As per Intent Market Research, the Dental Practice Management Software Market was valued at USD 2.4 billion in 2023 and will surpass USD 4.7 billion by 2030; growing at a CAGR of 10.1% during 2024 - 2030.

The Dental Practice Management Software (DPMS) market is experiencing robust growth, driven by the increasing digitization of healthcare operations and the rising demand for efficient dental practice management. The market serves various stakeholders, including dental clinics, hospitals, and other end-users, offering solutions that streamline workflows, enhance patient engagement, and optimize financial performance. With advancements in deployment models, applications, and regional adoption, the DPMS market is poised for significant expansion.

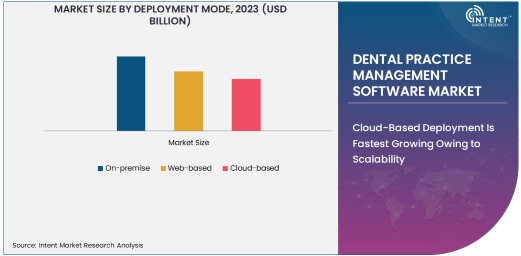

Cloud-Based Deployment Is Fastest Growing Owing to Scalability

Cloud-based deployment is the fastest-growing segment in the DPMS market due to its scalability, accessibility, and cost-effectiveness. Unlike traditional on-premise systems, cloud-based solutions provide users with the flexibility to access patient data and manage practice operations from any location with an internet connection. This makes it particularly attractive for multi-location dental practices and smaller clinics aiming to minimize infrastructure costs.

The integration of advanced technologies, such as artificial intelligence (AI) and machine learning, within cloud-based platforms enhances their functionality. Features like automated appointment scheduling, predictive analytics, and real-time data synchronization improve operational efficiency. Additionally, strong data security protocols and compliance with healthcare regulations further drive the adoption of cloud-based DPMS.

Patient Communication Software Is Largest Owing to Growing Demand for Engagement

Among applications, patient communication software holds the largest market share, driven by the increasing focus on patient satisfaction and retention. These solutions enable practices to streamline communication through automated appointment reminders, follow-ups, and feedback collection, reducing no-shows and improving patient experience.

The growing popularity of mobile apps and portals for patient engagement further strengthens this segment. These platforms allow patients to schedule appointments, view treatment plans, and communicate with dental staff directly, fostering trust and transparency. As practices continue to prioritize personalized care and efficient communication, this segment is expected to sustain its dominance.

Insurance Management Software Is Fastest Growing Owing to Administrative Efficiency

Insurance management software is witnessing the fastest growth in the DPMS market due to the increasing complexity of dental insurance processes. As patients increasingly rely on insurance for dental care affordability, practices require robust tools to handle claims submission, pre-authorizations, and payment tracking efficiently.

Advanced insurance management solutions leverage AI to predict claim approval probabilities, detect errors in submissions, and optimize reimbursement timelines. This ensures a smoother administrative workflow, reduced claim denials, and enhanced financial performance for dental practices. The growing adoption of these solutions underscores their pivotal role in addressing administrative challenges.

Dental Clinics Are Largest Owing to High Patient Footfall

Dental clinics account for the largest end-user segment in the DPMS market, primarily due to their significant patient volume and diverse service offerings. The adoption of DPMS in clinics helps streamline operations, including appointment scheduling, billing, and patient record management, thereby enhancing overall efficiency and patient care.

The rising demand for cosmetic dentistry and preventive care further boosts the need for advanced practice management solutions. Dental clinics, particularly those expanding under Dental Support Organizations (DSOs), are increasingly adopting DPMS to standardize operations across multiple locations, ensuring consistent service quality and compliance.

Asia-Pacific Is Fastest Growing Owing to Expanding Infrastructure

The Asia-Pacific region is the fastest-growing market for DPMS, driven by the rapid expansion of healthcare infrastructure, increasing awareness of oral health, and rising disposable incomes. Countries like China, India, and Japan are witnessing significant investments in modernizing dental facilities, creating a fertile ground for the adoption of advanced software solutions.

The growing prevalence of dental diseases and the rising demand for cosmetic procedures further fuel market growth in the region. Additionally, the tech-savvy population and the proliferation of cloud-based solutions position Asia-Pacific as a key market for global DPMS providers aiming to expand their footprint.

Competitive Landscape

The DPMS market is highly competitive, with leading companies such as Henry Schein, Patterson Companies, Carestream Dental, and DentiMax driving innovation and market penetration. These players focus on enhancing product offerings through AI integration, cloud capabilities, and user-friendly interfaces to address evolving customer needs.

Emerging players are leveraging niche opportunities, such as targeting small and medium-sized practices with cost-effective solutions. Strategic partnerships, mergers, and acquisitions are common strategies employed by market leaders to strengthen their portfolios and expand geographically. The dynamic competitive landscape fosters continuous innovation, ensuring sustained growth for the DPMS market.

Recent Developments:

- In October 2022, Henry Schein One, a joint venture of Henry Schein, Inc. and Internet Brands, announced that Smile Brands adopted Dentrix Ascend, their cloud-based practice management software, as the exclusive system for its affiliated dental practices.

- In September 2022, Curve Dental partnered with Dental Whale, a prominent practice solutions provider in North America. This collaboration aims to offer dental practices enhanced resources to improve operations and patient care.

- In March 2023, Good Methods Global Inc., known for its cloud-based DPMS CareStack, partnered with Pearl Group, a dental AI solutions provider. This partnership integrates Pearl’s AI capabilities into CareStack’s platform, enhancing diagnostic and operational efficiency for dental practices.

- In January 2024, Smilefy, Inc. introduced Smilefy 4.0, an AI-driven 3D smile design software. This tool enables dental professionals to create 3D smile designs and generate 3D print-ready models, enhancing patient communication and treatment planning.

List of Leading Companies:

- Henry Schein, Inc.

- Patterson Companies, Inc.

- Carestream Dental, LLC

- DentiMax

- NextGen Healthcare Information Systems, LLC

- ACE Dental Software

- Planet DDS

- CD Newco, LLC

- Open Dental Software

- Datacon Dental Systems, Inc.

- Curve Dental, Inc.

- Dentrix

- Eaglesoft

- SoftDent

- Practice-Web, Inc.

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 2.4 Billion |

|

Forecasted Value (2030) |

USD 4.7 Billion |

|

CAGR (2024 – 2030) |

10.1% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Dental Practice Management Software Market By Deployment Mode (On-Premise, Web-Based, Cloud-Based), By Application (Patient Communication Software, Invoice/Billing Software, Payment Processing Software, Insurance Management), By End-User Industry (Dental Clinics, Hospitals, Other End Users) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Henry Schein, Inc., Patterson Companies, Inc., Carestream Dental, LLC, DentiMax, NextGen Healthcare Information Systems, LLC, ACE Dental Software, Planet DDS, CD Newco, LLC, Open Dental Software, Datacon Dental Systems, Inc., Curve Dental, Inc., Dentrix, Eaglesoft, SoftDent, Practice-Web, Inc. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Dental Practice Management Software Market, by Deployment Mode (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. On-premise |

|

4.2. Web-based |

|

4.3. Cloud-based |

|

5. Dental Practice Management Software Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Patient Communication Software |

|

5.2. Invoice/Billing Software |

|

5.3. Payment Processing Software |

|

5.4. Insurance Management |

|

5.5. Others |

|

6. Dental Practice Management Software Market, by End User (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Dental Clinics |

|

6.2. Hospitals |

|

6.3. Other End Users |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Dental Practice Management Software Market, by Deployment Mode |

|

7.2.7. North America Dental Practice Management Software Market, by Application |

|

7.2.8. North America Dental Practice Management Software Market, by End User |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Dental Practice Management Software Market, by Deployment Mode |

|

7.2.9.1.2. US Dental Practice Management Software Market, by Application |

|

7.2.9.1.3. US Dental Practice Management Software Market, by End User |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Henry Schein, Inc. |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Patterson Companies, Inc. |

|

9.3. Carestream Dental, LLC |

|

9.4. DentiMax |

|

9.5. NextGen Healthcare Information Systems, LLC |

|

9.6. ACE Dental Software |

|

9.7. Planet DDS |

|

9.8. CD Newco, LLC |

|

9.9. Open Dental Software |

|

9.10. Datacon Dental Systems, Inc. |

|

9.11. Curve Dental, Inc. |

|

9.12. Dentrix |

|

9.13. Eaglesoft |

|

9.14. SoftDent |

|

9.15. Practice-Web, Inc. |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Dental Practice Management Software Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Dental Practice Management Software Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Dental Practice Management Software Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA