As per Intent Market Research, the Disposable Endoscopes Market was valued at USD 2.9 Billion in 2024-e and will surpass USD 8.7 Billion by 2030; growing at a CAGR of 17.2% during 2025-2030.

The disposable endoscopes market is witnessing substantial growth as the healthcare industry continues to prioritize infection control and hygiene in medical procedures. Disposable endoscopes are becoming increasingly popular due to their single-use nature, which minimizes the risk of cross-contamination and reduces the need for complex sterilization processes. This market is driven by technological advancements, the growing demand for minimally invasive surgeries, and an expanding geriatric population requiring diagnostic procedures. Additionally, the rising prevalence of chronic diseases such as gastrointestinal disorders, respiratory diseases, and urological conditions is contributing to the higher adoption of disposable endoscopes in hospitals and clinics globally.

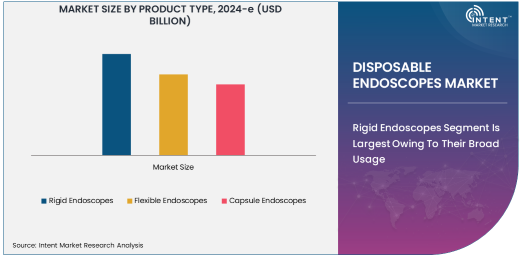

Rigid Endoscopes Segment Is Largest Owing To Their Broad Usage

Among the various product types in the disposable endoscopes market, rigid endoscopes hold the largest share due to their widespread usage across a variety of medical fields, including gastrointestinal (GI), urology, and respiratory endoscopy. These devices are highly reliable for diagnostic purposes and offer high image clarity, making them ideal for procedures that require precision. Rigid endoscopes are particularly common in surgeries where visualization of internal cavities is required, such as in arthroscopic or urological procedures. Due to their durable structure and lower manufacturing costs compared to other types of endoscopes, rigid endoscopes are favored by healthcare providers and are seen as the standard for many endoscopic applications.

In addition to their utility in diagnostic settings, rigid endoscopes are increasingly being used in therapeutic interventions, which further boosts their market share. The ease of use, cost-effectiveness, and consistent performance in a variety of environments make rigid endoscopes an indispensable part of modern healthcare diagnostics and surgeries. As healthcare providers continue to focus on infection prevention, the preference for rigid disposable endoscopes is expected to remain strong.

Hospitals Segment Is Fastest Growing Owing To Rising Patient Volume

The hospitals segment is the fastest-growing subsegment within the disposable endoscopes market. This growth is attributed to the increasing patient volume in hospitals, which is driven by the rising incidence of chronic diseases such as gastrointestinal, urological, and respiratory conditions. Hospitals play a central role in healthcare delivery, providing a range of diagnostic and therapeutic services, including minimally invasive endoscopic procedures. Disposable endoscopes are increasingly being adopted by hospitals due to their infection control benefits and the ease of use in busy hospital settings.

As hospitals continue to prioritize patient safety and cost efficiency, the demand for disposable endoscopes, particularly in high-volume environments, has surged. Additionally, hospitals are implementing infection control protocols more stringently, making disposable endoscopes an attractive option due to their single-use nature, which eliminates the need for costly sterilization and reduces the risk of cross-contamination. The growing preference for minimally invasive surgeries and diagnostic procedures also supports the adoption of disposable endoscopes in hospitals.

Gastrointestinal (GI) Endoscopy Is Largest Application Segment Due To High Incidence of GI Disorders

Gastrointestinal (GI) endoscopy is the largest application segment in the disposable endoscopes market, driven by the high prevalence of GI disorders globally. Conditions such as colorectal cancer, irritable bowel syndrome (IBS), and gastroesophageal reflux disease (GERD) contribute to a substantial demand for GI endoscopic procedures. GI endoscopy is crucial for diagnosing these conditions and for performing procedures such as colonoscopies and endoscopies for tissue biopsy and surveillance. The increasing awareness of GI health, along with advancements in endoscopic technology, has contributed to the widespread adoption of disposable endoscopes in this field.

Moreover, the aging global population is more prone to developing GI diseases, further driving the demand for diagnostic tools like disposable endoscopes. The preference for minimally invasive methods, such as GI endoscopy, over traditional surgical methods is another key factor in this segment's growth. The ability to offer precise, real-time imaging without the need for extensive recovery time has made GI endoscopy a critical tool in the early detection and treatment of gastrointestinal conditions.

North America Is Largest Region Due To Advanced Healthcare Infrastructure

North America holds the largest share of the disposable endoscopes market, primarily due to its advanced healthcare infrastructure and high healthcare spending. The U.S., in particular, represents the largest market for disposable endoscopes, driven by the growing preference for minimally invasive surgical techniques and a high demand for diagnostic procedures. The region’s well-established healthcare system, coupled with a high incidence of chronic diseases such as gastrointestinal and urological disorders, has created a significant demand for disposable endoscopes.

Additionally, North America has a high concentration of leading medical device manufacturers, such as Medtronic, Olympus, and Boston Scientific, which continue to drive innovation in the disposable endoscopes market. Government initiatives promoting advanced healthcare technologies and patient safety are further encouraging the adoption of disposable endoscopes. The growing trend toward minimally invasive procedures is expected to continue fueling the demand for disposable endoscopes in North America.

Leading Companies and Competitive Landscape

The disposable endoscopes market is highly competitive, with several key players leading the way in terms of innovation, product development, and market share. Companies such as Medtronic, Olympus Corporation, Johnson & Johnson, Stryker Corporation, and Boston Scientific are some of the major players in the market, offering a wide range of disposable endoscopes for various applications. These companies invest heavily in research and development to enhance the functionality and performance of their products, such as improving imaging capabilities and ensuring compatibility with minimally invasive surgical tools.

To stay competitive, companies are focusing on strategic acquisitions, partnerships, and collaborations. For example, Medtronic recently expanded its product offerings through the acquisition of a company specializing in single-use endoscopic devices. As the demand for disposable endoscopes grows, the market is expected to witness increasing consolidation among leading players, as they aim to strengthen their market position and expand their product portfolios. The focus on innovation, cost efficiency, and regulatory compliance will be crucial for companies looking to lead in the evolving disposable endoscopes market.

Recent Developments:

- Medtronic announced the launch of its new single-use flexible endoscopes aimed at improving diagnostic and therapeutic procedures, offering high-definition imaging and ease of use in minimally invasive surgeries.

- Olympus Corporation entered into a strategic partnership with a leading healthcare provider to expand its disposable endoscope product portfolio, focusing on the gastrointestinal and respiratory sectors.

- Johnson & Johnson acquired a company specializing in single-use endoscopic systems, which will enhance its product offerings in minimally invasive surgery and diagnostic tools.

- Ambu A/S unveiled its new disposable bronchoscopes, designed to meet the growing demand for flexible endoscopy in respiratory diagnostics, ensuring better infection control in hospitals.

- Stryker Corporation received FDA clearance for its new line of disposable arthroscopes, which are set to revolutionize joint surgeries by improving operational efficiency and reducing costs associated with infection risks.

List of Leading Companies:

- Medtronic

- Olympus Corporation

- Johnson & Johnson

- Karl Storz GmbH & Co. KG

- Stryker Corporation

- Boston Scientific

- Richard Wolf GmbH

- Fujifilm Holdings Corporation

- Cook Medical

- Ambu A/S

- Hoya Corporation

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- Conmed Corporation

- C.R. Bard, Inc.

- Smith & Nephew

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 2.9 Billion |

|

Forecasted Value (2030) |

USD 8.7 Billion |

|

CAGR (2025 – 2030) |

17.2% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Disposable Endoscopes by Product Type (Rigid Endoscopes, Flexible Endoscopes, Capsule Endoscopes), by End-User Industry (Hospitals, Diagnostic Centers, Ambulatory Surgical Centers, Research Institutions), by Application (Gastrointestinal Endoscopy, Urology Endoscopy, ENT Endoscopy, Arthroscopy, Respiratory Endoscopy) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Medtronic, Olympus Corporation, Johnson & Johnson, Karl Storz GmbH & Co. KG, Stryker Corporation, Boston Scientific, Richard Wolf GmbH, Fujifilm Holdings Corporation, Cook Medical, Ambu A/S, Hoya Corporation, Shenzhen Mindray Bio-Medical Electronics Co., Ltd., Conmed Corporation, C.R. Bard, Inc., Smith & Nephew |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Disposable Endoscopes Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Rigid Endoscopes |

|

4.2. Flexible Endoscopes |

|

4.3. Capsule Endoscopes |

|

5. Disposable Endoscopes Market, by End-User Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Hospitals |

|

5.2. Diagnostic Centers |

|

5.3. Ambulatory Surgical Centers |

|

5.4. Research Institutions |

|

6. Disposable Endoscopes Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Gastrointestinal (GI) Endoscopy |

|

6.2. Urology Endoscopy |

|

6.3. ENT Endoscopy |

|

6.4. Arthroscopy |

|

6.5. Respiratory Endoscopy |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Disposable Endoscopes Market, by Product Type |

|

7.2.7. North America Disposable Endoscopes Market, by End-User Industry |

|

7.2.8. North America Disposable Endoscopes Market, by Application |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Disposable Endoscopes Market, by Product Type |

|

7.2.9.1.2. US Disposable Endoscopes Market, by End-User Industry |

|

7.2.9.1.3. US Disposable Endoscopes Market, by Application |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Medtronic |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Olympus Corporation |

|

9.3. Johnson & Johnson |

|

9.4. Karl Storz GmbH & Co. KG |

|

9.5. Stryker Corporation |

|

9.6. Boston Scientific |

|

9.7. Richard Wolf GmbH |

|

9.8. Fujifilm Holdings Corporation |

|

9.9. Cook Medical |

|

9.10. Ambu A/S |

|

9.11. Hoya Corporation |

|

9.12. Shenzhen Mindray Bio-Medical Electronics Co., Ltd. |

|

9.13. Conmed Corporation |

|

9.14. C.R. Bard, Inc. |

|

9.15. Smith & Nephew |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Disposable Endoscopes Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Disposable Endoscopes Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Disposable Endoscopes Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA