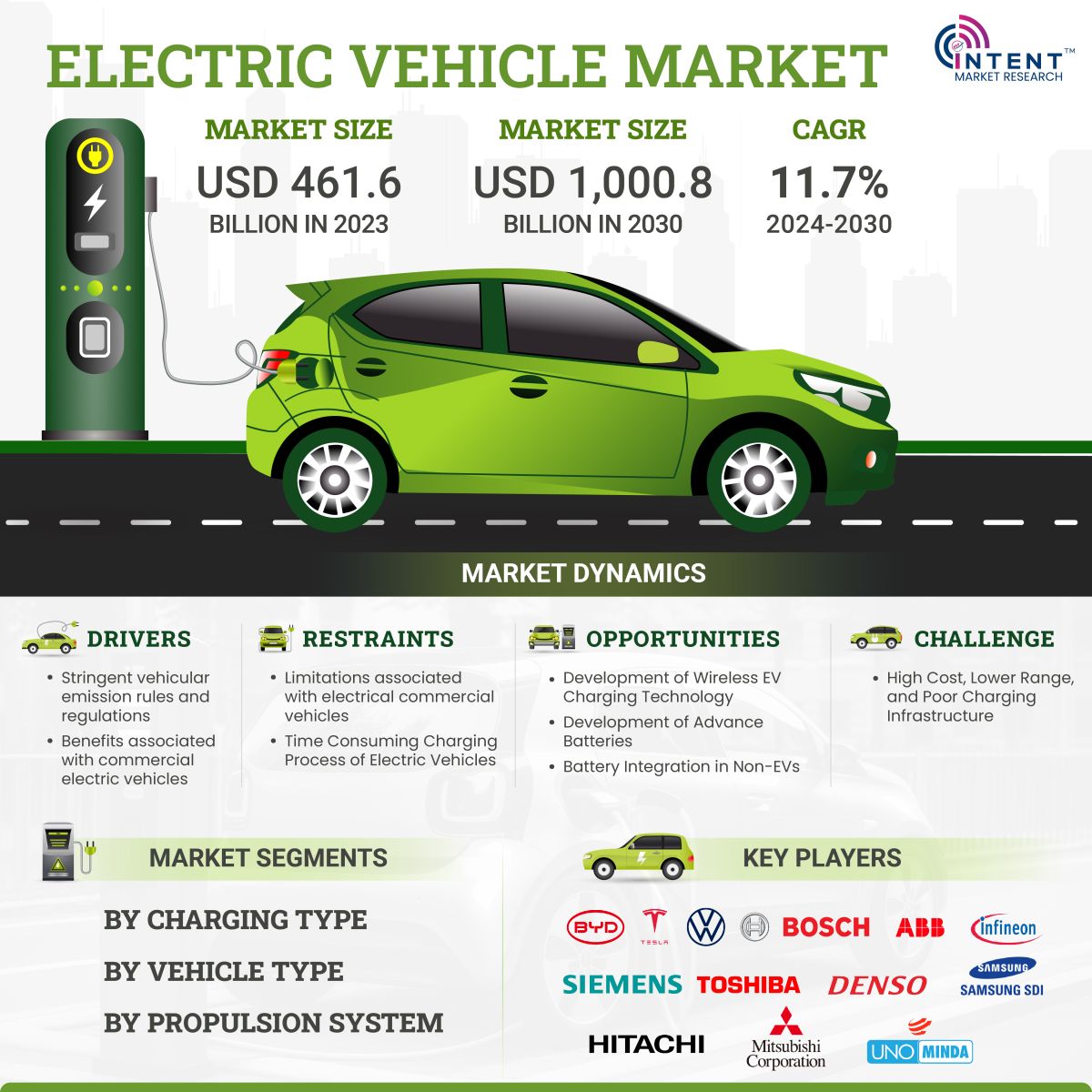

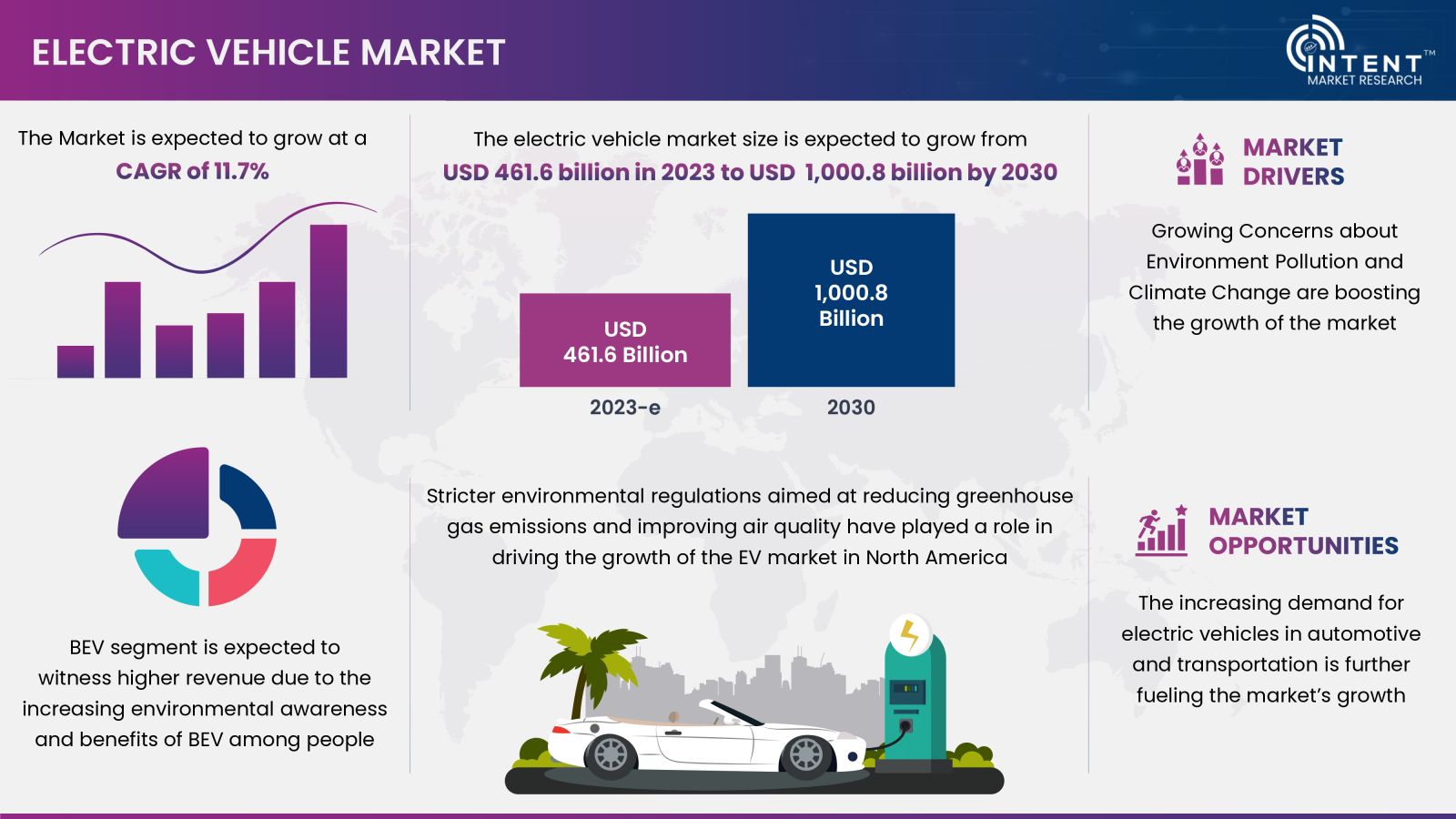

According to Intent Market Research, the Electric Vehicle Market is expected to grow from USD 461.6 billion in 2023-e at a CAGR of 11.7% to touch USD 1,000.8 billion by 2030. Prominent players include BYD, Tesla, Volkswagen, Bosch, ABB, Infineon Technologies, Siemens, Toshiba, Denso, Samsung SDI, Hitachi, Mitsubishi Corporation, Minda, amongst others.

The key factors contributing to the growth of the electric vehicle market during the forecast period include new technological advancements such as low CO2 emissions and maintenance, smooth driving, and reduced engine noise. Demand for electric vehicles is rapidly increasing as they are fuel efficient, high-performance, and low-emission vehicles. Strict government rules and regulations regarding vehicle emissions and reduced cost of electric vehicles are significantly boosting the market growth.

Click here to: Get FREE Sample Pages of this Report

An electric vehicle (EV) is a vehicle that is powered by one or more electric motors and stores its energy in rechargeable batteries or another energy storage device. EVs come in a variety of forms, including all-electric vehicles (AEVs), which run entirely on electricity, and plug-in hybrid electric vehicles (PHEVs), which combine an electric motor with an internal combustion engine and can be charged using an external power source.

Electric Vehicle (EV) Market Dynamics

Stringent Vehicular Emission Rules and Regulations are Fostering Market Growth

There are several laws and regulations set up by the government across the globe in countries to monitor vehicular emissions. The countries have adopted strict versions of European and United Nations Economic Commission for Europe (UNECE) emission regulations. These rules and regulations that had been made to control the emission in the environment would likely to drive the demand for electric vehicles. Even some countries have adopted more than advanced regulations based on the most recent version of European and U.S. regulations. These factors are expected to promote the EVs market growth over the projected timeframe.

Electric and hybrid electric buses are becoming increasingly popular among global bus manufacturers, replacing diesel buses. Benefits such as thermal comfort and noise reduction will further strengthen the automotive electric bus market. Electric buses and hybrid electric buses reduce the effects of solar heat inside the vehicle and filter out nuisance noises such as car horns and construction sounds.

Limitations Associated with Electrical Commercial Vehicles are Hindering the Market Growth

Electric vehicles have certain limitations such as lower range, limited charging infrastructure, and restrictions on the availability of the vehicle to the purchaser. Currently, the average range of electric vehicles is approximately 100km, but the target range is approximately 200km. High ambient temperatures, especially in the afternoon, further reduced the range per charge to 85 -90km. Currently, there are limited products available on the market and buyers don't have many options to choose from which will further restrict the market growth.

Electric Vehicle Segment Insights

Increasing Adoption of Technologies Such as RFID & NFC in Highway Charging Stations are Propelling the Supercharging Segment Growth

Integration of highway charging stations with RFID and NFC technology, provide electric vehicle (EV) drivers with a more user-friendly experience. These technologies simplify the authentication and payment process, making it easier for electric vehicle owners to access charging services on the go.

Overall, integrating RFID and NFC technology into highway charging stations is critical to not only improving operational efficiency and user experience, but also accelerating electric vehicle adoption and promoting sustainable transportation solutions. As a result, the market in the supercharger sector is experiencing significant growth due to these technological advancements.

%20Market_page-0003.jpg)

The Increasing Acceptance and Adoption of Passenger Vehicles as a Mainstream Transportation Option is Contributing to the Market Growth

The passenger cars segment has registered the fastest-growing segment during the forecast period due to the rapidly increasing sales of electric cars across the globe. Many governments worldwide offer incentives, subsidies, and tax breaks to promote the adoption of electric vehicles. These incentives make EVs more affordable and attractive to consumers, thereby fueling market growth. Overall, the passenger electric cars segment`s rapid growth during the forecast period reflects a broader shift towards sustainable mobility and underscores the increasing acceptance and adoption of electric vehicles as a mainstream transportation option.

Advances in a BEV is Thriving the Electric Vehicle Market Growth

Advances in battery technology are leading to increased driving ranges and reduced charging times for BEVs, addressing key concerns such as range anxiety. Furthermore, the expansion of charging infrastructure, including the deployment of fast-charging stations, is enhancing the practicality and convenience of owning a BEV. Advances in battery technology are leading to increased driving ranges and reduced charging times for BEVs, addressing key concerns such as range anxiety. Furthermore, the expansion of charging infrastructure, including the deployment of fast-charging stations, is enhancing the practicality and convenience of owning a BEV.

Regional Insights

Stricter Environmental Regulations are Contributing to the North American Electric Vehicle Market Growth

Federal, state, and local governments in North America have introduced a variety of policies and incentives to encourage the adoption of electric vehicles. These measures include financial incentives, tax credits, subsidies and rebates for purchasing electric vehicles or installing charging infrastructure. Government support has reduced the cost of purchasing electric vehicles and encouraged consumers and businesses to switch to electric vehicles. Stricter environmental regulations to reduce greenhouse gas emissions and improve air quality are contributing to the North American market growth.

In the United States, three-quarters of all oil consumption comes from the transportation sector. PHEVs and EVs are flexible when it comes to fueling. The production and consumption curves of electric vehicles show a significant increase in last few years. Increasing attention and efforts of multinational brands such as Ford and Tesla, low operating costs, favorable norms and policies of state and local governments are the key factors driving electric truck market growth in the country.

Competitive Landscape

Product Expansion are the Major Strategy Adopted by the Key Market Players

Key players operating in global electric vehicle (EV) market include BYD, Tesla, BMW, Mercedes, Volvo, Nissan, Tata Motors, Hyundai, General Motors, Stellantis, Ford, Jeep, and Chevrolet. To further enhance their market share, these companies employ various strategies, including partnerships, mergers and acquisitions, license agreements, joint ventures, and new product launches.

Get your custom research report today

EV Market Coverage

The report provides key insights into the electric vehicle market, and it focuses on technological developments, trends, and initiatives taken by the government. This sector analysis delves into market drivers, restraints, opportunities, and other pertinent factors, examining key players and the competitive landscape in the electric vehicle (ev) market.

%20Market_page-0002.jpg)

Report Scope

|

Report Features |

Description |

|

Market Value (2023-e) |

USD 461.6 billion |

|

Forecast Revenue (2030) |

USD 1,000.8 billion |

|

CAGR (2024-2030) |

11.7% |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024-2030 |

|

Report Coverage |

Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Electric Vehicle Market by Charging Type (Normal Charging, Super Charging), By Vehicle Type (Passenger vehicle, Commercial vehicle and Two-Wheeler), by Propulsion Type (Battery electric, Plug-in Hybrid Electric, Hybrid Electric, Fuel Cell Electric), by Electric Truck, By Electric Bus, By Electric Wire Harness, Electric Vehicle Component |

|

Regional Analysis |

North America (US, Canada), Europe (Germany, France, UK, Italy,), Asia-Pacific (China, Japan, South Korea, India), Latin America (Brazil, Mexico, Argentina), Middle East and Africa (Saudi Arabia, South Africa, United Arab Emirates) |

|

Competitive Landscape |

BYD, Tesla, Volkswagen, Bosch, ABB, Infineon Technologies, Siemens, Toshiba, Denso, Samsung SDI, Hitachi, Mitsubishi Corporation, Minda |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

|

Purchase Options |

We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) |

|

1.Introduction |

|

1.1. Key Research Objectives |

|

1.2.Market Definition |

|

1.3.Report Scope |

|

1.4.Currency & Conversion |

|

2.Research Methodology |

|

2.1.Market Size Estimation & Data Triangulation |

|

2.2.Key Sources |

|

2.3.Research Assumptions & Limitations |

|

3.Executive Summary |

|

4.Electric Vehicle (EV) Market Premium Insights |

|

4.1.Upcoming Electric Vehicle Models |

|

4.2.Electric Vehicles Initiatives |

|

4.3.Trends and developments in EV markets |

|

4.4.Regulatory Framework |

|

4.5.Patent Analysis |

|

4.6.Electric Vehicle market: swot analysis |

|

4.7.Pricing Analysis |

|

4.8.Technology Analysis |

|

5.Global Electric Vehicle Market Overview |

|

5.1.Global Electric Vehicle (EV) Market, by Charging Type (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

5.1.1.Normal Charging |

|

5.1.2.Super Charging |

|

5.2.Global Electric Vehicle (EV) Market, by Vehicle Type (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

5.2.1.Passenger Electric Vehicle |

|

5.2.2.Commercial Electric Vehicle |

|

5.2.3.Two Wheelers |

|

5.3.Global Electric Vehicle (EV) Market, by Propulsion System (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

5.3.1.Battery Electric Propulsion System |

|

5.3.2.Plug-in Hybrid Electric Vehicle |

|

5.3.3.Hybrid Electric Vehicle |

|

5.3.4.Fuel Cell Electric Vehicle |

|

5.4.Market Overview of Electric Vehicle (EV) Market |

|

5.4.1.Growth Drivers |

|

5.4.1.1.Stringent vehicular emission rules and regulations |

|

5.4.1.2.Benefits associated with commercial electric vehicles |

|

5.4.1.3.Better development and cost reductions |

|

5.4.1.4.Increase in production and sales of automobile |

|

5.4.2.Growth Restraints |

|

5.4.2.1.Limitations associated with electric commercial vehicles |

|

5.4.2.2.Recharging time for electric vehicles batteries |

|

5.4.3.Market Opportunities |

|

5.4.3.1.Rising integration of IT solutions for electric cars |

|

5.4.3.2.Growing electric vehicle penetration in the market |

|

5.4.4.Market Challenges |

|

5.4.4.1.Cost, range, infrastructure are the biggest challenges for the EV market |

|

5.5.Regional Analysis (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

5.5.1.Regional Overview |

|

5.5.1.1.North America |

|

5.5.1.1.1.Regional Trends & Growth Drivers |

|

5.5.1.1.2.Barriers & Challenges |

|

5.5.1.1.3.Opportunities |

|

5.5.1.1.4.Factor Impact Analysis |

|

5.5.1.1.5.Technology Trends |

|

5.5.1.1.6.North America Electric Vehicle (EV) Market, by Charging Type |

|

5.5.1.1.7.North America Electric Vehicle (EV) Market, by Vehicle Type |

|

5.5.1.1.8.North America Electric Vehicle (EV) Market, by Propulsion System |

|

*Similar segmentation will be provided at each regional level |

|

5.5.2.By Country |

|

5.5.2.1.US |

|

5.5.2.1.1.US Electric Vehicle (EV) Market, by Charging Type |

|

5.5.2.1.2.US Electric Vehicle (EV) Market, by Vehicle Type |

|

5.5.2.1.3.US Electric Vehicle (EV) Market, by Propulsion System |

|

5.5.2.2.Canada |

|

*Similar segmentation will be provided at each country level |

|

5.5.1.2.Europe |

|

5.5.1.3.APAC |

|

5.5.1.4.Latin America |

|

5.5.1.5.Middle East & Africa |

|

6.Global Electric Truck Market Overview |

|

6.1.Global Electric Truck Market, by Vehicle Type (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

6.1.1.Light-Duty Electric Truck |

|

6.1.2.Medium-Duty Trucks |

|

6.1.3.Heavy-Duty Trucks |

|

6.1.4.Super Charging |

|

6.2.Global Electric Truck Market, by Range (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

6.2.1.0-150 Miles |

|

6.2.2.151-250 Miles |

|

6.2.3.Above 250 Miles |

|

6.3.Global Electric Truck Market, by Range (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

6.3.1. Battery Electric |

|

6.3.2. Plug-in Hybrid Electric |

|

6.3.3.Hybrid Electric |

|

6.3.4.Fuel Cell Electric |

|

6.4.Market Overview of Electric Truck Market |

|

6.4.1.Growth Drivers |

|

6.4.1.1.Fuel efficient and low maintenance costs |

|

6.4.1.2.Rise of demand in logistic sector |

|

6.4.2.Growth Restraints |

|

6.4.2.1.Lack of trained staff for operational purposes |

|

6.4.2.2.Lack of charging infrastructure in many countries |

|

6.4.3.Market Opportunity |

|

6.4.3.1.Rising pressure from several governments on vehicle manufacturers to reduce carbon emissions |

|

6.4.3.2.Growing investments for electric trucks |

|

6.4.4.Market Challenges |

|

6.4.4.1.High prices of electric trucks and short battery life span |

|

6.5.Regional Analysis (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

6.5.1.Regional Overview |

|

6.5.1.1.North America |

|

6.5.1.1.1.Regional Trends & Growth Drivers |

|

6.5.1.1.2.Barriers & Challenges |

|

6.5.1.1.3.Opportunities |

|

6.5.1.1.4.Factor Impact Analysis |

|

6.5.1.1.5.Technology Trends |

|

6.5.1.1.6.North America Electric Truck Market, by Vehicle Type |

|

6.5.1.1.7.North America Electric Truck Market, by Range |

|

*Similar segmentation will be provided at each regional level |

|

6.5.2.By Country |

|

6.5.2.1.US |

|

6.5.2.1.1.US Electric Truck Market, by Vehicle Type |

|

6.5.2.1.2.US Electric Truck Market, by Range |

|

6.5.2.2.Canada |

|

*Similar segmentation will be provided at each country level |

|

6.5.1.2.Europe |

|

6.5.1.3.APAC |

|

6.5.1.4.Latin America |

|

6.5.1.5.Middle East & Africa |

|

7.Global Electric Bus Market Overview |

|

7.1.Global Electric Bus Market, by Application (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

7.1.1.Intercity |

|

7.1.2.Intracity |

|

7.2.Global Electric Bus Market, by Consumer Segments (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

7.2.1.Fleet Operators |

|

7.2.2.Government |

|

7.3.Global Electric Bus Market, by Propulsion (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

7.3.1.Battery Electric |

|

7.3.2.Plug-in Hybrid Electric |

|

7.3.3.Hybrid Electric |

|

7.3.4.Fuel Cell Electric |

|

7.4.Global Electric Bus Market, by Range (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

7.4.1.0-150 Miles |

|

7.4.2.151-300 Miles |

|

7.4.3.300 Miles Above |

|

7.5.Global Electric Bus Market, by Length of Bus (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

7.5.1.Less than 9 Meters |

|

7.5.2.9-14 Meters |

|

7.5.3.300 Miles Above |

|

7.6.Global Electric Bus Market, by Battery Capacity (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

7.6.1.Less Than 50 KWH |

|

7.6.2.50 to 250 KWH |

|

7.6.3.Above 250 KWH |

|

7.7.Global Electric Bus Market, by Power Output (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

7.7.1.Less Than 100 kWh |

|

7.7.2.100-250 kWh |

|

7.7.3.Above 250 kWh |

|

7.8.Global Electric Bus Market, by Component (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

7.8.1.Motor |

|

7.8.2.Battery |

|

7.8.3.Fuel Cells Stack |

|

7.8.4.Ultra Capacitor |

|

7.8.3.Others |

|

7.9.Market Overview of Electric Bus Market |

|

7.9.1.Growth Drivers |

|

7.9.1.1.Strong government support for the electric mass transit solutions |

|

7.9.1.2.Increasing demand for energy efficient and hydrogen fuel cell-based public transport |

|

7.9.2.Growth Restraints |

|

7.9.2.1.Higher weight and high procurement costs of electric buses |

|

7.9.2.2.Real-time energy system monitoring |

|

7.9.3.Market Opportunity |

|

7.9.3.1.Reducing the energy consumption of electric buses with design choices and predictive driving |

|

7.9.3.2.Growing initiatives for electric buses as it helps in curbing vehicular emissions |

|

7.9.4.Market Challenges |

|

7.9.4.1.Charging infrastructure |

|

7.10.Regional Analysis (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

7.10.1.Regional Overview |

|

7.10.1.1.North America |

|

7.10.1.1.1.Regional Trends & Growth Drivers |

|

7.10.1.1.2.Barriers & Challenges |

|

7.10.1.1.3.Opportunities |

|

7.10.1.1.4.Factor Impact Analysis |

|

7.10.1.1.5.Technology Trends |

|

7.10.1.1.6.North America Electric Bus Market, by Application |

|

7.10.1.1.7.North America Electric Bus Market, by Consumer Segment |

|

7.10.1.1.8.North America Electric Bus Market, by Propulsion |

|

7.10.1.1.9.North America Electric Bus Market, by Range |

|

7.10.1.1.10.North America Electric Bus Market, by Length of Bus |

|

7.10.1.1.11.North America Electric Bus Market, by Battery Capacity |

|

7.10.1.1.12.North America Electric Bus Market, by Power Output |

|

7.10.1.1.13.North America Electric Bus Market, by Component |

|

*Similar segmentation will be provided at each regional level |

|

7.10.2.By Country |

|

7.10.2.1.US |

|

7.10.2.1.1.US Electric Bus Market, by Application |

|

7.10.2.1.2.US Electric Bus Market, by Consumer Segment |

|

7.10.2.1.3.US Electric Bus Market, by Propulsion |

|

7.10.2.1.4.US Electric Bus Market, by Range |

|

7.10.2.1.5.US Electric Bus Market, by Length of Bus |

|

7.10.2.1.6.US Electric Bus Market, by Battery Capacity |

|

7.10.2.1.7.US Electric Bus Market, by Power Output |

|

7.10.2.1.8.US Electric Bus Market, by Component |

|

7.10.2.2.Canada |

|

*Similar segmentation will be provided at each country level |

|

7.10.1.2.Europe |

|

7.10.1.3.APAC |

|

7.10.1.4.Latin America |

|

7.10.1.5.Middle East & Africa |

|

8.Global Electric Wire Harness Market Overview |

|

8.1.Global Electric Wire Harness Market, by Voltage (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

8.1.1.Low Voltage Wiring Harness |

|

8.1.2.Medium Voltage Wiring Harness |

|

8.1.3.High Voltage Wiring Harness |

|

8.2.Global Electric Wire Harness Market, by Component (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

8.2.1.Electric Wires |

|

8.2.2.Connectors |

|

8.2.3.Terminals |

|

8.2.4.Clamps |

|

8.2.5.Tape |

|

8.2.6.Convoluted Tube |

|

8.2.7.Others |

|

8.3.Global Electric Wire Harness Market, by Material Type (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

8.2.1.Aluminium Alloy Wire |

|

8.2.2.Copper-Clad Aluminum Wire |

|

8.2.3.Others |

|

8.4.Global Electric Wire Harness Market, by Propulsion Type (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

8.4.1.BEV |

|

8.4.2.HEV |

|

8.4.3.PHEV |

|

8.4.4.FCBEV |

|

8.5.Global Electric Wire Harness Market, by Vehicle Type (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

8.5.1.Light Vehicle |

|

8.5.2.Medium Vehicle |

|

8.5.3.Heavy Vehicle |

|

8.6.Global Electric Wire Harness Market, by Application (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

8.6.1.Body and Lighting |

|

8.6.2.Engine |

|

8.6.3.Chassis |

|

8.6.4.Dashboard/Cabin |

|

8.6.5.HVAC |

|

8.6.6.Seat |

|

8.6.7.Battery |

|

8.6.8.Door |

|

8.7.Market Overview of Electric Wire Harness Market |

|

8.6.1.Growth Drivers |

|

8.7.1.1.Increasing demand and usage of electric vehicles |

|

8.7.1.2.Growing emphasis on safety solutions |

|

8.7.2.Growth Restraints |

|

8.7.2.1.Lack of advanced technology for electric wire harness |

|

8.7.2.2.Fluctuations in copper prices can hamper the wire harness market |

|

8.7.3.Market Opportunities |

|

8.7.3.1.Increase in use of speed sensors wiring harness |

|

8.7.4.Market Challenge |

|

8.7.4.1.Use of low quality material and incompatible components |

|

8.8.Regional Analysis (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

8.8.1.Regional Overview |

|

8.8.1.1.North America |

|

8.8.1.1.1.Regional Trends & Growth Drivers |

|

8.8.1.1.2.Barriers & Challenges |

|

8.8.1.1.3.Opportunities |

|

8.8.1.1.4.Factor Impact Analysis |

|

8.8.1.1.5.Technology Trends |

|

8.8.1.1.6.North America Electric Wire Harness Market, by Voltage |

|

8.8.1.1.7.North America Electric Wire Harness Market, by Component |

|

8.8.1.1.8.North America Electric Wire Harness Market, by Material Type |

|

8.8.1.1.9.North America Electric Wire Harness Market, by Propulsion Type |

|

8.8.1.1.10.North America Electric Wire Harness Market, by Vehicle Type |

|

8.8.1.1.11.North America Electric Wire Harness Market, by Application |

|

*Similar segmentation will be provided at each regional level |

|

8.8.2.By Country |

|

8.8.2.1.US |

|

8.8.2.1.1.US Electric Wire Harness Market, by Voltage |

|

8.8.2.1.2.US Electric Wire Harness Market, by Component |

|

8.8.2.1.3.US Electric Wire Harness Market, by Material Type |

|

8.8.2.1.4.US Electric Wire Harness Market, by Propulsion Type |

|

8.8.2.1.5.US Electric Wire Harness Market, by Vehicle Type |

|

8.8.2.1.6.US Electric Wire Harness Market, by Application |

|

8.8.2.2.Canada |

|

*Similar segmentation will be provided at each country level |

|

8.8.1.2.Europe |

|

8.8.1.3.APAC |

|

8.8.1.4.Latin America |

|

8.8.1.5.Middle East & Africa |

|

9.Global Electric Vehicle Component Market Overview |

|

9.1.Global Electric Vehicle Component Market, by Type (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

9.1.1.Battery Modules And Packs |

|

9.1.2.Vehicle Body |

|

9.1.3.Chassis |

|

9.1.4.Drivetrain |

|

9.1.5.Power Distribution Modules (PDM) |

|

9.1.6.High-voltage Cable |

|

9.1.7.Electric Brakes |

|

9.1.8.Monitoring Displays |

|

9.1.9.Thermal Management |

|

9.1.10.Others |

|

9.2.Global Electric Vehicle Component Market, by Vehicle Type (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

9.2.1.Battery electric vehicle (BEV) |

|

9.2.2.Plug-in Hybrid Electric Vehicle (PHEV) |

|

9.3.Global Electric Vehicle Component Market, by Application (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

9.3.1.Electric Car |

|

9.3.2.Electric Bus |

|

9.3.3.Electric Scooter and Motorcycle |

|

9.3.4.Electric Three-wheeler |

|

9.3.5.Electric Fleet Utility |

|

9.3.6.Electric Truck |

|

9.4.Global Electric Vehicle Component Market, by Sales Channel (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

9.4.1.Original Equipment Manufacturer (OEM) |

|

9.4.2.Aftermarket |

|

9.5.Market Overview of Electric Vehicle Component Market |

|

9.5.1.Growth Drivers |

|

9.5.1.1.Increased efficiency of electric vehicles through high voltage cables |

|

9.5.1.2.Thermal management of electric vehicle components |

|

9.5.1.3.Rise in affordable prices and improved safety features |

|

9.5.2.Growth Restraints |

|

9.5.2.1.Lack of charging infrastructure of electric vehicles |

|

9.5.2.2.High R&D costs related to development of electric vehicle components |

|

9.5.3.Market Opportunity |

|

9.5.3.1.Reducing price pressures and adaptability of high-quality components |

|

9.5.3.2.Growing demand of electronic brake components |

|

9.5.4.Market Challenges |

|

9.5.4.1.Challenges of thermal management in electric vehicles |

|

9.6.Regional Analysis (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

9.6.1.Regional Overview |

|

9.6.1.1.North America |

|

9.6.1.1.1.Regional Trends & Growth Drivers |

|

9.6.1.1.2.Barriers & Challenges |

|

9.6.1.1.3.Opportunities |

|

9.6.1.1.4.Factor Impact Analysis |

|

9.6.1.1.5.Technology Trends |

|

9.6.1.1.6.North America Electric Vehicle Component Market, by Application |

|

9.6.1.1.7.North America Electric Vehicle Component Market, by Sales Channel |

|

*Similar segmentation will be provided at each regional level |

|

9.6.2.By Country |

|

9.6.2.1.US |

|

9.6.2.1.1.US Electric Vehicle Component Market, by Application |

|

9.6.2.1.2.US Electric Vehicle Component Market, by Sale Channel |

|

9.6.2.2.Canada |

|

*Similar segmentation will be provided at each country level |

|

9.6.1.2.Europe |

|

9.6.1.3.APAC |

|

9.6.1.4.Latin America |

|

9.6.1.5.Middle East & Africa |

|

10.Competitive Landscape |

|

10.1.Introduction |

|

10.2.Company Market Share Analysis |

|

10.3.Company Benchmarking Matrix |

|

10.3.1.By Vehicle Type |

|

10.3.2.By Operating Parameters |

|

11.Company Profiles |

|

11.1.Manufacturers of EVs |

|

11.1.1.Tesla |

|

11.1.1.1.Company Overview |

|

11.1.1.2.Company Financials |

|

11.1.1.3.Product/Service Portfolio |

|

11.1.1.4.Recent Developments |

|

11.1.1.5.IMR Analysis |

|

*Similar information will be provided for other companies |

|

11.2.BYD |

|

11.3.Volkswagen |

|

11.2.Manufacturers of Battery & Components |

|

11.2.1.Bosch |

|

11.2.2.Siemens |

|

11.2.3.Infineon Technologies |

|

11.2.4.Nidec Corporation |

|

11.2.5.Schneider Electric |

|

11.2.6.ABB |

|

11.2.7.Toshiba |

|

11.2.8.Denso Corporation |

|

11.2.9.Motherson Sumi Systems |

|

11.2.10.Magna International |

|

11.2.11.Samsung SDI |

|

11.2.12.Hitachi |

|

11.2.13.OptimumNano Energy |

|

11.2.14.Contemporary Amperex Technology Co. (CATL) |

|

11.2.15.Mitsubishi Corporation |

|

11.2.16.Minda Corporation |

|

12.Appendix |

Intent Market Research employs a rigorous methodology to minimize residual errors by carefully defining the scope, validating findings through primary research, and consistently updating our in-house database. This dynamic approach allows us to capture ongoing market fluctuations and adapt to evolving market uncertainties.

The research factors used in our methodology vary depending on the specific market being analysed. To begin with, we incorporate both demand and supply side information into our model to identify and address market gaps. Additionally, we also employ approaches such as Macro-Indicator Analysis, Factor Analysis, Value Chain-Based Sizing, and forecasting to further increase the accuracy of the numbers and validate the findings.

Research Approach

%20Market_page-0005.jpg)

- Secondary Research Approach: During the initial phase of the research process, we acquire and accumulate extensive data continuously. This data is carefully filtered and validated through a variety of secondary sources.

- Primary Research Approach: Following the consolidation of data gathered through secondary research, we initiate a validation process to verify all the market numbers, and assumptions and validate the findings by engaging with subject matter experts.

Data Collection, Analysis and Interpretation:

%20Market_page-0004.jpg)

Research Methodology

Our market research methodology utilizes both top-down and bottom-up approaches to segment and estimate quantitative aspects of the market. We also employ multi-perspective analysis, examining the market from distinct viewpoints.

%20Market_page-0006.jpg)