As per Intent Market Research, the Disappearing Packaging Market was valued at USD 3.9 billion in 2024-e and will surpass USD 8.3 billion by 2030; growing at a CAGR of 13.2% during 2025 - 2030.

The disappearing packaging market has gained significant momentum, driven by growing concerns over plastic waste and the increased demand for sustainable alternatives. As consumer awareness about environmental issues rises, businesses are under pressure to adopt eco-friendly packaging solutions. Disappearing packaging, which includes biodegradable, edible, and water-soluble materials, offers a promising solution by reducing waste and minimizing environmental impact. Companies across various sectors, including food & beverages, cosmetics, and pharmaceuticals, are actively exploring innovative packaging options to meet sustainability goals and regulatory requirements.

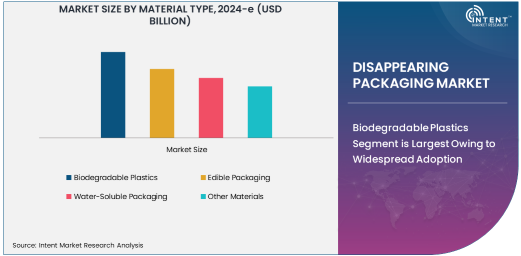

Biodegradable Plastics Segment is Largest Owing to Widespread Adoption

Among various material types in the disappearing packaging market, biodegradable plastics represent the largest segment. This material is gaining traction due to its ability to break down over time, unlike conventional plastics that persist in landfills and oceans for centuries. Biodegradable plastics, made from renewable sources such as corn starch, sugarcane, or other plant-based materials, are being integrated into a wide range of packaging products across industries. The food & beverage industry is especially reliant on biodegradable plastics for single-use packaging, such as wrappers, straws, and containers, as they align with both environmental goals and consumer demand for sustainable products.

The shift toward biodegradable plastics is largely attributed to advancements in bioplastics technology, making these materials more affordable and functional. Governments and regulatory bodies are also pushing for the reduction of plastic waste, with many countries implementing strict regulations on the use of non-biodegradable plastics. As biodegradable plastics continue to evolve in terms of strength and flexibility, their widespread adoption across industries is expected to continue growing, driving the largest market share within disappearing packaging.

Food & Beverages Industry is Fastest Growing in Disappearing Packaging

The food & beverages industry is experiencing the fastest growth in the disappearing packaging market. This sector is one of the largest consumers of packaging materials, with a significant portion transitioning to sustainable alternatives. Packaging for food products, especially single-use items like takeout containers, snack wrappers, and beverage bottles, is seeing a surge in the use of disappearing packaging solutions. Growing consumer awareness of the environmental impacts of plastic waste, combined with increasing regulations on single-use plastics, is driving this shift.

In addition, food companies are under pressure to adopt more sustainable solutions as part of their environmental and corporate social responsibility (CSR) initiatives. The rise of plant-based food options and organic products, which emphasize sustainability, is also contributing to the demand for biodegradable and edible packaging materials. This makes the food & beverages industry a key driver of the disappearing packaging market, with growth rates outpacing those in other sectors.

Packaging for Food Products is Dominating the Application Segment

When considering applications within the disappearing packaging market, packaging for food products holds the largest share. This is primarily because food packaging is a significant contributor to plastic waste globally, and the industry is under increasing pressure to adopt eco-friendly alternatives. Consumer preferences are shifting toward sustainable packaging for food items, including ready-to-eat meals, snacks, and beverages. As a result, many food producers are turning to biodegradable plastics, edible films, and water-soluble materials to package their products.

The push for reducing food waste is another factor contributing to the growth of sustainable packaging in this segment. Packaging that helps extend shelf life while being environmentally friendly is gaining popularity. As consumer demand for sustainable food packaging continues to rise, food manufacturers are expected to invest heavily in technologies that make disappearing packaging more accessible and cost-effective.

Asia-Pacific Region is Fastest Growing Due to Rising Demand

The Asia-Pacific region is the fastest-growing market for disappearing packaging, driven by rapid industrialization, urbanization, and a growing middle class with heightened environmental awareness. Countries like China, India, and Japan are major markets for sustainable packaging solutions, especially in food & beverages and consumer goods. Governments in these regions are implementing stricter waste management regulations, which are pushing businesses to adopt more eco-friendly packaging solutions.

In addition, Asia-Pacific is home to several large consumer goods manufacturers that are actively looking to reduce their environmental footprint. The availability of cost-effective biodegradable materials and the increasing demand for sustainable packaging from consumers are expected to drive significant growth in this region. As environmental concerns continue to grow, Asia-Pacific's adoption of disappearing packaging solutions is anticipated to accelerate, outpacing other global regions in terms of growth rate.

Leading Companies and Competitive Landscape

The disappearing packaging market is highly competitive, with key players striving to innovate and capture market share in the growing demand for sustainable solutions. Leading companies such as Amcor PLC, Tetra Pak, Unilever, Nestlé, and BASF SE are at the forefront of developing biodegradable, edible, and water-soluble packaging materials. These companies are investing in research and development to create more effective, cost-efficient, and scalable disappearing packaging options. Additionally, many companies are forming strategic partnerships and collaborations to expand their product portfolios and leverage emerging technologies in the bioplastics and sustainable packaging sectors.

The market is also characterized by a strong focus on sustainability, with many companies aligning their business strategies with environmental goals. Competitive dynamics are influenced by the ability to secure patents for new materials, meet regulatory requirements, and scale production. As the market continues to evolve, companies with strong R&D capabilities and a commitment to sustainability will likely lead the market, offering innovative solutions to meet the growing demand for disappearing packaging.

Recent Developments:

- Amcor PLC announced a new partnership with a leading food company to develop biodegradable packaging solutions aimed at reducing the environmental impact of plastic packaging in the food industry.

- Unilever PLC unveiled its commitment to transition to 100% biodegradable or recyclable packaging by 2025, focusing on sustainable materials and disappearing packaging technologies.

- Nestlé S.A. expanded its use of water-soluble packaging materials for select food products, enhancing sustainability efforts in line with its zero-waste packaging goal.

- Tetra Pak launched an innovative range of biodegradable beverage cartons, designed to reduce environmental footprint by using sustainable materials and disappearing packaging technology.

- Smurfit Kappa Group entered into a strategic alliance with a leading bioplastics producer to develop and commercialize fully compostable and biodegradable packaging solutions for the consumer goods sector.

List of Leading Companies:

- Amcor PLC

- Ecolab Inc.

- BASF SE

- Unilever PLC

- Procter & Gamble

- Nestlé S.A.

- Tetra Pak

- Sealed Air Corporation

- Dow Inc.

- Smurfit Kappa Group

- Cargill, Incorporated

- Mondi Group

- DSM

- Biopak

- Innovia Films Ltd.

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 3.9 Billion |

|

Forecasted Value (2030) |

USD 8.3 Billion |

|

CAGR (2025 – 2030) |

13.2% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Disappearing Packaging Market By Material Type (Biodegradable Plastics, Edible Packaging, Water-Soluble Packaging), By End-Use Industry (Food & Beverages, Cosmetics & Personal Care, Pharmaceuticals, Household Products, Industrial Goods), By Application (Packaging for Food Products, Packaging for Beverages, Packaging for Pharmaceuticals, Packaging for Cosmetics & Personal Care, Packaging for Household Products) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Amcor PLC, Ecolab Inc., BASF SE, Unilever PLC, Procter & Gamble, Nestlé S.A., Tetra Pak, Sealed Air Corporation, Dow Inc., Smurfit Kappa Group, Cargill, Incorporated, Mondi Group, DSM, Biopak, Innovia Films Ltd. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Disappearing Packaging Market, by Material Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Biodegradable Plastics |

|

4.2. Edible Packaging |

|

4.3. Water-Soluble Packaging |

|

4.4. Other Materials |

|

5. Disappearing Packaging Market, by End-Use Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Food & Beverages |

|

5.2. Cosmetics & Personal Care |

|

5.3. Pharmaceuticals |

|

5.4. Household Products |

|

5.5. Industrial Goods |

|

5.6. Other End-Use Industries |

|

6. Disappearing Packaging Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Packaging for Food Products |

|

6.2. Packaging for Beverages |

|

6.3. Packaging for Pharmaceuticals |

|

6.4. Packaging for Cosmetics & Personal Care |

|

6.5. Packaging for Household Products |

|

6.6. Other Applications |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Disappearing Packaging Market, by Material Type |

|

7.2.7. North America Disappearing Packaging Market, by End-Use Industry |

|

7.2.8. North America Disappearing Packaging Market, by Application |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Disappearing Packaging Market, by Material Type |

|

7.2.9.1.2. US Disappearing Packaging Market, by End-Use Industry |

|

7.2.9.1.3. US Disappearing Packaging Market, by Application |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Amcor PLC |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Ecolab Inc. |

|

9.3. BASF SE |

|

9.4. Unilever PLC |

|

9.5. Procter & Gamble |

|

9.6. Nestlé S.A. |

|

9.7. Tetra Pak |

|

9.8. Sealed Air Corporation |

|

9.9. Dow Inc. |

|

9.10. Smurfit Kappa Group |

|

9.11. Cargill, Incorporated |

|

9.12. Mondi Group |

|

9.13. DSM |

|

9.14. Biopak |

|

9.15. Innovia Films Ltd. |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Disappearing Packaging Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Disappearing Packaging Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Disappearing Packaging Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA