As per Intent Market Research, the Digital Health Monitoring Devices Market was valued at USD 14.2 Billion in 2024-e and will surpass USD 42.7 Billion by 2030; growing at a CAGR of 17.0% during 2025-2030.

The digital health monitoring devices market has witnessed significant growth over the past few years, primarily driven by the growing prevalence of chronic diseases, an aging population, and technological advancements in healthcare. These devices are designed to offer continuous, real-time monitoring of patients' health metrics, helping healthcare providers detect potential issues early and provide better personalized care. With the integration of technologies such as artificial intelligence (AI), cloud computing, and the Internet of Things (IoT), digital health monitoring devices are becoming indispensable tools for both healthcare professionals and patients, enabling efficient management of health conditions.

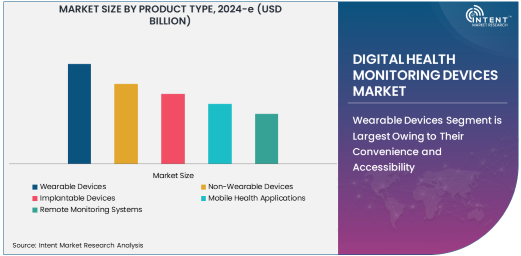

Wearable Devices Segment is Largest Owing to Their Convenience and Accessibility

Among the various product types in the digital health monitoring devices market, wearable devices hold the largest market share. This is primarily due to their ability to seamlessly integrate into daily life, providing continuous monitoring of key health metrics such as heart rate, blood pressure, glucose levels, and activity levels. Wearables, including fitness trackers, smartwatches, and health bands, have become mainstream consumer products, making them highly accessible to a broad demographic. Additionally, their ability to sync with mobile applications and cloud-based platforms enhances the user experience and enables data sharing between patients and healthcare providers.

The increasing adoption of wearable devices can also be attributed to their ease of use, portability, and the growing trend of self-care and personal health management. With ongoing innovations in battery life, sensors, and user interfaces, the wearable devices market is expected to continue its dominance. Furthermore, the integration of AI and machine learning into wearables is helping deliver more personalized insights, further driving market expansion.

Hospitals Segment is Fastest Growing Due to Increasing Healthcare Demand

The hospital end-user segment is experiencing the fastest growth in the digital health monitoring devices market. Hospitals are increasingly investing in these devices as they enhance patient care by providing real-time data, facilitating early diagnosis, and reducing the need for hospital visits. Digital health monitoring devices enable hospitals to remotely monitor patients with chronic conditions, such as heart disease or diabetes, which can improve patient outcomes and reduce healthcare costs.

As hospitals face pressure to improve efficiency and patient care while controlling expenses, the demand for digital health monitoring devices has surged. These devices also help healthcare providers to manage hospital capacity better, especially during peak times. The ongoing shift towards value-based care and patient-centric models of healthcare further accelerates the adoption of digital health monitoring solutions in hospitals.

Artificial Intelligence and Machine Learning Segment is Largest Due to Advanced Insights

In the technology segment, artificial intelligence (AI) and machine learning (ML) are the largest contributors to the growth of digital health monitoring devices. AI and ML algorithms enable devices to not only collect data but also analyze and interpret it in real-time. These technologies allow for predictive analytics, early detection of health conditions, and personalized care recommendations. The ability to analyze large volumes of health data also supports the development of more effective treatments and enhances the overall healthcare experience.

AI and ML-powered devices are increasingly integrated into wearables and other health monitoring systems, further amplifying their capabilities. As these technologies continue to evolve, they hold the potential to revolutionize the way healthcare is delivered, making AI and ML integral to the future of digital health monitoring.

Chronic Disease Management Application is Largest Owing to the Growing Prevalence of Chronic Conditions

In the application segment, chronic disease management is the largest area of demand for digital health monitoring devices. With the rising global prevalence of chronic conditions such as cardiovascular disease, diabetes, and hypertension, there is an increasing need for devices that can monitor patients' health on a continuous basis. Digital health devices allow for real-time monitoring of critical parameters, which helps in better managing these conditions and preventing complications.

The ability to track and manage chronic diseases remotely, without the need for frequent hospital visits, has become increasingly attractive to both patients and healthcare providers. Furthermore, the integration of data analytics and remote care models into chronic disease management is expected to further drive growth in this application segment. As the demand for efficient healthcare solutions grows, digital health monitoring devices are expected to play a pivotal role in chronic disease management.

North America is Largest Region Due to High Healthcare Adoption

North America currently dominates the digital health monitoring devices market due to the region's advanced healthcare infrastructure, high adoption rate of new technologies, and a growing focus on patient-centered care. The U.S., in particular, has seen widespread integration of digital health solutions across hospitals, healthcare providers, and homecare settings. The region also benefits from high disposable incomes, which enables consumers to invest in personal health monitoring devices like wearables and mobile health applications.

Government initiatives aimed at improving healthcare outcomes and reducing costs, such as the adoption of electronic health records (EHRs) and value-based care models, have further accelerated the growth of the digital health market in North America. The high prevalence of chronic diseases and the growing need for healthcare efficiency have driven the demand for digital health monitoring devices in the region. The ongoing push towards digital health solutions is expected to continue, maintaining North America’s leadership in the market.

Leading Companies and Competitive Landscape

The digital health monitoring devices market is highly competitive, with numerous players striving to innovate and capture market share. Key players in the market include Medtronic, Abbott Laboratories, Philips Healthcare, Omron Healthcare, and Fitbit, among others. These companies are focusing on developing cutting-edge wearable devices, AI-driven health applications, and IoT-enabled monitoring systems to meet the evolving demands of healthcare providers and consumers.

The competitive landscape is marked by significant mergers and acquisitions, partnerships, and collaborations to expand product portfolios and improve market reach. For example, Fitbit's acquisition by Google has enabled the company to enhance its wearables with advanced AI and machine learning capabilities. Similarly, Medtronic’s continuous innovations in wearable health technology and remote monitoring systems position it as a leader in the market. As the demand for personalized and data-driven healthcare solutions grows, the competitive intensity is expected to remain high, with companies investing heavily in R&D to stay ahead.

Recent Developments:

- Philips Healthcare has announced the launch of its new wearable health monitoring device, which integrates with its cloud-based health management platform for real-time patient data analytics.

- Abbott Laboratories secured FDA approval for its next-generation continuous glucose monitoring system, enhancing remote management of diabetes through mobile health apps.

- Medtronic has acquired Mazor Robotics, further expanding its reach in digital health solutions, particularly in neurosurgery and patient monitoring.

- Fitbit launched a new heart rate tracking feature on its wearable devices, integrating AI-powered analytics to offer users personalized health recommendations.

- Siemens Healthineers introduced a remote patient monitoring system that uses IoT technology to track vital signs and alerts healthcare providers in real-time, reducing patient visits.

List of Leading Companies:

- Medtronic

- Abbott Laboratories

- Philips Healthcare

- GE Healthcare

- Omron Healthcare

- Honeywell Life Care Solutions

- Fitbit (A subsidiary of Google)

- Garmin Ltd.

- Boston Scientific

- Siemens Healthineers

- Biotronik

- Withings

- Dexcom, Inc.

- Abbott Laboratories

- Samsung Electronics

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 14.2 Billion |

|

Forecasted Value (2030) |

USD 42.7 Billion |

|

CAGR (2025 – 2030) |

17.0% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Digital Health Monitoring Devices Market By Product Type (Wearable Devices, Non-Wearable Devices, Implantable Devices, Mobile Health Applications, Remote Monitoring Systems), By End-User Industry (Hospitals, Diagnostic Centers, Research Institutions, Homecare Settings, Healthcare Providers), By Technology (Artificial Intelligence and Machine Learning, IoT Technology, Blockchain Technology, Cloud Computing, Big Data Analytics), By Application (Chronic Disease Management, Fitness and Wellness Monitoring, Remote Patient Monitoring, Elderly Care and Monitoring, Post-operative Monitoring) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Medtronic, Abbott Laboratories, Philips Healthcare, GE Healthcare, Omron Healthcare, Honeywell Life Care Solutions, Fitbit (A subsidiary of Google), Garmin Ltd., Boston Scientific, Siemens Healthineers, Biotronik, Withings, Dexcom, Inc., Abbott Laboratories, Samsung Electronics |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Digital Health Monitoring Devices Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Wearable Devices |

|

4.2. Non-Wearable Devices |

|

4.3. Implantable Devices |

|

4.4. Mobile Health Applications |

|

4.5. Remote Monitoring Systems |

|

5. Digital Health Monitoring Devices Market, by End-User Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Hospitals |

|

5.2. Diagnostic Centers |

|

5.3. Research Institutions |

|

5.4. Homecare Settings |

|

5.5. Healthcare Providers |

|

6. Digital Health Monitoring Devices Market, by Technology (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Artificial Intelligence and Machine Learning |

|

6.2. IoT (Internet of Things) Technology |

|

6.3. Blockchain Technology |

|

6.4. Cloud Computing |

|

6.5. Big Data Analytics |

|

7. Digital Health Monitoring Devices Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Chronic Disease Management |

|

7.2. Fitness and Wellness Monitoring |

|

7.3. Remote Patient Monitoring |

|

7.4. Elderly Care and Monitoring |

|

7.5. Post-operative Monitoring |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Digital Health Monitoring Devices Market, by Product Type |

|

8.2.7. North America Digital Health Monitoring Devices Market, by End-User Industry |

|

8.2.8. North America Digital Health Monitoring Devices Market, by Technology |

|

8.2.9. North America Digital Health Monitoring Devices Market, by Application |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Digital Health Monitoring Devices Market, by Product Type |

|

8.2.10.1.2. US Digital Health Monitoring Devices Market, by End-User Industry |

|

8.2.10.1.3. US Digital Health Monitoring Devices Market, by Technology |

|

8.2.10.1.4. US Digital Health Monitoring Devices Market, by Application |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Medtronic |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Abbott Laboratories |

|

10.3. Philips Healthcare |

|

10.4. GE Healthcare |

|

10.5. Omron Healthcare |

|

10.6. Honeywell Life Care Solutions |

|

10.7. Fitbit (A subsidiary of Google) |

|

10.8. Garmin Ltd. |

|

10.9. Boston Scientific |

|

10.10. Siemens Healthineers |

|

10.11. Biotronik |

|

10.12. Withings |

|

10.13. Dexcom, Inc. |

|

10.14. Abbott Laboratories |

|

10.15. Samsung Electronics |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Digital Health Monitoring Devices Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Digital Health Monitoring Devices Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Digital Health Monitoring Devices Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA