As per Intent Market Research, the Electrical Stimulation Devices Market was valued at USD 1.7 billion in 2023 and will surpass USD 3.4 billion by 2030; growing at a CAGR of 10.7% during 2024 - 2030.

The global electrical stimulation devices market is experiencing significant growth, driven by the increasing prevalence of chronic pain, neurological disorders, and the rising demand for non-invasive treatments. These devices use electrical impulses to treat various health conditions, including pain relief, muscle rehabilitation, and nerve disorders. As the market diversifies with the development of advanced technologies, including wireless and wearable devices, different product types, applications, and end-users are contributing to this growing sector. The market is also witnessing innovations that enhance the effectiveness, comfort, and accessibility of these devices, making them increasingly popular in both clinical and home care settings.

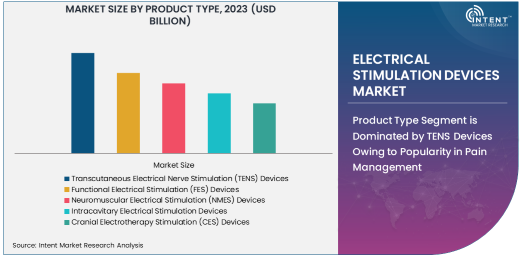

Product Type Segment is Dominated by TENS Devices Owing to Popularity in Pain Management

Within the product type segment, Transcutaneous Electrical Nerve Stimulation (TENS) Devices are the largest subsegment, primarily due to their widespread application in pain management. TENS devices are non-invasive and offer patients an effective way to manage acute and chronic pain, making them highly favored by both consumers and healthcare providers. The simplicity of the device, coupled with its proven efficacy in blocking pain signals, has led to its significant adoption across various pain management therapies. TENS units are commonly used for conditions such as arthritis, fibromyalgia, and post-operative pain, and their use in home care settings has further driven their market dominance.

In addition to being cost-effective, TENS devices are portable and user-friendly, which has made them highly accessible for patients seeking at-home pain relief. Furthermore, the rising awareness regarding the benefits of TENS for managing conditions without the need for pharmaceutical intervention is contributing to its ongoing popularity. With continuous advancements in battery life, comfort, and portability, TENS devices are poised to maintain their leading position in the electrical stimulation devices market.

Pain Management Application is Largest Due to Increasing Chronic Pain Prevalence

Among the various applications of electrical stimulation devices, Pain Management stands out as the largest segment. This is largely due to the increasing prevalence of chronic pain disorders across the globe, coupled with a growing patient preference for non-invasive, drug-free treatments. Pain management using electrical stimulation devices, particularly TENS, has been clinically proven to help alleviate conditions like back pain, arthritis, and nerve pain. These devices are especially sought after in regions with an aging population, as the elderly are more prone to chronic pain conditions, which in turn drives demand.

The convenience and non-pharmacological nature of electrical stimulation therapy make it an attractive alternative to traditional pain management methods, which often rely on painkillers or invasive surgeries. As healthcare providers and patients continue to focus on improving quality of life and reducing dependency on medications, the demand for electrical stimulation devices for pain management is expected to remain robust. The segment's growth is further supported by the development of innovative, user-friendly devices that can be used in both clinical and home care settings.

Home Care Settings is Fastest Growing End-User Segment Owing to Increasing Consumer Adoption

The Home Care Settings end-user segment is the fastest-growing within the electrical stimulation devices market. The shift toward home-based healthcare, driven by advancements in wearable and portable medical devices, has been a key factor in the rise of this subsegment. Electrical stimulation devices, particularly for pain management and muscle rehabilitation, offer convenience and affordability for consumers seeking to manage their conditions from the comfort of their homes. Home care settings are increasingly becoming a primary destination for patients looking to avoid frequent hospital visits, making electrical stimulation devices a popular choice for personal healthcare solutions.

The growing availability of over-the-counter TENS units and wearable electrical stimulation devices further supports the expansion of this market segment. As healthcare systems globally shift towards more sustainable and patient-centric models, home care is expected to continue growing. With improved access to online resources and e-commerce platforms, consumers are increasingly purchasing these devices directly, bypassing traditional healthcare settings. This shift is likely to accelerate as people seek affordable, long-term solutions for managing pain and other chronic conditions at home.

Wireless Electrical Stimulation Devices Are Fastest Growing Technology Segment Due to Convenience

Among the various technological advancements in electrical stimulation devices, Wireless Electrical Stimulation Devices are experiencing the fastest growth. The convenience and flexibility offered by wireless devices make them highly appealing to consumers who value portability and ease of use. Unlike wired devices, which often require patients to remain stationary during treatment, wireless models allow for greater mobility, enabling patients to use them while going about their daily activities. This capability is particularly beneficial for patients who require ongoing therapy for chronic pain or muscle rehabilitation.

Wireless electrical stimulation devices are also gaining popularity due to their integration with smartphone apps, which allow users to control settings and track progress seamlessly. As consumers become more accustomed to using wearable devices that integrate with their smartphones, the demand for wireless electrical stimulation products is likely to continue its upward trajectory. Furthermore, advancements in battery technology and Bluetooth connectivity have enhanced the performance and appeal of these devices, making them a key driver in the growth of the electrical stimulation devices market.

North America Region Leads in the Market Due to Advanced Healthcare Infrastructure

North America is the largest region in the electrical stimulation devices market, owing to the region's well-established healthcare infrastructure and high levels of healthcare spending. The U.S. dominates this market due to the high prevalence of chronic pain conditions and neurological disorders, which has led to a significant demand for electrical stimulation therapies. Additionally, the increasing adoption of advanced technologies such as wireless and wearable devices has contributed to the growth of the market in this region.

The availability of healthcare insurance, reimbursement programs, and a strong network of healthcare providers who recommend electrical stimulation devices for pain management and rehabilitation also fuels market growth. North America is expected to maintain its leadership position due to continuous innovations, the aging population, and the increasing trend of at-home healthcare solutions. The region's supportive regulatory environment for medical devices further bolsters the adoption of new electrical stimulation technologies.

Leading Companies and Competitive Landscape

The electrical stimulation devices market is highly competitive, with several prominent companies leading the innovation and production of these devices. Medtronic, Boston Scientific, and Abbott Laboratories are among the largest players, leveraging their global presence, strong R&D capabilities, and diverse product portfolios. These companies are focusing on technological innovations, such as the development of wireless, wearable, and portable devices, to stay ahead in the market.

The competitive landscape is characterized by a combination of large multinational companies and smaller, specialized firms offering niche products for specific therapeutic needs. As the market evolves, partnerships, mergers, and acquisitions are expected to continue as key strategies for growth. Companies are also investing in expanding their reach to emerging markets, where rising healthcare awareness and affordability are driving the demand for electrical stimulation devices. With advancements in both technology and patient care models, the competitive dynamics of the market will likely remain fluid, with a strong emphasis on patient-centric solutions.

Recent Developments:

- Medtronic launched its new Intellis™ Spinal Cord Stimulator System for pain management in chronic pain patients, incorporating advanced patient-controlled programming features.

- Boston Scientific completed its acquisition of Baylis Medical, expanding its portfolio in the field of neuromodulation and advancing its electrical stimulation devices offerings.

- Abbott Laboratories received FDA approval for its Proclaim™ XR SCS System, a spinal cord stimulation device designed for pain relief, featuring new programming technology.

- Zynex, Inc. introduced its Zynex NeuroMatrix® device, a non-invasive electrical stimulation device aimed at improving chronic pain relief for patients.

- NeuroMetrix announced the launch of its new Quell® 2.0, a wearable pain relief device using electrical stimulation technology to provide greater comfort and effectiveness for users.

List of Leading Companies:

- Medtronic

- Boston Scientific

- Zynex, Inc.

- Abbott Laboratories

- Cyberonics, Inc. (LivaNova)

- NeuroMetrix

- DJO Global

- Omron Healthcare

- TensCare

- Huntleigh Healthcare

- Pain Management Technologies, Inc.

- RS Medical

- Bioness Inc.

- Empi Inc.

- Katherine H. Jackson & Associates

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 1.7 Billion |

|

Forecasted Value (2030) |

USD 3.4 Billion |

|

CAGR (2024 – 2030) |

10.7% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Electrical Stimulation Devices Market By Product Type (Transcutaneous Electrical Nerve Stimulation (TENS) Devices, Functional Electrical Stimulation (FES) Devices, Neuromuscular Electrical Stimulation (NMES) Devices, Intracavitary Electrical Stimulation Devices, Cranial Electrotherapy Stimulation (CES) Devices), By Application (Pain Management, Muscle Rehabilitation, Neurological Disorders, Cardiovascular Rehabilitation, Aesthetic Applications, Sport Recovery), By End-User Industry (Hospitals, Clinics, Home Care Settings, Rehabilitation Centers, Sports Medicine Centers), By Technology (Wireless Electrical Stimulation Devices, Wired Electrical Stimulation Devices, Wearable Electrical Stimulation Devices) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Medtronic, Boston Scientific, Zynex, Inc., Abbott Laboratories, Cyberonics, Inc. (LivaNova), NeuroMetrix, DJO Global, Omron Healthcare, TensCare, Huntleigh Healthcare, Pain Management Technologies, Inc., RS Medical, Bioness Inc., Empi Inc., Katherine H. Jackson & Associates |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Electrical Stimulation Devices Market, by Product Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Transcutaneous Electrical Nerve Stimulation (TENS) Devices |

|

4.2. Functional Electrical Stimulation (FES) Devices |

|

4.3. Neuromuscular Electrical Stimulation (NMES) Devices |

|

4.4. Intracavitary Electrical Stimulation Devices |

|

4.5. Cranial Electrotherapy Stimulation (CES) Devices |

|

5. Electrical Stimulation Devices Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Pain Management |

|

5.2. Muscle Rehabilitation |

|

5.3. Neurological Disorders |

|

5.4. Cardiovascular Rehabilitation |

|

5.5. Aesthetic Applications |

|

5.6. Sport Recovery |

|

5.7. Others (e.g., PTSD, Sleep Disorders) |

|

6. Electrical Stimulation Devices Market, by End-User (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Hospitals |

|

6.2. Clinics |

|

6.3. Home Care Settings |

|

6.4. Rehabilitation Centers |

|

6.5. Sports Medicine Centers |

|

7. Electrical Stimulation Devices Market, by Technology (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Wireless Electrical Stimulation Devices |

|

7.2. Wired Electrical Stimulation Devices |

|

7.3. Wearable Electrical Stimulation Devices |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Electrical Stimulation Devices Market, by Product Type |

|

8.2.7. North America Electrical Stimulation Devices Market, by Application |

|

8.2.8. North America Electrical Stimulation Devices Market, by End-User |

|

8.2.9. North America Electrical Stimulation Devices Market, by |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Electrical Stimulation Devices Market, by Product Type |

|

8.2.10.1.2. US Electrical Stimulation Devices Market, by Application |

|

8.2.10.1.3. US Electrical Stimulation Devices Market, by End-User |

|

8.2.10.1.4. US Electrical Stimulation Devices Market, by |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Medtronic |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Boston Scientific |

|

10.3. Zynex, Inc. |

|

10.4. Abbott Laboratories |

|

10.5. Cyberonics, Inc. (LivaNova) |

|

10.6. NeuroMetrix |

|

10.7. DJO Global |

|

10.8. Omron Healthcare |

|

10.9. TensCare |

|

10.10. Huntleigh Healthcare |

|

10.11. Pain Management Technologies, Inc. |

|

10.12. RS Medical |

|

10.13. Bioness Inc. |

|

10.14. Empi Inc. |

|

10.15. Katherine H. Jackson & Associates |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Electrical Stimulation Devices Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Electrical Stimulation Devices Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Electrical Stimulation Devices Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA