As per Intent Market Research, the Drone Phones Market was valued at USD 4.6 billion in 2023 and will surpass USD 12.3 billion by 2030; growing at a CAGR of 15.0% during 2024 - 2030.

The drone phones market is evolving rapidly, driven by the increasing demand for multifunctional mobile devices that combine the capabilities of drones and smartphones. These devices offer the convenience of traditional mobile phones, along with the advanced features of drone technology, such as real-time aerial surveillance, remote control, and enhanced connectivity. As drone technology becomes more integrated into daily activities, the market for drone phones is expected to grow significantly, with applications across various industries, including commercial, defense, and agriculture. This development is powered by advances in wireless communication, including the shift from 4G to 5G networks, and the rising adoption of IoT-based devices.

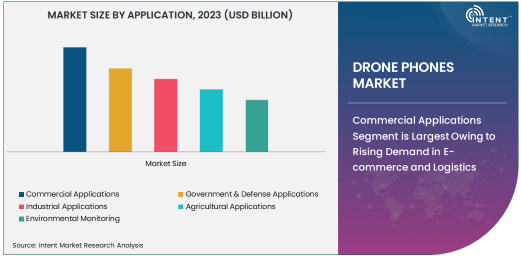

Commercial Applications Segment is Largest Owing to Rising Demand in E-commerce and Logistics

The commercial applications segment is the largest within the drone phones market, driven by the increasing demand for aerial surveillance and logistics operations. With the boom in e-commerce, companies are looking for innovative solutions to enhance their supply chain and improve delivery processes. Drone phones provide an ideal solution by combining mobile communication capabilities with the flexibility of drone technology, enabling seamless integration into warehouse management, delivery tracking, and inventory control. Additionally, these devices are being utilized in surveillance, marketing, and promotional activities, making them essential for businesses that require both mobile and aerial capabilities.

As industries seek to automate and optimize their operations, commercial use of drone phones is expanding. The ability to use drone phones for real-time data collection, aerial mapping, and inventory management makes them indispensable in logistics. Moreover, as more businesses look to improve operational efficiency, drone phones are becoming a must-have tool for large-scale commercial enterprises.

5G-Enabled Drone Phones Segment is Fastest Growing Owing to Advancements in Connectivity

The 5G-enabled drone phones segment is the fastest-growing, as 5G technology promises to revolutionize the capabilities of drone phones. 5G networks offer significantly faster data speeds and lower latency, which are essential for real-time video streaming, remote control, and surveillance applications. This technology enables drone phones to operate more efficiently and with greater range, making them suitable for more complex commercial and industrial tasks. As industries, particularly agriculture, defense, and environmental monitoring, increasingly require fast data transmission for real-time decision-making, the adoption of 5G-enabled drone phones is expected to accelerate.

The transition to 5G has made drone phones more powerful, offering advanced features such as enhanced video resolution, improved camera functions, and more reliable communication channels. This is driving the demand for 5G-enabled devices, as businesses recognize the benefits of faster connectivity in applications like remote inspections, delivery tracking, and surveillance. The increase in 5G rollouts worldwide will further support the rapid adoption of these devices.

Agriculture Segment is Largest End-User Industry Owing to Growing Demand for Precision Farming

In the drone phones market, the agriculture sector is the largest end-user industry, benefiting from the increasing demand for precision farming technologies. Drone phones are used in agriculture for various applications, such as crop monitoring, land surveying, and real-time data collection on soil health. With the ability to combine mobile connectivity and aerial observation, drone phones are helping farmers make data-driven decisions, optimizing crop yields, and improving resource management. This integration is particularly important as agriculture moves toward more sustainable and technology-driven practices, with drone phones playing a critical role in precision agriculture.

Farmers are leveraging these devices to conduct aerial surveys, track crop health, and monitor large agricultural areas more efficiently. The use of drones in agriculture continues to rise as the technology becomes more affordable and accessible. As a result, the agriculture industry remains the largest consumer of drone phones, further solidifying its position as a key segment in the market.

Cameras Segment is Largest Component Owing to Demand for Enhanced Aerial Imaging

The cameras segment is the largest within the drone phone component market, as advanced imaging technology is one of the main drivers of drone phone adoption. High-resolution cameras are essential for capturing clear, real-time aerial footage, which is particularly valuable in applications such as surveillance, environmental monitoring, and agriculture. As the demand for high-quality visual data continues to rise, drone phone manufacturers are focusing on integrating advanced camera systems that offer improved image quality, stability, and longer-lasting performance. The camera's ability to capture clear, high-definition images from the air makes it a crucial component of drone phones.

In addition to high-definition imaging, the development of specialized camera features, such as thermal imaging and night vision, is increasing the utility of drone phones in industries like security, military surveillance, and emergency response. The growing need for versatile, powerful camera systems is expected to continue driving the dominance of the camera segment in the drone phones market.

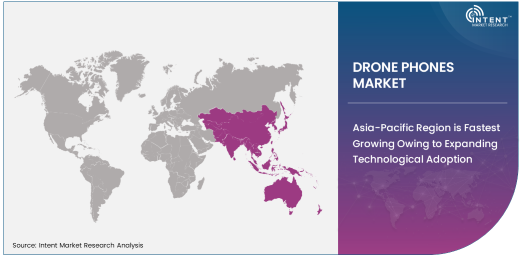

Asia-Pacific Region is Fastest Growing Owing to Expanding Technological Adoption

The Asia-Pacific region is the fastest-growing market for drone phones, driven by the rapid adoption of advanced technologies in countries such as China, India, and Japan. The region is experiencing a surge in the adoption of drones for both commercial and industrial applications, and countries are investing heavily in the development of smart cities, which are expected to integrate drone technology for surveillance, delivery, and environmental monitoring. Additionally, the region's growing agricultural sector is increasingly adopting drone technology to improve crop yields and resource management.

As a result of these factors, Asia-Pacific is witnessing a boom in drone phone applications. The availability of affordable drone phones and favorable government regulations in the region have further supported this growth. The region’s increasing investment in technological infrastructure, coupled with rising interest in IoT-based devices, is expected to continue driving the demand for drone phones in the coming years.

Competitive Landscape and Leading Companies

Leading companies in the drone phones market include industry giants such as Samsung, Huawei, Xiaomi, and Apple. These companies are at the forefront of integrating drone technology into their mobile devices, offering enhanced features such as 5G connectivity, AI-powered imaging, and real-time data transmission. They are investing heavily in R&D to improve the capabilities of drone phones, with a particular focus on expanding their application range across commercial, industrial, and agricultural sectors.

The competitive landscape is becoming increasingly fragmented as more companies enter the market, bringing innovative solutions to address the growing demand for multifunctional devices. The market is also seeing partnerships between smartphone manufacturers and drone technology companies to enhance product offerings. As the technology matures and consumer interest increases, competition is expected to intensify, with companies striving to differentiate themselves through advanced features, better performance, and cost-effective solutions.

Recent Developments:

- Samsung Launches New 5G Drone Phone – Samsung has launched a new 5G-enabled drone phone with enhanced connectivity features for remote applications like surveillance and monitoring.

- Huawei Expands Drone Phone Range – Huawei announced an expansion of its drone phone range to cater to the growing demand in commercial and defense sectors, enhancing its technological features with AI integration.

- Xiaomi Partners with DJI for Drone Phone Integration – Xiaomi has partnered with DJI to develop an affordable drone phone with integrated aerial technology, targeting the retail and e-commerce sectors.

- Apple Acquires Drone Camera Technology Company – Apple has acquired a drone camera technology company to enhance its drone phone development, focusing on superior camera capabilities for mobile surveillance applications.

- ZTE Receives Regulatory Approval for Drone Phones in Europe – ZTE has received regulatory approval for its line of drone phones in European markets, with plans for widespread launch across the continent in the next quarter.

List of Leading Companies:

- Samsung Electronics Co., Ltd.

- Huawei Technologies Co., Ltd.

- Sony Corporation

- DJI Innovations

- Xiaomi Corporation

- Apple Inc.

- LG Electronics Inc.

- ZTE Corporation

- Motorola Mobility

- Qualcomm Incorporated

- OnePlus

- Nokia Corporation

- Lenovo Group Limited

- Google LLC (Alphabet Inc.)

- Panasonic

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 4.6 Billion |

|

Forecasted Value (2030) |

USD 12.3 Billion |

|

CAGR (2024 – 2030) |

15.0% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Drone Phones Market By Application (Commercial Applications, Government & Defense Applications, Industrial Applications, Agricultural Applications, Environmental Monitoring), By Technology (4G-enabled Drone Phones, 5G-enabled Drone Phones, IoT-based Drone Phones), By End-User Industry (Telecom, Defense & Military, Retail & E-commerce, Healthcare, Agriculture), By Component (Cameras, Sensors, Batteries, GPS Modules, Communication Systems) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Samsung Electronics Co., Ltd., Huawei Technologies Co., Ltd., Sony Corporation, DJI Innovations, Xiaomi Corporation, Apple Inc., LG Electronics Inc., ZTE Corporation, Motorola Mobility, Qualcomm Incorporated, OnePlus, Nokia Corporation, Lenovo Group Limited, Google LLC (Alphabet Inc.), Panasonic |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Drone Phones Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Commercial Applications |

|

4.2. Government & Defense Applications |

|

4.3. Industrial Applications |

|

4.4. Agricultural Applications |

|

4.5. Environmental Monitoring |

|

5. Drone Phones Market, by Technology (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. 4G-enabled Drone Phones |

|

5.2. 5G-enabled Drone Phones |

|

5.3. IoT-based Drone Phones |

|

6. Drone Phones Market, by End-User Industry (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Telecom |

|

6.2. Defense & Military |

|

6.3. Retail & E-commerce |

|

6.4. Healthcare |

|

6.5. Agriculture |

|

7. Drone Phones Market, by Component (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Cameras |

|

7.2. Sensors |

|

7.3. Batteries |

|

7.4. GPS Modules |

|

7.5. Communication Systems |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Drone Phones Market, by Application |

|

8.2.7. North America Drone Phones Market, by Technology |

|

8.2.8. North America Drone Phones Market, by End-User Industry |

|

8.2.9. North America Drone Phones Market, by Component |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Drone Phones Market, by Application |

|

8.2.10.1.2. US Drone Phones Market, by Technology |

|

8.2.10.1.3. US Drone Phones Market, by End-User Industry |

|

8.2.10.1.4. US Drone Phones Market, by Component |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Samsung Electronics Co., Ltd. |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Huawei Technologies Co., Ltd. |

|

10.3. Sony Corporation |

|

10.4. DJI Innovations |

|

10.5. Xiaomi Corporation |

|

10.6. Apple Inc. |

|

10.7. LG Electronics Inc. |

|

10.8. ZTE Corporation |

|

10.9. Motorola Mobility |

|

10.10. Qualcomm Incorporated |

|

10.11. OnePlus |

|

10.12. Nokia Corporation |

|

10.13. Lenovo Group Limited |

|

10.14. Google LLC (Alphabet Inc.) |

|

10.15. Panasonic |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Drone Phones Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Drone Phones Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Drone Phones Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA