As per Intent Market Research, the Disaster Preparedness Systems Market was valued at USD 176.1 billion in 2024-e and will surpass USD 291.9 billion by 2030; growing at a CAGR of 8.8% during 2025 - 2030.

The disaster preparedness systems market is essential for mitigating the impact of natural and man-made disasters by providing solutions that enable quick response, communication, and recovery. These systems are used by organizations in various industries to ensure business continuity and safety during critical events. As the frequency of disasters continues to rise, businesses and governments worldwide are increasingly investing in disaster preparedness solutions that help reduce risks and ensure rapid, effective responses. The market is driven by the growing need for advanced systems to handle emergencies, as well as technological innovations in communication and disaster recovery.

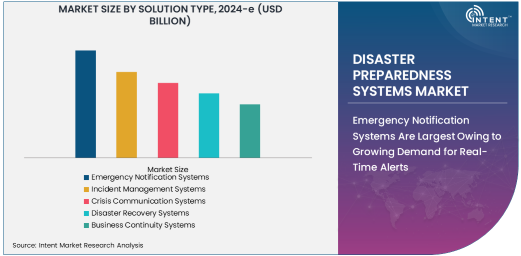

Emergency Notification Systems Are Largest Owing to Growing Demand for Real-Time Alerts

Emergency notification systems are the largest segment in the disaster preparedness systems market, driven by the increasing need for real-time alerts and communication during emergencies. These systems are widely used across various industries and government agencies to send immediate notifications about disasters, ranging from natural disasters like hurricanes and earthquakes to man-made events such as cyberattacks or industrial accidents. The ability to notify large populations in real time helps mitigate risks, protect lives, and manage resources effectively during high-stakes situations. With advancements in mobile and cloud technologies, these systems have become more reliable, efficient, and accessible, contributing to their dominance in the market.

The widespread adoption of emergency notification systems has been particularly prominent in sectors such as healthcare, government, and transportation, where timely warnings are critical. As the world faces an increasing number of disasters, the demand for these systems is expected to continue growing, reinforcing their position as the largest subsegment in the disaster preparedness market.

Healthcare Sector Is Fastest Growing Owing to Increased Focus on Patient Safety

The healthcare sector is the fastest-growing end-user industry for disaster preparedness systems, driven by the growing need to protect patients and ensure the continuity of critical medical services during emergencies. Healthcare facilities, such as hospitals and clinics, are increasingly adopting disaster preparedness solutions to safeguard both their staff and patients in case of disasters like floods, fires, pandemics, or terrorist attacks. These systems help healthcare providers to manage emergency situations effectively by ensuring that communication networks remain intact, critical equipment is safeguarded, and staff is informed of procedures and evacuation plans.

The healthcare sector's rapid growth in disaster preparedness solutions is fueled by the need for more robust crisis management and incident response capabilities, especially after the COVID-19 pandemic highlighted the vulnerabilities in the healthcare system. Investments in these systems are expected to rise as governments, healthcare providers, and organizations focus on improving disaster resilience and ensuring the delivery of essential medical services during crises.

Software Segment Is Largest Owing to Comprehensive Disaster Management Needs

The software component of disaster preparedness systems is the largest subsegment, as it provides the foundational tools for managing crises and ensuring business continuity. Disaster recovery, business continuity, and incident management software are crucial for orchestrating the response to emergencies. These software solutions enable organizations to predict, prepare, respond, and recover from disasters efficiently. They offer capabilities like real-time monitoring, data backup, and recovery, as well as incident tracking and reporting, which are essential for maintaining operations during disruptive events.

The prominence of software in the disaster preparedness systems market is driven by its scalability and ability to integrate with other systems such as communication tools, hardware, and cloud solutions. As organizations continue to prioritize preparedness, the demand for software solutions that can automate tasks, provide detailed analytics, and support decision-making during crises is growing. This has solidified the software segment as the largest in the market.

Cloud-Based Deployment Mode Is Fastest Growing Due to Scalability and Flexibility

Cloud-based deployment mode is the fastest-growing segment in the disaster preparedness systems market, driven by the scalability, flexibility, and cost-effectiveness of cloud solutions. Cloud-based systems allow organizations to store and access data remotely, ensuring that disaster recovery processes and business continuity plans are not dependent on physical infrastructure. This is particularly valuable for businesses with multiple locations or distributed operations, as it enables them to maintain access to critical data and communication tools during a disaster.

The cloud-based approach also supports real-time collaboration and communication, which is essential for managing emergency situations. As more businesses and governments move toward digital transformation, the adoption of cloud-based solutions for disaster preparedness is expected to accelerate, making it the fastest-growing deployment mode in the market.

North America Is Largest Region Owing to Advanced Infrastructure and High Adoption Rates

North America is the largest region in the disaster preparedness systems market, owing to its advanced infrastructure, high technological adoption rates, and well-established regulatory frameworks. In countries like the United States and Canada, the emphasis on disaster preparedness is a top priority, particularly in sectors like healthcare, energy, and government. The region’s governments and private organizations are heavily investing in advanced systems to improve disaster resilience and ensure public safety during crises.

Moreover, North America benefits from a well-developed IT infrastructure, which supports the widespread adoption of cloud-based and software solutions for disaster preparedness. The region’s continued focus on enhancing emergency management capabilities, coupled with increasing awareness of disaster risks, ensures that North America will remain the largest market for disaster preparedness systems for the foreseeable future.

Leading Companies and Competitive Landscape

The disaster preparedness systems market is characterized by the presence of several leading players that offer a diverse range of solutions to meet the growing demand for disaster management. Companies such as Honeywell International Inc., Motorola Solutions, Everbridge, Thales Group, and Siemens AG are at the forefront of the market. These companies have a strong presence in key regions such as North America and Europe, and they continue to innovate and expand their portfolios through product launches, acquisitions, and partnerships.

The competitive landscape is also shaped by ongoing advancements in cloud computing, AI, and IoT, which are being integrated into disaster preparedness systems to enhance their effectiveness. As the market grows, companies are focusing on providing integrated, scalable solutions that can address the diverse needs of industries such as healthcare, government, and energy. Strategic collaborations, mergers, and acquisitions are expected to continue, with companies striving to strengthen their positions in a market that is poised for long-term growth.

Recent Developments:

- Motorola Solutions has announced the launch of its new cloud-based public safety solution, aimed at enhancing communication and coordination during disaster response efforts.

- Everbridge has acquired xMatters, a leader in incident management and communication solutions, to strengthen its disaster preparedness solutions for enterprise clients.

- Siemens has launched new AI-driven communication tools to improve real-time coordination and decision-making during disaster scenarios, making their systems more responsive and intelligent.

- Thales Group has received ISO certification for its advanced disaster recovery systems, underscoring its commitment to providing secure and compliant solutions for critical infrastructure.

- Atos has partnered with Cloudflare to integrate cloud-based disaster response systems, enhancing security and ensuring faster recovery for businesses facing cyber disasters.

List of Leading Companies:

- Honeywell International Inc.

- Siemens AG

- Thales Group

- Motorola Solutions, Inc.

- Everbridge, Inc.

- SABER Technology Inc.

- Atos SE

- Cisco Systems Inc.

- BlackBerry Limited

- MedeAnalytics, Inc.

- AlertMedia

- Rave Mobile Safety

- Unify Inc.

- Zebra Technologies Corporation

- Vocal Technologies

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 176.1 Billion |

|

Forecasted Value (2030) |

USD 291.9 Billion |

|

CAGR (2025 – 2030) |

8.8% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Disaster Preparedness Systems Market By Solution Type (Emergency Notification Systems, Incident Management Systems, Crisis Communication Systems, Disaster Recovery Systems, Business Continuity Systems), By End-Use Industry (Government & Defense, Healthcare, Education, Retail, Energy & Utilities, Transportation), By Component (Software, Hardware, Services), By Deployment Mode (On-Premises, Cloud-Based) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Honeywell International Inc., Siemens AG, Thales Group, Motorola Solutions, Inc., Everbridge, Inc., SABER Technology Inc., Atos SE, Cisco Systems Inc., BlackBerry Limited, MedeAnalytics, Inc., AlertMedia, Rave Mobile Safety, Unify Inc., Zebra Technologies Corporation, Vocal Technologies |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Disaster Preparedness Systems Market, by Solution Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Emergency Notification Systems |

|

4.2. Incident Management Systems |

|

4.3. Crisis Communication Systems |

|

4.4. Disaster Recovery Systems |

|

4.5. Business Continuity Systems |

|

5. Disaster Preparedness Systems Market, by End-Use Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Government & Defense |

|

5.2. Healthcare |

|

5.3. Education |

|

5.4. Retail |

|

5.5. Energy & Utilities |

|

5.6. Transportation |

|

5.7. Others |

|

6. Disaster Preparedness Systems Market, by Component (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Software |

|

6.2. Hardware |

|

6.3. Services |

|

7. Disaster Preparedness Systems Market, by Deployment Mode (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. On-Premises |

|

7.2. Cloud-Based |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Disaster Preparedness Systems Market, by Solution Type |

|

8.2.7. North America Disaster Preparedness Systems Market, by End-Use Industry |

|

8.2.8. North America Disaster Preparedness Systems Market, by Deployment Mode |

|

8.2.9. By Country |

|

8.2.9.1. US |

|

8.2.9.1.1. US Disaster Preparedness Systems Market, by Solution Type |

|

8.2.9.1.2. US Disaster Preparedness Systems Market, by End-Use Industry |

|

8.2.9.1.3. US Disaster Preparedness Systems Market, by Deployment Mode |

|

8.2.9.2. Canada |

|

8.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Honeywell International Inc. |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Siemens AG |

|

10.3. Thales Group |

|

10.4. Motorola Solutions, Inc. |

|

10.5. Everbridge, Inc. |

|

10.6. SABER Technology Inc. |

|

10.7. Atos SE |

|

10.8. Cisco Systems Inc. |

|

10.9. BlackBerry Limited |

|

10.10. MedeAnalytics, Inc. |

|

10.11. AlertMedia |

|

10.12. Rave Mobile Safety |

|

10.13. Unify Inc. |

|

10.14. Zebra Technologies Corporation |

|

10.15. Vocal Technologies |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Disaster Preparedness Systems Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Disaster Preparedness Systems Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Disaster Preparedness Systems Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA