used in the assembly of semiconductor devices, microelectronics, and sensors, where electrical performance is crucial. Their superior conductivity ensures that they are the preferred choice for critical applications such as automotive electronics, consumer electronics, and medical devices.

Despite the higher cost of silver compared to other materials, its exceptional conductivity and longevity justify its use in high-performance applications. The increasing demand for electronics with faster processing speeds and more compact designs further bolsters the demand for silver-based adhesives. Additionally, as the trend toward miniaturization continues across multiple industries, the role of silver-based conductive adhesives in ensuring reliable electrical connections will only increase, supporting their continued dominance in the market.

Electronics Application is Largest Due to Increasing Demand for Miniaturization

The electronics application segment is the largest within the electrically conductive adhesives market, driven by the ever-growing need for miniaturized, high-performance electronic components. As the electronics industry continues to innovate with smaller, more efficient devices, the demand for materials like ECAs that can offer strong electrical performance in compact designs is skyrocketing. Consumer electronics, telecommunications, and automotive sectors particularly drive this demand as they continue to push the limits of device miniaturization and functionality.

Electrically conductive adhesives play a vital role in electronic device assembly, enabling smaller component sizes and more intricate designs. Their ability to perform at high frequencies and with high reliability in demanding environments further makes them ideal for applications in the electronics industry. As smart devices, wearables, and IoT products become more ubiquitous, the electronics sector’s demand for ECAs will remain a key growth driver, ensuring this segment's continued dominance in the market.

Consumer Electronics End-User Industry Is Largest Due to Demand for Compact Devices

Within the consumer electronics end-user industry, electrically conductive adhesives play a crucial role in assembling smaller, more efficient, and robust electronic devices. The growing demand for smartphones, wearable devices, and smart home technology is pushing the need for advanced adhesive solutions that provide both electrical conductivity and mechanical strength. As the consumer electronics industry is highly competitive, manufacturers are increasingly seeking ways to optimize product performance while reducing size and cost, making ECAs an essential component in the assembly process.

The consumer electronics sector’s focus on producing lighter, smaller, and more durable devices creates significant opportunities for the electrically conductive adhesives market. Additionally, with the rise of the Internet of Things (IoT) and wireless communication technologies, the sector's need for adhesives that can support high-frequency performance and ensure long-term durability continues to grow. Consequently, the consumer electronics segment remains a dominant force in driving the demand for advanced electrically conductive adhesives.

Pressure-Sensitive Electrically Conductive Adhesives Are Fastest Growing Due to Versatility and Ease of Use

Among the various technologies, pressure-sensitive electrically conductive adhesives (PSAs) are the fastest-growing subsegment in the market. PSAs offer excellent versatility and ease of use in a range of applications where minimal heat or curing time is required. Their ability to bond to a variety of surfaces without the need for additional equipment or heat makes them particularly appealing for manufacturers looking to streamline production processes and reduce energy costs. PSAs are widely used in electronics, automotive components, and consumer goods where flexibility and rapid assembly are crucial.

The rise in the adoption of pressure-sensitive adhesives is also driven by their ability to deliver consistent performance under variable conditions, making them ideal for automotive and consumer electronic products. As industries continue to prioritize cost-effective, scalable solutions, PSAs are emerging as a top choice for companies looking to optimize both performance and production efficiency. This growing demand for PSAs across multiple industries solidifies their position as the fastest-growing technology within the electrically conductive adhesives market.

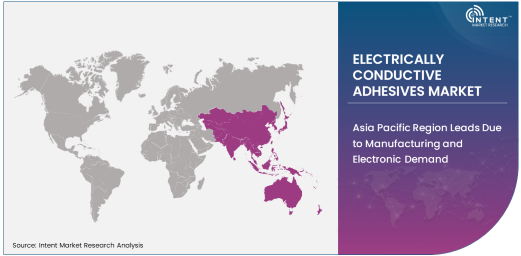

Asia Pacific Region Leads Due to Manufacturing and Electronic Demand

The Asia Pacific region is the largest and fastest-growing market for electrically conductive adhesives, primarily driven by the presence of leading manufacturing hubs in countries like China, Japan, South Korea, and India. These countries are home to some of the world’s largest electronics manufacturers, which require large volumes of high-performance adhesive solutions for the assembly of consumer electronics, automotive components, and industrial electronics. Additionally, the growth of the electric vehicle (EV) market in the region, along with an expanding consumer electronics sector, significantly boosts the demand for ECAs.

Asia Pacific’s dominance is also fueled by the region’s strategic investments in renewable energy and the increasing trend of adopting advanced manufacturing technologies. As the region continues to lead in electronics production, the demand for cost-effective and efficient conductive adhesives will continue to rise. The region’s rapid industrialization, coupled with growing technological advancements in electronics and automotive industries, makes it a vital market for the continued growth of electrically conductive adhesives.

Leading Companies and Competitive Landscape

The electrically conductive adhesives market is highly competitive, with key players focusing on product innovation, expansion, and strategic partnerships to capture market share. Leading companies in this space include Henkel AG, 3M, Dow Inc., Huntsman Corporation, and Panasonic Corporation, all of which are investing heavily in R&D to enhance adhesive performance and address the evolving needs of industries like electronics, automotive, and healthcare. These companies are also expanding their product portfolios, offering a range of solutions, from silver-based adhesives to pressure-sensitive and heat-curable adhesives.

The competitive landscape also features numerous smaller, specialized firms focusing on specific subsegments such as conductive inks, conductive epoxies, and polymer-based adhesives. Mergers and acquisitions, as well as collaborations with manufacturers, are common strategies for growth in this market. Companies are also focusing on sustainability, offering eco-friendly adhesives as an alternative to traditional soldering methods. The increasing importance of advanced technologies in electronics, automotive, and renewable energy sectors will continue to drive innovation and competition in the electrically conductive adhesives market.

Recent Developments:

- Henkel AG expanded its portfolio of conductive adhesives by launching new Loctite ABLESTIK series adhesives, designed for high-performance applications in electronic devices and automotive electronics.

- Dow Inc. entered into a partnership with a major electronics manufacturer to develop advanced electrically conductive adhesives tailored for high-frequency, high-precision electronic components.

- 3M announced the acquisition of Apex Material Technology, a company specializing in conductive adhesives for the automotive and renewable energy industries, strengthening its position in the electronics adhesives market.

- Huntsman Corporation unveiled a new line of heat-curable conductive adhesives that offer superior performance in industrial applications, with a focus on automotive and aerospace industries.

- Panasonic Corporation launched a new conductive adhesive technology aimed at improving the efficiency of solar power applications, providing enhanced performance in photovoltaic module connections.

List of Leading Companies:

- 3M

- Henkel AG & Co. KGaA

- Huntsman Corporation

- Conductive Compounds, Inc.

- Dexter Chemical Company

- Dow Inc.

- MG Chemicals

- Namics Corporation

- Panasonic Corporation

- Electron Microscopy Sciences

- Creative Materials, Inc.

- KYOCERA Corporation

- Aptiv PLC

- Alpha Assembly Solutions

- AIM Solder

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 4.4 Billion |

|

Forecasted Value (2030) |

USD 8.0 Billion |

|

CAGR (2024 – 2030) |

8.8% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Electrically Conductive Adhesives Market By Product Type (Silver-Based Electrically Conductive Adhesives, Carbon-Based Electrically Conductive Adhesives, Copper-Based Electrically Conductive Adhesives, Nickel-Based Electrically Conductive Adhesives, Conductive Polymer-Based Adhesives), By Application (Electronics, Automotive, Aerospace, Healthcare, Solar Power, Industrial & Manufacturing, Consumer Goods), By End-User Industry (Consumer Electronics, Automotive, Healthcare, Industrial Electronics, Telecommunications, Aerospace & Defense, Energy & Power), By Technology (Pressure-Sensitive Electrically Conductive Adhesives, Heat-Curable Electrically Conductive Adhesives, Light-Curable Electrically Conductive Adhesives, Conductive Epoxies, Conductive Inks) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

3M, Henkel AG & Co. KGaA, Huntsman Corporation, Conductive Compounds, Inc., Dexter Chemical Company, Dow Inc., MG Chemicals, Namics Corporation, Panasonic Corporation, Electron Microscopy Sciences, Creative Materials, Inc., KYOCERA Corporation, Aptiv PLC, Alpha Assembly Solutions, AIM Solder |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Electrically Conductive Adhesives Market, by Product Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Silver-Based Electrically Conductive Adhesives |

|

4.2. Carbon-Based Electrically Conductive Adhesives |

|

4.3. Copper-Based Electrically Conductive Adhesives |

|

4.4. Nickel-Based Electrically Conductive Adhesives |

|

4.5. Conductive Polymer-Based Adhesives |

|

4.6. Others (e.g., Hybrid Conductive Adhesives) |

|

5. Electrically Conductive Adhesives Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Electronics |

|

5.2. Automotive |

|

5.3. Aerospace |

|

5.4. Healthcare |

|

5.5. Solar Power |

|

5.6. Industrial & Manufacturing |

|

5.7. Consumer Goods |

|

5.8. Others (e.g., LED, Wearables) |

|

6. Electrically Conductive Adhesives Market, by End-User Industry (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Consumer Electronics |

|

6.2. Automotive |

|

6.3. Healthcare |

|

6.4. Industrial Electronics |

|

6.5. Telecommunications |

|

6.6. Aerospace & Defense |

|

6.7. Energy & Power |

|

6.8. Others |

|

7. Electrically Conductive Adhesives Market, by Technology (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Pressure-Sensitive Electrically Conductive Adhesives |

|

7.2. Heat-Curable Electrically Conductive Adhesives |

|

7.3. Light-Curable Electrically Conductive Adhesives |

|

7.4. Conductive Epoxies |

|

7.5. Conductive Inks |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Electrically Conductive Adhesives Market, by Product Type |

|

8.2.7. North America Electrically Conductive Adhesives Market, by Application |

|

8.2.8. North America Electrically Conductive Adhesives Market, by End-User Industry |

|

8.2.9. North America Electrically Conductive Adhesives Market, by Technology |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Electrically Conductive Adhesives Market, by Product Type |

|

8.2.10.1.2. US Electrically Conductive Adhesives Market, by Application |

|

8.2.10.1.3. US Electrically Conductive Adhesives Market, by End-User Industry |

|

8.2.10.1.4. US Electrically Conductive Adhesives Market, by Technology |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. 3M |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Henkel AG & Co. KGaA |

|

10.3. Huntsman Corporation |

|

10.4. Conductive Compounds, Inc. |

|

10.5. Dexter Chemical Company |

|

10.6. Dow Inc. |

|

10.7. MG Chemicals |

|

10.8. Namics Corporation |

|

10.9. Panasonic Corporation |

|

10.10. Electron Microscopy Sciences |

|

10.11. Creative Materials, Inc. |

|

10.12. KYOCERA Corporation |

|

10.13. Aptiv PLC |

|

10.14. Alpha Assembly Solutions |

|

10.15. AIM Solder |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Electrically Conductive Adhesives Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Electrically Conductive Adhesives Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Electrically Conductive Adhesives Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA