As per Intent Market Research, the Disposable Gloves Market was valued at USD 8.5 billion in 2024-e and will surpass USD 13.9 billion by 2030; growing at a CAGR of 8.5% during 2024 - 2030.

The disposable gloves market has experienced significant growth due to the rising awareness of health and safety in various sectors, including healthcare, food handling, and industrial applications. Disposable gloves are widely used to protect workers and consumers from contamination, ensure hygiene, and comply with regulations. The market has further expanded due to the increased demand for personal protective equipment (PPE) during health crises such as the COVID-19 pandemic. This surge in demand has driven innovations in materials and designs to meet diverse industry needs. The market continues to evolve as hygiene practices, health regulations, and safety concerns remain at the forefront of public and industrial focus.

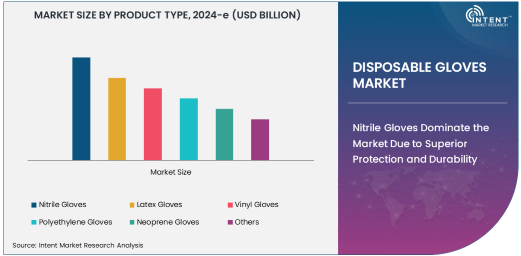

Nitrile Gloves Dominate the Market Due to Superior Protection and Durability

Nitrile gloves are the largest and most popular product type in the disposable gloves market, primarily due to their high durability, flexibility, and excellent resistance to chemicals and punctures. Nitrile gloves are favored in the healthcare, industrial, and chemical sectors because they provide a higher level of protection compared to latex and vinyl gloves. Nitrile gloves are non-allergenic, making them a safer option for individuals with latex allergies, which further bolsters their market dominance.

The increased demand for nitrile gloves is largely driven by their widespread use in medical settings, including hospitals, clinics, and laboratories, where protection against pathogens and contaminants is essential. In addition, nitrile gloves are becoming increasingly popular in food handling and industrial applications, owing to their strength and versatility. This combination of features ensures that nitrile gloves will continue to lead the disposable gloves market in both volume and value.

Latex Gloves Experience Strong Demand in Healthcare Due to Comfort and Elasticity

Latex gloves, while facing some competition from nitrile, continue to experience strong demand in the healthcare sector due to their comfort, elasticity, and superior tactile sensitivity. Latex gloves are ideal for use in medical examinations, surgeries, and other healthcare applications where dexterity and sensitivity to touch are crucial. The natural elasticity of latex makes it a perfect fit for healthcare professionals who require gloves that conform to their hands while offering excellent stretchability.

Although latex gloves are associated with a risk of allergic reactions in some individuals, their advantages in healthcare applications—such as providing a snug fit and excellent barrier properties—ensure their continued use in medical settings. This sector's consistent demand for latex gloves will keep it as a significant player in the disposable gloves market.

Vinyl Gloves Are the Fastest Growing Due to Cost-Effectiveness and Non-Allergenic Properties

Vinyl gloves are one of the fastest-growing segments in the disposable gloves market, primarily due to their cost-effectiveness and non-allergenic properties. Vinyl gloves are made from synthetic PVC (polyvinyl chloride) and are commonly used in low-risk environments, such as food handling, cleaning, and household applications. They are particularly attractive to businesses looking for an economical alternative to nitrile or latex gloves.

The vinyl glove market is also expanding in sectors where gloves are required but there is a lower risk of exposure to hazardous chemicals or pathogens. The non-allergenic nature of vinyl gloves appeals to users who may experience reactions to latex, further fueling their growth in the market. Their widespread use in non-medical applications ensures that vinyl gloves will continue to experience rapid expansion.

Healthcare & Medical Sector Is the Largest Application Segment Driven by Safety Regulations

The healthcare and medical sector is the largest application segment for disposable gloves, driven by the critical need for hygiene and safety in healthcare settings. Gloves are a fundamental part of infection control in medical environments, where the risk of contamination and transmission of pathogens is high. Disposable gloves are used in surgeries, patient care, diagnostic procedures, and laboratory work to protect both healthcare workers and patients from cross-contamination.

The global health crisis, particularly the COVID-19 pandemic, has significantly increased the demand for disposable gloves in healthcare settings, further solidifying this segment as the largest in the market. Stringent health and safety regulations continue to drive growth in the sector, ensuring that disposable gloves remain an essential part of infection control measures in medical and healthcare settings.

Food Handling & Processing Is the Fastest Growing Application Driven by Hygiene Standards

The food handling and processing sector is the fastest-growing application segment for disposable gloves, primarily due to heightened hygiene standards in food safety. Gloves are used extensively in food preparation, packaging, and distribution to prevent contamination and ensure that products meet health and safety regulations. The growing demand for convenience foods and processed products has led to an increased need for disposable gloves in food-related operations.

As food safety becomes more important to consumers and regulators, the use of disposable gloves is becoming standard practice in the food industry. The rise in foodborne illnesses and the increasing focus on hygiene protocols in food manufacturing and handling further support the rapid growth of disposable gloves in this application.

Healthcare & Pharmaceuticals Remain the Largest End-Use Industry Driven by Pandemic Response and Ongoing Healthcare Needs

The healthcare and pharmaceuticals sector is the largest end-use industry for disposable gloves, a position solidified by the heightened focus on health and hygiene, especially in response to the global pandemic. Healthcare professionals, including doctors, nurses, and laboratory staff, rely on disposable gloves to prevent the spread of infections and protect themselves from exposure to hazardous materials and pathogens.

With the ongoing emphasis on infection prevention and healthcare regulations, this industry is expected to remain the dominant consumer of disposable gloves. The growing demand for healthcare services, coupled with the increased need for safety measures in healthcare settings, ensures that the healthcare and pharmaceuticals industry will continue to lead the market for disposable gloves.

Manufacturing & Industrial Sector Shows Strong Demand for Safety Equipment

The manufacturing and industrial sector is another significant end-use industry in the disposable gloves market. This sector relies on gloves for protection against chemical exposure, sharp objects, and other hazardous materials in various industrial processes. Disposable gloves are commonly used in the automotive, chemical, and electronics manufacturing industries to ensure worker safety and comply with safety regulations.

As industrial processes become more stringent in terms of safety and hygiene, the demand for disposable gloves continues to grow, especially in high-risk environments where workers are exposed to toxic substances or need to maintain high levels of cleanliness. This sector remains a key contributor to the ongoing expansion of the disposable gloves market.

Asia Pacific Holds the Largest Market Share Due to High Production Capacity and Demand

Asia Pacific is the largest region in the disposable gloves market, driven by both high production capacity and strong demand for gloves across various industries. Countries like China, Malaysia, and Thailand are major global suppliers of disposable gloves, with their large manufacturing base enabling them to meet the increasing global demand. The region is home to leading glove manufacturers such as Top Glove, Hartalega, and Kossan, which dominate the supply chain.

In addition to the strong manufacturing presence, the growing demand for gloves in healthcare, food processing, and industrial applications across Asia Pacific supports the region’s dominant market position. The ongoing industrialization and increased focus on health and safety across emerging economies in the region further boost demand, ensuring Asia Pacific’s continued leadership in the disposable gloves market.

Leading Companies and Competitive Landscape

The disposable gloves market is competitive, with key players such as Top Glove, Ansell, Kimberly-Clark, and Cardinal Health leading the market. These companies are focused on increasing production capacity, expanding their product offerings, and meeting the growing global demand for disposable gloves. Strategic acquisitions, partnerships with healthcare providers, and investments in research and development are key strategies for maintaining a strong market position.

As demand stabilizes in the post-pandemic era, these companies are also exploring new opportunities in eco-friendly glove alternatives and enhancing the comfort and protection features of their products to cater to evolving consumer needs. Continuous innovation and scalability remain critical factors in ensuring long-term success in the disposable gloves market.

Recent Developments:

- Top Glove Corporation Berhad expanded its production capacity to meet the increased global demand for disposable gloves, especially in healthcare sectors.

- Ansell Limited launched a new range of nitrile gloves designed for enhanced tactile sensitivity and durability in medical environments.

- Kimberly-Clark Corporation introduced eco-friendly gloves made from sustainable materials, aiming to reduce the environmental impact of single-use gloves.

- Hartalega Holdings Berhad increased production of nitrile gloves to address the growing demand due to ongoing global health concerns.

- Medline Industries, Inc. announced a strategic partnership with healthcare providers to improve the distribution of disposable gloves to hospitals and clinics.

List of Leading Companies:

- Top Glove Corporation Berhad

- Hartalega Holdings Berhad

- Ansell Limited

- Kimberly-Clark Corporation

- Supermax Corporation Berhad

- Medline Industries, Inc.

- Semperit AG Holding

- Rubberex Corporation (M) Berhad

- Kossan Rubber Industries Bhd

- Adelphi Healthcare Packaging

- Cardinal Health, Inc.

- Dynarex Corporation

- Saint-Gobain Performance Plastics

- Supermax Healthcare

- The Gloves Company

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 8.5 billion |

|

Forecasted Value (2030) |

USD 13.9 billion |

|

CAGR (2025 – 2030) |

8.5% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Disposable Gloves Market By Product Type (Nitrile Gloves, Latex Gloves, Vinyl Gloves, Polyethylene Gloves, Neoprene Gloves), By Application (Healthcare & Medical, Food Handling & Processing, Industrial & Chemical, Cleaning & Household, Automotive), By End-Use Industry (Healthcare & Pharmaceuticals, Food & Beverage, Manufacturing & Industrial, Retail, Agriculture) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Top Glove Corporation Berhad, Hartalega Holdings Berhad, Ansell Limited, Kimberly-Clark Corporation, Supermax Corporation Berhad, Medline Industries, Inc., Semperit AG Holding, Rubberex Corporation (M) Berhad, Kossan Rubber Industries Bhd, Adelphi Healthcare Packaging, Cardinal Health, Inc., Dynarex Corporation, Saint-Gobain Performance Plastics, Supermax Healthcare, The Gloves Company |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Disposable Gloves Market, by Product Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Nitrile Gloves |

|

4.2. Latex Gloves |

|

4.3. Vinyl Gloves |

|

4.4. Polyethylene Gloves |

|

4.5. Neoprene Gloves |

|

4.6. Others |

|

5. Disposable Gloves Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Healthcare & Medical |

|

5.2. Food Handling & Processing |

|

5.3. Industrial & Chemical |

|

5.4. Cleaning & Household |

|

5.5. Automotive |

|

5.6. Others |

|

6. Disposable Gloves Market, by End-Use Industry (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Healthcare & Pharmaceuticals |

|

6.2. Food & Beverage |

|

6.3. Manufacturing & Industrial |

|

6.4. Retail |

|

6.5. Agriculture |

|

6.6. Others |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Disposable Gloves Market, by Product Type |

|

7.2.7. North America Disposable Gloves Market, by Application |

|

7.2.8. North America Disposable Gloves Market, by End-Use Industry |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Disposable Gloves Market, by Product Type |

|

7.2.9.1.2. US Disposable Gloves Market, by Application |

|

7.2.9.1.3. US Disposable Gloves Market, by End-Use Industry |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Top Glove Corporation Berhad |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Hartalega Holdings Berhad |

|

9.3. Ansell Limited |

|

9.4. Kimberly-Clark Corporation |

|

9.5. Supermax Corporation Berhad |

|

9.6. Medline Industries, Inc. |

|

9.7. Semperit AG Holding |

|

9.8. Rubberex Corporation (M) Berhad |

|

9.9. Kossan Rubber Industries Bhd |

|

9.10. Adelphi Healthcare Packaging |

|

9.11. Cardinal Health, Inc. |

|

9.12. Dynarex Corporation |

|

9.13. Saint-Gobain Performance Plastics |

|

9.14. Supermax Healthcare |

|

9.15. The Gloves Company |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Disposable Gloves Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Disposable Gloves Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Disposable Gloves Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA