As per Intent Market Research, the Dental Consumables Market was valued at USD 15.3 billion in 2024-e and will surpass USD 26.4 billion by 2030; growing at a CAGR of 8.1% during 2025 - 2030.

The global dental consumables market has witnessed steady growth driven by increasing dental health awareness, technological advancements in dental materials, and a rising demand for aesthetic and restorative dental treatments. Dental consumables are essential for a wide range of procedures, including restorative dentistry, preventive care, orthodontics, endodontics, and periodontal treatments. The market is segmented into various categories, including product type, material type, end-user industry, and distribution channels, each of which plays a critical role in shaping the overall market dynamics. As oral health awareness continues to rise globally, the demand for high-quality dental consumables is expected to grow, particularly in emerging markets where access to advanced dental care is expanding.

The market's expansion is fueled by the introduction of innovative materials and technologies that enhance the quality, durability, and aesthetic outcomes of dental treatments. As the dental industry evolves, key players continue to invest in research and development to meet the diverse needs of patients and dental professionals. Segments such as restorative materials and composite materials are experiencing robust growth, driven by a preference for durable and aesthetically pleasing dental solutions. Additionally, regions like North America and Europe continue to dominate the market, while Asia-Pacific is emerging as a significant growth region, driven by improving dental care infrastructure and rising disposable incomes.

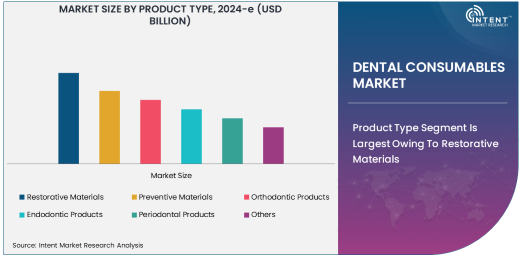

Product Type Segment Is Largest Owing To Restorative Materials

The restorative materials segment is the largest in the dental consumables market. This segment includes products such as dental fillings, crowns, bridges, and dental cements, all of which are essential for repairing or replacing damaged teeth. The growing prevalence of dental issues, such as cavities, tooth decay, and fractures, drives the demand for restorative materials. As dental care becomes more accessible and patients increasingly seek restorative procedures to improve both functionality and aesthetics, restorative materials remain in high demand.

Furthermore, technological advancements in restorative materials, such as improved dental composites and biocompatible ceramics, have led to better patient outcomes. The shift towards more aesthetic and durable restorative options is also propelling this segment’s growth. The high demand for these materials is especially prevalent in developed regions, where a significant portion of the population undergoes dental restoration procedures. As dental care continues to advance globally, the restorative materials segment is expected to maintain its leading position in the market.

Material Type Segment Is Fastest Growing Owing To Composite Materials

Composite materials are the fastest-growing subsegment within the material type category. Composite materials, such as dental resins and ceramics, are widely used in restorative dentistry due to their ability to closely resemble the appearance of natural teeth. These materials are favored for their aesthetic properties, durability, and versatility. Their use in dental fillings, crowns, and veneers has surged in recent years, making them an essential part of modern dental treatments.

The growth of composite materials is also driven by innovations in material formulations that improve their strength, wear resistance, and ease of handling. As patients increasingly demand aesthetic, long-lasting dental solutions, composite materials are becoming the preferred choice for dental professionals. With their ability to provide durable and highly aesthetic results, composite materials are expected to continue to gain market share and lead the growth in the material type segment.

End-User Industry Segment Is Largest Owing To Dental Clinics

The dental clinics segment is the largest within the end-user industry category in the dental consumables market. Dental clinics serve as the primary setting for most dental procedures, including restorative, preventive, orthodontic, and periodontic treatments. The growing number of dental clinics worldwide, driven by increasing demand for oral care and dental services, directly influences the demand for consumables in this sector. As the global population becomes more health-conscious and dental care awareness increases, the need for consumable products in dental clinics continues to rise.

Dental clinics also benefit from advancements in dental technologies, which have improved the overall efficiency and quality of treatments, creating a greater need for high-quality consumables. In addition, the increasing number of private and specialized dental practices, particularly in emerging markets, is fueling the growth of this segment. As dental clinics become more equipped with advanced tools and materials, the demand for consumables used in daily dental procedures remains robust and is expected to continue growing in the foreseeable future.

Distribution Channel Segment Is Fastest Growing Owing To Online Sales

The online sales channel is the fastest-growing subsegment within the distribution channel category for dental consumables. With the growing trend of e-commerce across various industries, dental consumables are increasingly being sold through online platforms. Online sales offer convenience, a wide range of product choices, and often competitive pricing, making it a preferred option for dental professionals and consumers. The ability to order consumables from established online retailers and manufacturers has streamlined the purchasing process, particularly in regions with fewer local distributors.

In addition, the rise of direct-to-consumer sales models has enabled patients to purchase certain dental care products for at-home use, such as teeth whitening kits and orthodontic appliances. As the global adoption of e-commerce continues to expand, the online sales subsegment is expected to see rapid growth. This shift towards online purchasing is further supported by improved logistics, better delivery networks, and increasing trust in digital platforms, which are contributing to the accelerated growth of this channel in the dental consumables market.

Region Segment Is Fastest Growing Owing To Asia Pacific

The Asia Pacific region is the fastest-growing in the global dental consumables market. This growth is largely driven by improving dental healthcare infrastructure, increasing awareness of oral health, and rising disposable incomes in countries such as China, India, and Southeast Asian nations. As these countries continue to develop, the demand for dental services and products, including consumables, is increasing rapidly. The growing number of dental clinics and hospitals in this region is further fueling the demand for dental consumables.

In addition to the rise in demand, the Asia Pacific region is seeing an influx of international dental product manufacturers looking to expand their presence in these emerging markets. The availability of affordable yet high-quality dental care products is making dental treatments more accessible to a larger population. With a burgeoning middle class and government initiatives to improve healthcare access, the Asia Pacific region is expected to remain the fastest-growing market for dental consumables, contributing significantly to global market growth.

Leading Companies and Competitive Landscape

The dental consumables market is highly competitive, with numerous global and regional players striving to maintain or expand their market share. Leading companies such as 3M Health Care, Dentsply Sirona, Zimmer Biomet, and Ivoclar Vivadent are at the forefront of the market. These companies are heavily investing in research and development to innovate and improve their product offerings. Their focus on launching new materials, advanced dental technologies, and expanding their product portfolios has been a key strategy to stay competitive.

In addition to established players, the market is also witnessing the rise of smaller, specialized companies that focus on niche dental products, further intensifying competition. The competitive landscape is characterized by strategic mergers and acquisitions, partnerships, and collaborations, as companies seek to diversify their product offerings and expand their geographic reach. The ongoing technological advancements, combined with a rising demand for aesthetic dental solutions, are driving the evolution of the market, with companies continuously introducing new and improved dental consumables to meet the growing demands of patients and dental professionals.

Recent Developments:

- Dentsply Sirona launched a new line of advanced dental restorative materials designed to improve the durability and aesthetic appearance of fillings and crowns.

- 3M Health Care entered into a strategic partnership with a leading dental lab network to distribute their innovative dental consumables globally.

- Ivoclar Vivadent received regulatory approval for a new generation of tooth-whitening products that offer quicker results and reduced sensitivity.

- Align Technology unveiled a new orthodontic product aimed at improving treatment outcomes and patient comfort for both professionals and consumers.

- Zimmer Biomet expanded its product portfolio with the release of a new range of dental implants and surgical tools, enhancing its position in the dental consumables market.

List of Leading Companies:

- 3M Health Care

- Dentsply Sirona

- Zimmer Biomet

- Henry Schein

- Straumann

- Danaher Corporation

- Ivoclar Vivadent

- GC Corporation

- Planmeca Oy

- Voco GmbH

- Align Technology

- Nobel Biocare

- Coltene Holding

- Kuraray Noritake Dental

- Bausch Health Companies

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 15.3 Billion |

|

Forecasted Value (2030) |

USD 26.4 Billion |

|

CAGR (2025 – 2030) |

8.1% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Dental Consumables Market By Product Type (Restorative Materials, Preventive Materials, Orthodontic Products, Endodontic Products, Periodontal Products), By Material Type (Metals, Polymers, Ceramics, Composite Materials), By End-User Industry (Dental Clinics, Hospitals, Dental Laboratories, Research Institutions), By Distribution Channel (Direct Sales, Retail Sales, Online Sales) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

3M Health Care, Dentsply Sirona, Zimmer Biomet, Henry Schein, Straumann, Danaher Corporation, Ivoclar Vivadent, GC Corporation, Planmeca Oy, Voco GmbH, Align Technology, Nobel Biocare, Coltene Holding, Kuraray Noritake Dental, Bausch Health Companies |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Dental Consumables Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Restorative Materials |

|

4.2. Preventive Materials |

|

4.3. Orthodontic Products |

|

4.4. Endodontic Products |

|

4.5. Periodontal Products |

|

4.6. Others |

|

5. Dental Consumables Market, by Material Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Metals |

|

5.2. Polymers |

|

5.3. Ceramics |

|

5.4. Composite Materials |

|

5.5. Others |

|

6. Dental Consumables Market, by End-User Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Dental Clinics |

|

6.2. Hospitals |

|

6.3. Dental Laboratories |

|

6.4. Research Institutions |

|

6.5. Others |

|

7. Dental Consumables Market, by Distribution Channel (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Direct Sales |

|

7.2. Retail Sales |

|

7.3. Online Sales |

|

7.4. Others |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Dental Consumables Market, by Product Type |

|

8.2.7. North America Dental Consumables Market, by Material Type |

|

8.2.8. North America Dental Consumables Market, by End-User Industry |

|

8.2.9. North America Dental Consumables Market, by Distribution Channel |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Dental Consumables Market, by Product Type |

|

8.2.10.1.2. US Dental Consumables Market, by Material Type |

|

8.2.10.1.3. US Dental Consumables Market, by End-User Industry |

|

8.2.10.1.4. US Dental Consumables Market, by Distribution Channel |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. 3M Health Care |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Dentsply Sirona |

|

10.3. Zimmer Biomet |

|

10.4. Henry Schein |

|

10.5. Straumann |

|

10.6. Danaher Corporation |

|

10.7. Ivoclar Vivadent |

|

10.8. GC Corporation |

|

10.9. Planmeca Oy |

|

10.10. Voco GmbH |

|

10.11. Align Technology |

|

10.12. Nobel Biocare |

|

10.13. Coltene Holding |

|

10.14. Kuraray Noritake Dental |

|

10.15. Bausch Health Companies |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Dental Consumables Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Dental Consumables Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Dental Consumables Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA