As per Intent Market Research, the Electric Dental Handpiece Market was valued at USD 1.5 Billion in 2024-e and will surpass USD 2.8 Billion by 2030; growing at a CAGR of 9.7% during 2025-2030.

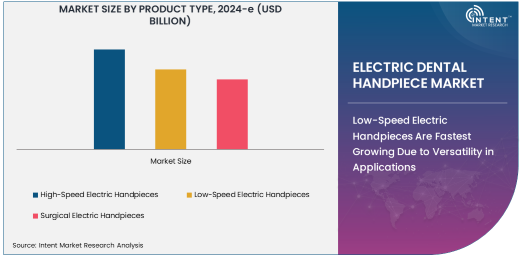

The Electric Dental Handpiece market has experienced significant growth driven by technological advancements in dentistry, with high-speed electric handpieces emerging as the largest subsegment. High-speed handpieces are pivotal in restorative dentistry, which requires precision and rapid operation to perform procedures like cavity preparation, crown and bridge placement, and more. These handpieces are designed to cut through tough dental materials with minimal vibration and heat generation, improving both the speed and quality of treatments. The high-speed electric handpieces are equipped with advanced motor technology that provides reliable and consistent performance, making them the tool of choice for dental professionals globally.

The growing demand for efficient and precise dental treatments is primarily fueled by rising awareness of oral hygiene and an increase in dental procedures. High-speed handpieces play a critical role in achieving high standards of patient care, making them a vital component in dental clinics. As restorative dentistry continues to grow, driven by aging populations and an increased focus on aesthetic dental procedures, the demand for high-speed electric handpieces is anticipated to maintain its upward trajectory, securing its position as the largest subsegment in the market.

Low-Speed Electric Handpieces Are Fastest Growing Due to Versatility in Applications

Low-speed electric handpieces represent one of the fastest-growing segments within the Electric Dental Handpiece market. These handpieces are particularly useful in procedures that involve polishing, finishing, and prophylaxis in dental clinics and hospitals. Low-speed electric handpieces allow for precise control over torque, making them ideal for tasks like cleaning, shaping, and smoothing surfaces in restorative dentistry, periodontics, and endodontics. This segment's rapid growth can be attributed to an increasing focus on non-invasive dental procedures and the enhanced patient comfort provided by these tools.

The versatility and cost-effectiveness of low-speed electric handpieces are contributing factors to their expansion. These devices not only provide reliable performance for general dental treatments but also enable specialized procedures in periodontal care and root canal treatments. As the market for dental treatments continues to grow, particularly in emerging economies, the demand for low-speed handpieces is expected to increase, further propelling their growth as the fastest-growing subsegment in the electric dental handpiece market.

Dental Clinics Are Largest End-User Industry Driven by Rising Demand for Oral Health Care

In the Electric Dental Handpiece market, dental clinics are the largest end-user industry. As the primary setting for dental treatments, clinics consistently demand high-quality tools that provide both efficiency and precision. Electric dental handpieces, particularly high-speed models, are essential in performing a wide range of procedures, including fillings, crowns, and root canals. These handpieces offer improved durability, precision, and speed, making them indispensable in dental clinics where patient satisfaction and treatment efficiency are of utmost importance.

The increasing number of dental visits globally, fueled by growing awareness of oral hygiene and advancements in dental treatments, has led to a surge in demand for electric handpieces in dental clinics. As more patients seek restorative, aesthetic, and preventive care, the dental clinic segment is expected to maintain its dominance in the market. Furthermore, the rise of cosmetic dentistry and the preference for minimally invasive procedures have further amplified the reliance on electric handpieces in dental practices, solidifying dental clinics as the largest end-user industry.

Brushless Electric Motors Are Fastest Growing Technology Due to Enhanced Efficiency

Brushless electric motors are driving the fastest growth in the Electric Dental Handpiece market. This technology offers several advantages over traditional brushed motors, including higher efficiency, longer lifespan, and quieter operation. Brushless motors reduce the need for frequent maintenance, leading to lower operational costs for dental professionals. Their efficiency and smooth performance make them the preferred choice in electric handpieces, especially for high-speed applications where precision and reliability are paramount.

The growing adoption of brushless motors can be attributed to their superior performance in demanding dental procedures. As dental technology advances and the need for improved treatment outcomes increases, brushless electric motors are expected to continue their rapid adoption. Their energy-efficient operation, reduced noise levels, and longer service life make them highly attractive in both clinical and hospital settings. With a focus on reducing operational costs and improving patient comfort, the market for brushless electric motors in dental handpieces is expected to expand rapidly.

Restorative Dentistry Is Largest Application Driven by Increasing Demand for Cosmetic and Aesthetic Treatments

Restorative dentistry is the largest application segment for electric dental handpieces, driven by the increasing demand for cosmetic and aesthetic dental treatments. Restorative procedures such as cavity preparation, crown placements, and fillings require precision tools that can work effectively with various materials, including metals, ceramics, and composites. Electric handpieces are essential in these procedures, offering consistent power, minimal heat generation, and enhanced control, ensuring both precision and comfort for patients.

As the global population ages, the need for restorative dental treatments continues to grow, further fueling the demand for high-quality electric handpieces. Additionally, the rise in cosmetic dentistry, where appearance-based dental procedures like veneers and whitening treatments are becoming more common, is driving the growth of restorative dentistry. The increasing focus on improving dental aesthetics and function is expected to ensure that restorative dentistry remains the largest application for electric dental handpieces in the market.

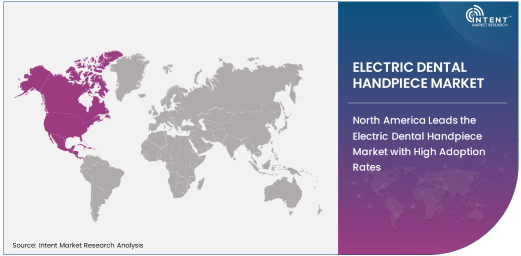

North America Leads the Electric Dental Handpiece Market with High Adoption Rates

North America is the largest region in the Electric Dental Handpiece market, primarily driven by advanced healthcare infrastructure, high disposable income, and a high rate of dental care awareness. The United States, in particular, is home to a large number of dental practices and clinics that continually invest in the latest technologies to improve patient care. North American consumers also tend to opt for advanced dental treatments, including cosmetic dentistry, which drives demand for high-performance handpieces.

The region's dominance is further supported by the presence of leading manufacturers of electric dental handpieces and the ongoing focus on innovations in dental technology. The increasing adoption of electric handpieces, particularly high-speed and low-speed models, in both private clinics and hospitals, ensures that North America remains a leader in this market. Additionally, North America's favorable regulatory environment for medical devices and its robust healthcare systems contribute to its growth.

Leading Companies and Competitive Landscape in the Electric Dental Handpiece Market

The competitive landscape of the Electric Dental Handpiece market is characterized by a few major players, including Dentsply Sirona, KaVo Dental, NSK Ltd., and Bien-Air Dental. These companies are known for their high-quality products, innovative technologies, and strong customer bases. As the market becomes increasingly competitive, these companies focus on developing advanced handpieces equipped with features like brushless motors, LED lighting, and noise-reduction technology. Partnerships, mergers, and acquisitions are also common strategies employed by these companies to expand their market reach and enhance product offerings.

In addition to these industry giants, numerous smaller players are emerging in the market, introducing cost-effective solutions and catering to niche customer needs. Companies are also focusing on expanding their product portfolios to include handpieces that cater to various applications, such as restorative dentistry, periodontics, and oral surgery. With technological advancements, increasing patient demand for high-quality dental treatments, and a growing number of dental practices, the competitive landscape is expected to remain dynamic and innovative, with companies continually pushing for improvements in dental handpiece technology

Recent Developments:

- Dentsply Sirona launched a new line of electric handpieces, offering enhanced comfort and durability for both professionals and patients.

- NSK Ltd. received regulatory approval for its new brushless electric dental handpiece, which provides quieter operation and increased precision.

- KaVo Dental announced an acquisition of a major competitor in the handpiece market, expanding its product range in electric dental tools.

- Bien-Air Dental introduced a cutting-edge electric handpiece with integrated LED light, improving visibility and treatment efficiency.

- Midmark Corporation collaborated with a leading dental technology company to integrate its electric handpieces into digital workflows for enhanced patient care.

List of Leading Companies:

- Dentsply Sirona

- NSK Ltd.

- KaVo Dental

- Bien-Air Dental

- Midmark Corporation

- Planmeca Oy

- A-dec Inc.

- Sirona Dental Systems

- South Korea Dental

- VDW GmbH

- FONA Dental

- Morita Corporation

- Flight Dental Systems

- DentalEZ Group

- W&H Dentalwerk Bürmoos

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 1.5 Billion |

|

Forecasted Value (2030) |

USD 2.8 Billion |

|

CAGR (2025 – 2030) |

9.7% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Electric Dental Handpiece Market By Product Type (High-Speed Electric Handpieces, Low-Speed Electric Handpieces, Surgical Electric Handpieces), By End-User Industry (Dental Clinics, Hospitals, Dental Laboratories, Research Institutions), By Technology (Brushless Electric Motors, Brushed Electric Motors), By Application (Restorative Dentistry, Endodontics, Periodontics, Oral Surgery, Prosthodontics), and By Region; Global Insights & Forecast (2023 – 2030) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Dentsply Sirona, NSK Ltd., KaVo Dental, Bien-Air Dental, Midmark Corporation, Planmeca Oy, A-dec Inc., Sirona Dental Systems, South Korea Dental, VDW GmbH, FONA Dental, Morita Corporation, Flight Dental Systems, DentalEZ Group, W&H Dentalwerk Bürmoos |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Electric Dental Handpiece Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. High-Speed Electric Handpieces |

|

4.2. Low-Speed Electric Handpieces |

|

4.3. Surgical Electric Handpieces |

|

5. Electric Dental Handpiece Market, by End-User Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Dental Clinics |

|

5.2. Hospitals |

|

5.3. Dental Laboratories |

|

5.4. Research Institutions |

|

6. Electric Dental Handpiece Market, by Technology (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Brushless Electric Motors |

|

6.2. Brushed Electric Motors |

|

7. Electric Dental Handpiece Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Restorative Dentistry |

|

7.2. Endodontics |

|

7.3. Periodontics |

|

7.4. Oral Surgery |

|

7.5. Prosthodontics |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Electric Dental Handpiece Market, by Product Type |

|

8.2.7. North America Electric Dental Handpiece Market, by End-User Industry |

|

8.2.8. North America Electric Dental Handpiece Market, by Technology |

|

8.2.9. By Country |

|

8.2.9.1. US |

|

8.2.9.1.1. US Electric Dental Handpiece Market, by Product Type |

|

8.2.9.1.2. US Electric Dental Handpiece Market, by End-User Industry |

|

8.2.9.1.3. US Electric Dental Handpiece Market, by Technology |

|

8.2.9.2. Canada |

|

8.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Dentsply Sirona |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. NSK Ltd. |

|

10.3. KaVo Dental |

|

10.4. Bien-Air Dental |

|

10.5. Midmark Corporation |

|

10.6. Planmeca Oy |

|

10.7. A-dec Inc. |

|

10.8. Sirona Dental Systems |

|

10.9. South Korea Dental |

|

10.10. VDW GmbH |

|

10.11. FONA Dental |

|

10.12. Morita Corporation |

|

10.13. Flight Dental Systems |

|

10.14. DentalEZ Group |

|

10.15. W&H Dentalwerk Bürmoos |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Electric Dental Handpiece Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Electric Dental Handpiece Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Electric Dental Handpiece Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA