As per Intent Market Research, the Direct-To-Consumer Genetic Testing Market was valued at USD 1.1 Billion in 2024-e and will surpass USD 5.3 Billion by 2030; growing at a CAGR of 25.0% during 2025-2030.

The direct-to-consumer (DTC) genetic testing market is rapidly expanding as consumers increasingly seek personalized health insights and a deeper understanding of their genetic makeup. With advancements in biotechnology and next-generation sequencing (NGS), these tests are now more accessible and affordable than ever before. DTC genetic testing offers valuable insights across multiple domains, including health-related conditions, ancestry, and wellness. As more individuals become empowered to take charge of their own health, the demand for these tests is expected to grow significantly, with companies expanding their offerings to cater to different consumer needs. The increasing consumer preference for non-invasive, at-home genetic tests is set to reshape the healthcare landscape, allowing individuals to make more informed health and lifestyle decisions.

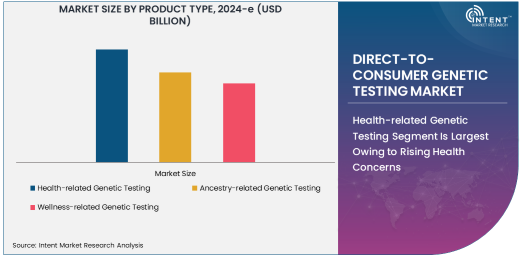

Health-related Genetic Testing Segment Is Largest Owing to Rising Health Concerns

Health-related genetic testing is the largest and most influential subsegment within the DTC genetic testing market. As consumers become more health-conscious, there has been a growing demand for genetic tests that provide insights into genetic disorders, predispositions to various diseases, and overall health risks. These tests can help identify inherited genetic conditions, cancer risk, and predispositions to chronic diseases such as heart disease, diabetes, and neurological disorders. The ability to take preventive actions or make lifestyle adjustments based on genetic information has been a key factor in driving growth in this area. With the increase in healthcare awareness and the emphasis on early disease detection, health-related genetic testing continues to dominate the market, offering critical insights that are transforming preventive healthcare.

The integration of AI and machine learning technologies has further bolstered the potential of health-related genetic testing, improving test accuracy and providing deeper insights into gene-disease relationships. Additionally, healthcare providers, research institutions, and diagnostic labs are increasingly adopting these tests to enhance patient care and offer personalized treatments. Consumers, in turn, are increasingly opting for these tests due to their convenience, affordability, and ability to empower them to make informed decisions about their health.

Next-Generation Sequencing Technology Is Fastest Growing Owing to Increased Precision

Next-generation sequencing (NGS) technology is rapidly emerging as the fastest-growing segment in the genetic testing market. NGS has revolutionized the way genetic information is analyzed, enabling the sequencing of an individual's entire genome at an unprecedented speed and accuracy. This technology is driving innovation in genetic testing, allowing for more comprehensive testing that goes beyond the traditional targeted tests. NGS offers the ability to detect genetic variations associated with a wide range of diseases, making it an invaluable tool for health-related genetic testing, especially in the areas of rare and complex diseases.

The adoption of NGS is also fueled by the growing interest in personalized medicine and precision health. With the ability to sequence entire genomes, this technology helps clinicians make more accurate diagnoses and recommend personalized treatment plans based on a patient's unique genetic makeup. As healthcare providers, research institutions, and direct-to-consumer platforms continue to adopt NGS, the technology is expected to experience substantial growth, becoming a central part of genetic testing offerings in the years to come.

Direct-to-Consumer Platforms Are Fastest Growing End-User Industry

Direct-to-consumer platforms represent the fastest-growing end-user industry in the genetic testing market. The convenience and accessibility of at-home genetic tests have made these platforms immensely popular, with companies such as 23andMe, Ancestry.com, and MyHeritage leading the charge. These platforms provide consumers with a range of genetic testing options, including health-related, ancestry, and wellness testing, all from the comfort of their own homes. DTC platforms cater to a wide demographic of consumers who are eager to learn more about their genetic health, family history, and wellness insights without the need for a healthcare provider's referral.

The popularity of DTC platforms can be attributed to their user-friendly interfaces, easy-to-understand results, and affordability. Additionally, these platforms often provide consumers with access to genetic counselors or health professionals, further enhancing the value of the testing services. As more individuals seek to take control of their health and wellness, the growth of DTC genetic testing platforms is expected to continue accelerating, driven by consumer demand for more personalized and proactive healthcare.

North America Is the Largest Region Owing to High Consumer Adoption

North America, particularly the United States, remains the largest region in the direct-to-consumer genetic testing market. The region has a high level of consumer adoption driven by the well-established healthcare infrastructure, access to cutting-edge technologies, and growing awareness of genetic testing's potential benefits. North American consumers are increasingly turning to genetic testing to gain insights into their health, family history, and wellness, fueling the demand for genetic testing services.

The region's robust regulatory framework, including FDA approvals for genetic testing kits and the presence of leading DTC companies, further supports the growth of the market. Additionally, as healthcare costs rise, more individuals are seeking proactive healthcare solutions, which includes genetic testing to predict and prevent potential health issues. North America is expected to continue dominating the market, though other regions such as Europe and Asia Pacific are also emerging as key growth areas as the demand for genetic testing becomes more global.

Competitive Landscape and Leading Companies

The competitive landscape of the direct-to-consumer genetic testing market is marked by a diverse range of companies offering specialized testing services. Leading players in the market include 23andMe, Ancestry.com, MyHeritage, and Invitae, each offering unique testing options and expanding their services to meet growing consumer demand. These companies leverage advanced technologies such as next-generation sequencing, PCR-based testing, and microarray technology to provide comprehensive genetic testing solutions. Additionally, some companies are forging partnerships with healthcare providers and research institutions to further enhance the value of their services and offer more personalized insights.

The market remains highly competitive, with companies differentiating themselves through factors such as test accuracy, ease of use, and price. As the market matures, leading players are investing heavily in research and development, focusing on expanding their product portfolios to include more health-related genetic tests, wellness insights, and ancestry-related services. The competitive landscape is expected to remain dynamic as new entrants and technological innovations continue to reshape the market.

Recent Developments:

- 23andMe announced an expanded partnership with GlaxoSmithKline to develop new drug discovery technologies based on genetic insights.

- Ancestry.com recently launched a new DNA match feature to better connect users with their extended family members based on shared genetic data.

- Invitae acquired Lynx Biosciences, strengthening its genetic testing offerings in hereditary cancer diagnostics.

- MyHeritage introduced new features for autosomal DNA testing, enhancing ethnic breakdown analysis and genetic connection reports for consumers.

- Illumina received regulatory approval from the FDA for its next-gen sequencing platform for broader use in clinical diagnostics

List of Leading Companies:

- 23andMe, Inc.

- Ancestry.com LLC

- MyHeritage Ltd.

- Invitae Corporation

- Illumina, Inc.

- Pathway Genomics Corporation

- Color Genomics, Inc.

- FamilyTreeDNA

- Helix, Inc.

- Fulgent Genetics, Inc.

- Gene by Gene, Ltd.

- Nebula Genomics

- Veritas Genetics, Inc.

- Xcode Life

- GenoPalate

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 1.1 Billion |

|

Forecasted Value (2030) |

USD 5.3 Billion |

|

CAGR (2025 – 2030) |

25.0% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Direct-to-Consumer Genetic Testing Market By Product Type (Health-related Genetic Testing, Ancestry-related Genetic Testing, Wellness-related Genetic Testing), By End-User Industry (Healthcare Providers, Direct-to-Consumer (DTC) Platforms, Diagnostic Laboratories, Research Institutions), By Technology (PCR-based Testing, Next-Generation Sequencing (NGS), CRISPR-based Testing, Microarray Technology), and By Application (Genetic Disease Detection, Ancestry and Genealogy, Health and Wellness Insights, Risk Assessment for Chronic Diseases, Carrier Screening) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

23andMe, Inc., Ancestry.com LLC, MyHeritage Ltd., Invitae Corporation, Illumina, Inc., Pathway Genomics Corporation, Color Genomics, Inc., FamilyTreeDNA, Helix, Inc., Fulgent Genetics, Inc., Gene by Gene, Ltd., Nebula Genomics, Veritas Genetics, Inc., Xcode Life, GenoPalate |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Direct-To-Consumer Genetic Testing Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Health-related Genetic Testing |

|

4.2. Ancestry-related Genetic Testing |

|

4.3. Wellness-related Genetic Testing |

|

5. Direct-To-Consumer Genetic Testing Market, by End-User Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Healthcare Providers |

|

5.2. Direct-to-Consumer (DTC) Platforms |

|

5.3. Diagnostic Laboratories |

|

5.4. Research Institutions |

|

6. Direct-To-Consumer Genetic Testing Market, by Technology (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. PCR-based Testing |

|

6.2. Next-Generation Sequencing (NGS) |

|

6.3. CRISPR-based Testing |

|

6.4. Microarray Technology |

|

7. Direct-To-Consumer Genetic Testing Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Genetic Disease Detection |

|

7.2. Ancestry and Genealogy |

|

7.3. Health and Wellness Insights |

|

7.4. Risk Assessment for Chronic Diseases |

|

7.5. Carrier Screening |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Direct-To-Consumer Genetic Testing Market, by Product Type |

|

8.2.7. North America Direct-To-Consumer Genetic Testing Market, by End-User Industry |

|

8.2.8. North America Direct-To-Consumer Genetic Testing Market, by Technology |

|

8.2.9. North America Direct-To-Consumer Genetic Testing Market, by Application |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Direct-To-Consumer Genetic Testing Market, by Product Type |

|

8.2.10.1.2. US Direct-To-Consumer Genetic Testing Market, by End-User Industry |

|

8.2.10.1.3. US Direct-To-Consumer Genetic Testing Market, by Technology |

|

8.2.10.1.4. US Direct-To-Consumer Genetic Testing Market, by Application |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. 23andMe, Inc. |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Ancestry.com LLC |

|

10.3. MyHeritage Ltd. |

|

10.4. Invitae Corporation |

|

10.5. Illumina, Inc. |

|

10.6. Pathway Genomics Corporation |

|

10.7. Color Genomics, Inc. |

|

10.8. FamilyTreeDNA |

|

10.9. Helix, Inc. |

|

10.10. Fulgent Genetics, Inc. |

|

10.11. Gene by Gene, Ltd. |

|

10.12. Nebula Genomics |

|

10.13. Veritas Genetics, Inc. |

|

10.14. Xcode Life |

|

10.15. GenoPalate |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Direct-to-Consumer Genetic Testing Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Direct-to-Consumer Genetic Testing Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Direct-to-Consumer Genetic Testing Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA