As per Intent Market Research, the Dental X-ray Market was valued at USD 2.1 billion in 2024-e and will surpass USD 3.6 billion by 2030; growing at a CAGR of 8.9% during 2025 - 2030.

The dental X-ray market is experiencing significant growth driven by the increasing demand for diagnostic imaging in dentistry. Dental X-rays are essential for detecting issues such as cavities, infections, bone loss, and abnormalities in tooth development. The market is driven by technological advancements in X-ray systems, which provide higher resolution images with reduced radiation exposure, thus enhancing patient safety and diagnostic accuracy. The growing number of dental clinics and the expanding adoption of dental X-ray systems for routine checkups and specialized treatments are contributing to the market's expansion.

In addition to the technological improvements, the increasing awareness of dental health and the growing demand for aesthetic treatments are further propelling the market. The adoption of digital X-ray technology, in particular, is expected to continue rising due to its speed, efficiency, and reduced environmental impact.

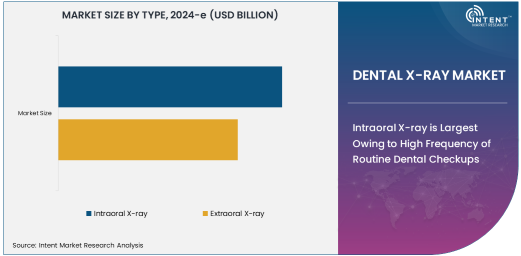

Intraoral X-ray is Largest Owing to High Frequency of Routine Dental Checkups

Intraoral X-ray is the largest segment in the dental X-ray market due to its high frequency of use in routine dental checkups and diagnostics. This X-ray type is widely used by dental professionals to examine teeth and surrounding tissues for issues such as cavities, infections, and other dental abnormalities. The ability to capture detailed images of the mouth and teeth with minimal patient discomfort has made intraoral X-rays the go-to imaging method for general dentistry and orthodontics.

As the most commonly used form of dental X-ray, intraoral X-rays are expected to maintain their dominance in the market. The increasing frequency of dental visits and advancements in intraoral X-ray technology that enhance image quality and reduce radiation exposure further support the growth of this segment.

Handheld X-ray Systems are Largest Product Due to Portability and Convenience

Handheld X-ray systems are the largest product segment in the dental X-ray market, primarily due to their portability, ease of use, and ability to capture high-quality images quickly. These systems are particularly beneficial in situations where space is limited or for mobile dental care services, making them ideal for use in dental clinics and on-the-go dental services. Handheld X-ray systems offer a level of convenience that traditional wall-mounted systems cannot, allowing dental professionals to move the equipment easily within the clinic and even take it directly to the patient’s side when needed.

The growing preference for more flexible, patient-friendly, and space-saving solutions continues to drive the demand for handheld X-ray systems. Additionally, advancements in handheld X-ray technology, including improved image resolution and radiation safety, are expected to maintain the segment's leading position in the market.

Orthodontics is Largest Application Owing to High Demand for Teeth Alignment Procedures

Orthodontics is the largest application segment in the dental X-ray market, driven by the growing demand for teeth alignment procedures such as braces and clear aligners. X-rays are essential in orthodontics to assess tooth positioning, alignment, and jaw development, helping orthodontists design effective treatment plans. The increasing awareness of oral health and the rising number of individuals seeking orthodontic treatment, particularly among teenagers and young adults, contribute to the growth of this segment.

The demand for aesthetic dental treatments, including orthodontics, continues to rise globally, further driving the adoption of dental X-rays in orthodontic practices. As orthodontic procedures become more common and accessible, the orthodontics segment is expected to remain the largest application for dental X-ray systems.

Dental Clinics are Largest End-User Owing to High Patient Volume and Specialized Services

Dental clinics are the largest end-user in the dental X-ray market, as they serve as the primary setting for routine dental examinations, diagnostics, and specialized dental treatments. Dental clinics frequently use X-ray systems to detect issues such as cavities, gum disease, and dental infections, ensuring early intervention and appropriate treatment planning. The high volume of patients seeking both preventive and corrective dental care further boosts the demand for X-ray systems in dental clinics.

The increasing number of dental clinics globally, as well as the growing emphasis on preventive dental care, positions dental clinics as the largest end-user segment in the dental X-ray market. The continuous adoption of advanced X-ray technology in these settings further supports their dominance in the market.

North America is Largest Region Owing to Advanced Healthcare Systems and High Demand for Dental Care

North America is the largest region in the dental X-ray market, driven by the advanced healthcare infrastructure and high demand for dental care services in the region. The United States, in particular, is a key market for dental X-ray systems due to the high number of dental visits, increasing awareness of dental health, and the rising number of dental specialists offering services such as orthodontics, implantology, and general dentistry.

Additionally, North America benefits from the early adoption of advanced dental X-ray technologies, including digital X-rays, which offer improved image quality and lower radiation exposure. The strong healthcare system, coupled with a growing focus on preventative oral healthcare, ensures that North America will continue to lead the dental X-ray market in the foreseeable future.

Leading Companies and Competitive Landscape

The dental X-ray market is highly competitive, with leading companies such as Carestream Health, Planmeca, and Sirona Dental Systems dominating the market. These companies provide a range of X-ray systems, including intraoral and extraoral X-rays, as well as handheld and wall-mounted systems. Technological advancements, such as digital imaging, enhanced image quality, and reduced radiation exposure, are key areas of focus for these companies.

The competitive landscape also features a mix of established players and emerging companies that are introducing innovative X-ray products to meet the growing demand for efficient and patient-friendly dental diagnostics. Strategic partnerships, mergers, and product innovations are driving growth in the market, with companies focusing on improving the safety, ease of use, and effectiveness of their dental X-ray systems.

Recent Developments:

- In December 2024, Carestream Health launched an advanced digital dental X-ray sensor, which improves image quality and reduces exposure times, addressing growing demands for precision in dental diagnostics.

- In November 2024, Planmeca Oy unveiled its new intraoral X-ray system with enhanced imaging features. The system offers high-definition images with reduced radiation, ideal for dental professionals focused on patient safety.

- In October 2024, Sirona Dental Systems introduced a new range of portable dental X-ray units. These units allow dental practitioners to perform quick, on-the-spot imaging, improving workflow in busy clinics.

- In September 2024, Konica Minolta announced an update to its digital X-ray sensors. The update enhances image clarity and speed, allowing dental clinics to diagnose more efficiently and accurately.

- In August 2024, GE Healthcare launched an advanced cephalometric X-ray system for orthodontic practices. This new system provides clear, accurate images for better treatment planning and monitoring of patient progress.

List of Leading Companies:

- Carestream Health

- GE Healthcare

- Sirona Dental Systems

- Planmeca Oy

- Konica Minolta

- Vatech Co., Ltd.

- Fujifilm Holdings Corporation

- Straumann Group

- X-Ray Imaging Inc.

- Midmark Corporation

- Hologic, Inc.

- Reichert Technologies

- 3M Health Care

- Yxlon International

- Comet Group

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 2.1 billion |

|

Forecasted Value (2030) |

USD 3.6 billion |

|

CAGR (2025 – 2030) |

8.9% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Dental X-ray Market By Type (Intraoral X-ray, Extraoral X-ray), By Product (Handheld X-ray Systems, Wall-mounted X-ray Systems, Cephalometric X-ray Systems), By Technology (Digital X-ray, Analog X-ray), By Application (Orthodontics, Periodontics, Implantology, General Dentistry), By End-Use (Dental Clinics, Hospitals, Dental Laboratories) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Carestream Health, GE Healthcare, Sirona Dental Systems, Planmeca Oy, Konica Minolta, Vatech Co., Ltd., Fujifilm Holdings Corporation, Straumann Group, X-Ray Imaging Inc., Midmark Corporation, Hologic, Inc., Reichert Technologies, 3M Health Care, Yxlon International, Comet Group |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Dental X-ray Market, by Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Intraoral X-ray |

|

4.2. Extraoral X-ray |

|

5. Dental X-ray Market, by Product (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Handheld X-ray Systems |

|

5.2. Wall-mounted X-ray Systems |

|

5.3. Cephalometric X-ray Systems |

|

6. Dental X-ray Market, by Technology (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Digital X-ray |

|

6.2. Analog X-ray |

|

7. Dental X-ray Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Orthodontics |

|

7.2. Periodontics |

|

7.3. Implantology |

|

7.4. General Dentistry |

|

8. Dental X-ray Market, by End-Use (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Dental Clinics |

|

8.2. Hospitals |

|

8.3. Dental Laboratories |

|

9. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

9.1. Regional Overview |

|

9.2. North America |

|

9.2.1. Regional Trends & Growth Drivers |

|

9.2.2. Barriers & Challenges |

|

9.2.3. Opportunities |

|

9.2.4. Factor Impact Analysis |

|

9.2.5. Technology Trends |

|

9.2.6. North America Dental X-ray Market, by Type |

|

9.2.7. North America Dental X-ray Market, by Product |

|

9.2.8. North America Dental X-ray Market, by Technology |

|

9.2.9. North America Dental X-ray Market, by Application |

|

9.2.10. North America Dental X-ray Market, by End-Use |

|

9.2.11. By Country |

|

9.2.11.1. US |

|

9.2.11.1.1. US Dental X-ray Market, by Type |

|

9.2.11.1.2. US Dental X-ray Market, by Product |

|

9.2.11.1.3. US Dental X-ray Market, by Technology |

|

9.2.11.1.4. US Dental X-ray Market, by Application |

|

9.2.11.1.5. US Dental X-ray Market, by End-Use |

|

9.2.11.2. Canada |

|

9.2.11.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

9.3. Europe |

|

9.4. Asia-Pacific |

|

9.5. Latin America |

|

9.6. Middle East & Africa |

|

10. Competitive Landscape |

|

10.1. Overview of the Key Players |

|

10.2. Competitive Ecosystem |

|

10.2.1. Level of Fragmentation |

|

10.2.2. Market Consolidation |

|

10.2.3. Product Innovation |

|

10.3. Company Share Analysis |

|

10.4. Company Benchmarking Matrix |

|

10.4.1. Strategic Overview |

|

10.4.2. Product Innovations |

|

10.5. Start-up Ecosystem |

|

10.6. Strategic Competitive Insights/ Customer Imperatives |

|

10.7. ESG Matrix/ Sustainability Matrix |

|

10.8. Manufacturing Network |

|

10.8.1. Locations |

|

10.8.2. Supply Chain and Logistics |

|

10.8.3. Product Flexibility/Customization |

|

10.8.4. Digital Transformation and Connectivity |

|

10.8.5. Environmental and Regulatory Compliance |

|

10.9. Technology Readiness Level Matrix |

|

10.10. Technology Maturity Curve |

|

10.11. Buying Criteria |

|

11. Company Profiles |

|

11.1. Carestream Health |

|

11.1.1. Company Overview |

|

11.1.2. Company Financials |

|

11.1.3. Product/Service Portfolio |

|

11.1.4. Recent Developments |

|

11.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

11.2. GE Healthcare |

|

11.3. Sirona Dental Systems |

|

11.4. Planmeca Oy |

|

11.5. Konica Minolta |

|

11.6. Vatech Co., Ltd. |

|

11.7. Fujifilm Holdings Corporation |

|

11.8. Straumann Group |

|

11.9. X-Ray Imaging Inc. |

|

11.10. Midmark Corporation |

|

11.11. Hologic, Inc. |

|

11.12. Reichert Technologies |

|

11.13. 3M Health Care |

|

11.14. Yxlon International |

|

11.15. Comet Group |

|

12. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Dental X-ray Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Dental X-ray Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Dental X-ray Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA