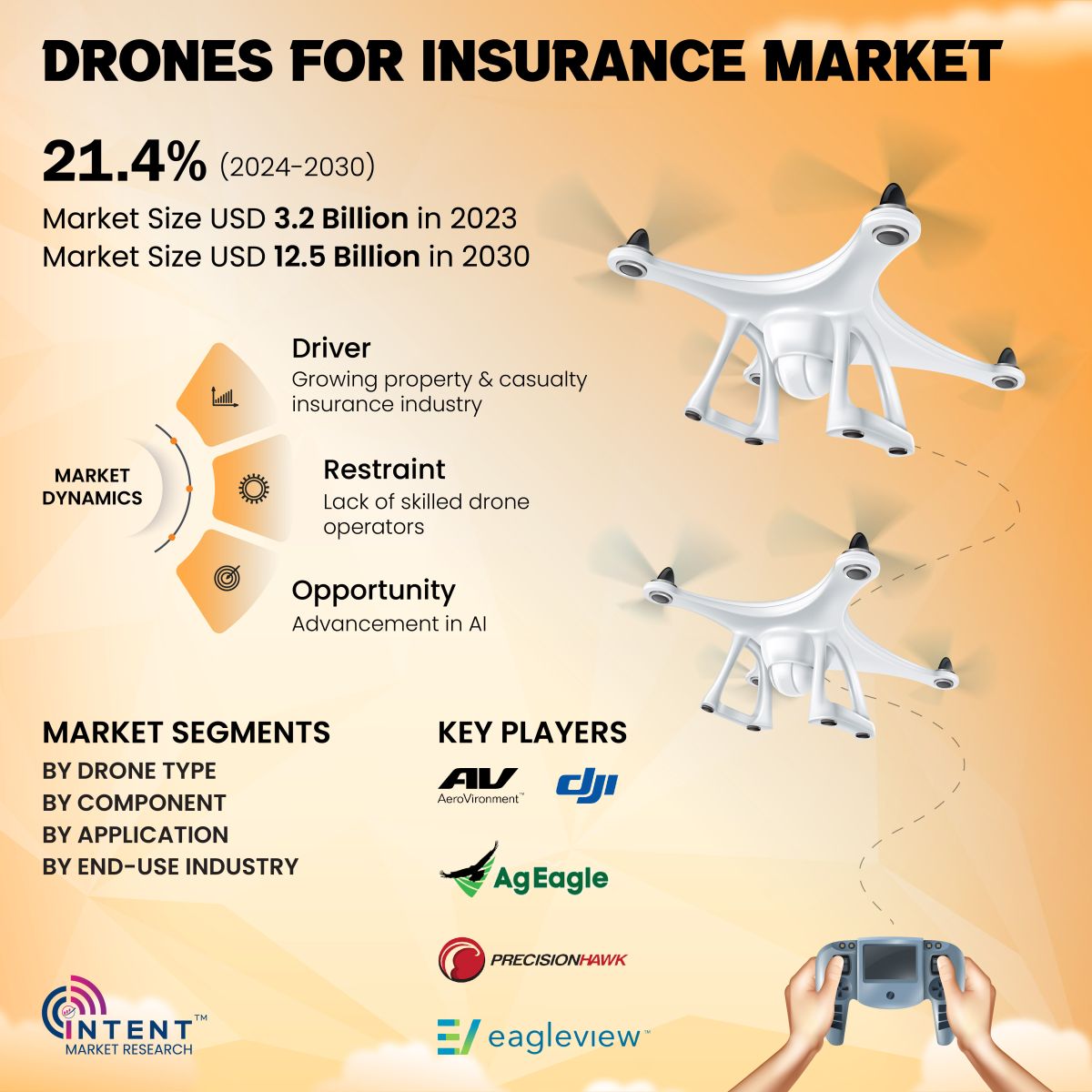

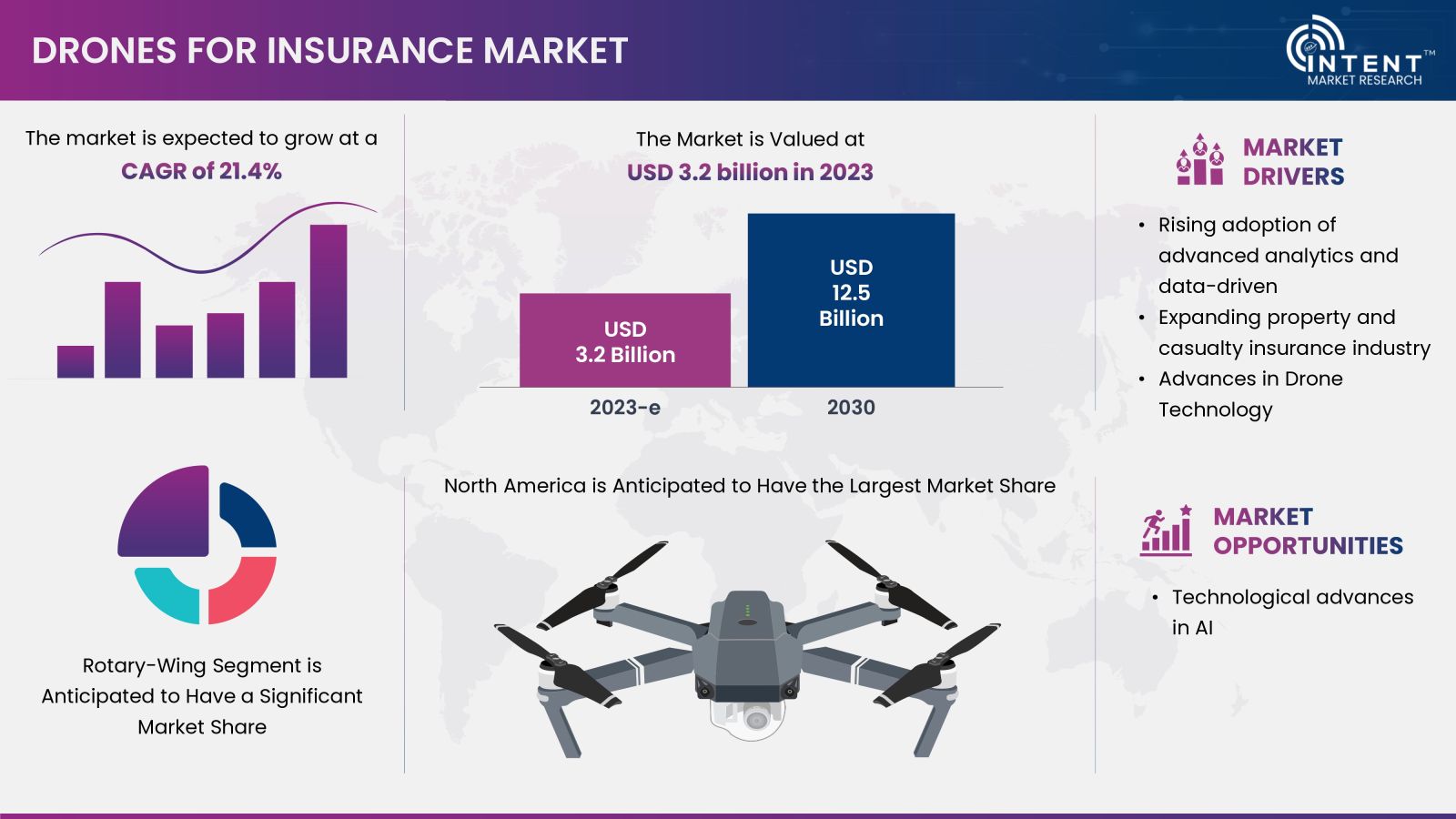

The Drones for Insurance Market is expected to grow from USD 3.2 billion in 2023-e to USD 12.5 billion by 2030, at a CAGR of 21.4% during the forecast period. The drones for insurance market is a competitive market, the prominent players in the global market include AeroVironment, AgEagle Aerial Sys, Delair, DJI, DroneDeploy, EagleView, Parrot, Pix4D, PowerVision, and PrecisionHawk.

Click here to: Get FREE Sample Pages of this Report

Drones For Insurance Market Overview

Drones, also known as unmanned aerial vehicles (UAVs), are increasingly being used in several industries including agriculture, logistics, media & entertainment, real estate & construction, security & law enforcement, and more. The insurance industry is also among the industries that are actively adopting drones to enhance their operations further. Drones also offer improved employee safety by allowing adjusters to remain in a safe area during site inspection, minimizing their exposure to accidents and hazardous conditions. The uptake in the adoption of drones in the insurance industry is owing to improved efficiency and effectiveness of claims processing, risk management, and data collection.

Increasing Digitization in Insurance Industry is Driving the Market Growth

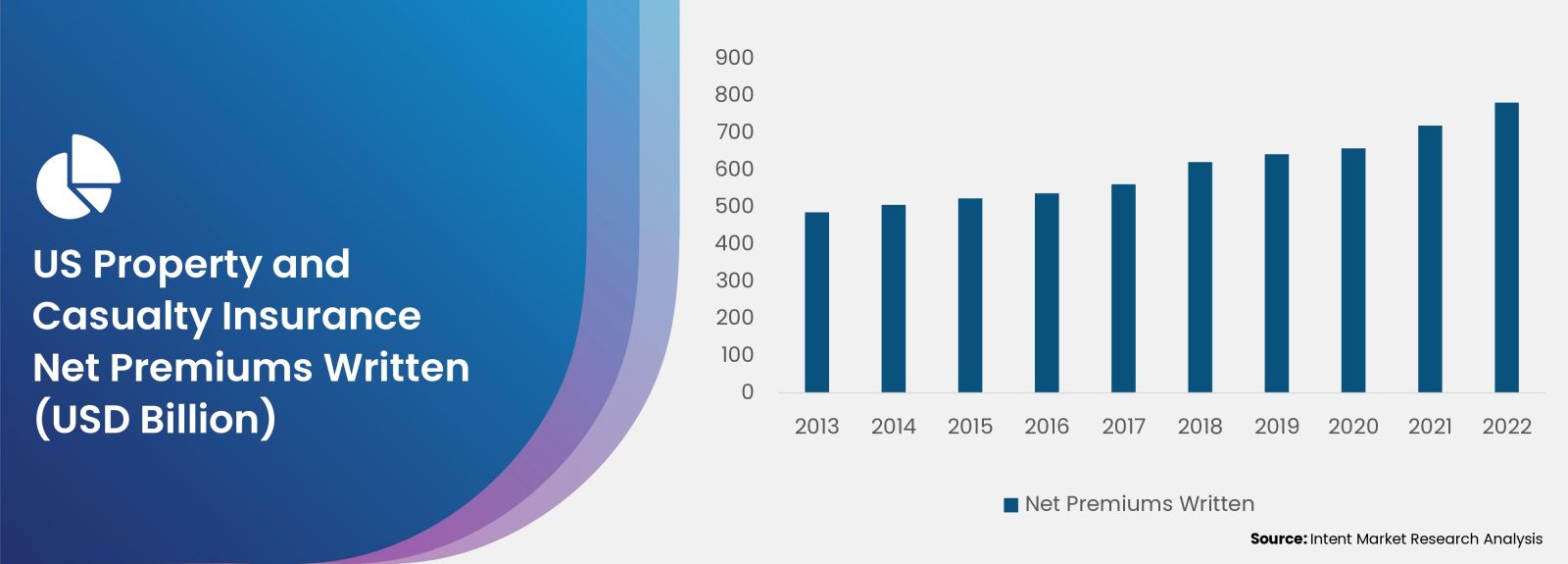

The insurance business is undergoing digitization and is revolutionizing the business models globally. Insurtech providers are opening up new opportunities for the insurance industry. The commercial property and casualty (P&C) lines have delivered strong financial performance in recent years. According to the National Association of Insurance Commissioners (NAIC), the net premium written for P&C insurance in the USA increased by 8.6% in 2022 accounting for USD 781.62 billion.

Moreover, several insurtech companies are actively expanding with strategic partnerships to implement the adoption of drones to gain a competitive advantage for their insurance products. For instance, in July 2023, EagleView came into partnership with Betterview, an insurtech company to integrate EagleView’s imagery into Betterview’s property intelligence platform to help insurers better understand a customer’s total property risk by providing broader, data-driven intelligence for both underwriters and claims professionals. The expanding insurance industry and the rising adoption of insurtech contribute to driving market growth.

Segment Analysis

The drones for insurance market is segmented based on drone type, component, application, and end-use.

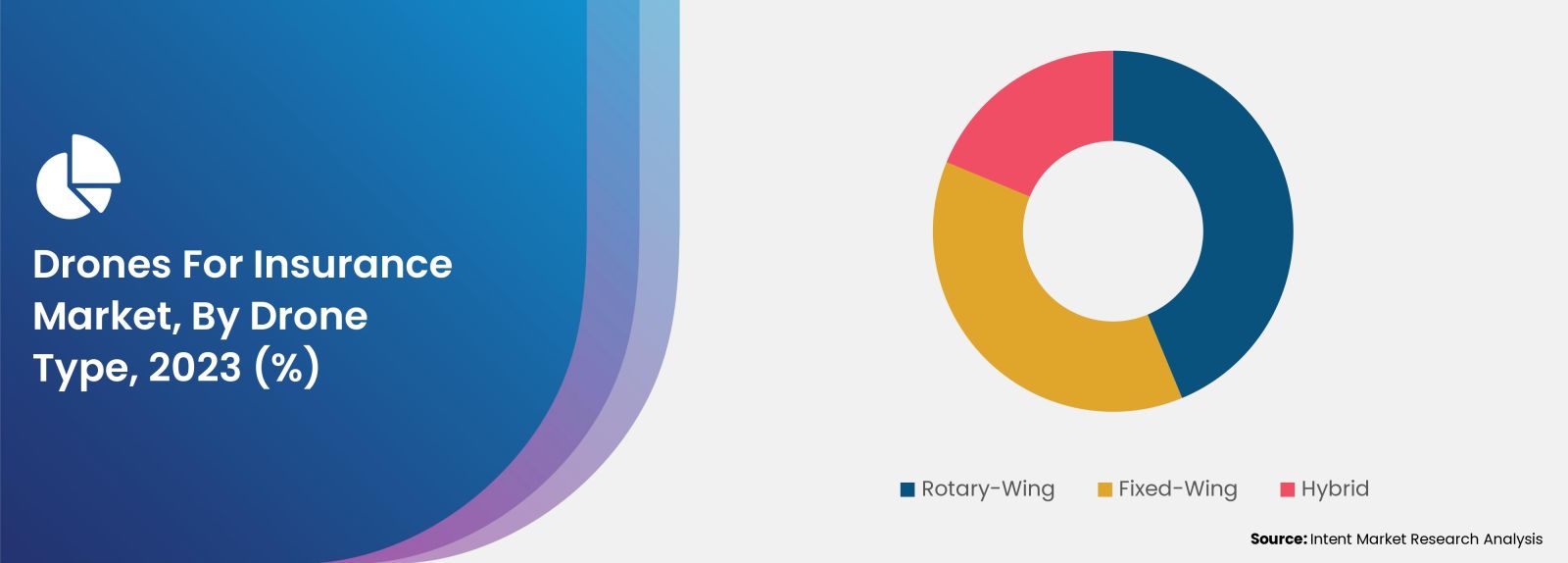

Increasing Adoption of Rotary-Wing Drones Drive the Market Growth

In a rotary-wing drone, a single or a set of rotor blades rotate to create the vertical lift. These drones are capable of vertical take-off and landing (VTOL). These drones provide better control of the drones during the flight and have better maneuverability. In addition, it also has the ability to fly closer to structures and buildings owing to which they are easy to use for house or property inspection. Moreover, rotary-wing drones can take multiple payloads per flight which further increases its operational efficiency and reduces the time taken for inspections. Thus, owing to various advantages, rotary-wing drones segment is anticipated to hold the largest market share in drones for insurance market.

Increasing Adoption of Advanced Analytics is Projected to Fuel Drones for Insurance Software Segment Market Growth

There has been exponential growth in the commercial drone market in recent years owing to the rise in popularity and increasing applications. The evolving data analytics is expected to boost adoption of the drones for commercial and industrial use. Increasing adoption of advanced analytics and growing investment in drone analytics solutions are projected to fuel drones for insurance software market growth.

There is a wide range of data processing tools available in the market for drones that could help insurers. Photogrammetry and geospatial analysis capabilities are among the core tools that are increasingly being used by insurers. The drone companies are investing substantially in drone analytics solutions, recognizing the market's huge potential. For instance, in April 2022, EagleView announced a long-term collaboration with CoreLogic, a global property information, analytics, and data-enabled solutions provider to automate claims processing to improve contractor and insurer experience. Likewise, in March 2022, EagleView launched EagleView Assess, a comprehensive claims inspection drone solution, throughout the USA and Canada.

An Aging Workforce is Anticipated to Drive the Demand for Drones in Inspection Applications

Drones are increasingly being used for insurance inspections. Drones can significantly speed up the inspection process and allow adjusters to make more accurate assessments. Moreover, drone inspections allow insurance companies to mitigate safety risks by having fewer inspectors on ladders and fewer site visits to inaccessible areas. An aging workforce in the insurance industry is also anticipated to drive the demand for drones for inspection applications. According to the U.S. Bureau of Labor Statistics, about 73.7% of the workforce in Insurance carriers and related activities are above the age of 35. Thus, there’s a high demand for drone inspection owing to the various benefits drones offer for their application in inspection.

Rise in Insurance Coverage of Agricultural Land is Driving the Agriculture Segment

There has been exponential growth in the agriculture insurance industry in recent years owing to increasing government support for protecting farmers, expansion of crop insurance products, and technological advancements in agricultural practices. There has been a global rise in insurance coverage of agricultural land. According to the U.S. Department of Agriculture, as of 2023, about 444 million acres of agricultural land are insured under the federal crop insurance program. This includes more than 80% of the acres of major field crops planted in the United States.

Key insurance companies are increasingly investing in drone technology for agricultural use. For instance, in January 2022, QBE Insurance Group's unit NAU Country came into a multi-year partnership with Agriculture Intelligence for its AI platform Agroview. Agroview utilizes aerial footage of crops captured by drones and its AI software to analyze and interpret. Thus, the growing agriculture insurance industry and the rising adoption of crop insurance drones are driving the market growth.

Regional Analysis

Rising Number of Drone Manufacturers in Asia-Pacific Driving the Market in the Region

In recent years, there has been an exponential number of drone manufacturing startups in the Asia-Pacific region. For instance, India has seen a surge in drone start-ups in recent years. According to the India Brand Equity Foundation, the number of drone start-ups in India has surged by 34.4% between August 2021 and February 2022 totaling about 220 drone startups by February 2022. The insurers are also actively adopting drones for their operations in the region. For instance, in October 2021, Sompo Singapore obtained an Unmanned Aircraft (“UA”) Operator Permit and UA Pilot Licenses from the Civil Aviation Authority of Singapore (“CAAS”) to better manage potential risks at corporate clients' properties that cannot be detected with physical visual inspection. In another instance, in November 2021, Agriculture Insurance Company (India) also announced that it is laying out plans for adopting technology-aided assessment methods involving drones. Thus, Asia-Pacific is the fastest-growing region in the Drones for Insurance Market.

Competitive Analysis

Drone manufacturers and drone software developers are industriously expanding their portfolios with the growing insurance industry. The drones for insurance market is dominated by a few key global market players having a significant market share and competitive numbers of small regional and local players. Some of the key players in the market are AeroVironment, AgEagle Aerial Sys, Delair, DJI, DroneDeploy, EagleView, Parrot, Pix4D, PowerVision, and PrecisionHawk.

Following are the key developments in the drones for insurance market:

- In May 2023, ACSL Ltd., one of Japan’s largest drone manufacturers, announced its entrance into the commercial drone market in the US with ACSL Inc.

- In June 2023, Skygauge Robotics launched its Skygauge Inspection Drone.

- In February 2023, EagleView expanded its EagleView Cloud, an aerial imagery and software service for all enterprise customers including insurance carriers. Enhanced access to pre-event imagery enables insurance carriers to gain a clearer understanding of claim severity and process claims more efficiently.

Click here to: Get your custom research report today

Drones for Insurance Market Coverage

The report provides key insights into the drones for insurance market, and it focuses on technological developments, trends, and initiatives taken by the government in this sector. The report delves into market drivers, restraints, and opportunities, and analyzes key players and the competitive landscape within the market.

Report Scope

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 3.2 billion |

|

Forecast Revenue (2030) |

USD 12.5 billion |

|

CAGR (2024-2030) |

21.4% |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

By Drone Type (Fixed-Wing, Rotary Blade, and Hybrid), By Component (Hardware, Software, and Service), By Application (Pre-Loss Deployment and Post-Loss Deployment), By End Use (Real Estate and Construction, Infrastructure, Agriculture, Logistics & Shipping, Power & Utilities, Oil & Gas, Mining, and Others) |

|

Regional Analysis |

North America (US, Canada), Europe (Germany, France, UK, Spain, Italy), Asia-Pacific (China, Japan, South Korea, India), Latin America (Brazil, Mexico), Middle East and Africa (Saudi Arabia, UAE, South Africa) |

|

Competitive Landscape |

AeroVironment, AgEagle Aerial Systems, Delair, DJI, DroneDeploy, EagleView, Parrot, Pix4D, PowerVision, and PrecisionHawk |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

|

Purchase Options |

We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) |

|

1.Introduction |

|

1.1. Study Assumptions and Market Definition |

|

1.2. Scope of the Study |

|

2.Research Methodology |

|

3.Executive Summary |

|

4.Market Dynamics |

|

4.1. Market Growth Drivers |

|

4.1.1. Growing insurance industry and increasing adoption of insurtech |

|

4.1.2. Rising adoption of advanced analytics and data-driven decision-making |

|

4.1.3. Advances in Drone Technology |

|

4.2. Market Growth Restraints |

|

4.2.1. Lack of Skilled Drone Operators |

|

4.2.2. Security Concerns and Threat of Data Leakage |

|

4.3. Market Growth Opportunities |

|

4.3.1. Advancement in AI |

|

4.4. Porter’s 5 Forces |

|

4.5. PESTLE Analysis |

|

5.Market Outlook |

|

5.1. Supply Chain Analysis |

|

5.2. Drones Industry Outlook |

|

5.3. Impact of COVID-19 on the Drones for Insurance Market |

|

5.4. Regulatory Framework |

|

5.5. Technology Analysis |

|

6.Market Segment Outlook (Market Size & Forecast: USD Billion, 2023 – 2030) |

|

6.1. Segment Synopsis |

|

6.2. By Drone Type |

|

6.2.1. Rotary-Wing |

|

6.2.2. Fixed-Wing |

|

6.2.3. Hybrid |

|

6.3. By Component |

|

6.3.1. Hardware |

|

6.3.2. Software |

|

6.3.3. Service |

|

6.4. By Application |

|

6.4.1. Pre-Loss Deployment |

|

6.4.1.1.Risk pricing |

|

6.4.1.2.Natural disaster monitoring |

|

6.4.2. Post-Loss Deployment |

|

6.4.2.1.Inspection |

|

6.4.2.2.Risk assessment |

|

6.4.2.3.Claims adjustment |

|

6.4.2.4.Fraud prevention |

|

6.5. By End Use |

|

6.5.1. Real Estate and Construction |

|

6.5.2. Infrastructure |

|

6.5.3. Agriculture |

|

6.5.4. Logistics & Shipping |

|

6.5.5. Power & Utilities |

|

6.5.6. Oil & Gas |

|

6.5.7. Mining |

|

6.5.8. Others |

|

7.Regional Outlook (Market Size & Forecast: USD Billion, 2023 – 2030) |

|

7.1. Global Market Synopsis |

|

7.2. North America |

|

7.2.1. North America Drones for Insurance Market Outlook |

|

7.2.2. US |

|

7.2.2.1.US Drones for Insurance Market, By Drone Type |

|

7.2.2.2.US Drones for Insurance Market, By Component |

|

7.2.2.3.US Drones for Insurance Market, By Application |

|

7.2.2.4.US Drones for Insurance Market, By End Use |

|

*Note: Cross-segmentation by segments for each country will be covered as shown above. |

|

7.2.3. Canada |

|

7.3. Europe |

|

7.3.1. Europe Drones for Insurance Market Outlook |

|

7.3.2. Germany |

|

7.3.3. UK |

|

7.3.4. France |

|

7.3.5. Spain |

|

7.3.6. Italy |

|

7.4. Asia-Pacific |

|

7.4.1. Asia-Pacific Drones for Insurance Market Outlook |

|

7.4.2. China |

|

7.4.3. India |

|

7.4.4. Japan |

|

7.4.5. South Korea |

|

7.4.6. Australia |

|

7.5. Latin America |

|

7.5.1. Latin America Drones for Insurance Market Outlook |

|

7.5.2. Mexico |

|

7.5.3. Brazil |

|

7.5.4. Argentina |

|

7.6. Middle East & Africa |

|

7.6.1. Middle East & Africa Drones for Insurance Market Outlook |

|

7.6.2. Saudi Arabia |

|

7.6.3. UAE |

|

7.6.4. South Africa |

|

8.Competitive Landscape |

|

8.1. Market Share Analysis |

|

8.2. Company Strategy Analysis |

|

8.3. Competitive Matrix |

|

9.Company Profiles |

|

9.1. Drones For Insurance Companies (Supply-Side) |

|

9.1.1. AeroVironment |

|

9.1.1.1.Company Synopsis |

|

9.1.1.2.Company Financials |

|

9.1.1.3.Product/Service Portfolio |

|

9.1.1.4.Recent Developments |

|

*Note: All the companies in the section 9.1 will cover same sub-chapters as above. |

|

9.1.2. AgEagle Aerial Sys |

|

9.1.3. Delair |

|

9.1.4. DJI |

|

9.1.5. DroneDeploy |

|

9.1.6. EagleView |

|

9.1.7. Parrot |

|

9.1.8. Pix4D |

|

9.1.9. PowerVision |

|

9.1.10. PrecisionHawk |

|

9.2. Key Insurance Providers (Demand-Side) |

|

9.2.1. Allianz |

|

9.2.1.1.Company Synopsis |

|

9.2.1.2.Company Financials |

|

9.2.1.3.Demand Analysis |

|

9.2.1.4.Recent Developments |

|

*Note: All the companies in the section 9.2 will cover same sub-chapters as above. |

|

9.2.2. AIG |

|

9.2.3. Allstate |

|

9.2.4. AXA Group |

|

9.2.5. Chubb |

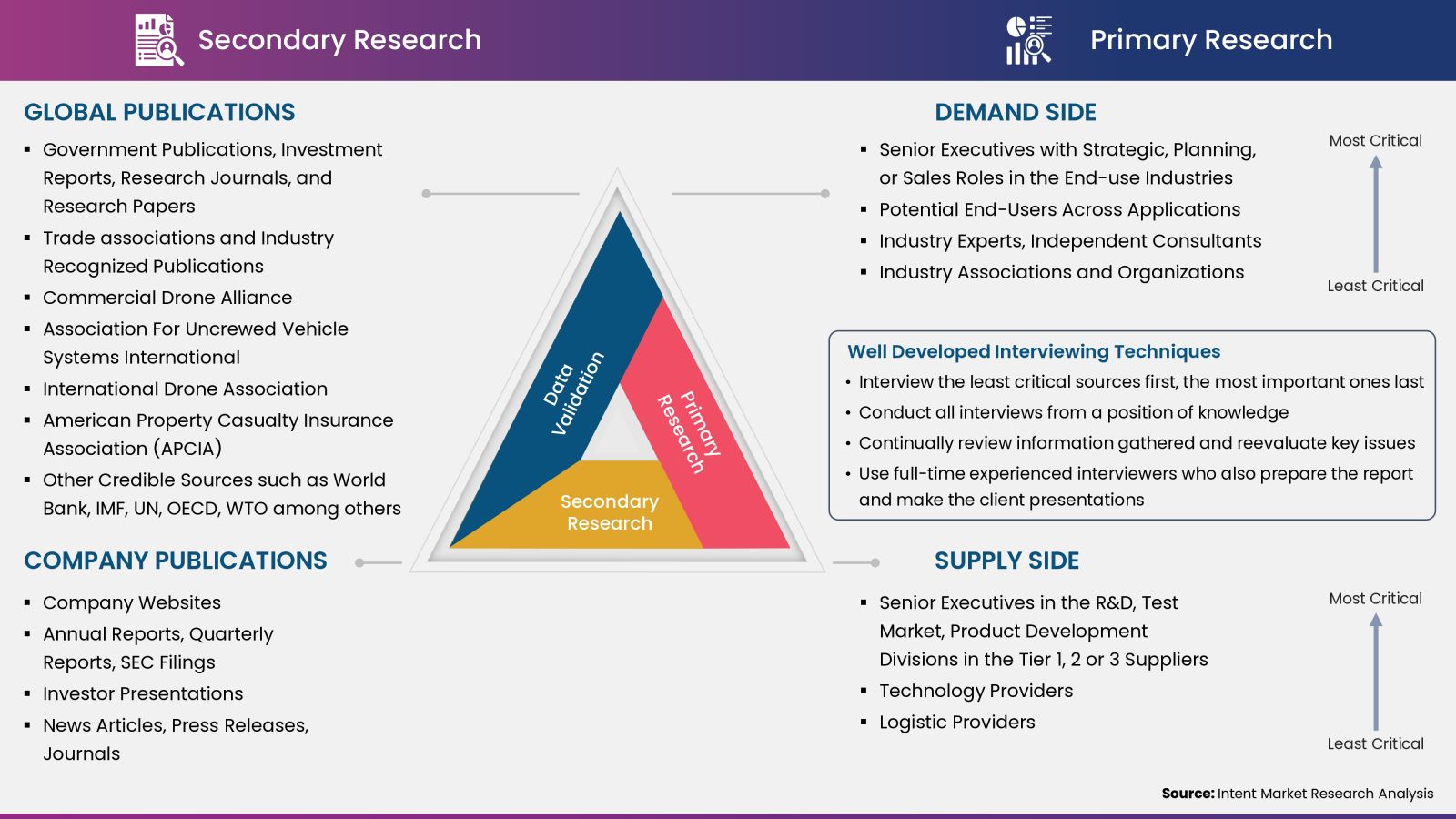

Intent Market Research employs a rigorous methodology to minimize residual errors by carefully defining the scope, validating findings through primary research, and consistently updating our in-house database. This dynamic approach allows us to capture ongoing market fluctuations and adapt to evolving market uncertainties.

The research factors used in our methodology vary depending on the specific market being analyzed. To begin with, we incorporate both demand and supply side information into our model to identify and address market gaps. Additionally, we also employ approaches such as Macro-Indicator Analysis, Factor Analysis, Value Chain-Based Sizing, and forecasting to further increase the accuracy of the numbers and validate the findings.

Research Approach

- Secondary Research Approach: During the initial phase of the research process, we acquire and accumulate extensive data continuously. This data is carefully filtered and validated through a variety of secondary sources.

- Primary Research Approach: Following the consolidation of data gathered through secondary research, we initiate a validation and verification process to verify all the market numbers and assumptions by engaging with the subject matter experts.

Data Collection, Analysis and Interpretation:

Research Methodology

Our market research methodology utilizes both top-down and bottom-up approaches to segment and estimate quantitative aspects of the market. We also employ multi-perspective analysis, examining the market from distinct viewpoints.

.jpg)