As per Intent Market Research, the DNA Data Storage Market was valued at USD 357 million in 2023-e and will surpass USD 3,100 million by 2030; growing at a CAGR of 89.3% during 2024 - 2030.

The DNA data storage market is rapidly emerging as a revolutionary solution for the increasing demand for efficient and sustainable data storage methods. As traditional storage technologies face limitations in capacity and energy consumption, DNA-based storage offers a promising alternative by leveraging the dense information storage capabilities of biological molecules. DNA has the potential to store vast amounts of data in a compact form, providing a long-term solution to the growing challenges of data management and preservation. With the exponential growth of data generation across industries, DNA data storage is gaining traction as a viable option for organizations seeking innovative methods to store and retrieve information efficiently.

This growth is fueled by advancements in sequencing technologies, increasing investments in biotechnology, and the rising need for sustainable data storage solutions. By the end of the forecast period in 2030.

Synthetic DNA Segment is Largest Owing to Established Technology

The synthetic DNA segment represents the largest share in the DNA data storage market, primarily due to the established technology and methodologies involved in DNA synthesis and sequencing. As researchers and organizations focus on developing efficient methods for encoding digital information into synthetic DNA, the segment has witnessed significant growth. Synthetic DNA can be designed to store vast amounts of data in a stable and durable format, making it ideal for archival and long-term storage solutions.

Furthermore, the commercial viability of synthetic DNA has been bolstered by advancements in DNA synthesis technologies, which have lowered the costs and improved the scalability of DNA production. Organizations are increasingly recognizing the potential of synthetic DNA for applications ranging from digital archiving to secure data storage in cloud environments. As the demand for efficient and high-capacity storage solutions continues to rise, the synthetic DNA segment is likely to maintain its dominance in the DNA data storage market.

Encoding Technology Segment is Fastest Growing Owing to Innovative Solutions

The encoding technology segment is experiencing the fastest growth within the DNA data storage market, driven by the rapid development of innovative techniques for translating digital data into DNA sequences. As researchers explore new algorithms and methods for encoding and decoding information, this segment is becoming a focal point for advancements in data storage technology. Innovations such as error-correction codes and optimization algorithms are enhancing the efficiency and reliability of DNA data storage systems.

Additionally, the emergence of hybrid encoding techniques, which combine traditional data storage methods with DNA encoding, is further fueling the growth of this segment. These innovations aim to address challenges associated with data retrieval and integrity in DNA storage systems, making them more accessible for commercial applications. As the demand for efficient data management solutions escalates, the encoding technology segment is poised for substantial growth, paving the way for broader adoption of DNA-based storage solutions.

Sequencing Technology Segment is Largest Owing to Critical Role in Data Retrieval

The sequencing technology segment holds the largest share in the DNA data storage market, primarily due to its critical role in data retrieval and analysis. As DNA storage systems rely on accurate sequencing methods to extract stored information, advancements in sequencing technologies have a direct impact on the performance and usability of DNA-based data storage solutions. The evolution of high-throughput sequencing technologies has significantly enhanced the speed and efficiency of data retrieval processes.

Moreover, the increasing demand for precise and reliable sequencing methods is driving investments in research and development within this segment. Companies and research institutions are focusing on improving sequencing accuracy, reducing costs, and enhancing scalability to make DNA data storage a more viable option for organizations of all sizes. As the sequencing technology segment continues to evolve, it will remain a key player in the overall DNA data storage market, ensuring that data retrieval processes are efficient and effective.

End-Use Application Segment is Fastest Growing Owing to Expanding Use Cases

The end-use application segment is witnessing rapid growth in the DNA data storage market, driven by the expanding range of applications across various industries. From healthcare and pharmaceuticals to information technology and telecommunications, organizations are exploring the potential of DNA storage for diverse data management needs. The healthcare sector, in particular, is increasingly recognizing the benefits of DNA data storage for genomic data and patient records, necessitating high-capacity storage solutions that are both secure and durable.

Additionally, the growing emphasis on data preservation and archival solutions in various sectors is propelling the demand for DNA-based storage systems. As businesses accumulate vast amounts of data and seek to future-proof their data storage strategies, the end-use application segment is set to grow significantly. This trend reflects the broader shift towards sustainable and efficient data storage solutions, positioning DNA data storage as a viable option for organizations looking to address their data management challenges.

Fastest Growing Region: North America

The North America region is emerging as the fastest-growing market for DNA data storage, driven by a robust biotechnology sector, significant research investments, and a growing emphasis on innovative data storage solutions. The presence of leading technology companies, research institutions, and biotechnology firms in the United States and Canada is fostering a conducive environment for the development and adoption of DNA data storage technologies. As organizations seek to leverage cutting-edge solutions for data management, the North America region is poised for substantial growth.

Furthermore, government initiatives and funding programs aimed at promoting research in biotechnology and data storage technologies are further bolstering the market's expansion in North America. As the region continues to lead in technological advancements and innovation, it is expected to remain a key player in the global DNA data storage market, driving growth and fostering collaboration among industry stakeholders.

Competitive Landscape

The competitive landscape of the DNA data storage market is characterized by a mix of established companies and innovative start-ups, all striving to capture a share of this emerging industry. Key players in the market include Illumina, Inc., Microsoft Corporation, Twist Bioscience Corporation, DNA Script, Ginkgo Bioworks, Catalog Technologies, Helix, Thermo Fisher Scientific Inc., EDP Biotech Corporation, and QIAGEN N.V. These companies are actively engaged in research and development efforts to enhance their product offerings and advance the capabilities of DNA data storage technologies.

Moreover, strategic partnerships and collaborations among industry players are becoming increasingly common as companies seek to leverage each other's expertise and resources. This collaborative approach aims to drive innovation and accelerate the commercialization of DNA-based storage solutions. As the market continues to evolve, competition is expected to intensify, with companies focusing on developing scalable, efficient, and cost-effective DNA storage systems to meet the growing demand for sustainable data management solutions.

Report Objectives:

The report will help you answer some of the most critical questions in the DNA Data Storage Market. A few of them are as follows:

- What are the key drivers, restraints, opportunities, and challenges influencing the market growth?

- What are the prevailing technology trends in the DNA Data Storage market?

- What is the size of the DNA Data Storage market based on segments, sub-segments, and regions?

- What is the size of different market segments across key regions: North America, Europe, Asia Pacific, Latin America, Middle East & Africa?

- What are the market opportunities for stakeholders after analyzing key market trends?

- Who are the leading market players and what are their market share and core competencies?

- What is the degree of competition in the market and what are the key growth strategies adopted by leading players?

- What is the competitive landscape of the market, including market share analysis, revenue analysis, and a ranking of key players?

Report Scope:

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 357 million |

|

Forecasted Value (2030) |

USD 3,100 million |

|

CAGR (2024-2030) |

89.3% |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024-2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

DNA Data Storage Market By Type (On-Premise, Cloud), By Technology (Structure-based, Sequence-based), By End-use (Healthcare & Biotechnology Companies, Government, Research Institutes) |

|

Regional Analysis |

North America (US, Canada), Europe (Germany, France, UK, Spain, Italy & Rest of Europe), Asia Pacific (China, Japan, South Korea, India, and rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, & Rest of Latin America), Middle East & Africa (Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1.Introduction |

|

1.1.Market Definition |

|

1.2.Scope of the Study |

|

1.3.Research Assumptions |

|

1.4.Study Limitations |

|

2.Research Methodology |

|

2.1.Research Approach |

|

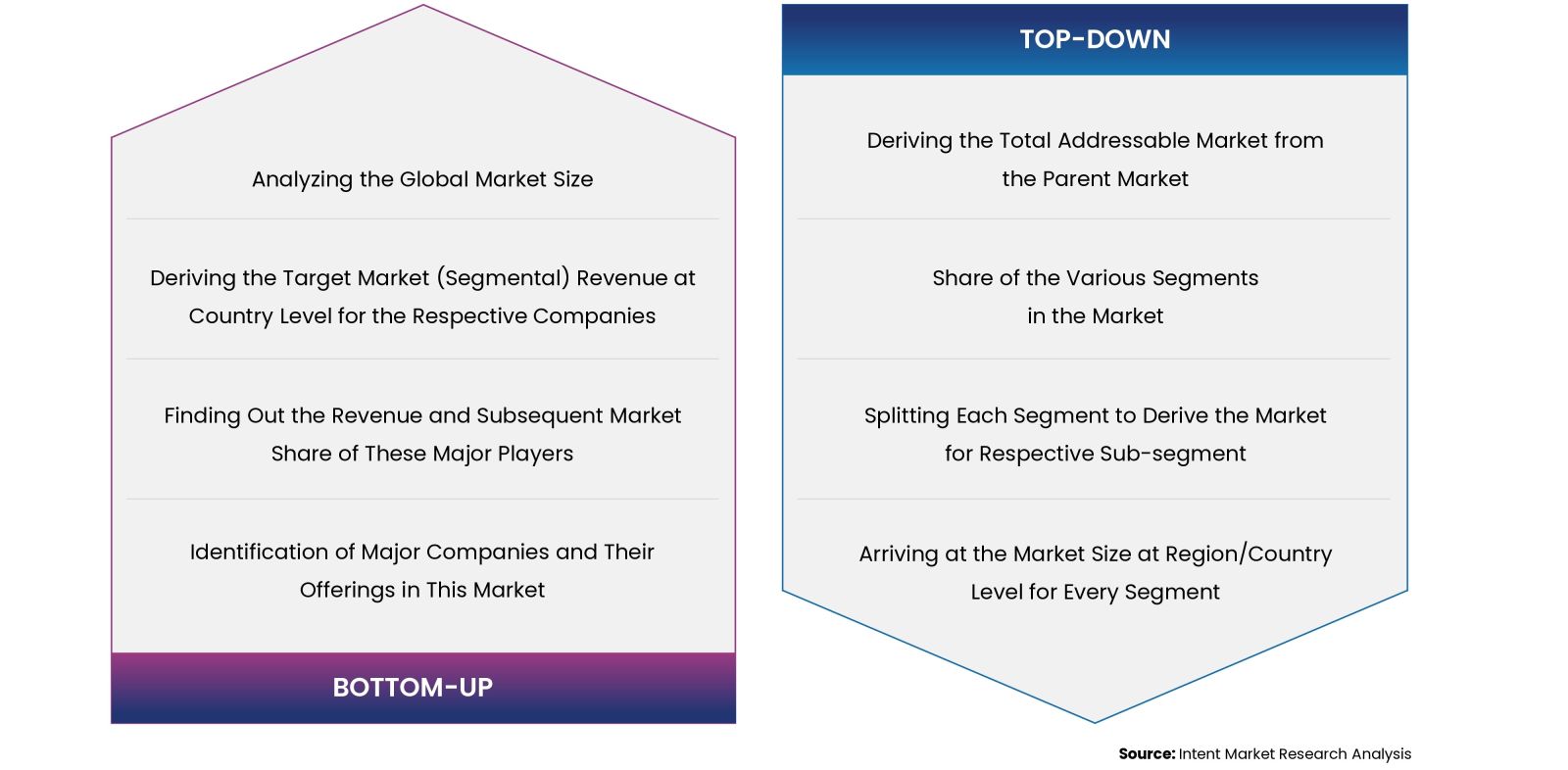

2.1.1.Top-Down Method |

|

2.1.2.Bottom-Up Method |

|

2.1.3.Factor Impact Analysis |

|

2.2.Insights & Data Collection Process |

|

2.2.1.Secondary Research |

|

2.2.2.Primary Research |

|

2.3.Data Mining Process |

|

2.3.1.Data Analysis |

|

2.3.2.Data Validation and Revalidation |

|

2.3.3.Data Triangulation |

|

3.Executive Summary |

|

3.1.Major Markets & Segments |

|

3.2.Highest Growing Regions and Respective Countries |

|

3.3.Impact of Growth Drivers & Inhibitors |

|

3.4.Regulatory Overview by Country |

|

4.DNA Data Storage Market, by Type (Market Size & Forecast: USD Million, 2024 – 2030) |

|

4.1.On-Premise |

|

4.2.Cloud |

|

5.DNA Data Storage Market, by Technology (Market Size & Forecast: USD Million, 2024 – 2030) |

|

5.1.Structure-based |

|

5.2.Sequence-based |

|

6.DNA Data Storage Market, by End-use (Market Size & Forecast: USD Million, 2024 – 2030) |

|

6.1.Government |

|

6.2.Media and Telecommunication |

|

6.3.Healthcare and Biotechnology Companies |

|

6.4.Others |

|

7.Regional Analysis (Market Size & Forecast: USD Million, 2024 – 2030) |

|

7.1.Regional Overview 7.2.North America |

|

7.2.1.Barriers & Challenges |

|

7.2.2.Opportunities |

|

7.2.3.Factor Impact Analysis |

|

7.2.4.Technology Trends |

|

7.2.5.North America DNA Data Storage Market, by Type |

|

7.2.6.North America DNA Data Storage Market, by Technology |

|

7.2.7.North America DNA Data Storage Market, by End-use |

|

*Similar segmentation will be provided at each regional level |

|

7.3.By Country |

|

7.3.1.US |

|

7.3.1.1.US DNA Data Storage Market, by Type |

|

7.3.1.2.US DNA Data Storage Market, by Technology |

|

7.3.1.3.US DNA Data Storage Market, by End-use |

|

7.3.2.Canada |

|

*Similar segmentation will be provided at each country level |

|

7.4.Europe |

|

7.5.APAC |

|

7.6.Latin America |

|

7.7.Middle East & Africa |

|

8.Competitive Landscape |

|

8.1.Overview of the Key Players |

|

8.2.Competitive Ecosystem |

|

8.2.1.Platform Manufacturers |

|

8.2.2.Subsystem Manufacturers |

|

8.2.3.Service Providers |

|

8.2.4.Software Providers |

|

8.3.Company Share Analysis |

|

8.4.Company Benchmarking Matrix |

|

8.4.1.Strategic Overview |

|

8.4.2.Product Innovations |

|

8.5.Start-up Ecosystem |

|

8.6.Strategic Competitive Insights/ Customer Imperatives |

|

8.7.ESG Matrix/ Sustainability Matrix |

|

8.8.Manufacturing Network |

|

8.8.1.Locations |

|

8.8.2.Supply Chain and Logistics |

|

8.8.3.Product Flexibility/Customization |

|

8.8.4.Digital Transformation and Connectivity |

|

8.8.5.Environmental and Regulatory Compliance |

|

8.9.Technology Readiness Level Matrix |

|

8.10.Technology Maturity Curve |

|

8.11.Buying Criteria |

|

9.Company Profiles |

|

9.1.Illumina |

|

9.1.1.Company Overview |

|

9.1.2.Company Financials |

|

9.1.3.Product/Service Portfolio |

|

9.1.4.Recent Developments |

|

9.1.5.IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2.Micron Technology |

|

9.3.ThermoFisher Scientific |

|

9.4.Agilent |

|

9.5.Microsoft |

|

9.6.Iridia |

|

9.7.Beckman Coulter |

|

9.8.Eurofins Scientific |

|

9.9.Siemens |

|

9.10.Helixworks Technologies |

|

9.Appendix |

A comprehensive market research approach was employed to gather and analyze data on the DNA Data Storage Market. In the process, the analysis was also done to estimate the parent market and relevant adjacencies to major the impact of them on the DNA Data Storage Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the DNA Data Storage ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Estimation

A combination of top-down and bottom-up approaches was utilized to estimate the overall size of the DNA Data Storage market. These methods were also employed to estimate the size of various sub-segments within the market. The market size estimation methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

Data Triangulation

To ensure the accuracy and reliability of the market size estimates, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size estimates.

NA