As per Intent Market Research, the Display Market was valued at USD 125.1 billion in 2024-e and will surpass USD 179.3 billion by 2030; growing at a CAGR of 6.2% during 2025 - 2030.

The global display market is poised for significant growth, driven by technological innovations and diverse applications across various industries. Displays serve as essential components in consumer electronics, automotive systems, industrial applications, and healthcare devices. With rapid advancements in display technologies, such as OLED, LED, and MicroLED, the market is evolving to meet the growing demands for high-quality, energy-efficient, and versatile display solutions. Displays are being incorporated into an increasing number of devices, from smartphones and smartwatches to automotive dashboards and industrial machines, fueling the market's expansion.

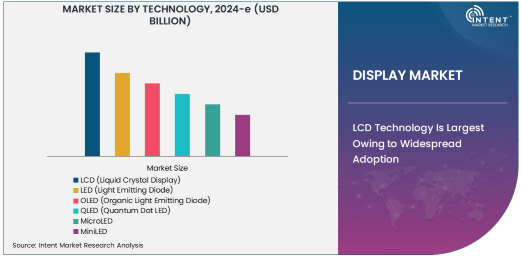

LCD Technology Is Largest Owing to Widespread Adoption

Among various display technologies, LCD (Liquid Crystal Display) remains the largest segment due to its widespread adoption across consumer electronics, televisions, and industrial applications. LCD panels offer a cost-effective solution without compromising on quality, making them the go-to choice for many manufacturers. As the most commonly used technology in display devices such as televisions, smartphones, and monitors, LCD's high production volume and affordability ensure its dominant position in the market. Even with the rise of newer technologies like OLED, LCD continues to be the preferred option for budget-conscious consumers and manufacturers seeking reliable, high-performance displays.

The dominance of the LCD segment is also supported by its versatility in various display formats, from small screens in wearable devices to large-format displays in televisions and digital signage. The technology's ability to deliver high brightness, clarity, and color accuracy at a lower cost makes it suitable for mass-market adoption in a range of consumer products. Additionally, LCD's ongoing advancements, including improvements in color reproduction and energy efficiency, further solidify its position in the display market.

Consumer Electronics Application Is Largest Owing to Demand for High-Quality Displays

In the consumer electronics segment, the demand for high-quality displays is the largest driver of the market. Consumer electronics, including smartphones, tablets, laptops, and televisions, account for the bulk of display sales. With the increasing consumption of digital content and the growing need for immersive, high-definition viewing experiences, the demand for advanced display technologies, such as OLED and QLED, is on the rise. Additionally, the growing trend of smart homes and interconnected devices is further contributing to the expansion of the consumer electronics display market.

The integration of displays in consumer electronics is not limited to traditional devices like smartphones and televisions but also extends to newer innovations, such as virtual reality headsets, gaming consoles, and home appliances. As consumers continue to prioritize visual quality in their electronic devices, the consumer electronics application remains the largest and most influential segment in the display market.

Consumer Electronics End-Use Industry Is Largest Owing to Widespread Device Usage

The consumer electronics industry remains the largest end-use segment in the display market due to the ubiquitous presence of display devices in everyday life. From smartphones and tablets to laptops, televisions, and gaming consoles, consumer electronics are the primary drivers of display technology adoption. With the global proliferation of smartphones and the increasing popularity of home entertainment systems, consumer electronics continue to account for a significant share of the overall display market. The rise of smart home devices, wearables, and augmented reality (AR) gadgets further contributes to the demand for displays in this sector.

The rapid pace of innovation in consumer electronics, such as the development of foldable smartphones, 8K televisions, and AR devices, is expected to keep the demand for advanced display technologies high. As consumers increasingly prioritize high-definition and immersive viewing experiences, the consumer electronics industry will remain a pivotal force in shaping the future of the display market.

Asia-Pacific Region Is Fastest Growing Due to Manufacturing Hub and Consumer Demand

The Asia-Pacific region is the fastest-growing market for displays, driven by its position as the global manufacturing hub for display technologies and the increasing demand for consumer electronics. Countries like China, Japan, South Korea, and Taiwan are home to some of the largest display manufacturers, including Samsung, LG, BOE Technology, and Sharp. These countries are at the forefront of innovation in display technologies such as OLED, MicroLED, and QLED, with substantial investments in research and development to maintain competitive advantages.

In addition to its manufacturing capabilities, Asia-Pacific benefits from a large and growing consumer base, particularly in emerging economies like China and India. The rising middle class and increasing disposable income in these countries are fueling the demand for consumer electronics, automotive displays, and other display-based technologies. As a result, Asia-Pacific is expected to continue leading the global display market in terms of both manufacturing and consumption.

Leading Companies and Competitive Landscape

Leading companies in the display market include Samsung Electronics, LG Display, BOE Technology, AU Optronics, and Sharp Corporation. These players dominate the market by investing heavily in research and development to introduce next-generation display technologies. Samsung and LG are particularly strong in the OLED and QLED segments, while BOE Technology leads in LCD panel production. The competitive landscape is marked by continuous innovation, with companies vying to develop more energy-efficient, high-performance displays.

The display market is characterized by significant competition among established players and new entrants seeking to capture market share. Strategic alliances, mergers and acquisitions, and partnerships with technology firms are common strategies to enhance product portfolios and expand global reach. As the demand for displays in emerging technologies like wearables, automotive infotainment systems, and smart home devices grows, companies are focusing on diversifying their offerings to meet the evolving needs of consumers and industries alike.

Recent Developments:

- Samsung Electronics announced the launch of its new QLED 8K TV series, claiming enhanced picture quality and immersive viewing experiences for users.

- LG Display completed the development of its OLED TV panels, which are now being incorporated into various high-end television models.

- BOE Technology Group secured a major contract with a leading automaker to supply OLED displays for in-car infotainment systems and dashboard panels.

- Japan Display Inc. revealed a major investment in MicroLED technology for future consumer electronics, including smartphones and wearable devices.

- TCL Corporation has entered into a strategic partnership with a major smartphone manufacturer to integrate MiniLED technology into smartphones and smart TVs, expanding its product offerings.

List of Leading Companies:

- Samsung Electronics

- LG Display

- BOE Technology Group

- AU Optronics

- Sharp Corporation

- Japan Display Inc.

- Innolux Corporation

- Samsung SDI

- Hon Hai Precision Industry (Foxconn)

- TCL Corporation

- Panasonic Corporation

- Sony Corporation

- E Ink Holdings

- Elbit Systems

- Koninklijke Philips N.V.

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 125.1 Billion |

|

Forecasted Value (2030) |

USD 179.3 Billion |

|

CAGR (2025 – 2030) |

6.2% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Display Market By Technology (LCD, LED, OLED, QLED, MicroLED, MiniLED), By Application (Consumer Electronics, Automotive Displays, Digital Signage, Industrial Displays, Television Panels, Smart Wearables, Advertising Displays), By End-Use Industry (Consumer Electronics, Automotive, Healthcare, Retail, Industrial, Entertainment, Aerospace & Defense) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Samsung Electronics, LG Display, BOE Technology Group, AU Optronics, Sharp Corporation, Japan Display Inc., Innolux Corporation, Samsung SDI, Hon Hai Precision Industry (Foxconn), TCL Corporation, Panasonic Corporation, Sony Corporation, E Ink Holdings, Elbit Systems, Koninklijke Philips N.V. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Display Market, by Technology (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. LCD (Liquid Crystal Display) |

|

4.2. LED (Light Emitting Diode) |

|

4.3. OLED (Organic Light Emitting Diode) |

|

4.4. QLED (Quantum Dot LED) |

|

4.5. MicroLED |

|

4.6. MiniLED |

|

5. Display Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Consumer Electronics |

|

5.2. Automotive Displays |

|

5.3. Digital Signage |

|

5.4. Industrial Displays |

|

5.5. Television Panels |

|

5.6. Smart Wearables |

|

5.7. Advertising Displays |

|

6. Display Market, by End-Use Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Consumer Electronics |

|

6.2. Automotive |

|

6.3. Healthcare |

|

6.4. Retail |

|

6.5. Industrial |

|

6.6. Entertainment |

|

6.7. Aerospace & Defense |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Display Market, by Technology |

|

7.2.7. North America Display Market, by Application |

|

7.2.8. North America Display Market, by End-Use Industry |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Display Market, by Technology |

|

7.2.9.1.2. US Display Market, by Application |

|

7.2.9.1.3. US Display Market, by End-Use Industry |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Samsung Electronics |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. LG Display |

|

9.3. BOE Technology Group |

|

9.4. AU Optronics |

|

9.5. Sharp Corporation |

|

9.6. Japan Display Inc. |

|

9.7. Innolux Corporation |

|

9.8. Samsung SDI |

|

9.9. Hon Hai Precision Industry (Foxconn) |

|

9.10. TCL Corporation |

|

9.11. Panasonic Corporation |

|

9.12. Sony Corporation |

|

9.13. E Ink Holdings |

|

9.14. Elbit Systems |

|

9.15. Koninklijke Philips N.V. |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Display Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Display Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Display Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA