As per Intent Market Research, the Disability Insurance Market was valued at USD 43.8 Billion in 2024-e and will surpass USD 80.5 Billion by 2030; growing at a CAGR of 9.1% during 2025-2030.

The global disability insurance market is witnessing growth as awareness of income protection and risk mitigation continues to rise. Disability insurance ensures that individuals are financially protected when they are unable to work due to illness or injury. The market is segmented based on type, coverage type, policy type, end-user industries, and distribution channels. Among these segments, certain subsegments are growing rapidly, driven by consumer preferences, regulatory changes, and advancements in the financial services sector.

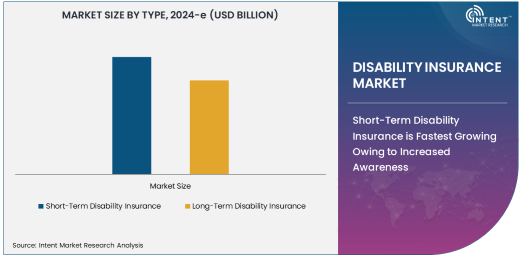

Short-Term Disability Insurance is Fastest Growing Owing to Increased Awareness

Short-term disability insurance is emerging as the fastest-growing segment within the disability insurance market. This type of insurance provides coverage for a brief period, typically between three to six months, for individuals who are temporarily unable to work due to illness or injury. The demand for short-term disability insurance is expanding as employers and employees recognize its benefits for short-term financial protection. Furthermore, increasing healthcare costs and rising awareness about the importance of financial safety nets have prompted more people to opt for these policies.

Short-term disability insurance is particularly attractive to younger workers and employees in industries with high injury risks. As the global workforce becomes more aware of the risks associated with temporary disabilities, insurance providers are focusing on offering more flexible plans to meet the needs of diverse professionals. This rapid growth is expected to continue as more businesses incorporate short-term disability insurance as part of their employee benefits packages, further boosting market expansion.

Own Occupation Coverage is Largest Due to Enhanced Security for Specialists

Among the different coverage types in the disability insurance market, own occupation coverage stands as the largest subsegment. This type of coverage offers a more comprehensive level of protection as it provides benefits if an individual is unable to work in their specific occupation, even if they can perform other types of work. For professionals in high-skill and high-risk occupations, such as surgeons, engineers, or executives, this coverage is particularly crucial. It ensures they can maintain their standard of living without the financial strain caused by an inability to perform their specialized job.

The popularity of own occupation coverage is driven by the desire for higher financial security and the growing number of workers in specialized fields who face higher risks of injury or health issues. As the economy shifts towards more specialized professions, the demand for this type of coverage will likely remain strong. Additionally, insurers are designing more tailored products to meet the specific needs of these high-risk professionals, contributing to the continued dominance of own occupation coverage in the market.

Group Disability Insurance is Largest Due to Employer Adoption

Group disability insurance is the largest subsegment within the policy type category in the disability insurance market. Employers typically offer group disability insurance to their employees as part of a broader benefits package. This form of insurance is generally more affordable than individual coverage due to the shared risk among a group of employees. The increasing adoption of employer-sponsored insurance programs, driven by both regulations and competitive job markets, has made group disability insurance the most popular option for both employers and employees.

Group disability insurance provides employees with coverage that is often more affordable and easier to access compared to individual policies. Many companies in industries such as healthcare, manufacturing, and finance are increasingly including group disability insurance as a key part of their employee benefits programs. This trend is expected to continue, as businesses understand the importance of offering such benefits to attract and retain top talent.

Healthcare Industry is Largest End-User Due to High Injury and Illness Risks

The healthcare sector is the largest end-user of disability insurance due to the high level of occupational hazards that healthcare workers face. From nurses and doctors to laboratory technicians and support staff, healthcare professionals are at a higher risk of developing occupational injuries or illnesses that could render them unable to work. As a result, healthcare organizations place a strong emphasis on ensuring that their employees have adequate disability coverage.

The healthcare industry is also seeing increasing adoption of disability insurance due to regulatory mandates in some regions, further driving the demand for protection among healthcare workers. With an aging global population and the growing demand for healthcare services, the sector's need for reliable and comprehensive disability coverage will continue to rise, cementing its position as the largest end-user.

Direct Sales Distribution Channel is Largest Due to Personalized Service

The direct sales channel is the largest distribution method for disability insurance policies. This channel allows insurers to establish direct relationships with customers, providing personalized services and detailed explanations of the policy terms and benefits. Direct sales are particularly effective in offering tailored products to individual clients, helping customers understand the nuances of different disability insurance options.

The preference for direct sales is growing due to consumers’ desire for personalized and clear advice when selecting disability insurance. Additionally, direct sales agents can offer a more hands-on experience, providing more customization and ensuring the policy fits the client's specific needs. As insurers continue to focus on improving the customer experience, the direct sales channel is expected to maintain its dominance in the market.

North America is Largest Region Due to High Demand for Disability Coverage

North America is the largest region in the global disability insurance market, driven primarily by the United States and Canada. In these countries, disability insurance has been a key part of employee benefits programs for decades, contributing to high penetration rates in both the individual and group policy markets. Furthermore, the regulatory environment in these regions supports and promotes the adoption of disability insurance, ensuring that employees and employers alike are incentivized to invest in these products.

In North America, the prevalence of work-related injuries, high healthcare costs, and the aging population have also spurred the demand for disability insurance. As more companies and individuals recognize the importance of securing income in case of illness or injury, North America is likely to remain the largest market for disability insurance for the foreseeable future.

Competitive Landscape and Leading Companies

The disability insurance market is highly competitive, with a mix of large insurance firms and specialized providers offering various products to meet the needs of individuals and businesses. Leading companies in the market include MetLife, Aflac, Prudential, The Hartford, and Cigna. These companies are constantly innovating and expanding their offerings to stay ahead of the competition. Key strategies employed by these companies include product diversification, enhanced customer service, and expansion into emerging markets.

The competitive landscape is also shaped by mergers and acquisitions, as larger firms seek to expand their market share through strategic partnerships and acquisitions. With the growing awareness of the importance of financial protection against disabilities, insurers are increasingly focusing on reaching new customer segments and offering more flexible policies. This ongoing evolution in the market will likely result in further consolidation among top players as they look to secure a larger portion of the market share.

Recent Developments:

- MetLife Expands Disability Insurance Offerings: MetLife launched a new short-term disability insurance product to support working professionals with enhanced benefits.

- Prudential Partners with Financial Institutions: Prudential announced a partnership with major banks to distribute disability insurance policies to a wider audience through bank channels.

- The Hartford Acquires Disability Insurance Provider: The Hartford acquired a leading disability insurance provider to expand its market share in the long-term disability segment.

- Aflac Introduces Innovative Disability Insurance Plans: Aflac rolled out new flexible plans with customizable options for short-term and long-term disability insurance.

- Allianz Receives Regulatory Approval for Global Expansion: Allianz received regulatory approval to offer disability insurance products in additional regions across Europe and Asia.

List of Leading Companies:

- Unum Group

- MetLife, Inc.

- Prudential Financial

- The Hartford

- Aflac

- Allianz SE

- Cigna

- Assicurazioni Generali

- Lincoln Financial Group

- Zurich Insurance Group

- Northwestern Mutual

- Sun Life Financial

- New York Life

- Tokio Marine Holdings

- TIAA-CREF

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 43.8 Billion |

|

Forecasted Value (2030) |

USD 80.5 Billion |

|

CAGR (2025 – 2030) |

9.1% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Disability Insurance Market by Type (Short-Term Disability Insurance, Long-Term Disability Insurance), by Coverage Type (Own Occupation Coverage, Any Occupation Coverage), by Policy Type (Group Disability Insurance, Individual Disability Insurance), by End-User Industry (Healthcare, Manufacturing, Finance, Government), and by Distribution Channel (Direct Sales, Brokers, Online Sales, Banks); Global Insights & Forecast (2023 – 2030). |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Unum Group, MetLife, Inc., Prudential Financial, The Hartford, Aflac, Allianz SE, Cigna, Assicurazioni Generali, Lincoln Financial Group, Zurich Insurance Group, Northwestern Mutual, Sun Life Financial, New York Life, Tokio Marine Holdings, TIAA-CREF |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Disability Insurance Market, by Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Short-Term Disability Insurance |

|

4.2. Long-Term Disability Insurance |

|

5. Disability Insurance Market, by Coverage Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Own Occupation Coverage |

|

5.2. Any Occupation Coverage |

|

6. Disability Insurance Market, by Policy Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Group Disability Insurance |

|

6.2. Individual Disability Insurance |

|

7. Disability Insurance Market, by End-User Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Healthcare |

|

7.2. Manufacturing |

|

7.3. Finance |

|

7.4. Government |

|

7.5. Other Industries |

|

8. Disability Insurance Market, by Distribution Channel (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Direct Sales |

|

8.2. Brokers |

|

8.3. Online Sales |

|

8.4. Banks |

|

9. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

9.1. Regional Overview |

|

9.2. North America |

|

9.2.1. Regional Trends & Growth Drivers |

|

9.2.2. Barriers & Challenges |

|

9.2.3. Opportunities |

|

9.2.4. Factor Impact Analysis |

|

9.2.5. Technology Trends |

|

9.2.6. North America Disability Insurance Market, by Type |

|

9.2.7. North America Disability Insurance Market, by Coverage Type |

|

9.2.8. North America Disability Insurance Market, by Policy Type |

|

9.2.9. North America Disability Insurance Market, by End-User Industry |

|

9.2.10. North America Disability Insurance Market, by Distribution Channel |

|

9.2.11. By Country |

|

9.2.11.1. US |

|

9.2.11.1.1. US Disability Insurance Market, by Type |

|

9.2.11.1.2. US Disability Insurance Market, by Coverage Type |

|

9.2.11.1.3. US Disability Insurance Market, by Policy Type |

|

9.2.11.1.4. US Disability Insurance Market, by End-User Industry |

|

9.2.11.1.5. US Disability Insurance Market, by Distribution Channel |

|

9.2.11.2. Canada |

|

9.2.11.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

9.3. Europe |

|

9.4. Asia-Pacific |

|

9.5. Latin America |

|

9.6. Middle East & Africa |

|

10. Competitive Landscape |

|

10.1. Overview of the Key Players |

|

10.2. Competitive Ecosystem |

|

10.2.1. Level of Fragmentation |

|

10.2.2. Market Consolidation |

|

10.2.3. Product Innovation |

|

10.3. Company Share Analysis |

|

10.4. Company Benchmarking Matrix |

|

10.4.1. Strategic Overview |

|

10.4.2. Product Innovations |

|

10.5. Start-up Ecosystem |

|

10.6. Strategic Competitive Insights/ Customer Imperatives |

|

10.7. ESG Matrix/ Sustainability Matrix |

|

10.8. Manufacturing Network |

|

10.8.1. Locations |

|

10.8.2. Supply Chain and Logistics |

|

10.8.3. Product Flexibility/Customization |

|

10.8.4. Digital Transformation and Connectivity |

|

10.8.5. Environmental and Regulatory Compliance |

|

10.9. Technology Readiness Level Matrix |

|

10.10. Technology Maturity Curve |

|

10.11. Buying Criteria |

|

11. Company Profiles |

|

11.1. Unum Group |

|

11.1.1. Company Overview |

|

11.1.2. Company Financials |

|

11.1.3. Product/Service Portfolio |

|

11.1.4. Recent Developments |

|

11.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

11.2. MetLife, Inc. |

|

11.3. Prudential Financial |

|

11.4. The Hartford |

|

11.5. Aflac |

|

11.6. Allianz SE |

|

11.7. Cigna |

|

11.8. Assicurazioni Generali |

|

11.9. Lincoln Financial Group |

|

11.10. Zurich Insurance Group |

|

11.11. Northwestern Mutual |

|

11.12. Sun Life Financial |

|

11.13. New York Life |

|

11.14. Tokio Marine Holdings |

|

11.15. TIAA-CREF |

|

12. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Disability Insurance Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Disability Insurance Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Disability Insurance Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA