sales@intentmarketresearch.com

+1 463-583-2713

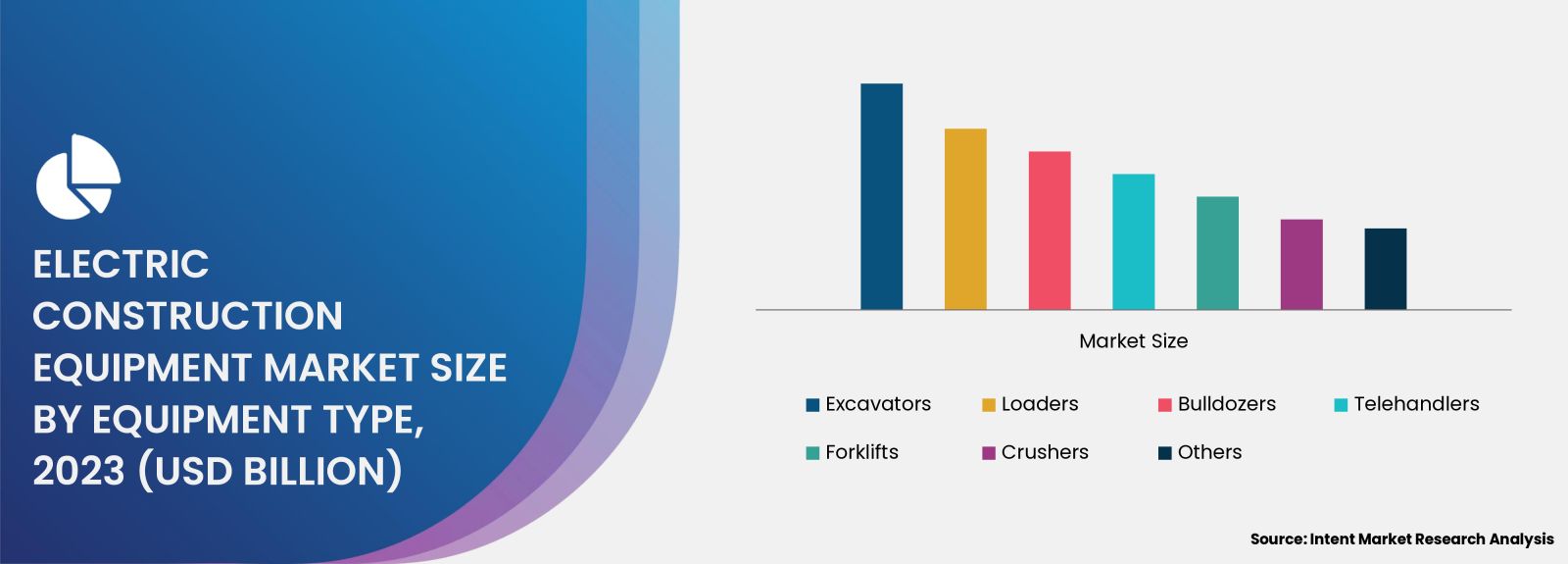

Electric Construction Equipment Market By Equipment Type (Excavators, Loaders, Bulldozers, Telehandlers, Forklifts, Crushers), By Battery Capacity (< 50 kWh, 50-200 kWh, > 200 kWh), By End-User (Construction, Mining, Agriculture, Forestry), and By Region; Global Insights & Forecast (2024 – 2030)

The Electric Construction Equipment Market is experiencing rapid growth, driven by increased environmental regulations and the push for sustainable construction practices. As construction companies seek alternatives to reduce emissions and fuel costs, electric equipment has emerged as a viable solution.

As per Intent Market Research, the Electric Construction Equipment Market was valued at USD 11.4 billion in 2023 and will surpass USD 27.9 billion by 2030; growing at a CAGR of 13.6% during 2024 - 2030. The base year for analysis is 2024, and this growth trajectory is attributed to technological advancements, cost efficiencies, and the increased adoption of electric-powered machinery across construction sites.

Powertrain Segment is Largest Owing to High Adoption of Electric Drivetrains

Within the electric construction equipment market, the powertrain segment holds the largest market share. Electric drivetrains are increasingly being integrated into construction machinery due to their efficiency and lower environmental impact compared to traditional combustion engines. These drivetrains not only reduce emissions but also offer higher torque capabilities, which enhance performance in demanding construction environments.

The largest subsegment in the powertrain category is electric propulsion systems, which account for a significant share of the market. This growth is due to the extensive use of battery-operated engines that have become popular among manufacturers. Battery technology advancements, particularly in lithium-ion batteries, provide longer operating hours and faster charging capabilities, making electric propulsion systems more efficient and attractive for construction companies.

Equipment Type Segment is Fastest Growing Owing to Excavator Electrification

The equipment type segment is witnessing the fastest growth rate in the electric construction equipment market, particularly driven by the electrification of excavators. As one of the most commonly used types of construction equipment, electric excavators are becoming increasingly popular due to their versatility and operational efficiency. These machines not only reduce operational costs but also provide enhanced precision and maneuverability, making them suitable for a variety of construction tasks.

Within this segment, the electric mini excavator subsegment is the fastest-growing, with significant demand from urban construction projects where noise and emission regulations are stringent. The compact size and reduced noise levels of electric mini excavators make them ideal for urban environments and indoor construction activities. The shift toward using these machines highlights the broader trend of adopting compact, efficient, and sustainable equipment to meet modern construction needs.

Battery Capacity Segment is Largest Due to Dominance of High-Capacity Batteries

Battery capacity plays a crucial role in determining the performance and usability of electric construction equipment. The battery capacity segment is the largest in the electric construction equipment market, with a notable focus on high-capacity batteries (above 100 kWh). The demand for these high-capacity batteries is primarily driven by the need for longer operational hours and increased power output, which are essential for heavy-duty equipment used in large-scale construction projects.

High-capacity battery systems enable electric equipment to operate for extended periods without requiring frequent recharges, enhancing productivity and reducing downtime. The development of advanced battery management systems (BMS) also supports the optimization of these high-capacity batteries, ensuring safety and efficiency during prolonged usage. As construction projects become more intensive, the reliance on high-capacity batteries is expected to remain dominant, driving further growth in this segment.

Application Segment is Fastest Growing Owing to Demand for Material Handling Equipment

The application segment is expanding rapidly, with material handling equipment identified as the fastest-growing subsegment. Electric material handling machinery, including loaders, forklifts, and telehandlers, is increasingly being adopted due to its operational efficiency and reduced emissions. These machines are crucial for transporting heavy loads across construction sites, and the switch to electric versions supports green building initiatives and helps construction companies comply with regulatory standards.

Electric telehandlers, in particular, have seen a surge in demand, with their ability to perform a wide range of lifting and transporting tasks in various terrains and construction environments. The versatility of electric telehandlers makes them an attractive choice for construction firms looking to enhance efficiency while minimizing their carbon footprint. Additionally, the integration of advanced technologies like autonomous controls and IoT connectivity in these machines is further boosting their appeal, contributing to the segment's rapid growth.

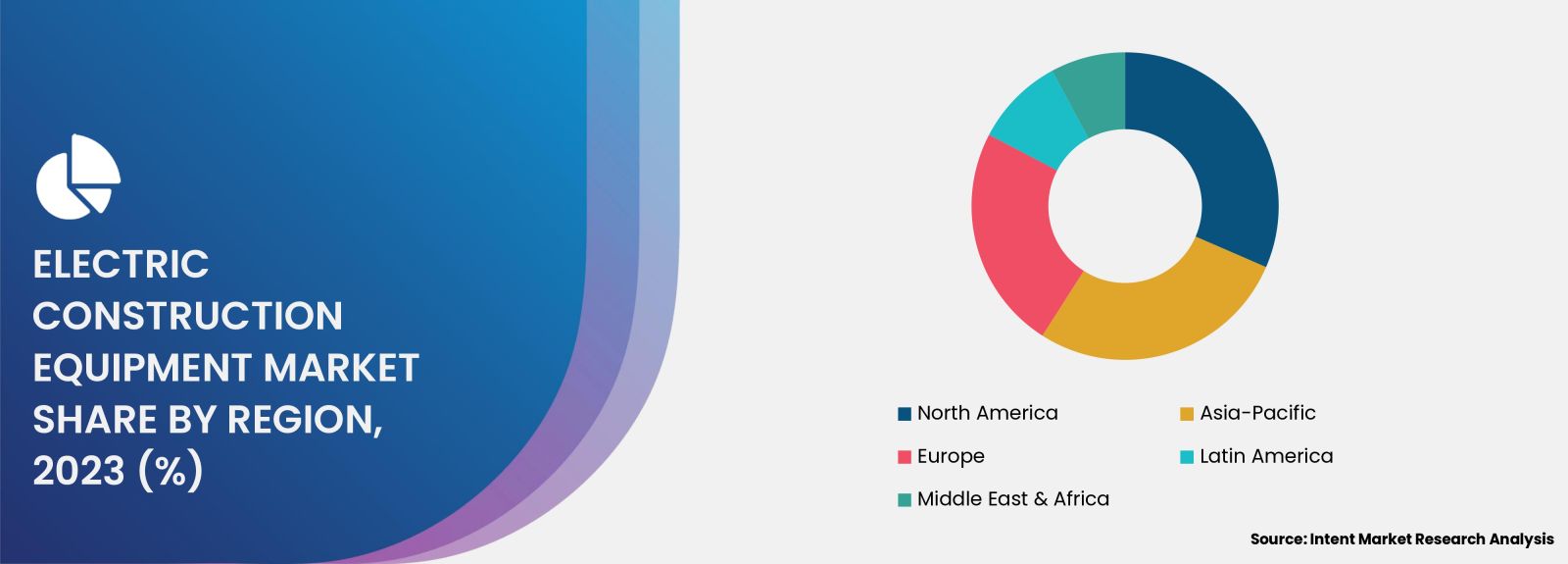

Regional Analysis: North America Dominates Due to Strong Regulatory Support

North America is the largest region in the electric construction equipment market, driven by strong regulatory frameworks and supportive government initiatives aimed at reducing greenhouse gas emissions from construction activities. The U.S. and Canada have implemented stringent regulations that encourage the adoption of electric equipment, including tax incentives and subsidies for companies that transition to greener machinery.

The construction sector in North America is also characterized by a high level of technological integration, which has facilitated the early adoption of electric equipment. Major construction firms are increasingly investing in electric machinery to align with sustainability goals, driving significant growth in the region. Additionally, the presence of key market players and continuous innovations in electric construction technology are solidifying North America's position as the market leader.

Competitive Landscape: Dominated by Key Players Investing in Technological Advancements

The electric construction equipment market is highly competitive, with several key players, including Caterpillar Inc., Volvo Construction Equipment, and Komatsu Ltd., driving the industry forward. These companies are heavily investing in R&D to enhance battery efficiency, improve equipment performance, and reduce costs. Partnerships and collaborations are also common as companies work together to accelerate the development of new electric technologies and gain a competitive edge.

The competitive landscape is characterized by a focus on expanding product portfolios, with leading firms introducing a variety of electric models to cater to different segments of the construction industry. As sustainability becomes a critical factor, competition is expected to intensify, with companies vying to offer the most innovative and efficient electric construction solutions.

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 11.4 billion |

|

Forecasted Value (2030) |

USD 27.9 billion |

|

CAGR (2024 – 2030) |

13.6% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Electric Construction Equipment Market By Equipment Type (Excavators, Loaders, Bulldozers, Telehandlers, Forklifts, Crushers), By Battery Capacity (< 50 kWh, 50-200 kWh, > 200 kWh), and By End-User (Construction, Mining, Agriculture, Forestry) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Electric Construction Equipment Market, by Equipment Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Excavators |

|

4.2. Loaders |

|

4.3. Bulldozers |

|

4.4. Telehandlers |

|

4.5. Forklifts |

|

4.6. Crushers |

|

4.7. Others |

|

5. Electric Construction Equipment Market, by Battery Capacity (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. < 50 kWh |

|

5.2. 50-200 kWh |

|

5.3. > 200 kWh |

|

6. Electric Construction Equipment Market, by End-User (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Construction |

|

6.2. Mining |

|

6.3. Agriculture |

|

6.4. Forestry |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Electric Construction Equipment Market, by Equipment Type |

|

7.2.7. North America Electric Construction Equipment Market, by Battery Capacity |

|

7.2.8. North America Electric Construction Equipment Market, by End-User |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Electric Construction Equipment Market, by Equipment Type |

|

7.2.9.1.2. US Electric Construction Equipment Market, by Battery Capacity |

|

7.2.9.1.3. US Electric Construction Equipment Market, by End-User |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Bobcat |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. CASE Construction |

|

9.3. Caterpillar |

|

9.4. Deere & Company |

|

9.5. Doosan |

|

9.6. Hitachi |

|

9.7. JCB Ltd. |

|

9.8. Kobelco Construction |

|

9.9. Komatsu |

|

9.10. Liugong Machinery |

|

9.11. Manitou |

|

9.12. SANY Group |

|

9.13. Terex |

|

9.14. Volvo |

|

9.15. Wacker Neuson |

|

10. Appendix |

Let us connect with you TOC

A comprehensive market research approach was employed to gather and analyze data on the Electric Construction Equipment Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Electric Construction Equipment Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the Electric Construction Equipment ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Electric Construction Equipment Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

Available Formats