The Electric Vehicle (EV) Motor Controller Market is experiencing significant growth, driven by the increasing adoption of electric vehicles globally, heightened environmental concerns, and regulatory measures to reduce carbon emissions. Motor controllers play a vital role in the efficient functioning of electric vehicles by regulating the power flow between the battery and the motor, ensuring optimal performance, safety, and energy efficiency.

As per Intent Market Research, the Electric Vehicle Motor Controller Market was valued at USD 5.0 billion in 2023 and will surpass USD 13.3 billion by 2030; growing at a CAGR of 14.8% during 2024 - 2030. This growth is underpinned by advancements in technology and a surge in demand for electric vehicles as countries push towards achieving zero-emission goals.

AC Motor Controllers Segment is Largest Due to Superior Efficiency

The AC Motor Controllers segment holds the largest market share within the Electric Vehicle Motor Controller Market. AC motor controllers are integral for high-performance electric vehicles, as they offer superior efficiency, speed control, and torque regulation. The increased adoption of AC motor controllers is primarily due to their compatibility with various electric vehicles, including passenger vehicles, commercial vehicles, and heavy-duty trucks. Additionally, their ability to enhance energy efficiency and extend the range of electric vehicles makes them the preferred choice among OEMs.

Moreover, technological advancements in AC motor controllers, such as the development of regenerative braking systems and advanced inverter technology, are driving their demand further. These innovations enable electric vehicles to recover energy during braking, reducing energy loss and increasing overall vehicle efficiency. The automotive industry's ongoing push for better performance and efficiency is expected to keep the AC motor controllers segment dominant throughout the forecast period.

Passenger Vehicle Segment is Fastest Growing Due to Increasing Adoption Rates

The Passenger Vehicle segment is the fastest-growing segment within the Electric Vehicle Motor Controller Market. With the increasing availability of electric passenger vehicles from leading manufacturers and the rising consumer awareness of the benefits of electric mobility, this segment is projected to grow significantly during the forecast period. The convenience of owning an electric vehicle, along with the growing infrastructure for charging stations and supportive government subsidies, has accelerated the adoption of electric passenger vehicles globally.

Governments worldwide are implementing stringent emission regulations and offering incentives to promote the shift to electric vehicles. This regulatory environment, coupled with advancements in battery technology that reduce charging time and increase vehicle range, is contributing to the rapid expansion of the passenger vehicle segment. As major automotive companies continue to introduce new models, the demand for efficient and high-performance motor controllers in this segment is expected to surge.

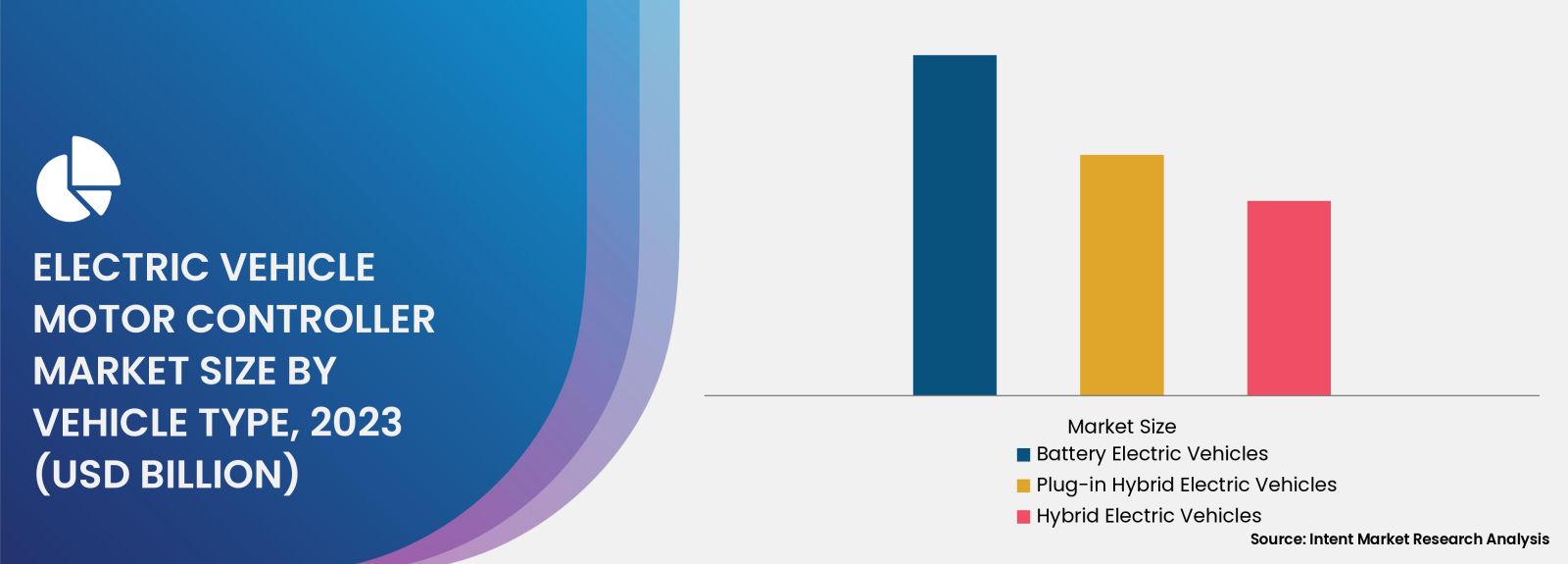

Battery Electric Vehicle (BEV) Segment Leads Due to Zero Emission Mandates

Battery Electric Vehicles (BEVs) dominate the market and are expected to maintain their position as the largest segment. The shift towards zero-emission mobility is a key driver for BEVs, as governments enforce strict emission standards and phase out traditional internal combustion engines. BEVs rely heavily on motor controllers to manage the energy flow between the battery and the motor, ensuring efficient performance and range optimization.

Technological innovations in motor controllers for BEVs, such as enhanced cooling systems and power management solutions, have significantly improved vehicle efficiency and longevity. Furthermore, global automakers are heavily investing in the development of BEV models with improved performance metrics, further driving the demand for advanced motor controllers. As infrastructure for electric mobility, including charging stations, continues to expand, BEVs are set to become the mainstream option, sustaining their leadership in the market.

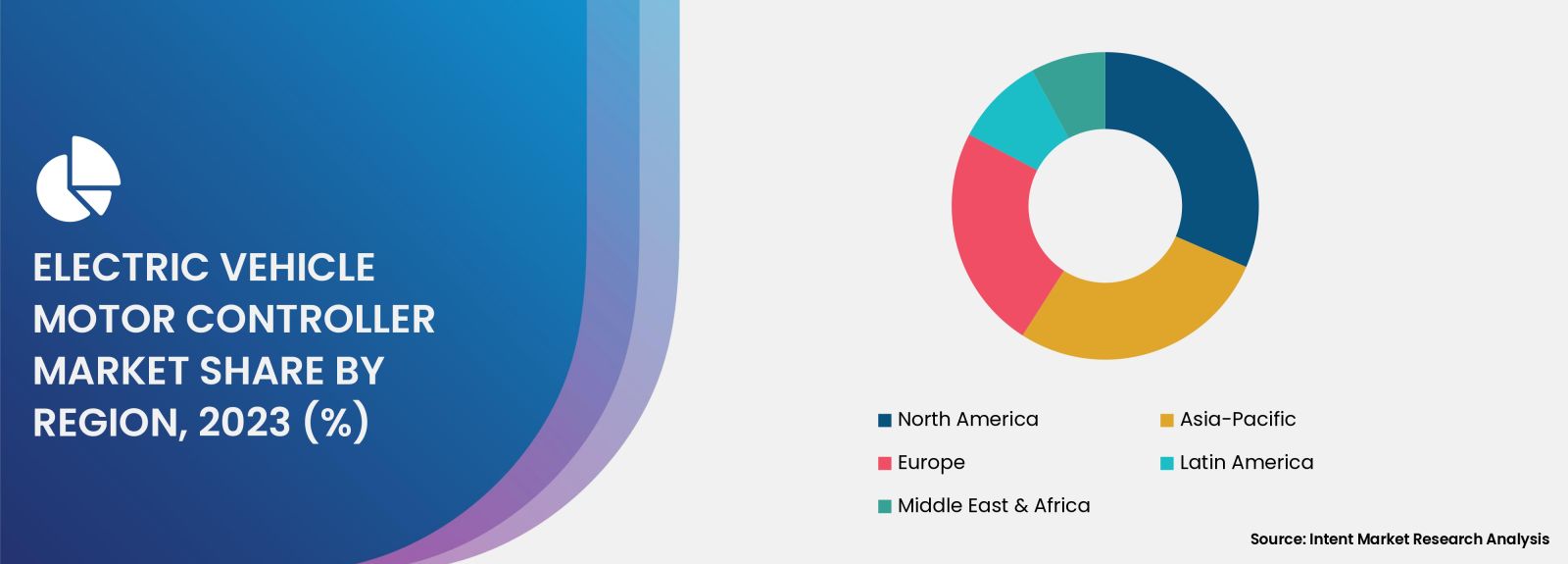

Asia-Pacific Region is Fastest Growing Due to Expanding EV Infrastructure

The Asia-Pacific region is the fastest-growing region in the Electric Vehicle Motor Controller Market, driven by the rapid adoption of electric vehicles in countries like China, Japan, and India. China, in particular, is leading the global electric vehicle market with its extensive production and adoption of electric vehicles, supported by government policies, subsidies, and infrastructural investments. The development of smart cities and expansion of EV charging networks across the region is also bolstering market growth.

Additionally, countries in the Asia-Pacific region are prioritizing environmental sustainability, leading to increased investments in electric vehicle technology and related components. Several local and international manufacturers are expanding their production facilities in the region to cater to the rising demand, making Asia-Pacific a key growth hub for electric vehicle motor controllers. This trend is expected to continue as these nations aim for large-scale electrification of their automotive industries to meet global emission reduction targets.

Inverter-Based Motor Controllers Segment Surges Ahead Due to Technological Advancements

The Inverter-Based Motor Controllers segment is witnessing rapid growth owing to continuous technological advancements and the increasing focus on enhancing the efficiency of electric vehicle systems. These controllers play a crucial role in converting DC from the battery into AC for the motor, ensuring the electric vehicle operates efficiently across various conditions. The development of silicon carbide (SiC) and gallium nitride (GaN) technologies has further improved inverter performance, reducing power loss and enhancing vehicle efficiency.

Automotive manufacturers are increasingly integrating advanced inverter-based motor controllers in their new electric vehicle models to improve power management, reduce energy consumption, and extend driving range. The evolution of these technologies is anticipated to propel the growth of the inverter-based motor controllers segment, making it one of the fastest-growing segments in the market.

The report focuses on estimating the current market potential in terms of the total addressable market for all the segments, sub-segments, and regions. In the process, all the high-growth and upcoming technologies were identified and analyzed to measure their impact on the current and future market. The report also identifies the key stakeholders, their business gaps, and their purchasing behavior. This information is essential for developing effective marketing strategies and creating products or services that meet the needs of the target market. The report also covers a detailed analysis of the competitive landscape which includes major players, their recent developments, growth strategies, product benchmarking, and manufacturing operations among others. Also, brief insights on start-up ecosystem and emerging companies is also included as part of this report.

Leading Companies and Competitive Landscape

The Electric Vehicle Motor Controller Market is characterized by intense competition, with leading companies like Bosch, Siemens, Nidec Corporation, Denso Corporation, and Mitsubishi Electric holding substantial market shares. These companies focus on developing advanced motor controller solutions and investing heavily in R&D to stay competitive. Collaborations, partnerships, and strategic acquisitions are common strategies employed by these players to enhance their market position.

New entrants and regional players are also gaining traction by offering cost-effective and innovative solutions, intensifying the competition further. As the market evolves, companies are expected to emphasize innovation and sustainability to capture a larger share of the rapidly growing market. The competitive landscape remains dynamic, with continuous technological advancements and product launches shaping the future of the Electric Vehicle Motor Controller Market.

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 5.0 billion |

|

Forecasted Value (2030) |

USD 13.3 billion |

|

CAGR (2024 – 2030) |

14.8% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Electric Vehicle Motor Controller Market By Product Type (AC Permanent Magnet Synchronous Motor Controller, AC Asynchronous Motor Controller, DC Motor Controller), By Power Output (1-20 kW, 21-40 kW, 41-80 kW, Above 80 kW), By Vehicle Type (Battery Electric Vehicles, Plug-in Hybrid Electric Vehicles, Hybrid Electric Vehicles) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3.Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Electric Vehicle Motor Controller Market, by Product Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. AC Permanent Magnet Synchronous Motor Controller |

|

4.2. AC Asynchronous Motor Controller |

|

4.3. DC Motor Controller |

|

5. Electric Vehicle Motor Controller Market, by Power Output (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. 1-20 kW |

|

5.2. 21-40 kW |

|

5.3. 41-80 kW |

|

5.4. Above 80 kW |

|

6. Electric Vehicle Motor Controller Market, by Vehicle Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Battery Electric Vehicles |

|

6.2. Plug-in Hybrid Electric Vehicles |

|

6.3. Hybrid Electric Vehicles |

|

6.4. Others |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Electric Vehicle Motor Controller Market, by Product Type |

|

7.2.7. North America Electric Vehicle Motor Controller Market, by Power Output |

|

7.2.8. North America Electric Vehicle Motor Controller Market, by Vehicle Type |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Electric Vehicle Motor Controller Market, by Product Type |

|

7.2.9.1.2. US Electric Vehicle Motor Controller Market, by Power Output |

|

7.2.9.1.3. US Electric Vehicle Motor Controller Market, by Vehicle Type |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. BYD Motors Inc. |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Continental AG |

|

9.3. Delphi Technologies |

|

9.4. DENSO WAVE INCORPORATED |

|

9.5. Infineon Technologies AG |

|

9.6. Mitsubishi Electric |

|

9.7. Nidec Motor Corporation |

|

9.8. Robert Bosch GmbH |

|

9.9. Siemens |

|

9.10. ZF Friedrichshafen AG |

|

9.11. Verizon |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Electric Vehicle Motor Controller Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Electric Vehicle Motor Controller Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the Electric Vehicle Motor Controller ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Electric Vehicle Motor Controller Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA