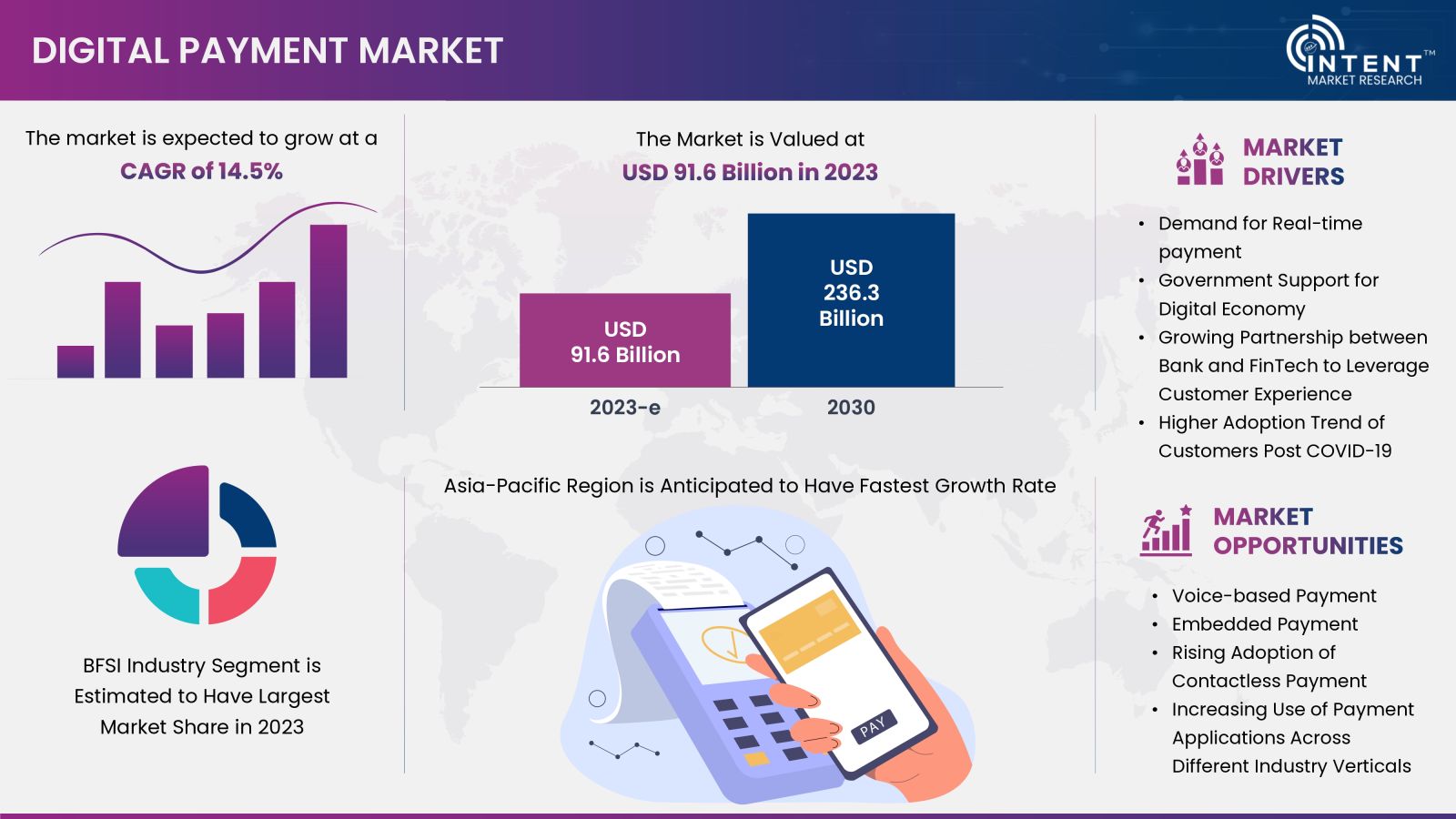

The Digital Payment Market is expected to grow from USD 91.6 billion in 2023-e to USD 236.3 billion by 2030, at a CAGR of 14.5% during the forecast period. The digital payment market is a competitive market, the prominent players in the global market include ACI Worldwide, Apple, Chase, FIS, Fiserv, Global Payments, Google, MasterCard, PayPal, and Visa among others. Additionally, Ant, Bharatpe, CRED, One97 Communications, Samsung Pay, Square, Tencent, VeriFone, Walmart and Wex are the emerging companies in the market.

A digital payment or an electronic payment, is the transfer of money from one payment account to another using a digital device or channel. It may include payments made with bank transfers, mobile money, QR codes, and payment instruments such as credit, debit, and prepaid cards. Digital payment offers several benefits such as speed, security, record keeping, and transparency, simpler cross-border transactions, low transaction cost, and quick & easy set-up, among others.

Digital payment systems often use advanced encryption technologies and two-factor authentication, enhancing the security of transactions. Many digital payment platforms employ fraud detection and prevention measures to safeguard users against unauthorized transactions. This has positively influenced the adoption of digital payment methods by end-use customers.

Demand for Quick Payment Driving the Digital Payment Market

The demand for quick and efficient payment solutions has been a major driver for the the digital payment market growth. The growth of online shopping and e-commerce has significantly increased the demand for quick payment options. Digital payments provide a fast and secure way for consumers to purchase online. This has helped to drive the adoption of digital payment across the world.

Additionally, the widespread adoption of smartphones has led to the rise of mobile payment solutions. Contactless payments, enabled by technologies such as NFC (Near Field Communication), allow users to make transactions swiftly by simply tapping their devices. Advancements in payment technologies have further boosted users' convenience thereby driving the digital payment market.

Digital Payment Market Segment Insights

POS Driving the Solution Segment

The increasing use of mobile wallets and apps, such as Apple Pay, Google Pay, and Samsung Pay, has transformed the way consumers make payments at the POS. These solutions enable users to store payment information securely on their smartphones and make payments with a simple tap or scan. The rise of contactless payment methods, such as NFC (Near Field Communication) and QR codes, has greatly contributed to the growth of POS payments. Consumers appreciate the speed and convenience of tapping their cards or mobile devices to make quick transactions.

The implementation of advanced security features, including encryption, tokenization, and biometric authentication, has increased consumer trust in POS payment systems. Enhanced security measures reduce the risk of fraud and unauthorized transactions. As a result, POS solution is expected to record significant growth during the forecast period.

Real-time Transaction Driving the Domestic Payment Transaction

The growth in penetration of the internet, and smartphones have made it easy for end-users to use banking apps such as PayPal and UPI for transactions. The COVID-19 pandemic has exploded e-commerce across the world. This has positively influenced the demand for online transactions. Post-pandemic, the global B2B e-commerce sales are expected to grow with a CAGR of 14.5% up to 2026, as per ITA.

Internet and smartphone have given rise to several start-ups in the recent past. These start-ups are serving industries such as food, fashion, pharmaceuticals, insurance, and trading. These start-ups have further promoted digital payment solutions to their consumers. This, in turn, increased the share of domestic transactions of the digital payment market.

Digital Wallet is Expected to Lead the Payment Mode Segment

Digital wallets typically come with robust security features, including encryption, biometric authentication, and tokenization. These measures enhance the security of transactions, addressing concerns about fraud and unauthorized access.

Digital wallet providers frequently form partnerships with businesses and platforms, leading to integrations that expand the use cases for digital wallets. For instance, integrating with ride-sharing apps, online retailers, and other services enhances the versatility of digital wallets. It is estimated that the digital wallet segment to grow with a significant growth rate during the forecast period.

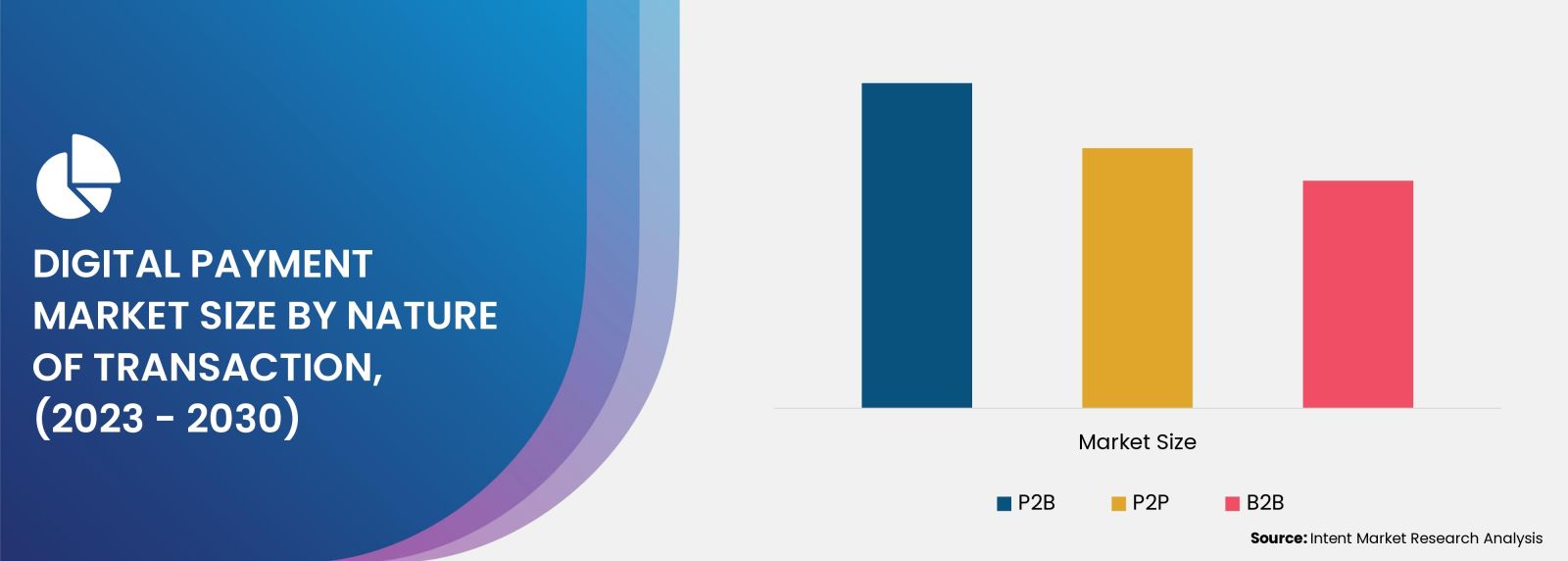

B2B Digital Payment is Expected to Grow with Higher CAGR

B2B digital payments can reduce transaction costs associated with traditional payment methods, such as cheque or wire transfers. Digital payment platforms offer lower fees, leading to cost savings for businesses. Businesses can receive payments in real time or within a shorter timeframe, improving cash flow and operational efficiency.

Integration of digital payment systems with other business software, such as Enterprise Resource Planning (ERP) and accounting systems, streamlines financial processes. Automation reduces manual errors, speeds up workflows, and enhances overall efficiency. Such benefits have influenced the adoption of the B2B nature of transactions across enterprises.

BFSI to Capture the Major Share of the Market

BFSI institutions are investing heavily in digital transformation to enhance operational efficiency, improve customer experience, and stay competitive. Digital payments are a crucial component of these initiatives. The proliferation of mobile banking apps has made it easier for customers to manage their finances and make digital payments on-the-go. These apps often integrate various payment functionalities, including bill payments, fund transfers, and mobile wallets.

In addition, regulatory bodies and governments across the world are supporting and promoting the adoption of digital payments. Regulatory frameworks often encourage innovation and competition within the BFSI sector, fostering the growth of digital payment solutions.

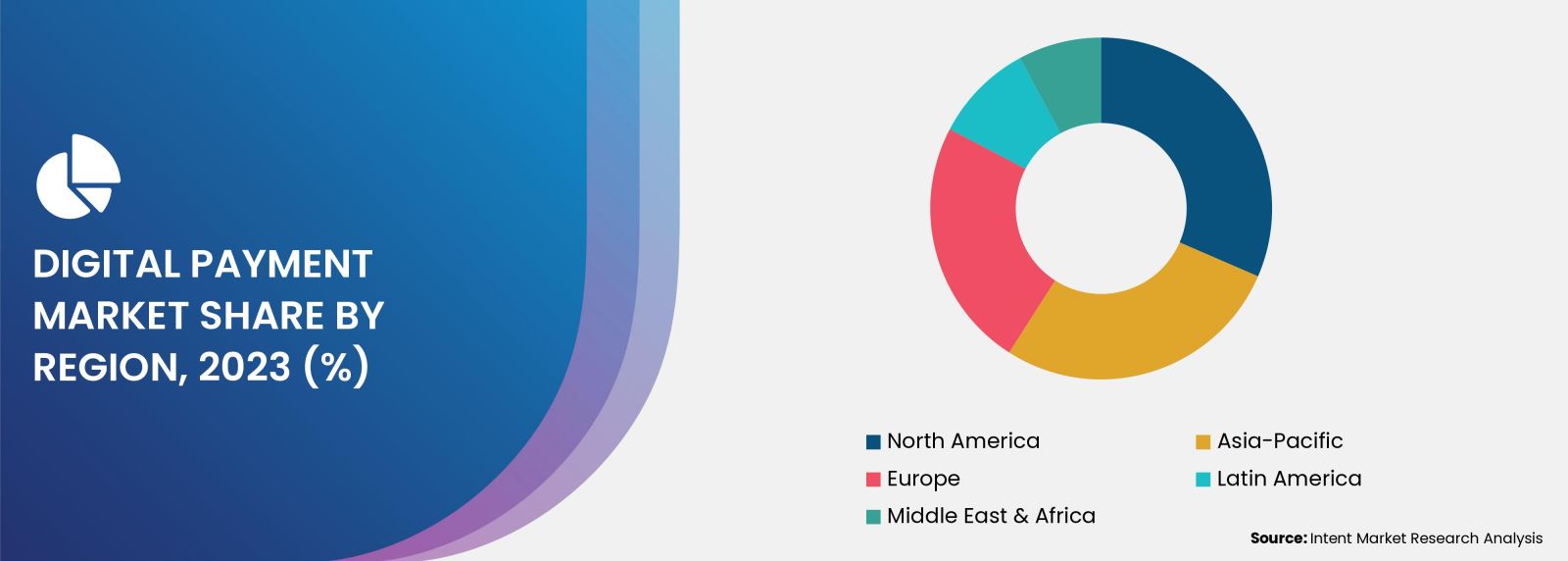

Asia-Pacific to Grow Exponentially in the Coming Years

Asia-Pacific has experienced the exponential growth of digital payment adoption in recent years. The increasing penetration of smartphones, the internet, and strong backing from the regional governments for the digital economy has promoted the adoption of the digital payment market in the region. In countries such as China, and India, there is rapid adoption of digital payment due to its benefits such as convenience, security, and real-time transactions.

Additionally, the growth of e-commerce in the region has further boosted the adoption of digital payment solutions in the region. Several countries in the region such as India, Bangladesh, China, and Indonesia have shown significant growth in their economies. Considering the potential of Asia-Pacific economies, the region is estimated to grow rapidly during the forecast period.

Major Industry Players are Enhancing their Market Positions By Adopting Several Growth Strategies

Major players operating in the global digital payment market are ACI Worldwide, Apple, Chase, FIS, Fiserv, Global Payments, Google, MasterCard, PayPal, and Visa among others. Additionally, Ant, Bharatpe, CRED, One97 Communications, Samsung Pay, Square, Tencent, VeriFone, Walmart, and Wex are the emerging companies in the market.

To tap the potential market share, major players have started adopting strategies such as new product launches, mergers & acquisitions, and partnerships & collaboration. Some of the significant developments are mentioned below

- In September 2023, ACI Worldwide, a global leader in mission-critical, real-time payments software, announced the launch of digital central infrastructure. It provides central banks and financial institutions with a one-stop solution encompassing real-time central infrastructure integrated with digital overlays such as Request to Pay, QR-code payments, back-office management platforms, and AI-powered fraud technology.

- In March 2023, Apple introduced Apple Pay Later in the US, designed with users’ financial health in mind, Apple Pay Later allows users to split purchases into four payments, spread over six weeks with no interest and no fees.

Digital Payment Market Coverage

The report provides key insights into the digital payment market, and it focuses on technological developments, trends, and initiatives taken by the government and private players. It delves into market drivers, restraints, opportunities, and challenges that are impacting market growth. It analyses key players as well as the competitive landscape within the global market.

Report Scope:

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 91.6 billion |

|

Forecast Revenue (2030) |

USD 236.3 billion |

|

CAGR (2024-2030) |

14.5% |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024-2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

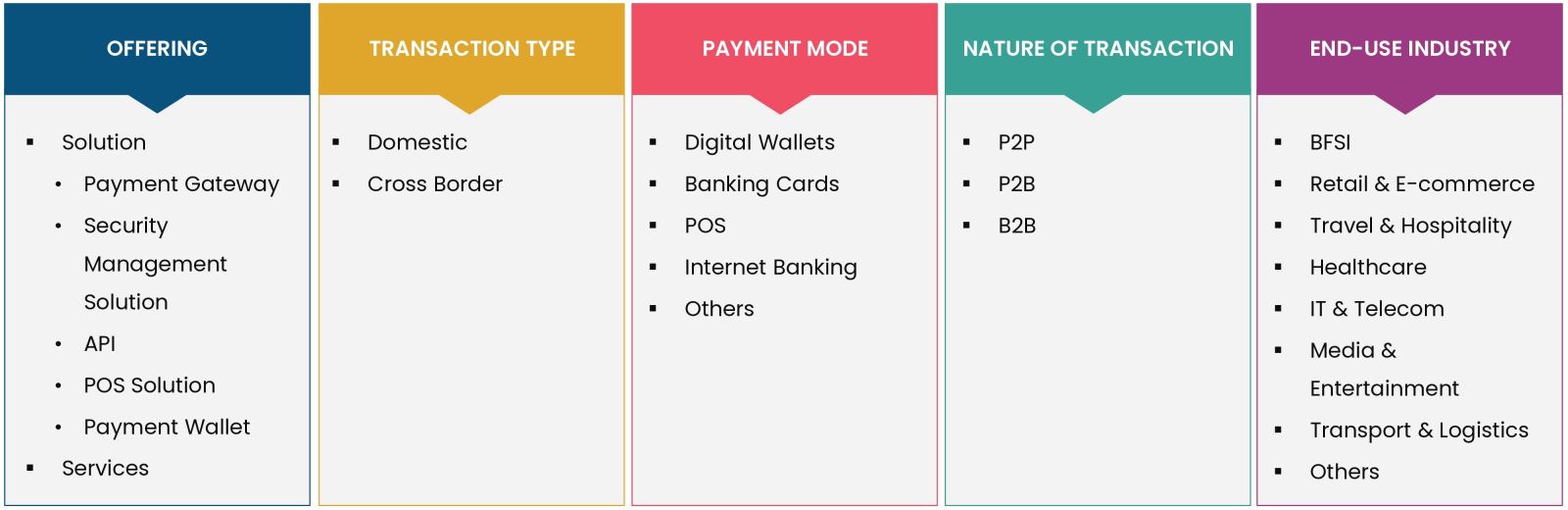

Segments Covered |

By Offering (Solution (Payment Gateway, Security Management Solution, API, POS Solution, Payment Wallet), Services); By Transaction Type (Domestic, Cross Border); By Payment Mode (Digital Wallet, Banking Card, POS, Internet Banking, Others); Nature of Transaction (P2P, P2B, B2B); By End-use Industry (BFSI, Retail & E-commerce, Travel & Hospitality, Healthcare, IT & Telecom, Media & Entertainment, Transport & Logistics, Other Industries) |

|

Regional Analysis |

North America (US, Canada), Asia-Pacific (China, Japan, South Korea, India, Rest of APAC), Europe (Germany, France, UK, Italy, Rest of Europe), Latin America and Middle East & Africa |

|

Competitive Landscape |

ACI Worldwide, Apple, Chase, FIS, Fiserv, Global Payments, Google, MasterCard, PayPal, and Visa, Ant, Bharatpe, CRED, One97 Communications, Samsung Pay, Square, Tencent, VeriFone, Walmart, and Wex |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

|

Purchase Options |

We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) |

|

1.Introduction |

|

1.1.Market Definition |

|

1.2.Scope of the Study |

|

1.3.Key Stakeholders of the Market |

|

2.Research Methodology |

|

2.1.Research Approach |

|

2.2.Data Collection |

|

2.3.Market Assessment |

|

2.4.Assumptions & Limitations for the Study |

|

3.Executive Summary |

|

4.Market Dynamics |

|

4.1.Drivers |

|

4.1.1.Demand for Real-time Payment |

|

4.1.2.Government Support for Digital Economy |

|

4.1.3.Growing Partnership between Bank and FinTech to Leverage Customer Experience |

|

4.1.4.Higher Adoption Trend of Customers Post COVID-19 |

|

4.2.Restraints |

|

4.2.1.Low Level of Awareness of Online Payments in Rural Areas |

|

4.2.2.Lower Internet penetration in Some Parts of the World |

|

4.3.Opportunities |

|

4.3.1.Rising Adoption of Contactless Payment |

|

4.3.2.Increasing Use of Payment Applications Across Different Industry Verticals |

|

4.4.Challenges |

|

4.4.1.Lack of Trust in Online Banking |

|

4.4.2.Increasing Cyber-Attacks on Digital Payments |

|

4.5.Trends |

|

4.5.1.Voice-based Payment |

|

4.5.2.Embedded Payment |

|

5.Market Outlook |

|

5.1.Regulatory Analysis |

|

5.2.PESTLE Analysis |

|

5.3.PORTER's Five Forces Analysis |

|

5.4.Case Studies |

|

6.Market Size by Offering (Market Size & Forecast: USD Billion, 2023 – 2030) |

|

6.1.Solution |

|

6.1.1.Payment Gateway |

|

6.1.2.Security Management Solution |

|

6.1.3.API |

|

6.1.4.POS Solution |

|

6.1.5.Payment Wallet |

|

6.2.Services |

|

7.Market Size by Transaction Type (Market Size & Forecast: USD Billion, 2023 – 2030) |

|

7.1.Domestic |

|

7.2.Cross Border |

|

8.Market Size by Payment Mode (Market Size & Forecast: USD Billion, 2023 – 2030) |

|

8.1.Digital Wallets |

|

8.2.Banking Cards |

|

8.3.POS |

|

8.4.Internet Banking |

|

8.5.Others |

|

9.Market Size by Nature of Transaction (Market Size & Forecast: USD Billion, 2023 – 2030) |

|

9.1.P2P |

|

9.2.P2B |

|

9.3.B2B |

|

10.Market Size by End-use Industry (Market Size & Forecast: USD Billion, 2023 – 2030) |

|

10.1. BFSI |

|

10.2. Retail & E-commerce |

|

10.3. Travel & Hospitality |

|

10.4. Healthcare |

|

10.5. IT & Telecom |

|

10.6. Media & Entertainment |

|

10.7. Transport & Logistics |

|

10.8. Other Industries |

|

11.Regional Outlook, (Market Size & Forecast: USD Billion, 2023 – 2030) |

|

11.1. North America |

|

11.1.1. US |

|

11.1.1.1. US Market Outlook by Offering |

|

11.1.1.2. US Market Outlook by Transaction Type |

|

11.1.1.3. US Market Outlook by Payment Mode |

|

11.1.1.4. US Market Outlook by Nature of Transaction |

|

11.1.1.5. US Market Outlook by End-use Industries |

|

Note: Similar Cross-segmentation for each country will be covered as shown above |

|

11.1.2. Canada |

|

11.2. Asia-Pacific |

|

11.2.1. China |

|

11.2.2. Japan |

|

11.2.3. South Korea |

|

11.2.4. India |

|

11.3. Europe |

|

11.3.1. UK |

|

11.3.2. Germany |

|

11.3.3. France |

|

11.3.4. Italy |

|

11.4. Latin America |

|

11.5. Middle East & Africa |

|

12.Competitive Landscape |

|

12.1. Market Share Analysis |

|

12.2. Key Market Growth Strategies |

|

12.3. Company Strategy Analysis |

|

12.4. Competitive Benchmarking |

|

13.Company Profile |

|

13.1. ACI Worldwide |

|

13.2. Apple |

|

13.3. Chase |

|

13.4. FIS Global |

|

13.5. Fiserv |

|

13.6. Global Payments |

|

13.7. Google |

|

13.8. MasterCard |

|

13.9. PayPal |

|

13.10. Visa |

|

14.Emerging Companies |

|

14.1. Ant |

|

14.2. Bharatpe |

|

14.3. CRED |

|

14.4. One97 Communications |

|

14.5. Samsung Pay |

|

14.6. Square |

|

14.7. Tencent |

|

14.8. VeriFone |

|

14.9. Walmart |

|

14.10. Wex |

|

15.Appendix |

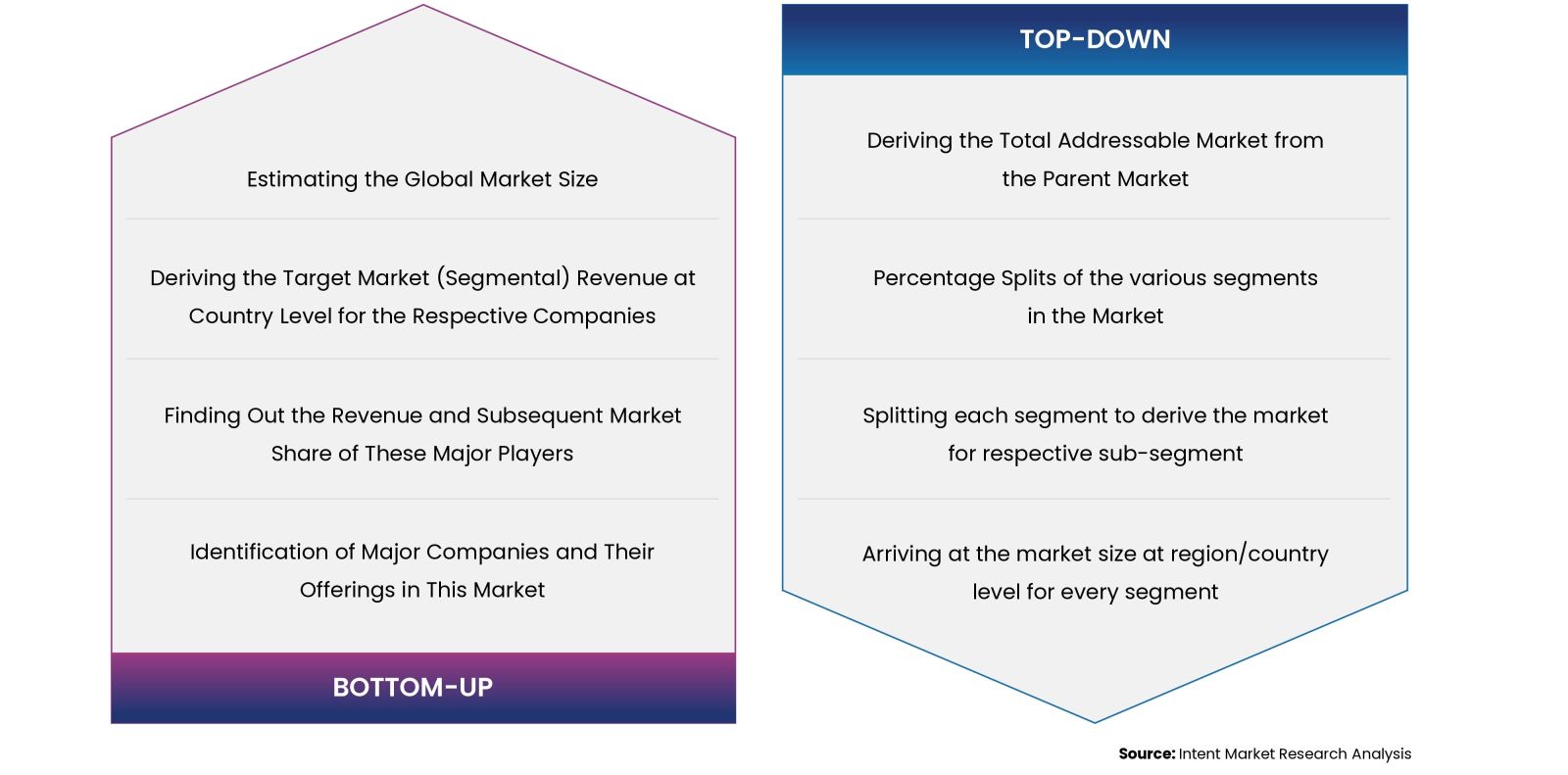

Intent Market Research employs a rigorous methodology to minimize residual errors by carefully defining the scope, validating findings through primary research, and consistently updating our in-house database. This dynamic approach allows us to capture ongoing market fluctuations and adapt to evolving market uncertainties.

The research factors used in our methodology vary depending on the specific market being analysed. To begin with, we incorporate both demand and supply side information into our model to identify and address market gaps. Additionally, we also employ approaches such as Macro-indicator Analysis, Factor Analysis, Value Chain-based Sizing, and forecasting to further increase the accuracy of the numbers and validate the findings.

Research Approach

- Secondary Research Approach: During the initial phase of the research process, we acquire and accumulate extensive data continuously. This data is carefully filtered and validated through a variety of secondary sources.

- Primary Research Approach: Following the consolidation of data gathered through secondary research, we initiate a validation process to verify all the market numbers, assumptions and validate the findings by engaging with subject matter experts.

Data Collection, Analysis and Interpretation:

.jpg)

Research Methodology

Our market research methodology utilizes both top-down and bottom-up approaches to segment and estimate quantitative aspects of the market. We also employ multi-perspective analysis, examining the market from distinct viewpoints.